If you’ve been watching the cryptocurrency space closely, you already know that the market moves fast—and sometimes, it doesn’t give you a second chance. Today, I’m sharing an urgent and detailed breakdown of why altcoins are on the verge of exploding, why Bitcoin and Ethereum are setting the stage, and what signals you should watch closely to position yourself before this wave takes off. This is not just hype; it’s a data-driven insight into the crypto market’s next big chapter.

Throughout this article, we’ll dive into the latest Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing updates, uncover the powerful ETF inflows, explore technical charts that have predicted every major altcoin run, and analyze major institutional moves that are shaping the market’s future.

Wall Street’s Massive Bitcoin Bet: Cantor Fitzgerald’s $4 Billion Deal

Let’s start with a headline that’s hard to ignore. Cantor Fitzgerald, a Wall Street heavyweight, is reportedly in talks for a $4 billion Bitcoin deal with Blockstream CEO Adam Back. If this deal closes, Cantor Fitzgerald’s crypto exposure could skyrocket to $10 billion by the end of this year—that’s billion with a b.

What does this mean? Wall Street’s obsession with crypto is accelerating at a breakneck pace. Despite what the current price might suggest, we are still very much in the early adoption phase. The fiat currency system around the world is increasingly losing its footing, and in such a world, there’s truly no price ceiling for Bitcoin.

At the time of writing, Bitcoin is trading near $118,000, with recent highs touching $123,000. These figures might seem exaggerated to some, but they highlight the growing institutional demand that is pushing the market forward.

ETF Inflows: The Institutional Demand Powering Bitcoin and Ethereum

One of the clearest indicators of institutional interest is the surge in ETF inflows. Since July 1, Bitcoin ETFs have seen near-continuous inflows, with only one day of outflows. Daily inflows have ranged from hundreds to over a thousand Bitcoin, signaling relentless buying pressure at these high price levels.

Ethereum ETFs are also making waves. Ethereum has rallied approximately 150% since its April low of around $1,400, currently trading near $3,300. This rally has been supported by a record-breaking $900 million inflow into Ethereum spot ETFs in a single week, the best performance since their launch.

These ETF inflows are not just numbers—they represent real capital moving into crypto assets, fueling price momentum and broadening adoption. The rotation from Bitcoin to Ethereum is becoming more evident, and it’s setting the stage for altcoins to follow suit.

Ethereum’s Technical Breakout: Holding Key Levels and Eyeing All-Time Highs

Ethereum’s price action is particularly exciting. It has not only broken through the “gold pocket” zone—a critical Fibonacci retracement level between the last high and swing low—but is also holding above a key quarterly support around $3,335.

This technical strength suggests that ETH is primed to retest its all-time highs near $4,800 over the coming weeks. As long as it remains above this quarterly level, the bullish trend remains intact.

Moreover, the sustained inflows into Ethereum ETFs reinforce the technical outlook, providing a solid foundation for a continued rally.

The Fear and Greed Index: How Market Sentiment Is Shaping the Next Move

Market sentiment often drives price action, and the Fear and Greed Index is a handy tool for gauging investor emotions. Currently, the crypto market is pushing into “greed” territory, a phase where optimism and buying pressure intensify.

While the saying goes “be fearful when others are greedy,” this greed phase can persist longer than many expect, sometimes lasting weeks or even months. The market has been in this greed zone for at least a month, with only brief periods of neutrality or fear.

This extended greed suggests there is still room for upside before a significant cooldown or correction occurs, reinforcing the bullish outlook for the next one to two months.

