Markets are in turmoil, and if you're invested in Bitcoin, crypto, or blockchain technologies, you’ve likely felt the tremors. With Donald Trump publicly calling for drastic interest rate cuts and Federal Reserve Chair Jerome Powell maintaining a cautious “wait and see” approach, financial markets are caught in a tug-of-war that’s causing uncertainty across all asset classes, including crypto.

In this comprehensive article, we’ll explore the latest market drama, dissect Trump's bold move to fire Powell, analyze the impact of potential rate cuts on Bitcoin and other cryptocurrencies, and dive deep into emerging opportunities like the Genius Act and the booming stablecoin market. Whether you're a seasoned BTC investor or a newcomer to crypto, understanding these forces will help you navigate this volatile period and position yourself for the exciting tokenization revolution on the horizon.

The Current Market Chaos: Trump vs. Powell

Let’s start with the elephant in the room: Donald Trump’s recent public statements demanding a massive 300 basis points (bps) cut in interest rates. This demand comes right after the release of Consumer Price Index (CPI) data revealing two consecutive months of increased inflation. While core inflation remains a concern, the overall CPI numbers, partly influenced by tariffs imposed during Trump’s administration, have rattled markets.

Markets are now caught between two competing signals. On one side, Trump’s aggressive calls for rate cuts are stirring hopes of looser monetary policy; on the other, Jerome Powell, the Federal Reserve Chair, is adopting a more cautious stance, emphasizing a “wait and see” approach. This duality leaves traders confused and markets directionless.

As predicted earlier, the market took a significant hit on Monday following an escalation in tariffs. The uncertainty generated by these conflicting signals has made trading especially challenging. Traders are unsure whether to bet on aggressive rate cuts or to brace for further tightening. This discord is particularly impactful for crypto investors who watch interest rates closely, as they influence liquidity and risk appetite.

What This Means for Crypto Traders

In the midst of this chaos, what’s a crypto trader to do? Here’s a snapshot of the current strategy I’m employing and advice for those looking to navigate these choppy waters:

- Patience is key: Avoid chasing high prices or “catching falling knives.” Wait for clear trading ranges to form before making significant moves.

- Watch for pullbacks: Markets always pull back. Look for technical signals such as overextended RSI, negative MACD, and double-bottom stochastic indicators before buying.

