If you’re deep into Bitcoin, crypto, BTC, blockchain, or any form of crypto investing, then you already know the market never sleeps — and neither does the drama. Today, we’re breaking down some explosive news that’s shaking the entire crypto market, including a scandal involving TON Coin, the stubborn resilience of XRP around the $2.30 mark, and some troubling news about tariffs impacting global markets.

This isn’t your typical crypto fluff. We’re diving into the hype, the lies, the truth bombs, and what it all means for your investments. Buckle up, because this ride is full of twists, turns, and a few punches thrown at some very questionable characters.

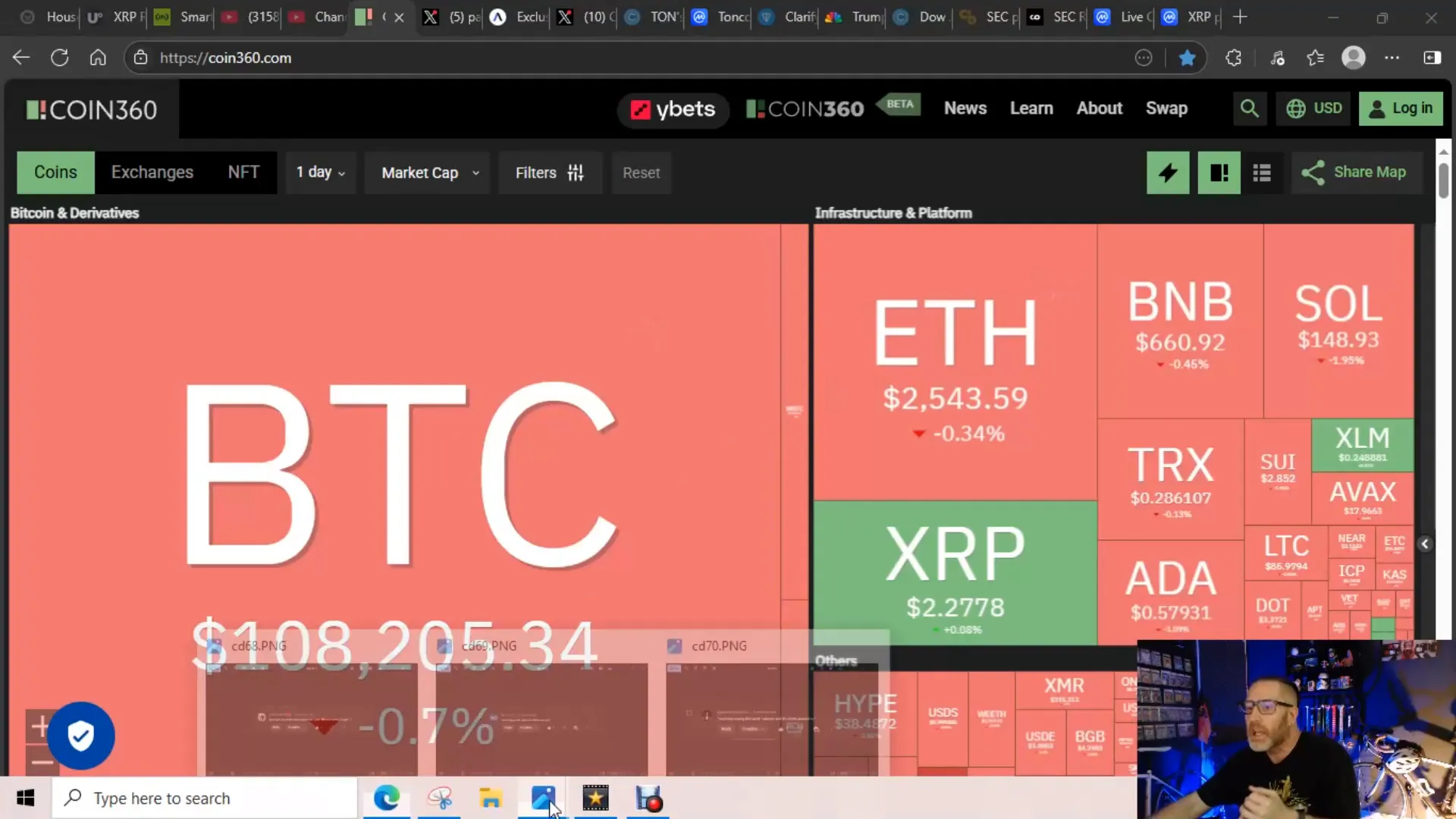

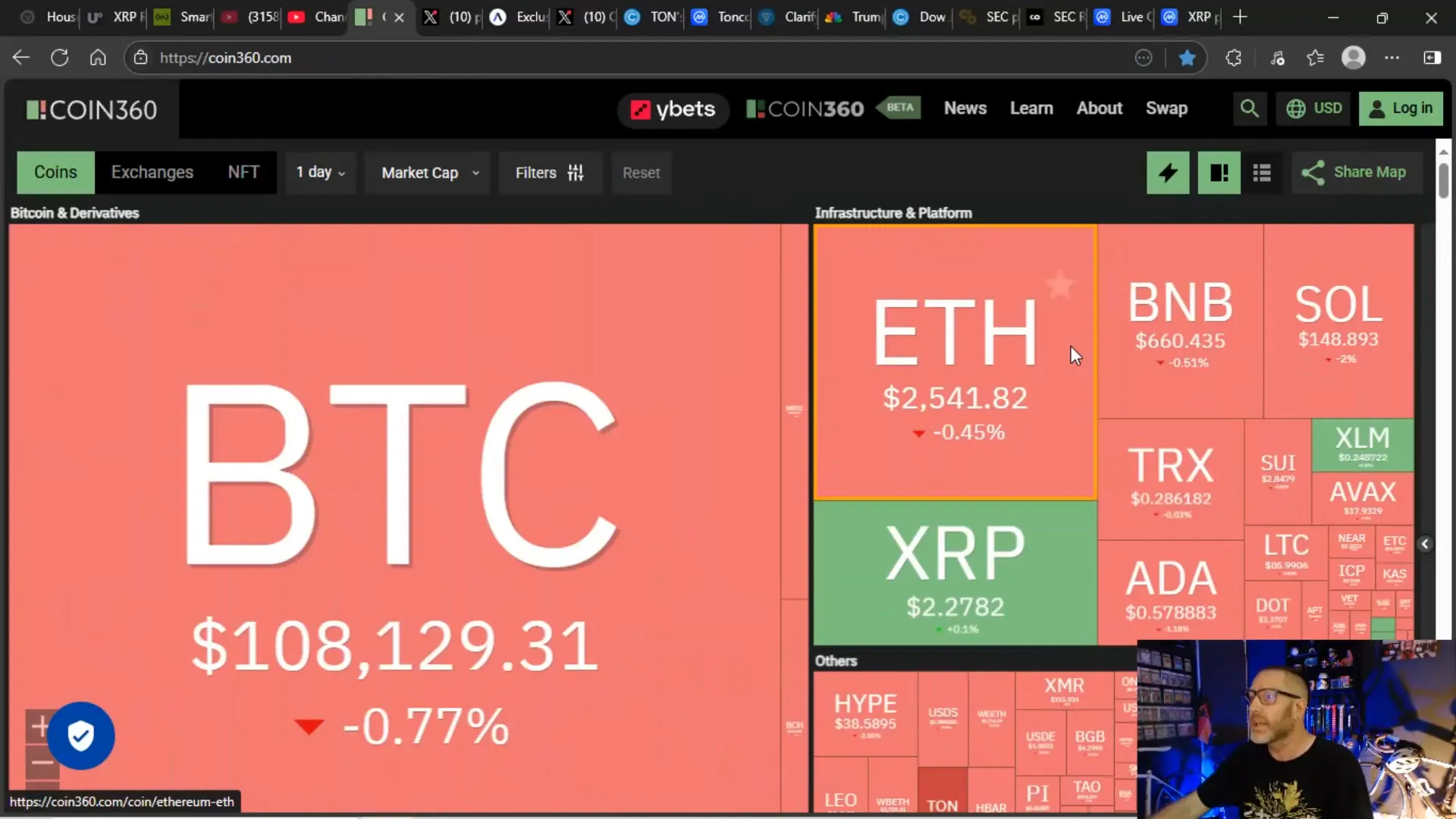

Setting the Scene: Market Red and the Importance of Real News

When I checked the charts recently, the screen was mostly red, with pockets of green and one coin deep in the red territory. That coin? TON Coin. The crypto market is a battlefield, and hype, misinformation, and outright lies can cause massive damage. If you’re a crypto investor or enthusiast, understanding how these forces interplay is critical.

