If you’ve been paying attention to the cryptocurrency markets lately, you know things are heating up—and fast. Bitcoin (BTC) is smashing through all-time highs, altcoins are riding the wave, and XRP’s volume is exploding like never before. With Crypto Week in Washington approaching, optimism is flooding the market, sidelined capital is ready to pour in, and regulatory clarity is finally on the horizon.

But what does all this mean for investors, traders, and crypto enthusiasts? And how should you position yourself to take advantage of this momentum? Let’s dive deep into the current state of Bitcoin, crypto, and XRP, explore the regulatory landscape, and break down what the next few weeks might bring.

Riding the Green Wave: Bitcoin and Altcoins on Fire

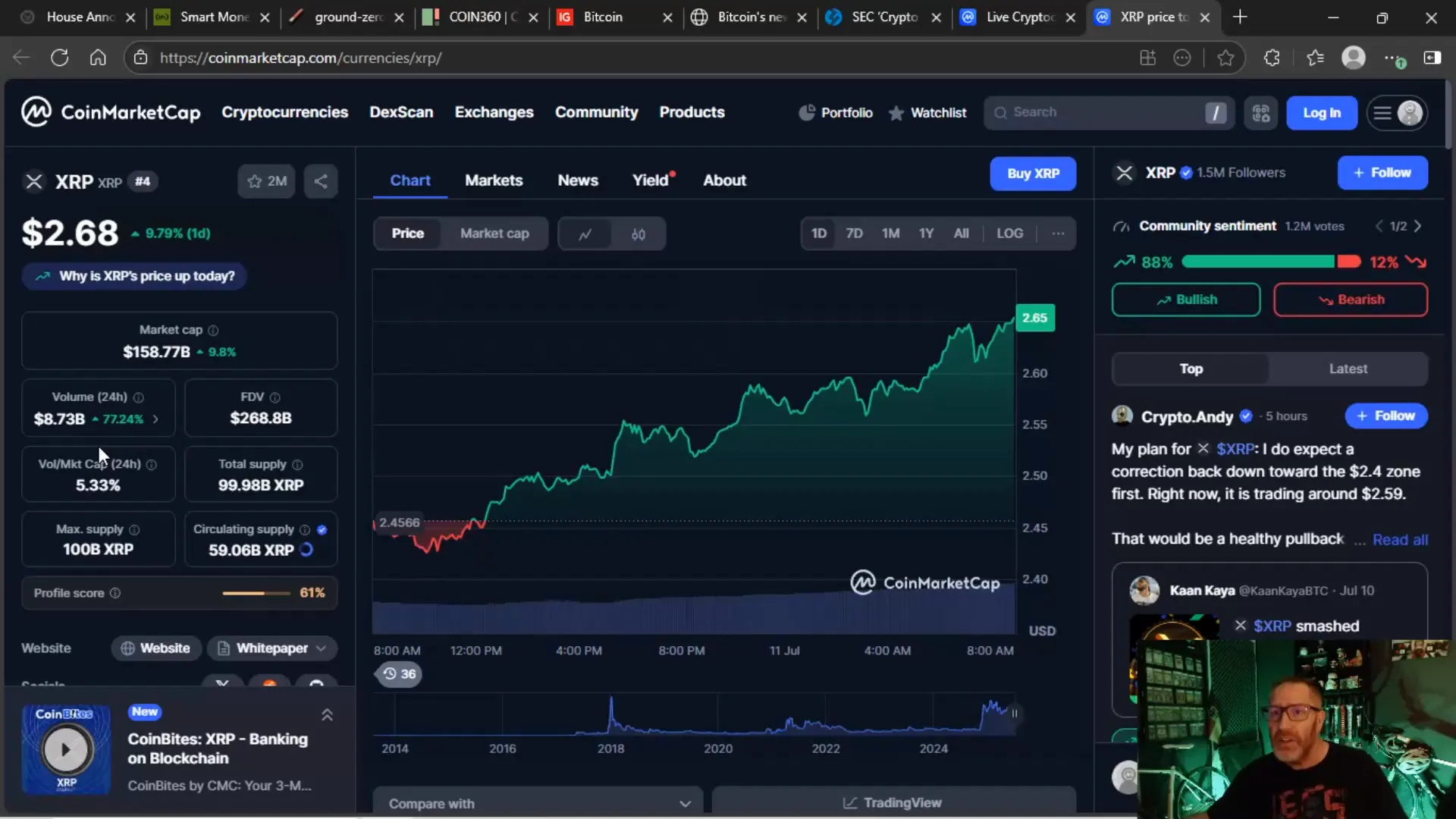

The crypto market is showing green across the board, and it’s not just a little green—it’s a full-on rally. Bitcoin has blasted past previous all-time highs, and altcoins are following suit. Notably, XRP is capturing attention with a volume explosion of over $8 billion in just 24 hours. This surge in volume is critical because it signals strong market participation and investor interest.