Altcoin Season Is Here: Momentum Building Across the Board

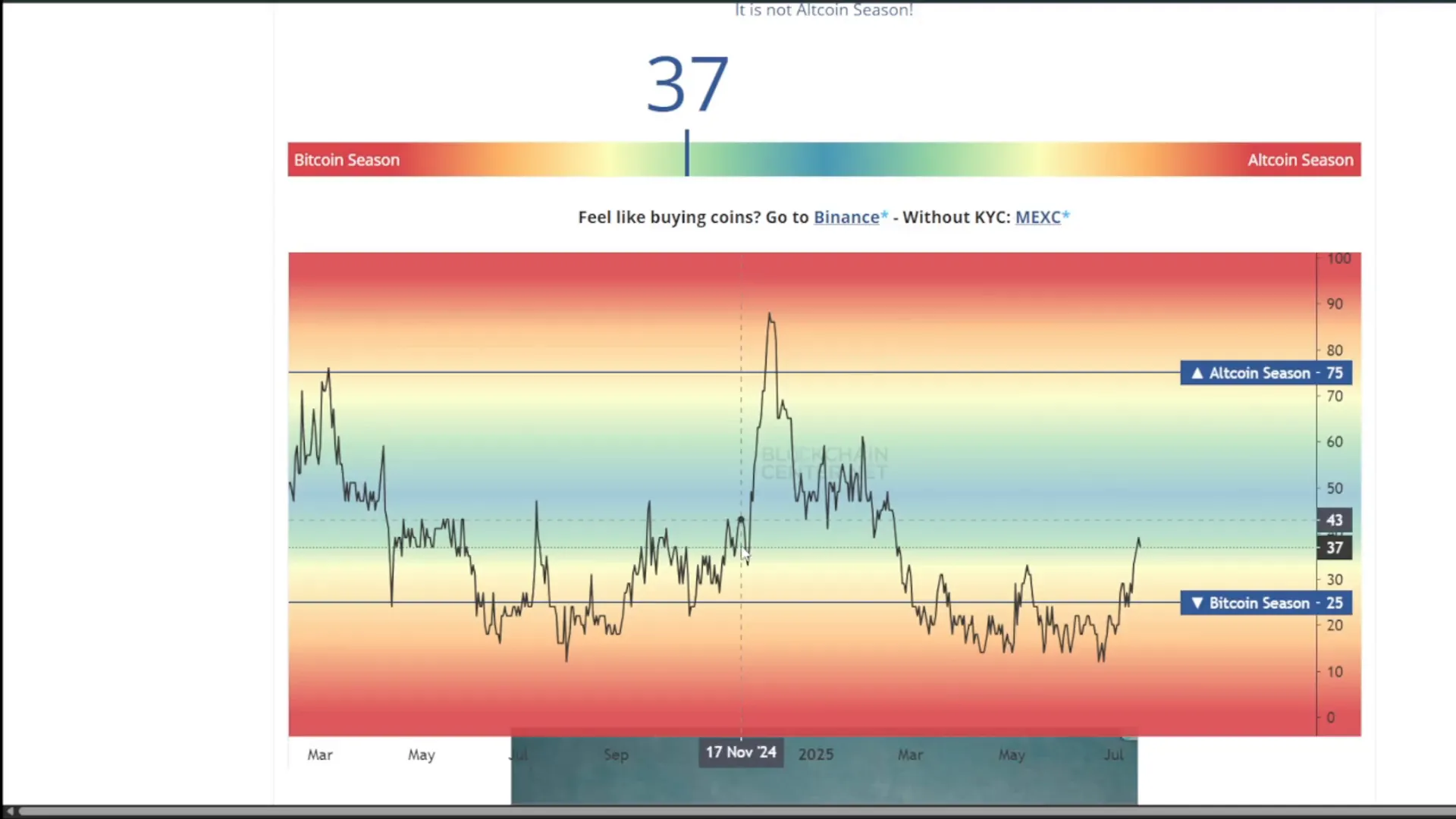

So, what’s the strategy right now? The data points clearly to the next one to two months being primed for altcoin strength. The Altcoin Season Index recently hit 39—a level not seen since just before the November 2024 U.S. election.

This index measures the relative strength of altcoins compared to Bitcoin, and a reading this high signals that the market is rotating capital out of Bitcoin and into altcoins. Momentum can snap back into altcoins faster than most expect, making this a critical window for investors and traders alike.

ETH/BTC Pair: Classic Signal Flashing for Altseason

One of the most telling charts to watch is the ETH/BTC pair. Historically, this pair’s breakout has preceded major altcoin runs. Currently, it’s retesting the same low levels that kicked off the last altseason in 2021, showing signs of a bullish breakout.

This pattern aligns with a harmonic setup I’ve been tracking for years—a technical formation based on Fibonacci ratios that often signals major market reversals. The recent bottoming process around April 2024 confirms this setup, suggesting Ethereum has years of potential upside ahead.

This is not a short-term pump but a multi-year trend that could extend well into 2026, supporting a prolonged altcoin rally that many investors are not yet fully pricing in.

