Welcome to an in-depth exploration of the current state of Bitcoin and the broader cryptocurrency market. As Bitcoin surges to new all-time highs, it’s essential to understand the driving forces behind this momentum, the technical patterns unfolding across major cryptos like Ethereum, Solana, XRP, and Chainlink, and how traders can position themselves for potential gains in this evolving landscape.

In this comprehensive guide, we’ll unpack recent Bitcoin news, analyze key price charts, reveal significant trading patterns, and discuss actionable strategies. Whether you’re a seasoned investor or just diving into crypto, this breakdown will equip you with insights to navigate the current bullish environment and prepare for what could be a defining altcoin season.

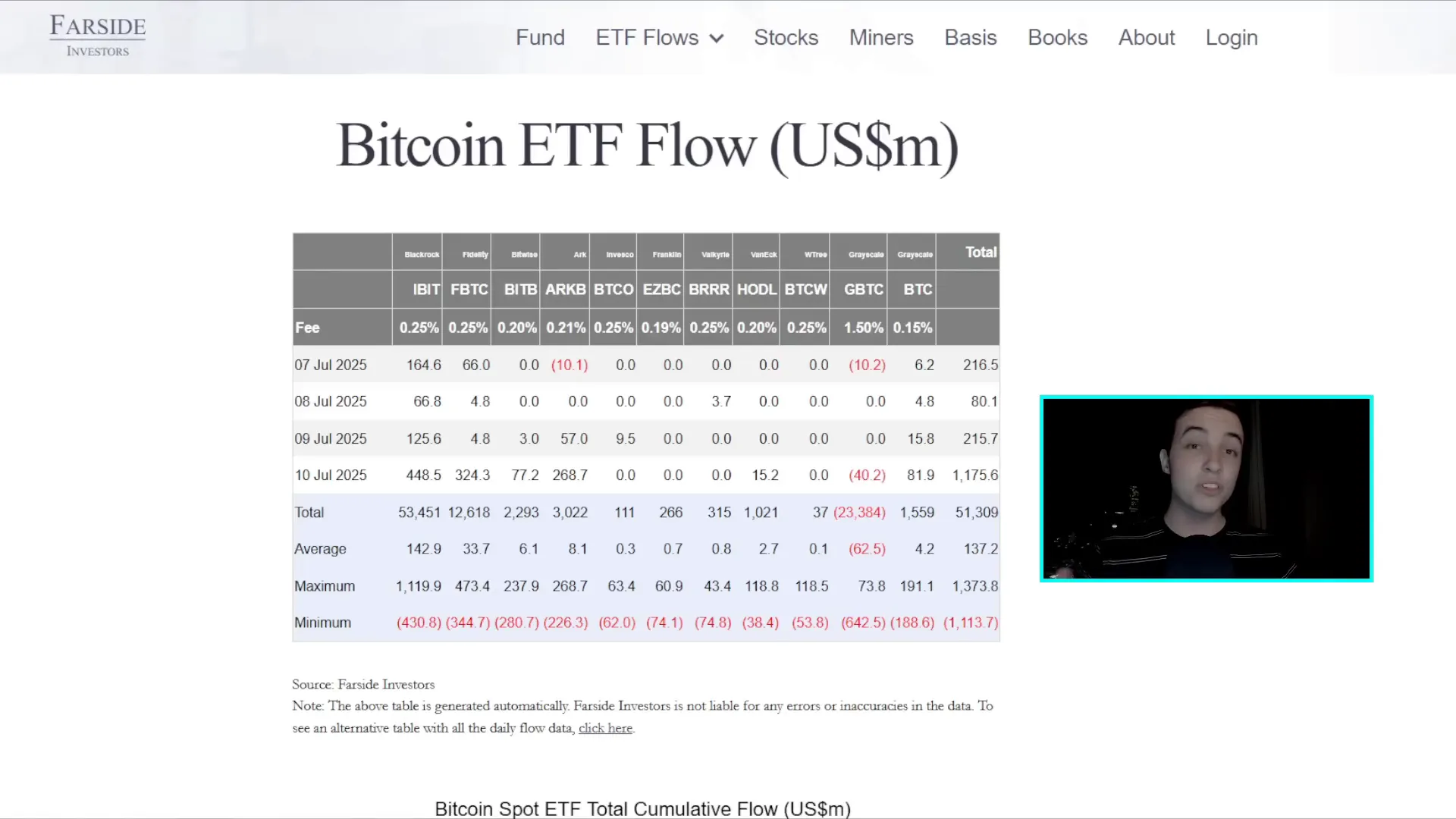

Bitcoin News Today: Massive ETF Inflows Signal Strong Buying Pressure

Before diving into the charts, it’s crucial to highlight a major catalyst fueling Bitcoin’s recent rally: a massive net inflow into spot Bitcoin ETFs. Just yesterday, over 1.1 billion US dollars flowed into these ETFs in a single trading day — the largest inflow we’ve seen in quite some time.

