If you’ve been following the whirlwind world of cryptocurrency, you know it never fails to deliver drama, surprises, and market moves that keep everyone on their toes. Today, we're diving deep into the latest explosive developments surrounding XRP, Ripple, and the ongoing legislative drama in Washington DC that’s shaking up the crypto community. This isn’t just another crypto news update; it’s a full-on ride through procedural votes, political holdouts, and market reactions that are shaping the future of Bitcoin, Crypto, BTC, Blockchain, and Investing.

We’ll unpack the latest on the Genius Act, the Clarity Act, anti-CBDC legislation, and how all these are impacting XRP’s price action and open interest. Plus, we’ll touch on the moves in ETH, ADA, SOL, and what this means for altcoins lagging behind. So buckle up, because this story is packed with insider info, market analysis, and some spicy political drama that you don’t want to miss.

Setting the Stage: The Big Crypto Drama in Washington DC

Let’s start with the political backdrop because, honestly, this is where the drama unfolds like a blockbuster. The U.S. House of Representatives is wrestling with three major pieces of legislation affecting cryptocurrency: the Genius Act, the Clarity Act, and an Anti-CBDC Act. These bills are crucial because they could set the regulatory framework for digital assets, including stablecoins, CBDCs (Central Bank Digital Currencies), and market structure reforms.

Despite former President Trump’s promise that these bills would pass swiftly, the reality has been far messier. Conservative Republicans have been blocking or delaying the procedural votes necessary to bring these bills to the floor for debate. This procedural vote isn’t about passing the bill itself but about deciding if the bill should be debated — a subtle but critical step in legislative progress.

The GOP leaders initially thought they had patched things up after Trump intervened, but holdouts remain, especially around the issue of CBDC banning language. Some Republicans want stronger legal guarantees that CBDCs won’t be introduced, fearing the potential for government overreach and control over individual finances — concerns rooted in watching how China uses its digital yuan.

