Bitcoin is blasting through all-time highs, and the crypto market is heating up faster than ever. This surge isn’t just about price movements—there’s a growing conversation around taxation frameworks and regulatory clarity that could unlock massive inflows of capital into the crypto ecosystem. In this comprehensive dive, we’ll explore the latest in Bitcoin’s record-breaking rally, the surge in altcoins like XRP, the critical developments in crypto taxation, and what this means for investors and the broader blockchain landscape.

Whether you’re a seasoned trader, a crypto enthusiast, or just curious about how Bitcoin and altcoins are evolving alongside regulatory shifts, this guide will walk you through the key insights shaping the market today. Let’s break it down.

The Bitcoin Breakout: A New Record High

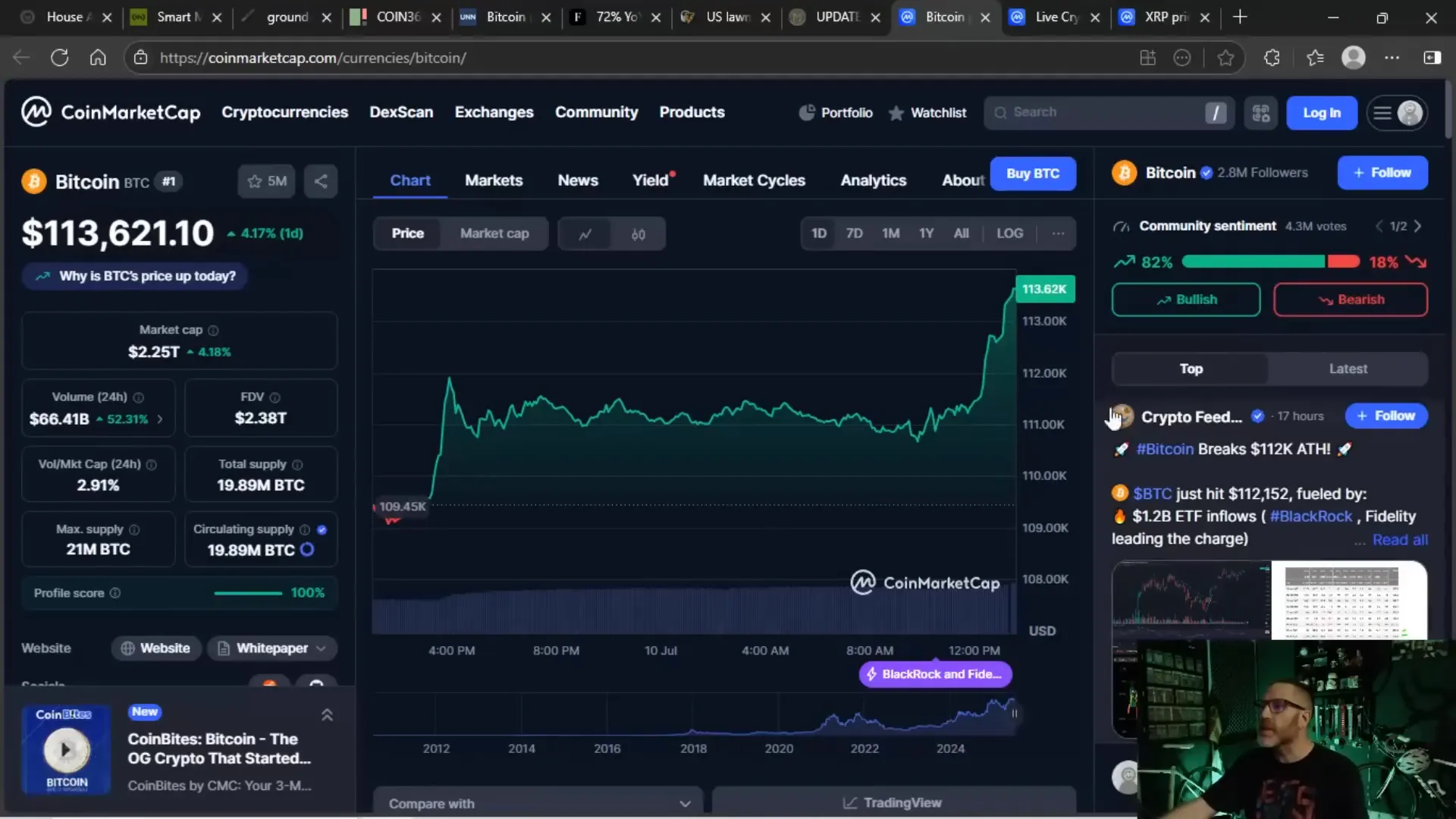

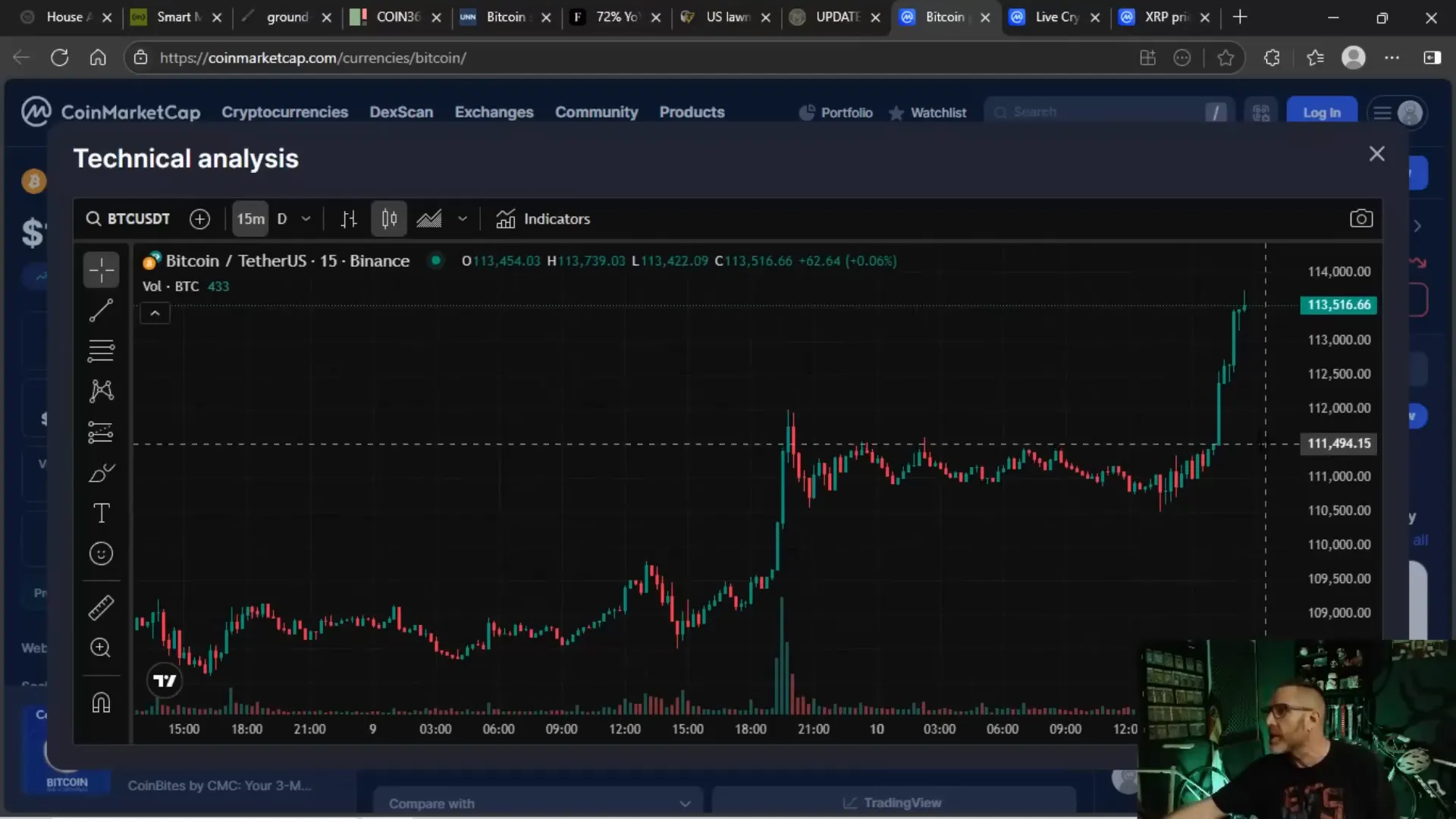

Bitcoin has been on an absolute tear, blasting through previous all-time highs and setting new records that have many investors buzzing. As of early July, BTC surged past the $113,000 mark, leaving analysts scrambling to keep up with the rapid price action. To put it simply, Bitcoin wasn’t just inching higher—it was rocketing upwards, moving from around $110,000 to over $113,500 within the span of an hour in some cases.