This influx isn’t just a number; it represents significant buying pressure that is propelling Bitcoin's price upwards in the short term. Among all the spot Bitcoin ETFs on Wall Street, BlackRock was the largest buyer, purchasing over 448 million dollars worth of Bitcoin on Thursday alone. This activity reflects strong investor demand and confidence, as BlackRock effectively buys Bitcoin on behalf of its investors.

It’s important to note a common misconception among new crypto enthusiasts: many believe that a billion dollars of buying pressure only increases Bitcoin’s market cap by a billion. In reality, the market cap can increase by tens or even hundreds of billions with such inflows. This is because Bitcoin’s price is influenced by liquidity and demand dynamics, not just the absolute dollars entering the market.

Technical Analysis: Bitcoin’s Bull Market Momentum Returns

Looking at Bitcoin’s weekly price chart, the bullish trend remains intact. The Super Trend indicator is green, signaling a larger bull market still in play. More encouragingly, we’re witnessing a resurgence in bullish momentum, especially visible in the weekly MACD and the three-day MACD, which show bullish crossovers — a strong technical sign that upward momentum is accelerating.

On the weekly chart, Bitcoin is breaking out not only in price but also in the RSI (Relative Strength Index). This breakout has temporarily invalidated a previous bearish divergence, which is when the price makes higher highs but the RSI makes lower highs, signaling potential weakness. While this bearish divergence could reconfirm later, for now, the momentum is decisively bullish.

The three-day Bitcoin chart reveals a fascinating pattern: a massive cup and handle formation, a classic bullish price pattern. The breakout point for this pattern is around $110,000, and Bitcoin is currently trading near $118,000, suggesting the breakout will likely be confirmed when the next three-day candle closes.

Once confirmed, this cup and handle pattern points to a significant price target of approximately $153,000 per Bitcoin — nearly a 40% move from the breakout point or around 30% from today’s price. For traders using leverage, such as 10x, this could translate into substantial profits. However, it’s essential to remember that price movements rarely follow a straight path; resistance and pullbacks are expected along the way.

My Bitcoin Trading Strategy: Swing Trading the Bullish Momentum

Personally, I have already entered a Bitcoin long position, treating this move as a swing trade with relatively low leverage. While I typically prefer to wait for candle closes to confirm breakouts, the breakout’s high probability prompted me to act early.

If Bitcoin dips back to retest the breakout level around $110,000, I plan to add more buy orders, capitalizing on key support levels turning from resistance. As the price approaches resistance points on the way to the target, I’ll take partial profits to reduce risk while maintaining a long exposure to ride the trend upward.

For those interested in trading, it’s critical to be ready on a crypto exchange to seize opportunities. I use BTNEXT, a no-KYC exchange accessible globally, offering generous deposit bonuses. Links to BTNEXT and 2Bit, another no-KYC exchange, are available for traders looking to start or expand their crypto trading journey.

Daily Bitcoin Chart: Confirming Breakouts and Resistance Ahead

The daily Bitcoin chart also supports the bullish thesis. A significant change in price structure occurred when Bitcoin closed above a descending resistance line, effectively breaking out of a descending parallel channel. This breakout happened around $111,000, and those who entered longs at this point have seen strong gains.

The next short-term resistance to watch is between $121,000 and $122,000, corresponding to the 161.8% Fibonacci extension level. This is a likely area for some price consolidation or minor pullbacks before the upward trend continues.

Bitcoin’s price will not ascend in a straight line, so traders should anticipate some choppiness and resistance at key levels. The overall trend remains bullish, with increasing momentum signaling further upside potential.

Short-Term Outlook: Overbought RSI and Potential Pullback

Zooming into the six-hour chart, Bitcoin recently broke above its previous all-time high around $111,500 to $112,000, triggering a major breakout. However, the RSI on this timeframe is highly overbought, indicating that a short-term cooldown or sideways price action is likely within the next one to two days. This does not suggest a crash but rather a healthy pause to reset momentum.

Traders should be prepared for minor pullbacks or sideways movement, which are natural in any bullish trend. These pauses often provide excellent entry points for new long positions or additions to existing trades.

Bitcoin Liquidation Heat Map: Understanding the Short Squeeze

One of the drivers behind Bitcoin’s rapid price increase is a short squeeze. As Bitcoin surpasses key resistance levels around $112,000 to $113,000, many short positions were liquidated. When shorts are forced to close, they buy Bitcoin to cover their positions, adding buying pressure and pushing the price higher. This creates a feedback loop that can intensify rallies.

The combination of the short squeeze and the massive ETF inflows creates a powerful bullish environment, suggesting the breakout above previous resistance is a strong signal to flip bullish on Bitcoin.

Bitcoin Dominance and Altcoin Season: What to Expect Next

The Bitcoin dominance chart, which measures Bitcoin’s market share relative to the entire crypto market, is now showing a bearish divergence on the three-day timeframe. This means while Bitcoin’s price makes higher highs, its dominance percentage is making lower highs, hinting at a potential pullback in Bitcoin’s market share over the coming days, weeks, or months.