Genius Act vs. Clarity Act: Why the Split Matters

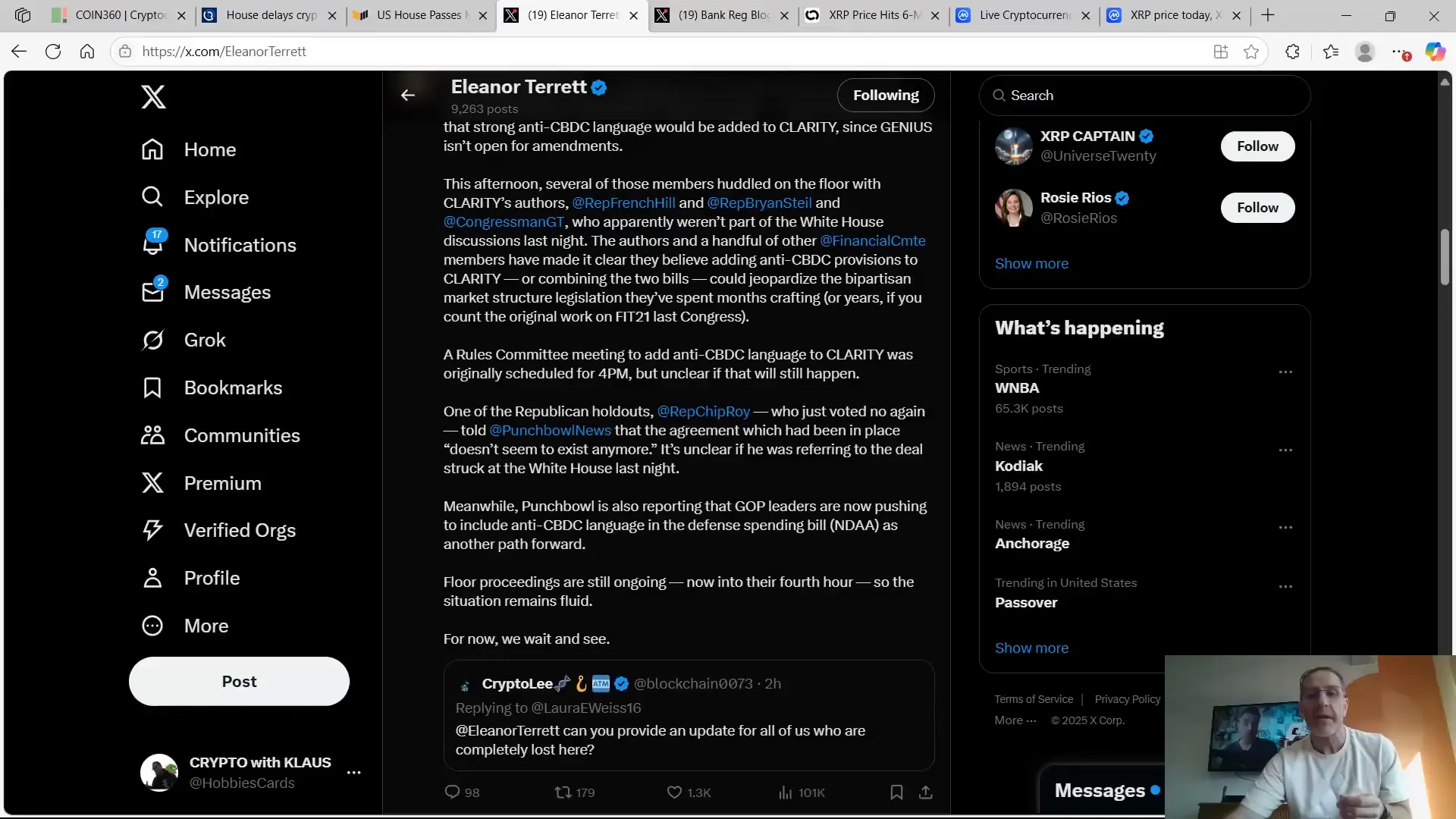

The Genius Act, which focuses on stablecoins, seems to be in a better position. It’s likely to pass cleanly, without amendments, and Trump has reportedly secured the support of remaining Republican holdouts for this bill. The Clarity Act, which includes provisions around anti-CBDC language and broader market structure reforms, is where the real contention lies.

Republicans like Marjorie Taylor Greene have openly opposed the current language in the Genius Act, stating that it does not ban CBDCs or maintain people’s chain of custody over their assets. She insists that only explicit laws can guarantee a ban on CBDCs, which is why the Anti-CBDC Act and the Clarity Act are so critical.

Adding to the complexity, the White House and authors of the Clarity Act are wary of combining anti-CBDC provisions directly into the Clarity Act or merging it with the Genius Act, fearing it might jeopardize the carefully crafted market structure legislation.

Senate Holds the Reins, Waiting for House Clarity

While the House is embroiled in debate, the Senate has decided to pump the brakes on releasing its own market structure discussion draft, initially slated for Thursday. According to insider sources, the Senate is waiting to see how the House resolves its issues before moving forward.

This delay underscores how interconnected the legislative process is and how fragile the current momentum is. Twelve Republicans flipped their vote from no to yes after meeting with Trump, but their support hinges on the promise of stronger anti-CBDC language in the Clarity Act — not the Genius Act.

However, some of these agreements seem to be unraveling. Representative Chip Roy, a Republican holdout, recently voted no again and indicated that the previous agreement might no longer exist. Meanwhile, GOP leaders are exploring alternative ways to pass anti-CBDC language, including pushing to include it in the defense spending bill.

Why the Resistance to CBDCs?

The core of the resistance to CBDCs is about control. CBDCs are digital currencies issued by central banks, and while they promise efficiency and modernization, they also raise concerns about privacy, government oversight, and financial freedom.

China’s digital yuan is a prime example of how CBDCs can be used for social control, tracking transactions, and limiting freedoms. Many Republicans and crypto advocates want to ensure that the U.S. doesn’t follow that path, pushing for legislation to ban or heavily regulate CBDCs.