Prices are moving nicely too. Ethereum (ETH) is flirting with the $3,000 mark, Cardano (ADA) is hovering around 75 cents, and XRP is pushing the $2.68 level. This broad-based rally indicates that the market isn’t just focused on Bitcoin but is embracing altcoins with renewed enthusiasm.

But what’s driving this momentum? It’s a potent mix of factors:

- Regulatory optimism: The upcoming Crypto Week in Washington is bringing lawmakers and industry players together to discuss critical crypto legislation.

- Capital flows: Investors who had been sitting on the sidelines due to regulatory uncertainty are ready to jump back in.

- Market sentiment: The broader risk-on environment, as traditional stocks wobble amid tariff fears, is pushing investors toward crypto as a hedge.

As one trader put it, “The green is in,” and the contracts are “going bird.” In other words, the market is buzzing with bullish energy.

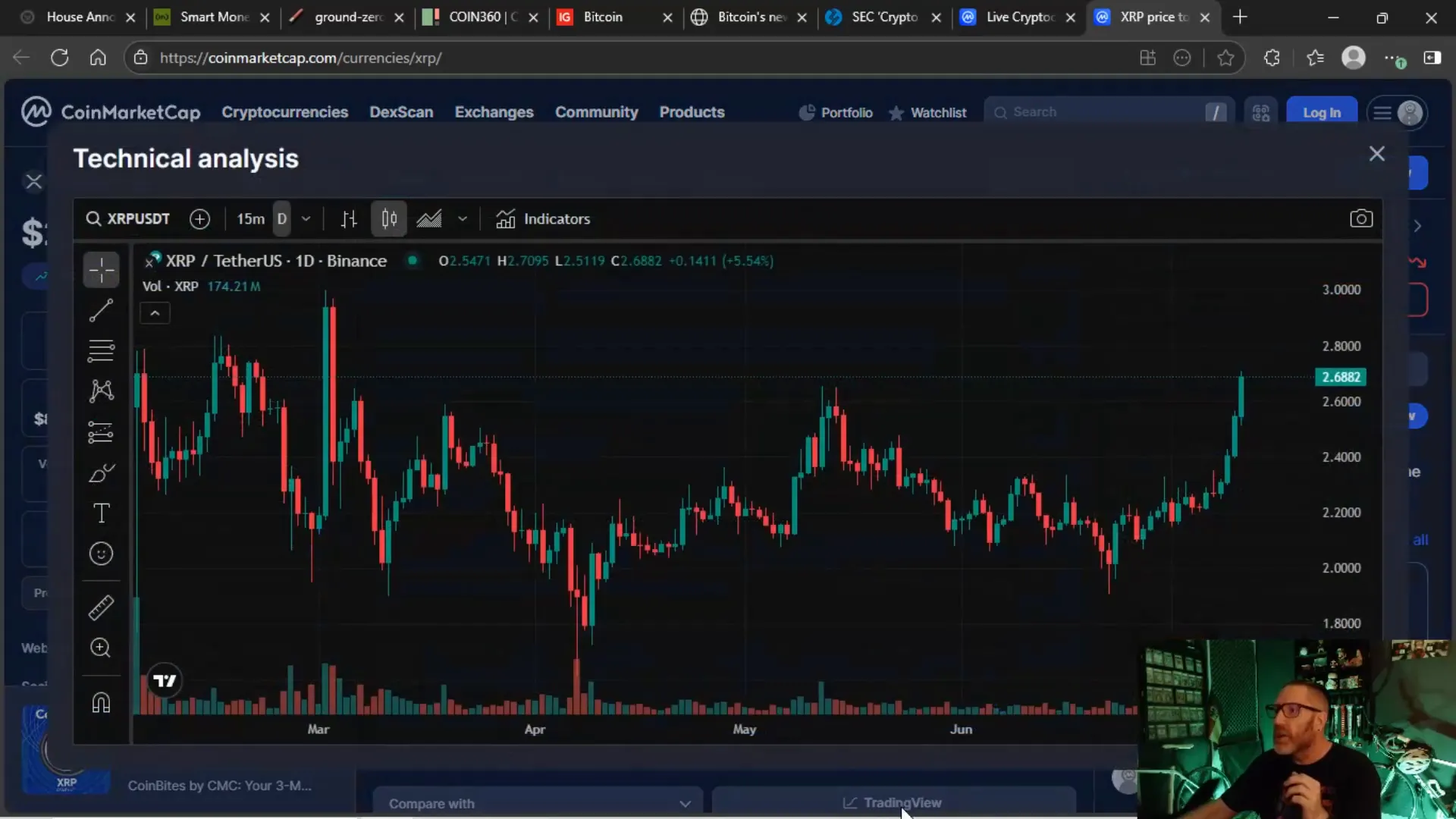

Breaking Through Resistance: XRP’s Big Day

For XRP fans, today is a landmark moment. The price has broken through key resistance levels formed back in May, where institutional investors took profits at around $2.65. Surpassing these levels signals strength and opens the door to new highs, potentially pushing XRP into the $2.70 to $2.80 range, or even eyeing the $3 mark again.

The 15-minute candlestick charts reveal a juicy run over the past four days, reflecting optimism priced into the market. Volume is robust, and momentum looks strong as we head into the weekend and prepare for Crypto Week. The key question now is: Can XRP maintain this momentum and push through the $2.70 ceiling? If it does, the next targets could be within striking distance.