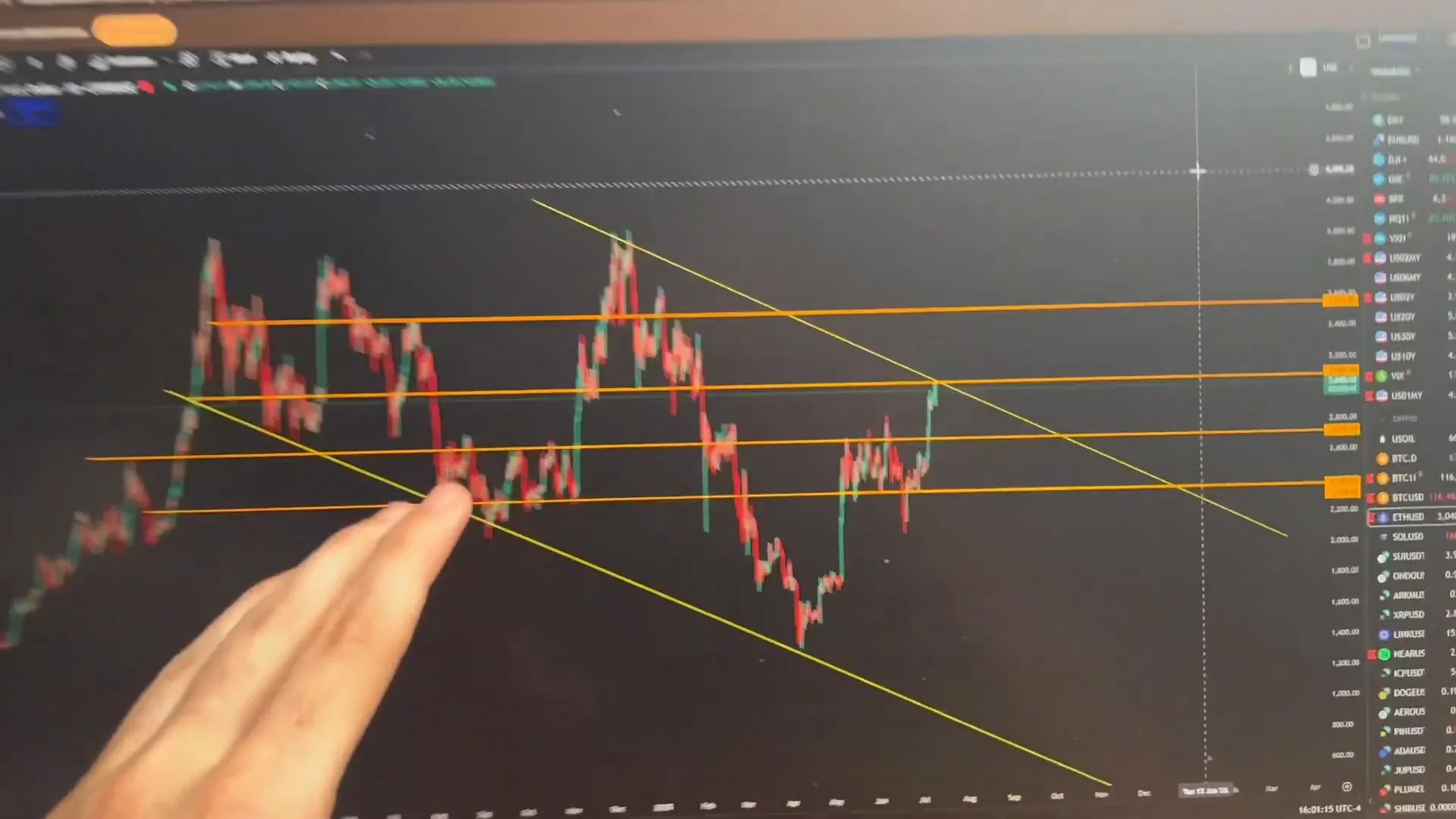

- Focus on range discovery: For Bitcoin and Ethereum, I anticipate new trading ranges to emerge soon. Ethereum’s range is expected between $3,100 and $4,000, while Bitcoin’s price discovery phase is underway.

- Spot buying: We’ve been accumulating at lower levels, including below $80,000 for Bitcoin, building strong spot positions.

This disciplined approach is crucial in volatile times. It prevents emotional trading and helps capitalize on opportunities when the market stabilizes.

The Genius Act: A Game Changer for Crypto and Altcoins

Amid the market turmoil, there’s a beacon of hope for crypto enthusiasts: The Genius Act. This bill, soon to be voted on by the U.S. House of Representatives, aims to position America as the undisputed global leader in digital assets. The Genius Act promises to put the U.S. light years ahead of China, Europe, and other international competitors who are furiously trying to catch up.

However, the bill faced some unexpected political hurdles. Democrats attempted to derail it by attaching unrelated Epstein files as amendments, which could have disrupted trillions of dollars in crypto market value and harmed millions of Americans involved in digital assets. Thankfully, the House rejected this amendment, allowing the Genius Act to move forward independently.

This is monumental for altcoins. The Genius Act is set to regulate the stablecoin market, encourage widespread adoption, and ensure stablecoins are backed 1:1 by the U.S. dollar. This regulatory clarity is expected to ignite a massive tokenization revolution, opening doors for new applications and investment opportunities across the crypto ecosystem.

Why Altcoins Are Thriving Right Now

Interestingly, Bitcoin dominance—the percentage of the total crypto market cap that Bitcoin holds—has begun to decline. Ethereum is outperforming Bitcoin, and altcoins are showing renewed strength. This shift is partially fueled by the anticipation around the Genius Act and the broader tokenization trend.

In our trading community, we’re running a $1,000 to $10,000 trading challenge. Despite a rough Monday that saw a $300 loss, we remain up over 80% overall. This demonstrates the resilience and opportunity present in the current market environment.

Stablecoins: The Unsung Heroes of the Crypto Market

One of the most exciting developments for investors is the explosive growth of the stablecoin market. Stablecoins, cryptocurrencies pegged to stable assets like the U.S. dollar, are becoming the backbone of crypto trading, lending, and tokenization.