Bitcoin Dominance Rolling Over: A Classic Altcoin Season Trigger

Bitcoin dominance—the percentage of the total crypto market cap held by Bitcoin—has begun to decline, a classic signal that altcoin season is starting. When Bitcoin dominance falls, capital typically flows into Ethereum and subsequently into other altcoins.

This pattern was observed during previous major altcoin seasons in 2017 and 2021, where Bitcoin led the initial rally before money rotated into altcoins. The same sequence appears to be unfolding in 2025, but with even larger institutional flows this time.

For the past year, Bitcoin has outperformed most altcoins due to massive institutional inflows. However, as this trend reverses, we expect Ethereum and other altcoins to outperform Bitcoin, starting with large-cap altcoins and eventually moving into smaller projects.

Rotation Roadmap: BTC → ETH → Large Caps → Small Caps

The typical rotation during an altseason moves from Bitcoin to Ethereum, then to large-cap altcoins like Solana, XRP, Litecoin, and Chainlink, before finally spreading to smaller-cap altcoins. This rotation doesn’t happen overnight—it’s a gradual process that unfolds over months.

Ethereum’s recent price action and ETF inflows suggest it’s already beginning to lead this rotation. Once Ethereum gains traction, large caps usually follow, setting the stage for a broad-based altcoin rally.

Patience is key here. While the market may experience pullbacks of 15-30% even during strong rallies, the overall trend is bullish for altcoins over the next year or more.

Smart Money Moves: Public Companies and Institutional Investors Entering Ethereum