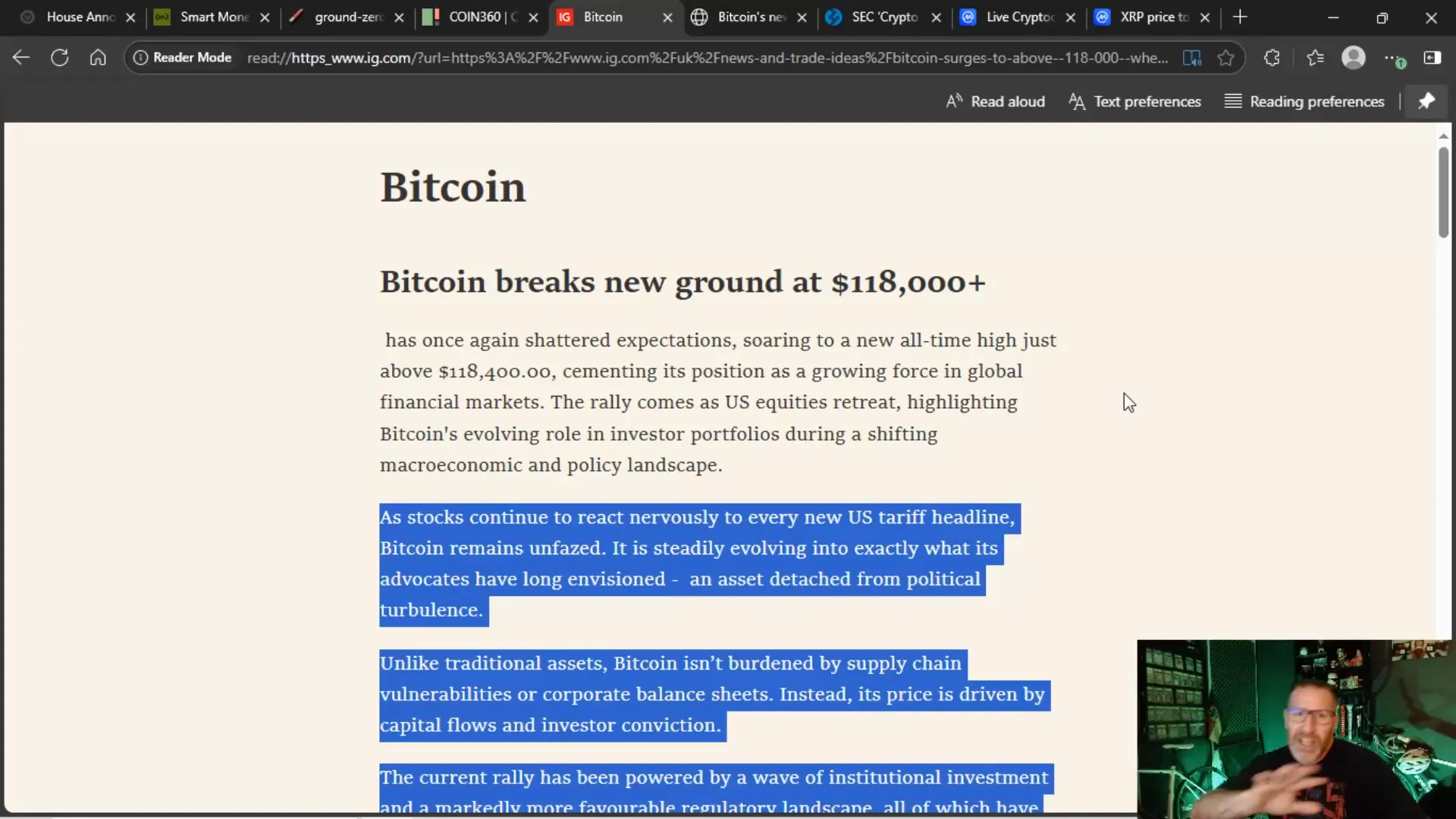

Bitcoin’s New Heights and What They Mean

Bitcoin recently broke new ground, surging past $118,000. This is a massive milestone that has the entire crypto community buzzing. However, with such rapid gains comes the inevitable fear of a pullback. What happens if a wave of FOMO (fear of missing out) buyers jump in at these highs and the price starts to retrace? Will these investors have the cash reserves to weather a dip, or will we see a quick sell-off?

While these are valid concerns, it’s important to stay optimistic and remember what sets Bitcoin apart from traditional assets:

- Decoupling from traditional markets: Unlike stocks, Bitcoin isn’t reacting nervously to every new US tariff headline or geopolitical tension.

- Supply chain resilience: Bitcoin isn’t dependent on corporate balance sheets or supply chains, which are vulnerable to disruptions.

- Investor conviction: Its price is driven primarily by capital flows and belief in its value as a decentralized store of value.

Currently, investor conviction is overwhelmingly positive, fueled by expectations of regulatory clarity and supportive legislation.

Crypto Week in Washington: A Regulatory Turning Point

Starting July 14th, the House of Representatives will debate three major crypto bills that could shape the industry’s future in the US. This event, dubbed “Crypto Week,” is a sharp reversal of fortune for a sector that once feared regulatory crackdowns would push innovation offshore.

The three bills under discussion are:

- The Genius Act: Expected to pass fairly easily, this bill focuses on fostering innovation and clarity in the crypto space.