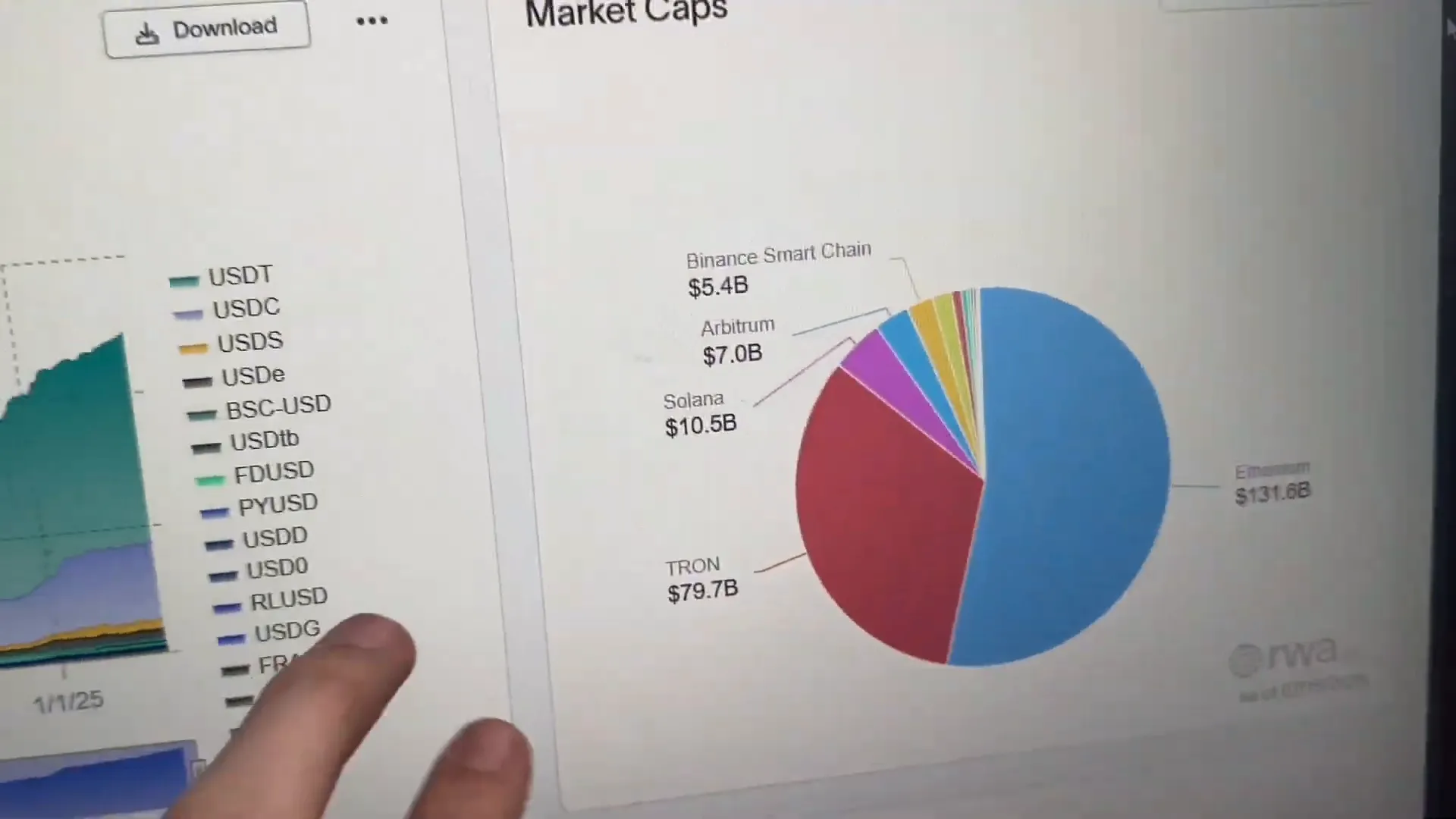

Currently, Ethereum hosts the majority of stablecoin activity, but other blockchains are quickly gaining ground:

- Justin Sun’s Tron: Approximately $80 billion in stablecoins.

- Solana: About $10.5 billion.

- Arbitrum and Binance Smart Chain: Also significant players.