This kind of momentum is rare and signals a strong bullish sentiment in the market. The volume accompanying this rally is “absolutely exploding,” signaling that not only is the price moving up, but a massive amount of trading activity is fueling the move. This kind of volume surge is critical because it reinforces the strength and sustainability of a rally.

Even digital publications and news outlets are struggling to keep pace with how fast Bitcoin’s price is moving. In a world where traditional media often lags behind, crypto’s digital-first nature means that news and market data can be updated in real-time, reflecting the rapid shifts traders and investors are witnessing firsthand.

Why Bitcoin Leads the Charge

Bitcoin is the “big kid on the block” for a reason. It’s the original cryptocurrency and has cemented itself as a digital commodity akin to gold or oil. Unlike many altcoins, BTC has the regulatory clarity of being recognized as a commodity, which gives it a “golden pass” in many financial frameworks. This status makes Bitcoin the go-to asset when big institutional money wants to dip its toes into the crypto space.

Because of this, Bitcoin often benefits first and most significantly when there’s positive momentum in the market or when regulatory clarity improves. This rally is no exception, with BTC leading the charge and pulling altcoins behind it.

Altcoins Join the Party: XRP and Others Showing Strength

While Bitcoin’s rally grabs headlines, altcoins are also starting to show healthy movement alongside it. XRP, in particular, has been making waves, pushing toward the $2.50 mark—a significant level it hasn’t comfortably held in a while. Other favorites like Ethereum (ETH), Cardano (ADA), and Dogecoin (DOGE) are also in the green, signaling that the broader crypto market is starting to thaw after a long period of sideways or bearish action.

Here’s a snapshot of some key altcoin prices during this surge:

- ETH around $2,813, flirting with the $3,000 milestone

- XRP pushing $2.49, eyeing the $2.50 resistance

- ADA sitting near $0.65

- DOGE approaching $0.20

XRP’s volume is especially noteworthy, with a 22% increase and over $5.25 billion traded in a 24-hour window. This kind of volume supports the price action and indicates real interest and demand rather than just speculative chatter.

What’s Driving Altcoin Optimism?

Altcoins often benefit from Bitcoin’s momentum, but their individual price trajectories are also influenced heavily by regulatory news, adoption, and technological developments. For XRP, a lot hinges on the upcoming Crypto Week, where lawmakers and regulators will discuss crypto taxation policies and frameworks. If the crypto community sees positive regulatory progress, altcoins like XRP could experience significant gains.

However, if the talks result in friction or unfavorable regulations, it could push prices down. The market is watching closely, hoping for bipartisan cooperation and clarity that will encourage investment rather than stifle it.

Crypto-Backed Borrowing and Usage: More Than Just Speculation

One of the common criticisms of the crypto market is that it’s driven mainly by speculation—buying low, hoping to sell high. While that’s an undeniable part of the ecosystem, there’s growing evidence of real-world utility and adoption that is helping to stabilize and legitimize the space.