- The Clarity Act: This bill aims to provide comprehensive regulatory guidance for the entire crypto market, including altcoins and meme coins. It faces some challenges but is critical for market certainty.

- The Anti-CBDC Surveillance State Act: Aimed at protecting privacy and preventing government overreach related to Central Bank Digital Currencies (CBDCs).

This legislative engagement is already having a positive effect. As Yag Kooner, Bitfinex’s head of derivatives, noted, “We expect capital that was previously sidelined due to regulatory uncertainty to reenter. Even if the final passage stalls, the optics of legislative engagement are bullish.”

In other words, the very act of Congress tackling crypto regulation signals to investors that the market is maturing and becoming less risky.

Waves of Capital: How Money Will Flow Back In

Don’t expect a sudden tidal wave of investment. Instead, capital will return in waves:

- Wave 1: Optimism around regulatory clarity will bring in investors who have been waiting for signals that crypto is “safe” to engage with.

- Wave 2: Once regulations are finalized, signed, and enforced, a larger influx of institutional and corporate money will follow.

- Wave 3: Tax rules that clarify crypto’s treatment will free up frozen sideline money, especially from big businesses wary of tax liabilities.

- Wave 4: Potential rate cuts by the Federal Reserve later this year could lower the cost of capital and encourage more investment.

- Wave 5: The approval and launch of XRP and other altcoin ETFs will open the floodgates for retail and institutional investors alike.

Stacked together, these waves create a bullish outlook for the remainder of the year and beyond.