Major institutional players like BlackRock, Fidelity, and Vanguard are gearing up for a tokenization boom by 2026. This isn’t just hype from a crypto YouTuber; it’s a widely supported forecast from global financial institutions and hedge funds.

Tokenization: The Future of Assets on Blockchain

Tokenization involves converting real-world assets—such as real estate, stocks, or commodities—into digital tokens on a blockchain. This process makes assets more liquid, accessible, and efficient to trade. The Genius Act and stablecoin regulation will accelerate this trend, making 2026 the year tokenization truly takes off.

As crypto traders, it’s wise to monitor where stablecoins are being built and how they’re used in tokenization projects. Understanding these ecosystems early can provide a significant edge.

Ripple and Government Collaboration: A Bullish Signal

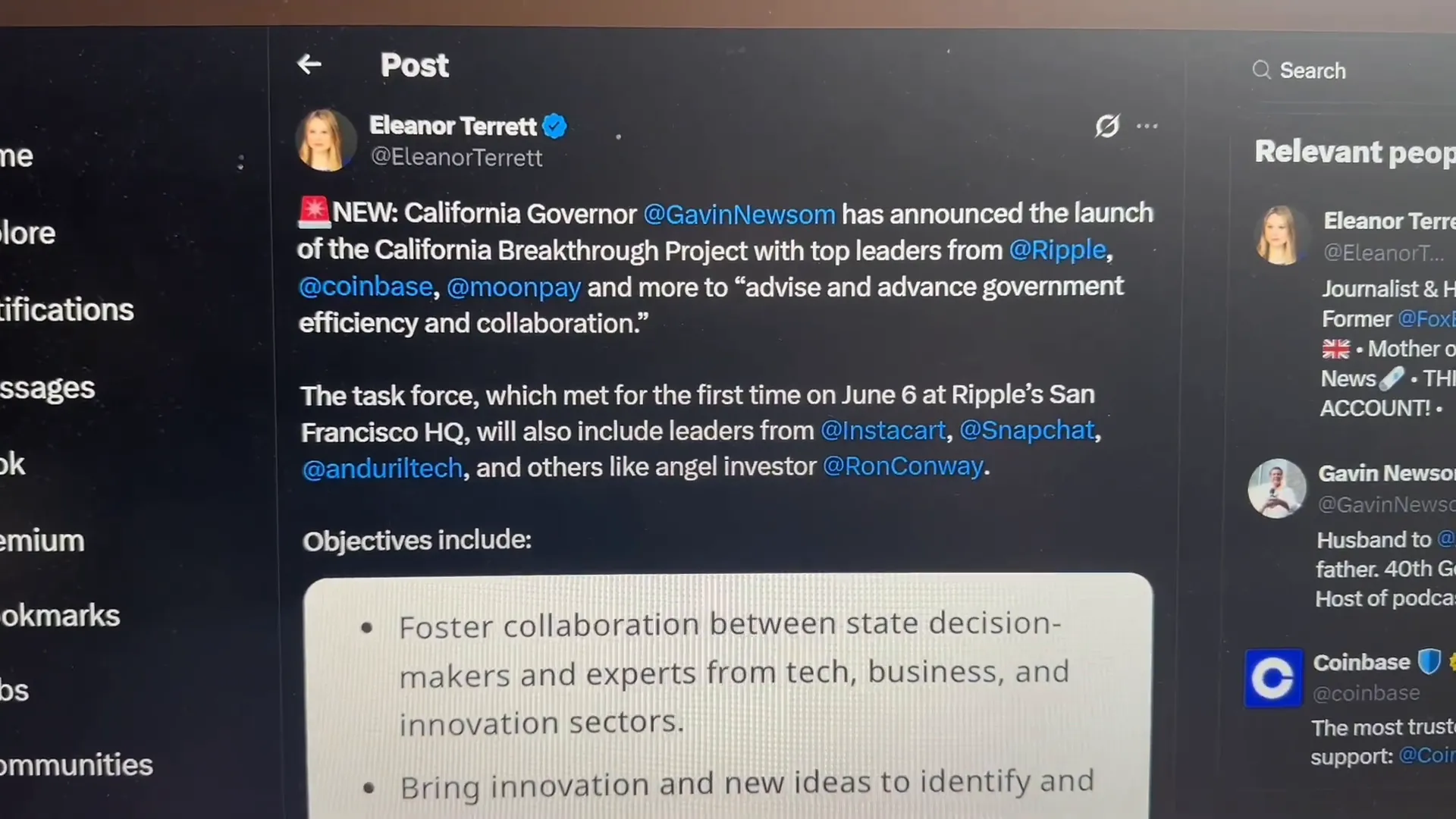

Another bullish development is Ripple’s direct collaboration with the California state government. California Governor Gavin Newsom recently launched the California Breakthrough Project, bringing together top leaders from Ripple (yes, XRP), Coinbase, MoonPay, and others to advise on advanced government efficiency collaboration.

The task force met at Ripple’s San Francisco headquarters for the first time in June, including industry leaders from companies like Instacart, Snapchat, Anduril Tech, and angel investor Ron Conway. This collaboration underscores Ripple’s growing influence and integration into mainstream financial and governmental systems.

For XRP holders and enthusiasts, this is a major positive signal, highlighting the token’s increasing legitimacy and utility. If you hold XRP, this development might reinforce your conviction in the asset’s long-term potential.

Trading Insights: Navigating the Current Crypto Market

Let’s dive deeper into trading strategies during this volatile period. Here’s what to keep in mind:

Wait for Range Discovery

Both Bitcoin and Ethereum are searching for new trading ranges. For Ethereum, expect a range between $3,100 and $4,000, with $3,100 acting as a strong support level based on historical data. Previously, Ethereum has traded between $2,400 and $2,800 multiple times, so these ranges provide a useful blueprint.

Don’t Chase Prices

It’s tempting to jump on green candlesticks and buy into rallying prices, but this is a risky approach. Instead, wait for pullbacks and look for confirmations through technical indicators:

- RSI (Relative Strength Index): Look for oversold conditions.

- MACD (Moving Average Convergence Divergence): Negative trends can indicate buying opportunities.