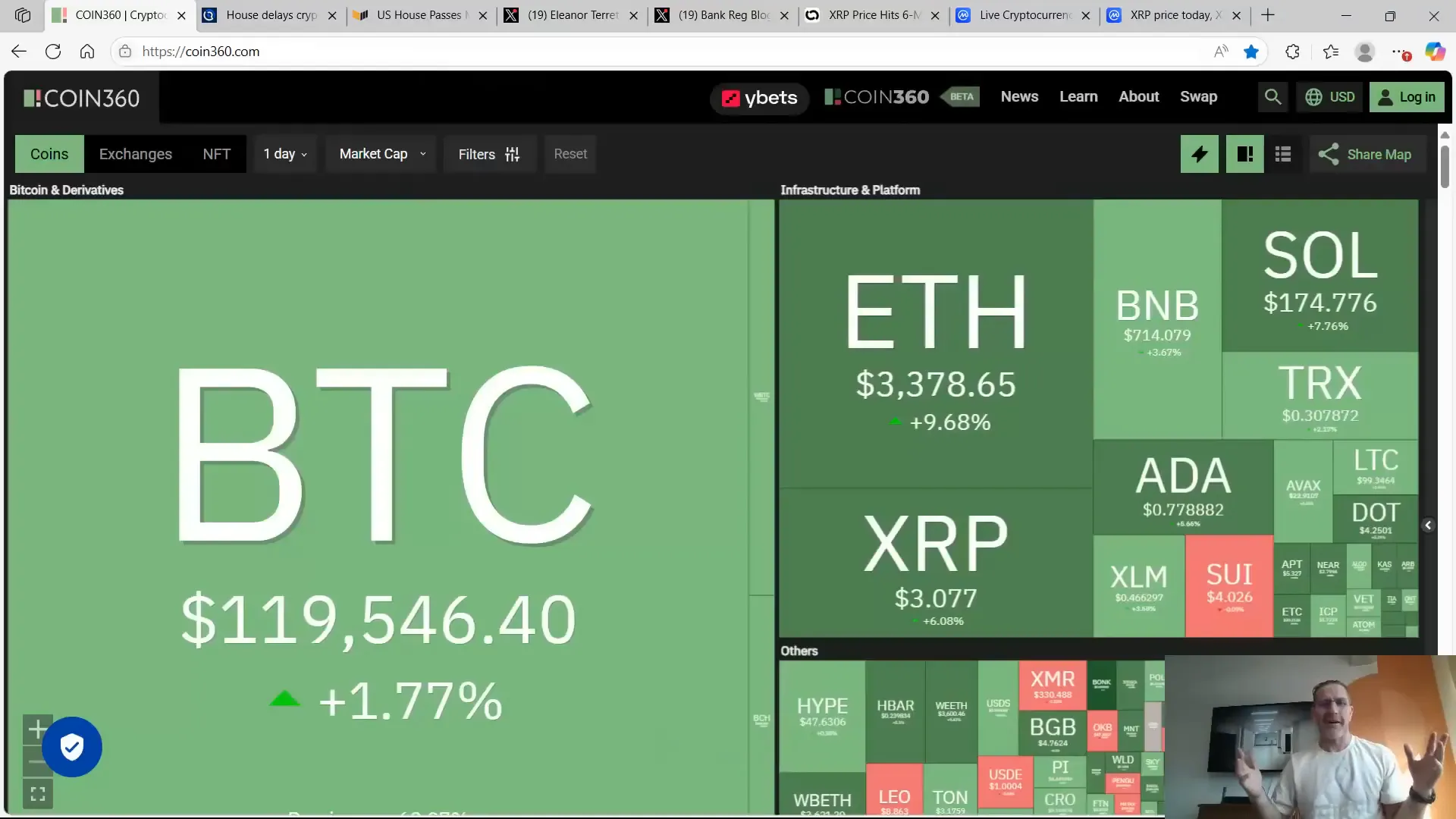

XRP’s Price Action and Market Response: “Screw You, We’re Pumping!”

Amid all this political back-and-forth, XRP is making a bold statement in the market. Despite the legislative uncertainty, XRP has smashed through the $3.00 resistance mark, reaching levels not seen since early February. This price surge is being fueled by optimism around the Genius Act’s likely passage and hopes that the Clarity Act will also move forward with strong anti-CBDC language.