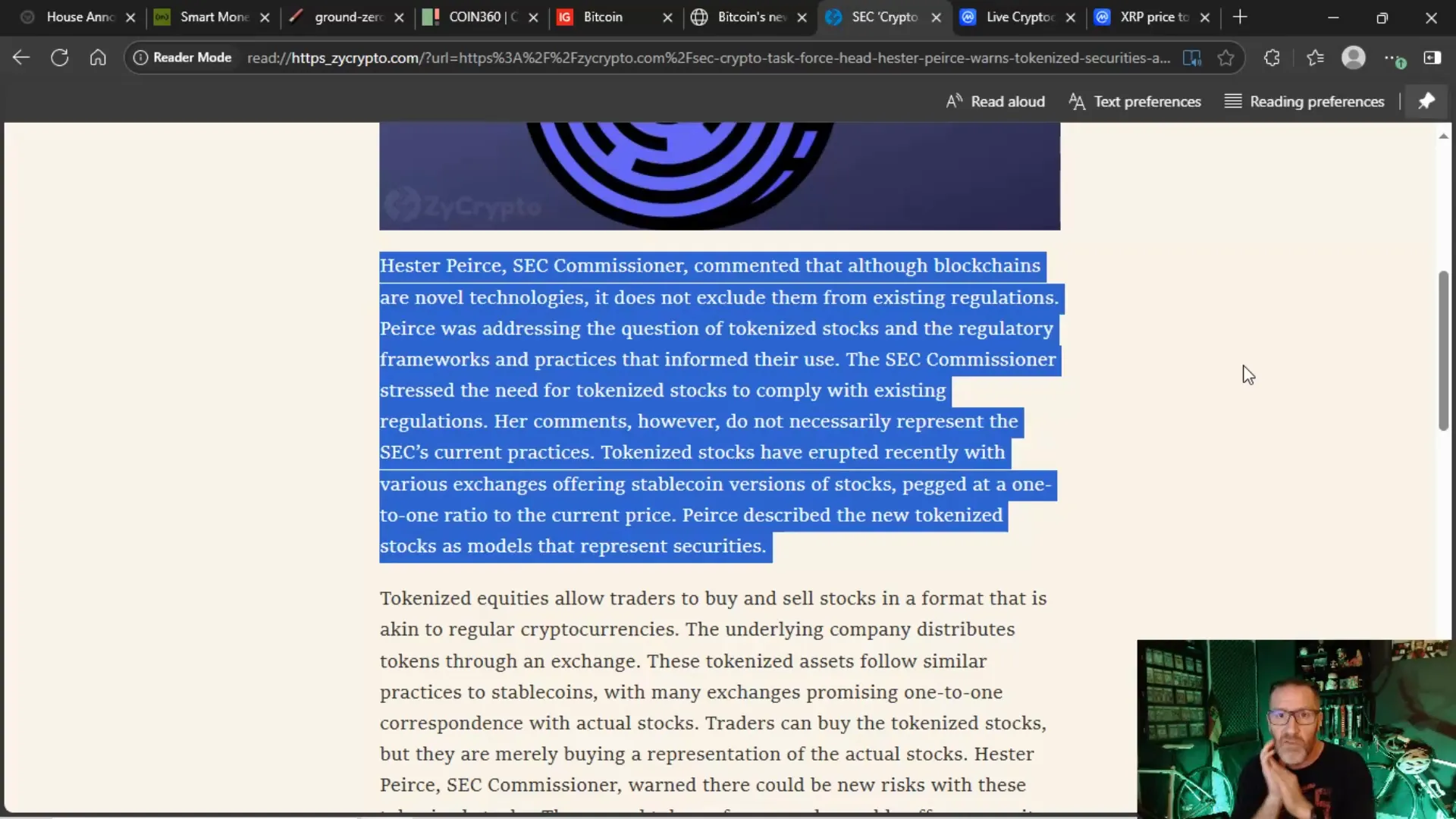

SEC Commissioner Hester Peirce’s Warning on Tokenized Securities

Not all the news is sunshine and rainbows. SEC Commissioner Hester Peirce, affectionately known as “Crypto Mom,” dropped a significant cautionary note about tokenized securities. She emphasized that tokenizing stocks or securities does not exempt them from existing securities regulations.

In simpler terms: Just because you put a security on a blockchain or tokenize it doesn’t mean you can bypass the SEC’s rules. This has huge implications for projects and platforms pushing tokenization as a way to skirt regulatory oversight.