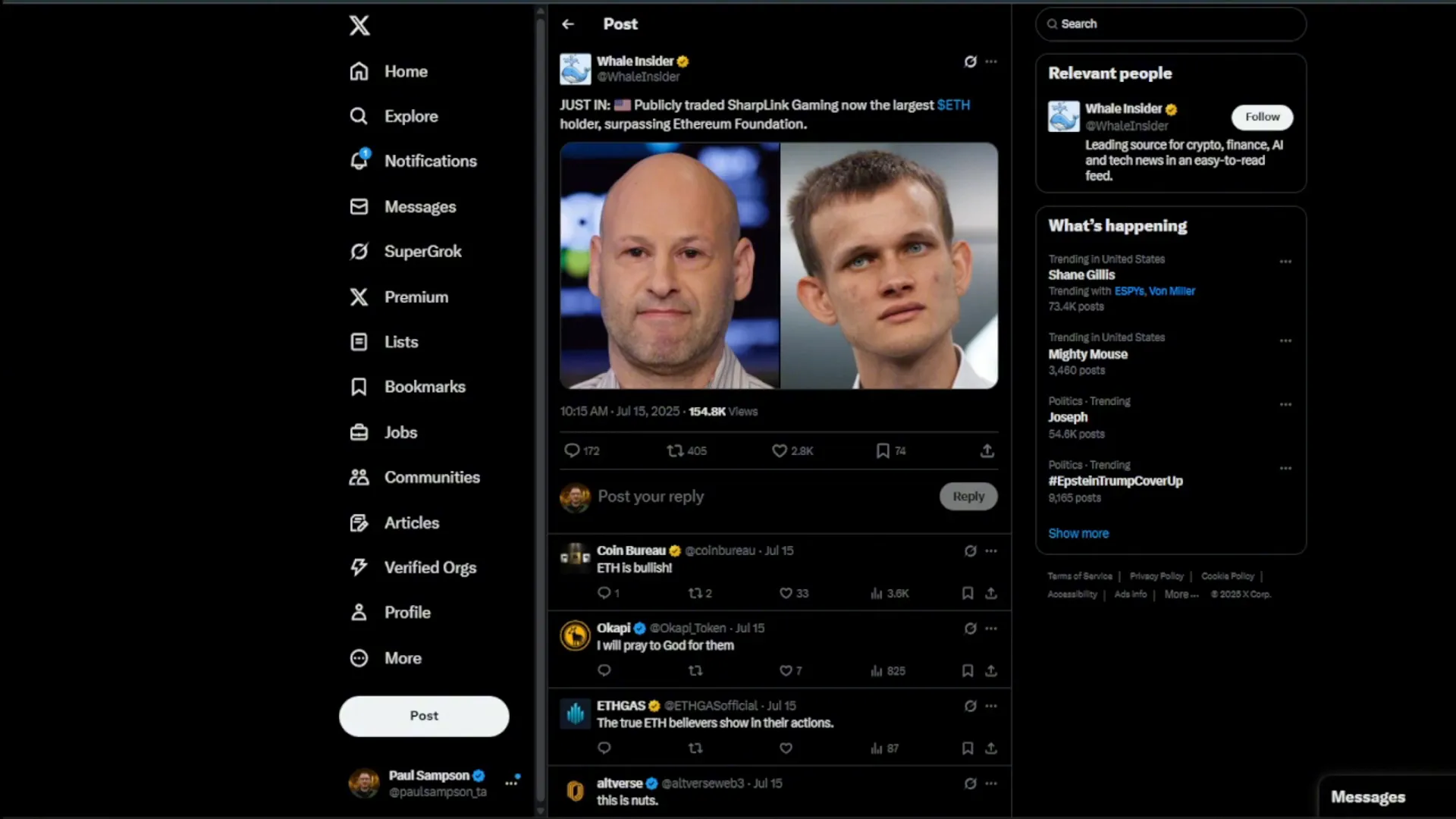

Another bullish sign is the growing number of publicly traded companies becoming major Ethereum holders. Sharpling Gaming recently surpassed the Ethereum Foundation as the largest public ETH holder after purchasing an additional $19.5 million worth of Ethereum.

Even Peter Thiel, PayPal’s co-founder and Facebook’s first external investor, has taken a significant position in an ETH treasury company. When investors of this caliber get involved, it signals that smart money is paying close attention.