Open interest in XRP futures has also hit record highs, surpassing $8.8 billion — a new peak compared to the previous $8.3 billion high back in January. Open interest reflects the amount of money controlled by leveraged positions, so this surge indicates growing confidence and speculative interest in XRP.

But it’s not just XRP that’s waking up. ETH, ADA, and SOL — which have been lagging recently — are showing signs of life, moving into the green and adding fuel to the overall crypto market’s bullish momentum.

XRP vs. Bitcoin: A Tale of Two Cryptos

Looking at the price action over the last month, Bitcoin (BTC) has been relatively smooth and steady, showing modest gains around 10%. XRP, however, has been much more volatile but with stronger upward moves, surging over 30% in the same period.

This volatility means XRP dips lower than Bitcoin during downturns but rallies higher during bullish runs. Since July 10, XRP’s outperformance has been notable, signaling growing market interest and positioning ahead of potential legislative clarity.

Ripple and Circle Charter Applications: What’s New?

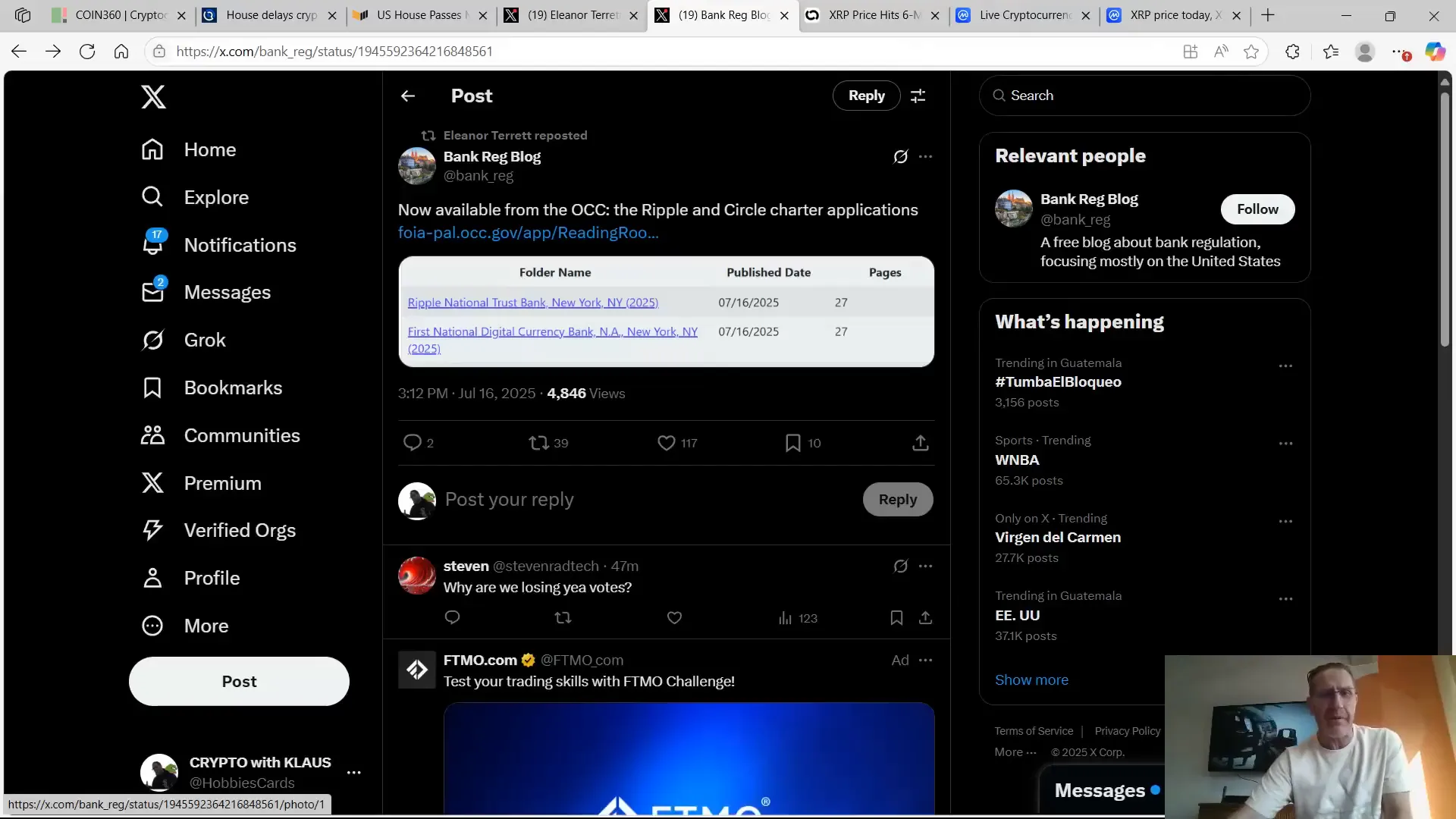

In additional breaking news, the Office of the Comptroller of the Currency (OCC) has published Ripple and Circle’s banking charter applications. This is a big deal because these charters would provide clearer regulatory pathways for these companies, potentially easing banking relationships and improving operational stability.

These documents were obtained through the Freedom of Information Act and published on the 16th, adding another layer of transparency and progress for Ripple and Circle in the U.S. financial ecosystem.

Market Health and Institutional Interest: Signs Point Up

The broader crypto market is showing strong signs of health. Trading volume perked up to $191 billion in the last 24 hours, and the Fear and Greed Index sits at a comfortable 68 — indicating optimism without excessive greed.

Altcoin season is currently at 38 out of 100, suggesting that while Bitcoin remains dominant, altcoins are gaining momentum. Institutional inflows over the past year have been mostly positive, signaling growing professional interest and investment in the space.

Why This Matters for Investors

For anyone involved in Bitcoin, Crypto, BTC, Blockchain, or CryptoNews, these developments signal a pivotal moment. The legislative framework that emerges in the next few weeks could either pave the way for clearer rules and growth or stifle innovation with restrictive policies.