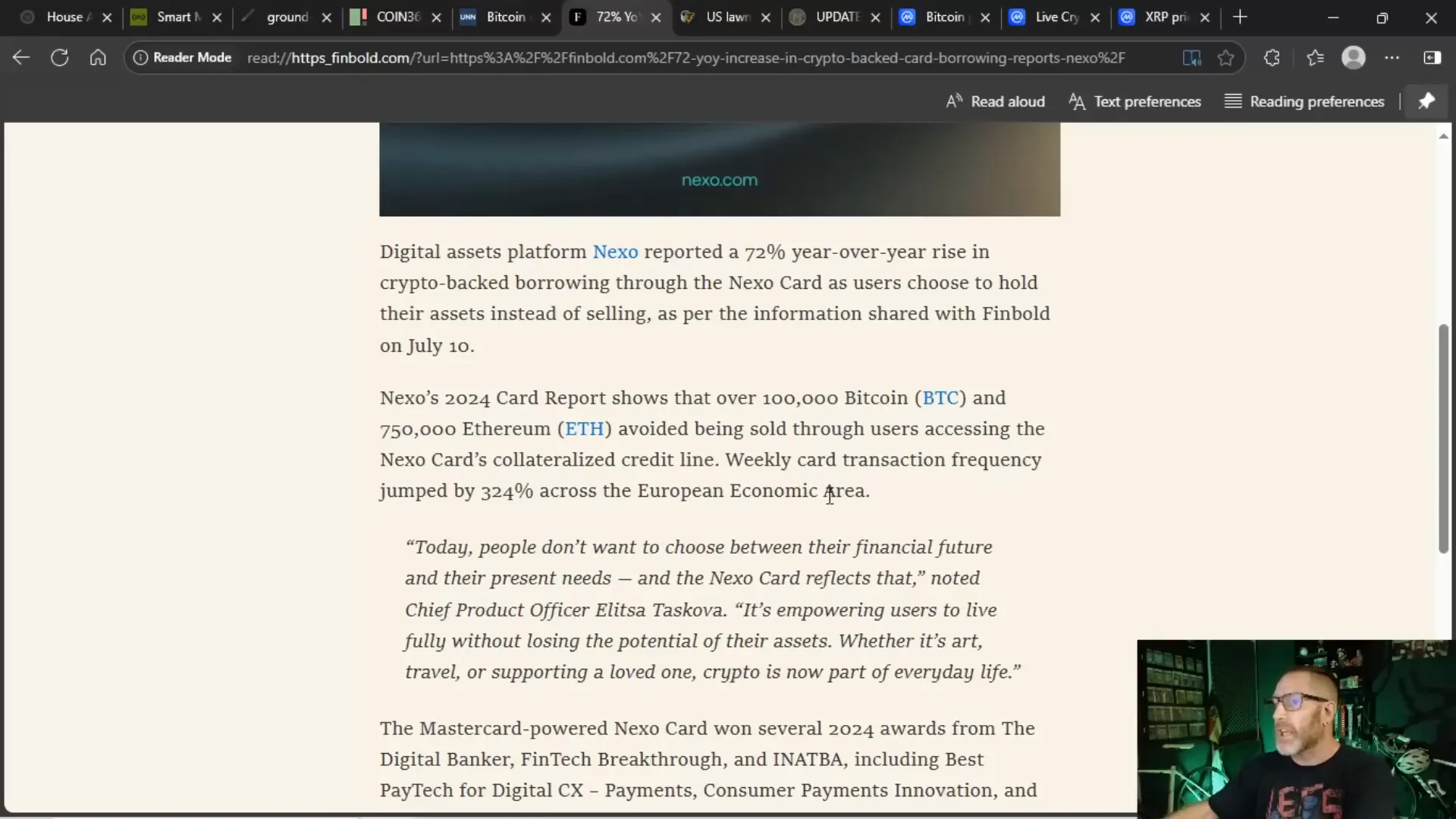

A recent report from digital asset platform Nexo reveals a 72% year-over-year increase in crypto-backed borrowing via the Nexo card. This means more people are using their crypto holdings as collateral to access credit, rather than selling their assets outright. This is a big deal because it shows that crypto holders want to maintain exposure to their assets' potential upside while still accessing liquidity for everyday needs.

Here are some key stats from Nexo’s 2024 card report:

- Over 100,000 BTC and 750,000 ETH avoided being sold by users accessing credit lines

- Weekly card transaction frequency jumped 324% across the European Economic Area

- Transaction volume grew by 203% year-over-year

This trend reflects a shift in how crypto is being integrated into daily financial life—from art purchases to travel expenses, and supporting loved ones, crypto is becoming a part of everyday transactions. This organic adoption is a strong indicator of the market’s maturity and signals that crypto isn’t just a speculative bubble but a growing financial ecosystem.