- Stochastic Oscillator: Double bottoms and oversold signals are positive signs.

Build Spot Positions at the Bottom

We’ve been accumulating spot positions below significant levels, such as $80,000 for Bitcoin. This strategy reduces risk and positions you well for potential upside when the market stabilizes.

Manage Your Profits

If you’re already in the market, consider taking profits during rallies. Markets tend to be choppy, and locking in gains during volatile times is prudent.

Looking Ahead: What to Watch and How to Prepare

We’re clearly in an uptrend, and there’s strong reason to believe the crypto market rally is just beginning. However, patience and preparation are crucial. Here’s what to keep on your radar:

- Legislation and Regulation: Follow developments around the Genius Act and other regulatory efforts that could reshape crypto markets.

- Stablecoin Growth: Monitor new stablecoins, their backing, and their use cases in tokenization.

- Altcoin Opportunities: Watch for altcoins gaining momentum, especially those benefiting from regulatory clarity and institutional interest.

- Technical Signals: Use proven indicators to time entries and exits prudently.

For those interested in deeper dives, tutorials, or altcoin research, engaging with trading communities and educational channels can provide invaluable insights.

Final Thoughts on Navigating Bitcoin, Crypto, and Blockchain Amid Market Uncertainty

The intersection of politics, monetary policy, and crypto markets is creating a complex environment filled with risk and opportunity. Donald Trump’s calls for aggressive rate cuts and the Federal Reserve’s cautious stance have injected volatility, but they also highlight the importance of strategic investing.

The Genius Act and stablecoin regulation offer a roadmap to a more mature, institutional-friendly crypto market. Meanwhile, collaborations like Ripple’s with California signal growing acceptance and integration of blockchain technologies in traditional systems.

By maintaining patience, focusing on technical signals, and staying informed about regulatory developments, investors can position themselves to benefit from the upcoming tokenization revolution and the evolving crypto landscape.

If you’re actively trading or investing in crypto, share your thoughts and altcoin picks in the comments. What tokens are you watching as this exciting new chapter unfolds?

Bitcoin, Crypto, BTC, Blockchain, and the Market Turmoil: How Trump and Powell Are Shaping the Crypto Landscape. There are any Bitcoin, Crypto, BTC, Blockchain, and the Market Turmoil: How Trump and Powell Are Shaping the Crypto Landscape in here.