XRP’s rally and the broader altcoin movements suggest that the market is pricing in optimism, betting that at least the Genius Act will pass cleanly and that the Clarity Act will find a way through with stronger anti-CBDC language.

Looking Ahead: What to Watch in Crypto and DC

The next few days will be critical. Watch for:

- House procedural votes: Will the Genius Act pass cleanly? Will the Clarity Act and Anti-CBDC Act get the language Republicans demand?

- Senate market structure draft: When will the Senate release its discussion draft, and how will it respond to the House’s actions?

- Market reactions: Will XRP and altcoins continue their momentum, or will uncertainty stall gains?

- Ripple and Circle banking charters: Updates on these applications could impact Ripple’s operational footing and investor confidence.

The crypto community is watching closely, knowing that these legislative moves could shape the future of investing and innovation in Bitcoin, Crypto, BTC, Blockchain, and beyond.

Final Thoughts on the Crypto Landscape

It’s rare to see such a dynamic intersection of politics, market action, and regulatory evolution all happening at once. The drama unfolding in DC is more than just noise; it’s a real battle over the future of money, control, and freedom in the digital age.

XRP’s strong performance amidst this uncertainty is a testament to the resilience and optimism within the crypto space. Whether you’re a seasoned investor or new to Bitcoin, Crypto, BTC, Blockchain, or CryptoNews, staying informed about these developments is essential.

As we wait for the dust to settle, remember that the market often moves ahead of legislation, pricing in expectations and sentiment. The coming weeks could be explosive, and positioning yourself with knowledge is your best asset.

And hey, if you’re curious about where I’m reporting from — the backdrop is stunning, mountains and skyscrapers all around, a reminder that while the crypto world keeps spinning, life’s beautiful moments still shine through.

Stay tuned, stay sharp, and keep those portfolios ready for what’s next.

Bitcoin, Crypto, BTC, Blockchain, and CryptoNews: A Deep Dive into XRP’s Surge Amid DC Crypto Drama. There are any Bitcoin, Crypto, BTC, Blockchain, and CryptoNews: A Deep Dive into XRP’s Surge Amid DC Crypto Drama in here.