The Taxation Puzzle: Why Crypto Taxes Matter More Than Ever

One of the biggest hurdles for crypto’s mainstream adoption has been the murky and often inconsistent taxation framework surrounding digital assets. Investors and corporations alike want to understand how their crypto holdings will be taxed before committing large sums of money.

This uncertainty has kept a lot of capital parked on the sidelines, waiting for lawmakers to provide clarity. The good news is that there’s movement on this front.

US Lawmakers Take Steps Toward Clearer Crypto Tax Policy

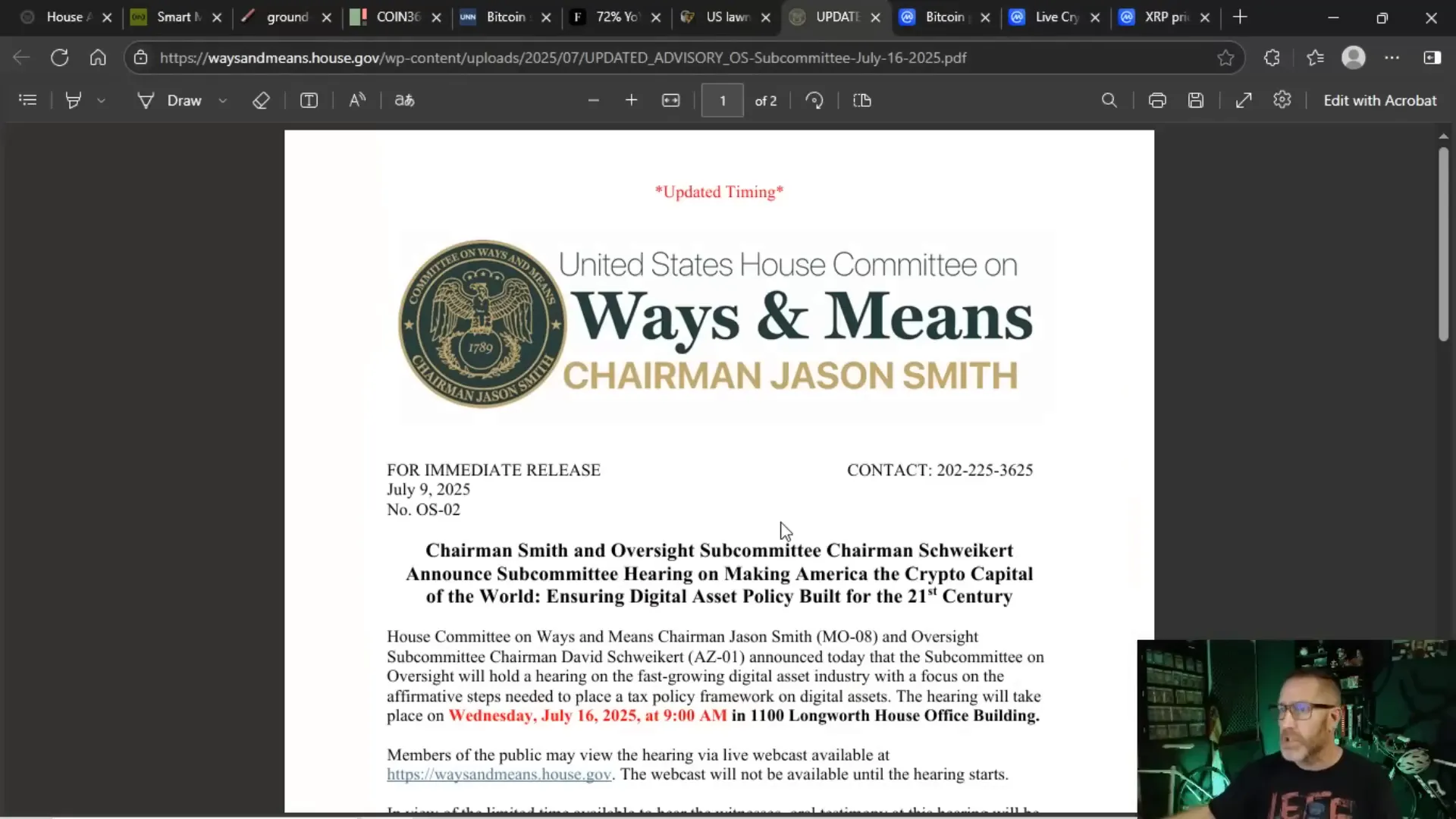

On July 16th, the House Committee on Ways and Means scheduled a hearing focused on developing a 21st-century tax policy framework for digital assets. This hearing aims to establish affirmative steps toward clarifying how crypto assets should be taxed, addressing one of the biggest gray areas in the market.