Before we get into the meat of the news, it’s important to emphasize the value of reliable, timely information. I bring you news not just on holidays like Christmas, New Year’s, or any other day because you, the viewer and reader, matter most. In a market where “hopium” — ungrounded hope and hype — runs rampant, staying informed with facts can make or break your portfolio.

From Epstein to Crypto Lies: When Truth is a Casualty

Let’s start with a hard-hitting truth bomb that transcends crypto but impacts the broader socio-political landscape — the ongoing saga of Jeffrey Epstein’s client list. Pam Bondi, a name you might recognize, recently claimed the Epstein client list was “sitting on her desk” ready to be reviewed. But guess what? The Department of Justice and FBI have concluded Epstein had no client list. This isn’t just a simple mistake; it’s a blatant lie that protects some of the worst criminals and their enablers.

Bondi and others covering up this scandal should be held accountable — fired, stripped of pensions, and removed from positions of power. Protecting child predators is not just disgusting; it’s a crime against humanity. This kind of deception is exactly why trust in institutions is eroding, and it’s a reminder to always question who benefits from the lies we’re fed.

TON Coin’s UAE Golden Visa Announcement: A Lesson in Crypto Hopium

Now, shifting gears back to crypto — TON Coin made headlines with a “huge” announcement on July 6th that anyone staking $100,000 worth of TON would be eligible for a 10-year UAE golden visa. The crypto community went wild, with many calling it a game-changer. But here’s the kicker: it was fake news.

This story spread like wildfire on Twitter and YouTube, causing TON Coin’s price to pump significantly. People rushed in, driven by hope — or hopium — only to see the price crash when the truth came out. The UAE regulators issued a clear statement: “There is no formal approval.” The TON Foundation later admitted they were merely “testing the waters,” but that excuse doesn’t undo the damage.

Why does this matter? Because these hype stories cause real financial losses for investors who don’t do their own research. Look at the volume spike — normally, TON Coin’s trading volume hovers around 70 to 100 million. On that announcement, it soared to over 500 million, even hitting 700 million and beyond. That’s hundreds of millions of dollars flowing in based on false hopes.

Many investors got “washed” — a brutal term for losing money after buying in at the peak. And who profits? The exchanges and insiders who sold at the top. This is the dark side of crypto hype, and it’s why you must be vigilant and skeptical about too-good-to-be-true news.

Understanding the Pump and Dump Cycle

What happened with TON Coin is a textbook example of a pump and dump — a manipulative scheme where the price is artificially inflated before insiders sell their holdings, causing the price to crash. It’s a cycle that hurts retail investors and damages trust in the entire crypto ecosystem.

Here’s a quick breakdown:

- Announcement or rumor: A bombshell claim is made, usually on social media or crypto news outlets.

- Price pumps: Investors rush in, buying the coin and driving the price up.

- Volume spikes: Trading volume surges as more people buy in.

- Insiders sell: Those with early knowledge or large holdings dump their tokens at the peak.

- Price crashes: The coin’s value plummets, leaving latecomers with losses.

TON Coin’s fake UAE visa story triggered exactly this, and it’s a painful reminder to always verify news before acting.

Market Turmoil: Tariffs Hit Japan and South Korea, Crypto and Stocks React

Adding fuel to the fire, former President Trump announced a 25% tariff on Japan and South Korea. This isn’t just a crypto problem — the Dow Jones and other major stock indices also took a hit. Tariff announcements create uncertainty, and investors often respond by pulling back from risky assets, including cryptocurrencies.

Trump warned about retaliation, saying if tariffs are met with countermeasures, the US would raise tariffs even higher. This escalating trade war rhetoric has sent shockwaves through global markets, pushing many cryptocurrencies into the red.

Interestingly, XRP showed resilience, holding onto a 0.1% gain in the last 24 hours, trading around $0.87, while the rest of the market slid. But even XRP is not immune to the broader market forces at play.

SEC and Spot ETFs: The Solana and XRP Race

Now, here’s some potentially good news for crypto investors: the SEC has pushed issuers of Solana spot ETFs to refile their applications by the end of July. This move signals a possible fast-track approval, which could be a game-changer for the crypto ETF landscape.

Why does this matter? Because Solana filed its ETF applications before XRP did. The SEC can only delay so long, so if they approve Solana’s ETFs, XRP’s spot ETFs might get the green light sooner than expected.