Peirce pointed out several critical issues:

- Tokenized stocks are still securities: They must comply with all applicable regulations.

- Investor protections matter: Tokenization often removes traditional shareholder rights like voting and can lack the same safeguards.

- Regulatory frameworks will apply: Blockchain innovation does not provide a free pass from the law.

This is a big deal because tokenization has been touted as the next big revolution in finance, promising democratized access to assets. But without proper regulatory compliance and investor protections, it could lead to serious issues down the line.

Volume Explodes: What the Numbers Tell Us

Volume is the lifeblood of any market, and right now, crypto’s volume is absolutely exploding. Total volume is up 74% from the previous day, hitting a staggering $251 billion. To put that in perspective, yesterday’s volume was already strong, but today’s surge is a clear sign of renewed enthusiasm and participation.

Altcoin season is officially kicking in, with altcoin dominance rising from around 26-28% to 30% of the total market cap. This means as Bitcoin pumps, altcoins are pumping even stronger, a classic sign of a bull market gaining strength.

Bitcoin alone saw inflows of $1.1 billion yesterday, a massive amount of fresh capital entering the market. Zooming out, the trend over the past few months shows a recovery from the rough patch in February and March, with the market looking juicy AF (as the traders say).

XRP’s Volume Surge: A Closer Look

XRP’s volume is up 77%, slightly outpacing the overall crypto market’s 74% increase. The one-day chart tells the story:

- Price moved from around $2.45 to $2.65 in a single day.

- Volume hit $8.7 billion, signaling strong buying interest.

- The breakout above resistance levels from May sets the stage for further gains.

Watching the 15-minute candlestick charts, the momentum is clear. This is optimism being priced in ahead of potential regulatory clarity and the unlocking of sidelined capital.

What to Watch for in the Coming Weeks

With Crypto Week just around the corner, here’s what to keep an eye on:

- Legislative developments: The outcomes of the debates on the Genius Act, Clarity Act, and Anti-CBDC Surveillance State Act will set the tone for the market. Any positive movement will likely trigger buying waves.

- Regulatory clarity: More insight into how regulations will be implemented helps businesses and investors make confident decisions.

- ETF approvals: The launch of ETFs for Bitcoin, XRP, and other altcoins could open the market to a broader range of investors.

- Tax rules: Clear guidelines on crypto taxation will unlock frozen capital, especially from big businesses and institutional investors.

- Interest rate decisions: Watch the Federal Reserve’s moves, particularly the potential rate cuts starting in September. Lower rates usually mean more investment in risk assets like crypto.

While the market is currently riding a wave of optimism, it’s important to remember that unexpected events can cause volatility. Geopolitical tensions, political spats, or regulatory setbacks can quickly turn sentiment sour. But for now, the screen is green, and the mood is electric.

Why This Rally Feels Different

This rally isn’t just a price pump; it’s a fundamental shift in how the crypto market is viewed and treated by lawmakers, investors, and the public. The waves of capital coming back are backed by real progress on the regulatory front, which has been the missing piece for years.

Investors who have been cautious or sidelined are seeing the light at the end of the tunnel, and that changes everything. The market is evolving into what advocates have long envisioned: a decentralized asset class that stands apart from political and economic turbulence.

Plus, the fact that altcoins like XRP are gaining volume and price strength alongside Bitcoin suggests broad-based health in the market, not just a Bitcoin-centric rally.

Final Thoughts: Get Ready for Crypto Week and Beyond

We’re entering a crucial phase for Bitcoin, crypto, and XRP. The combination of regulatory clarity, tax rule insights, potential ETF launches, and expected rate cuts sets the stage for a powerful bullish run. If you’ve been waiting for the right moment to double down or get involved, this could be it.

Remember, the market moves in waves, not in straight lines. Patience and strategic positioning will be key to riding this green train successfully.

As we look ahead to Crypto Week, keep your eyes on the news, watch volume and price action closely, and don’t forget to manage your risk. This is an exciting time for the crypto community—let’s enjoy the ride and see where it takes us.

So buckle up, because crypto week is coming, and it’s looking like Shark Week—but for crypto enthusiasts. Choo choo, muchachos!

Bitcoin, Crypto, and XRP Are Printing Money: What’s Next in This Bullish Crypto Surge?. There are any Bitcoin, Crypto, and XRP Are Printing Money: What’s Next in This Bullish Crypto Surge? in here.