SUI Network: An Altcoin on the Rise

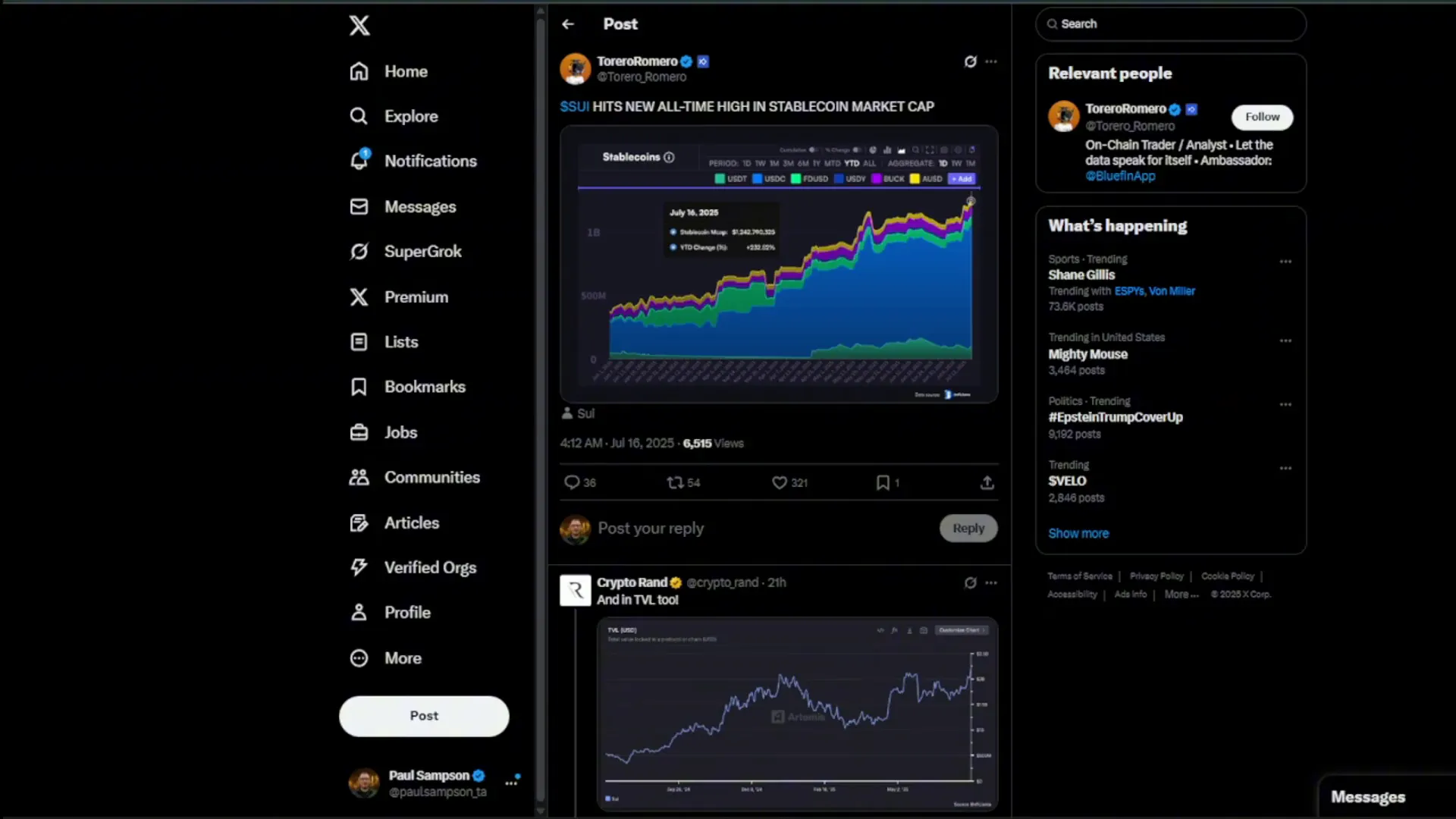

Aside from Ethereum, the SUI network is showing explosive growth. Daily active users have surged by 145%, and the stablecoin market cap has reached a new record. More stablecoins on-chain mean more digital cash ready to flow into new projects and trading opportunities.

Price-wise, SUI is coiling up around $3.96, forming a series of higher lows—a classic sign of accumulation. The next key resistance level is the golden pocket zone around $5.37, followed by potential targets at $6.60 and $9.63.

Breaking these levels would indicate a shift in market structure and could trigger a new leg higher, making SUI a project to watch closely during this altcoin season.

Solana, XRP, and Cardano: Potential Next Movers in the Altcoin Rotation

Looking at the broader altcoin landscape, Solana, XRP, and Cardano are poised as the next in line to benefit from the rotation. During the “Trump rally” in November 2024, Bitcoin broke out of a seven-month consolidation and surged past $74,000, triggering a rapid rotation into Ethereum and large-cap altcoins.

During that period, XRP experienced a remarkable 500% rally in just about a month. While another rally of that magnitude may not be expected this time, the pattern of rotation remains consistent.

If you missed the initial pumps, focusing on altcoins that haven’t yet popped can be a smart strategy. It’s about positioning yourself to ride the wave as it moves through different sectors of the crypto market.