The significance of this cannot be overstated. Clear tax policies will not only encourage more individual investors to enter the market but will also give corporations the confidence to deploy billions into crypto projects and infrastructure without fear of unexpected tax liabilities down the line.

What Investors Are Waiting For

Many investors are hesitant to add to their strategic crypto reserves because they are uncertain how regulators, especially the SEC, will classify different digital assets. Will Bitcoin remain a commodity? Will altcoins be classified as securities, commodities, or even collectibles? These classifications have significant implications for how these assets are taxed and regulated.

Companies that want to invest hundreds of millions or even billions into crypto want to be sure the tax rules are ironclad. They don’t want to be caught off guard by retroactive tax changes or unclear regulations that could force them into unexpected liabilities.

Fixing both the regulatory and taxation frameworks could unleash a wave of new capital into crypto, fueling further growth and innovation.

Challenges on the Horizon: Inflation, Tariffs, and Market Sentiment

Of course, it’s not all smooth sailing. The market still faces headwinds such as inflation concerns and tariff disputes that could weigh on investor sentiment. However, the current mood seems optimistic, with many investors willing to look past these challenges in anticipation of regulatory clarity and upcoming monetary policy moves.

At the end of this month, the Federal Open Market Committee (FOMC) meeting will be closely watched. Jerome Powell, the Federal Reserve Chair, is unlikely to cut rates immediately but could signal rate cuts in the September meeting. Such signals often trigger bullish movements in risk assets, including cryptocurrencies.

Why Bitcoin Miners Stand to Gain From Tax Clarity

Bitcoin miners face unique tax challenges that could be alleviated with better policy. Currently, miners are taxed twice: once when they mine BTC and receive it as income, and again when they sell those mined coins. This double taxation can dampen mining incentives and reduce liquidity in the market.

Clearer tax guidelines could help miners retain more of their earnings and potentially increase their selling power, which would have ripple effects throughout the market.

Market Volume and Institutional Inflows: Signs of Strength

The broader crypto market has seen a massive volume explosion, with 24-hour trading volumes hitting $153 billion—up 43% from the previous day. This surge in volume is a healthy sign of market participation and liquidity.

Altcoins are holding their ground well, supported by institutional inflows and increasing retail interest. XRP’s volume, for example, is particularly robust, signaling strong demand from traders and investors alike.

Looking Ahead: What Investors Should Watch

The next few weeks and months are shaping up to be pivotal for Bitcoin, crypto, and the entire blockchain ecosystem. Here’s what to keep an eye on:

- Crypto Week and Regulatory Hearings: The outcomes of discussions on crypto tax policy will set the tone for future investments.

- Market Reaction to FOMC Meetings: Jerome Powell's statements on interest rates can trigger significant market moves.

- Altcoin Price Action: Watch XRP and other key altcoins for breakout or breakdown patterns linked to regulatory news.

- Institutional Movements: Large inflows or outflows from institutional players will indicate confidence or caution.

- Adoption Metrics: Usage stats like Nexo’s card borrowing trends reveal how crypto is becoming part of everyday life.

For investors, staying informed and agile is key. The crypto market is evolving rapidly, but with the right knowledge and tools, it offers exciting opportunities for growth.

As we move forward, the combination of Bitcoin’s record-breaking momentum, growing altcoin strength, and crucial regulatory developments could usher in a new era for crypto investing. The blockchain revolution continues to unfold—and those who understand the nuances of price action, regulation, and adoption will be best positioned to thrive.

Keep your eyes peeled, your wallets ready, and your strategies sharp. The crypto world is just getting started.

Bitcoin, Crypto, BTC, Blockchain, and CryptoNews: Navigating the Explosive Market and Taxation Wave. There are any Bitcoin, Crypto, BTC, Blockchain, and CryptoNews: Navigating the Explosive Market and Taxation Wave in here.