Why does this matter? A decline in Bitcoin dominance often correlates with an altcoin season, where many altcoins outperform Bitcoin and capture more market share. This doesn’t mean Bitcoin’s price will necessarily fall; it can still rise while altcoins grow at a faster pace.

Investors should keep a close eye on this dynamic, as it may signal a shift where altcoins like Ethereum, Solana, XRP, and Chainlink begin to shine.

Ethereum Price Analysis: Breaking Key Resistance and Setting New Targets

Ethereum has recently confirmed a breakout above a crucial resistance zone between $2,700 and $2,800. The latest daily candle closed above $2,950, signaling that this former resistance is likely to become new support.

The next major upside target lies between $3,200 and $3,300, corresponding to the 78.6% Fibonacci retracement level. In the shorter term, Ethereum may face resistance around $3,050, where previous price action has shown congestion.

Overall, Ethereum’s price structure is bullish, having formed a new higher high after months of consolidation. This breakout aligns with Bitcoin’s bullish momentum and suggests Ethereum could follow suit with significant gains.

Solana Price Action: Confirmed Breakout and Bullish Patterns

Solana is experiencing a similar bullish setup. On the daily chart, Solana has encountered resistance around $166 to $167, which coincides with the 50% Fibonacci retracement level.

Whichever direction Solana takes here, the outlook remains bullish. Breaking above $167 would target resistance levels at $180 to $185, followed by a golden pocket resistance zone between $191 and $199.

If Solana faces rejection at $167, it might be forming a bullish inverse head and shoulders pattern, a powerful reversal pattern that would require a pullback before a breakout to confirm.

Zooming into the eight-hour chart, Solana has now confirmed a breakout from a short-term cup and handle pattern. This breakout sets a price target near $194 to $195, implying a potential 16-17% upside from current levels. For traders using leverage, this represents a substantial profit opportunity.

Trading strategy here mirrors that of Bitcoin: enter long positions on confirmed breakouts with stop losses set just below invalidation points (e.g., below $157-$158 for Solana) and gradually move stop losses into profit territory as the trade advances.

XRP Price Surge: Straight-Line Moves and Explosive Potential

XRP is currently undergoing a major squeeze to the upside, breaking through significant resistance levels on the twelve-hour chart. Unlike many cryptocurrencies that move with frequent pullbacks, XRP is known for rapid, almost straight-line moves during breakouts.

After confirming a breakout above around $2.36, XRP surged past the next resistance near $2.65. The current price action suggests that XRP is just getting started, with the next major target set between $2.90 and $3.00.

Given XRP’s history of swift moves, it’s plausible we could see prices quickly return to all-time highs between $3.30 and $3.40 within days. While this comes with increased risk due to the rapid price changes, the potential gains are significant for those who time it right.

Chainlink Breaking Out: Key Resistance and Bullish Momentum

Chainlink is also experiencing a breakout above a critical resistance zone of $15.30 to $15.50, a level that has acted as a strong barrier for an extended period.

Pending confirmation by candle close, Chainlink’s next resistance targets are $16.00, $16.50, $16.90, and finally around $17.50. Given the bullish momentum in the broader crypto market, Chainlink is likely to regain ground toward these levels.

Support is expected between $15.30 and $15.50, with a potential retracement to $14.50 if the price dips below this range. Overall, Chainlink’s trend is bullish, and even if minor pullbacks occur, the momentum favors further gains.

Staying Long in a Bullish Market

Given the current bullish environment across Bitcoin and major altcoins, the best approach is to focus on long positions and holding crypto assets rather than taking shorts. While pullbacks and consolidation phases are normal, the overarching trend is upward.

For those looking to capitalize on these moves, exchanges like BTNEXT and 2Bit offer excellent platforms with no KYC requirements and attractive bonuses for new users. These can be valuable tools to prepare for trading opportunities as the market volatility picks up.

Final Thoughts: Positioning for the Next Wave in Crypto

The cryptocurrency market is showing signs of renewed vigor and opportunity. Bitcoin’s breakout to new all-time highs, supported by massive ETF inflows and a short squeeze, signals strong bullish momentum.

Meanwhile, key altcoins like Ethereum, Solana, XRP, and Chainlink are confirming breakouts and setting ambitious price targets, suggesting the potential for a pronounced altcoin season. Technical patterns like cup and handle and inverse head and shoulders provide clear frameworks for traders to identify entry points, stop losses, and profit-taking zones.

Remember, price movements in crypto rarely follow a straight line. Expect resistance, pullbacks, and volatility as part of the journey toward higher prices. Being prepared, disciplined, and informed are your best tools for success.

Whether you’re a seasoned trader or new to the space, now is a crucial time to stay engaged, monitor the charts, and be ready to act on these emerging opportunities in Bitcoin, crypto, BTC, blockchain, and the broader market.

Bitcoin, Crypto, BTC, Blockchain, and Altcoin Season: Breaking Down the Latest Market Moves and Trading Strategies. There are any Bitcoin, Crypto, BTC, Blockchain, and Altcoin Season: Breaking Down the Latest Market Moves and Trading Strategies in here.