However, the SEC is demanding detailed disclosures about staking protocols and in-kind redemption processes. They’re scrutinizing these “naughty” aspects closely to see how they impact the broader crypto ETF market.

Remember the recent Bitcoin basket ETF that included Bitcoin, Ethereum, Solana, XRP, and ADA? It was initially approved but then pulled back two days later. That was a missed opportunity for XRP spot ETFs, but the Solana refiling might open the door again.

XRP’s Battle Around the $2.30 Mark

XRP investors are watching closely as the coin tries to hold its ground around $2.30. Recently, it managed to break above $2.34 and even touched $2.35, but the gains were short-lived. The price was pushed back down, wiping out most of the gains north of $2.30.

If you’re playing the trading game, the strategy is clear: take profits above $2.30 and consider reloading around $2.10. The market is volatile, but these levels are proving to be key battlegrounds for XRP.

But what’s driving the volatility? Aside from the tariff news and general market sentiment, there’s also the impact of misinformation and hype — or hopium — surrounding XRP. Pumpers constantly flood social media with rumors about massive buybacks, gold-backed XRP, or bank adoption in Japan. Most of these claims have turned out to be false, creating confusion and distrust.

The Damage of Hopium and Misinformation in Crypto

The crypto market is a minefield of misinformation. When people post unverified or outright false news, it creates a “crying wolf” effect. Investors get burned repeatedly and start doubting everything, even legitimate news.

For example, the TON Coin UAE visa story wasn’t the first time a crypto project jumped the gun with hype. The XRP community has also seen its share of false rumors:

- Claims of a $40,000 XRP buyback

- Rumors of XRP being backed by gold

- Stories about XRP’s adoption by banks in Japan

All three were lies that misled investors and hurt the coin’s credibility.

Calling out these lies is essential. Otherwise, the market remains a playground for grifters and scammers who profit at the expense of everyday investors.

Calling Out the Liars: Accountability in Crypto and Beyond

Speaking of liars, the situation with Pam Bondi and the Epstein list is a stark reminder that dishonesty isn’t confined to crypto. It’s everywhere — from government officials to crypto influencers. We need to demand accountability across the board.

The Epstein scandal involved trafficking that goes beyond individuals — it’s a systemic problem with cover-ups and protection for powerful people. The so-called “client list” was teased and then denied. People who flaunted the files like trophies should be fired. We need a world where truth matters, and liars don’t get a free pass.

Staying Ahead: Why Following Real News Matters in Crypto

In the fast-paced world of Bitcoin, crypto, BTC, blockchain, and investing, staying informed is your best defense. False hype can lead to quick gains, but it often ends with losses. Real news, honest analysis, and critical thinking are what protect your assets.

That’s why I’m committed to bringing you the truth — good, bad, happy, or sad — no matter the day or time. Whether it’s Christmas Eve, New Year’s Day, or a random Tuesday, you deserve real information that helps you make smart decisions.

Watching the Charts: What’s Next for XRP and the Market?

As of now, the charts are still unsettled. XRP’s initial breakout above $2.30 was promising but lacked follow-through. The market is waiting for a catalyst — maybe the SEC’s ETF decisions, maybe a broader market rally, or maybe just some clarity on geopolitical tensions.

The tariffs between Japan and South Korea are a headwind, so staying hydrated and patient is key. Crypto investing isn’t just about chasing pumps; it’s about weathering storms and playing the long game.

Final Thoughts: Be Smart, Stay Skeptical, and Protect Your Investments

Here’s the bottom line: the crypto market is full of promise but also pitfalls. From fake news about golden visas to government cover-ups and tariff wars, you need to keep your eyes open and your mind sharp.

Trust but verify. Don’t let hopium cloud your judgment. Follow credible sources, check your facts, and never invest more than you can afford to lose. The exchanges and insiders are always looking to profit off hype — don’t be their next victim.

Remember, Bitcoin, crypto, BTC, blockchain, and crypto investing are powerful tools, but only if you approach them with knowledge and caution. Stay informed, stay strong, and keep pushing forward.

Choo choo biz nachos — catch you cool cats later!

Bitcoin, Crypto, BTC, Blockchain, and the Truth Behind the Latest Market Drama: XRP, TON Coin, and More. There are any Bitcoin, Crypto, BTC, Blockchain, and the Truth Behind the Latest Market Drama: XRP, TON Coin, and More in here.