Historic Crypto Legislation on Capitol Hill: Impact on the Market

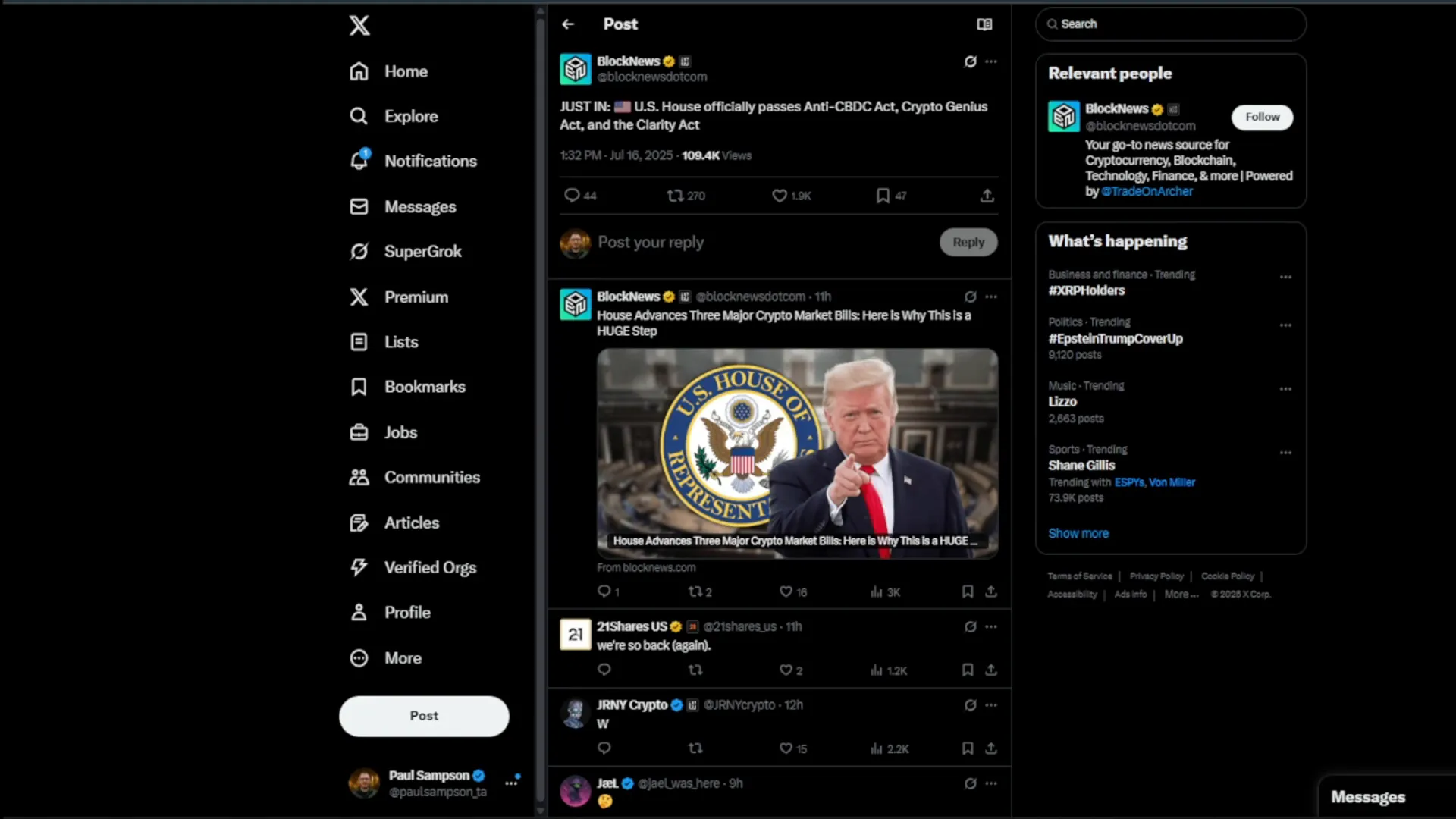

Beyond the charts and flows, a major catalyst is unfolding in Washington, D.C. The U.S. House has passed three landmark pieces of crypto legislation:

- The Anti-CBDC Act: Aims to block the creation of a central bank digital currency, protecting financial privacy and individual choice.

- The Crypto Genius Act: Clarifies rules around stablecoins, reducing regulatory uncertainty.

- The Digital Asset Clarity Act: Defines how crypto integrates into the U.S. financial system, providing much-needed clarity for institutions.

This trifecta of bills marks a watershed moment for digital assets in the United States, potentially unlocking new opportunities and fostering greater adoption.

Position Yourself Now: The Time to Act Is Quickly Approaching

Altcoin season is not coming—it’s already here. The charts are breaking out, ETF inflows are surging, and the rotation from Bitcoin to Ethereum to altcoins is unfolding right before our eyes. However, this phase moves fast, and when it rips, it doesn’t wait for permission.

You've seen the signs, the signals, and the data. The question is: Are you positioned, or are you waiting on the sidelines?

For traders and investors looking for real-time updates on market momentum and trade setups, joining communities like the Traders Club Discord can provide valuable insights and guidance. Additionally, platforms like Wex, which offers over 600 trading pairs and zero KYC requirements, are ideal for navigating this fast-moving market.

Final Thoughts on Navigating the Next Crypto Wave

While no one can predict the market with absolute certainty, the convergence of institutional demand, technical setups, market sentiment, and regulatory clarity paints a compelling picture for a sustained crypto rally—especially in altcoins.

Remember, investing and trading in crypto require discipline and patience. Avoid chasing pumps and be prepared for volatility along the way. Yet, if you’ve been waiting for a sign that altcoins are gearing up to explode, this is it.

Keep a close eye on Bitcoin dominance trends, Ethereum’s price action, ETF inflows, and the rotation roadmap from BTC to ETH to large and small-cap altcoins. These indicators will guide you through the upcoming market phases.

The crypto market is evolving rapidly, and those who stay informed and ready will be best positioned to capitalize on the next big move.

Bitcoin, Crypto, and Altcoins: Your Final Warning Before the Next Explosive Move. There are any Bitcoin, Crypto, and Altcoins: Your Final Warning Before the Next Explosive Move in here.