If you’ve been following the crypto market’s twists and turns, you’ve probably wondered: Can Ethereum really hit $15,000? As someone deeply entrenched in Bitcoin, Crypto, BTC, Blockchain, and Investing, I’m here to break down what’s happening with Ethereum, the key price levels to watch, and why this could be the start of an explosive altseason. I’ll also share how I made over $4,000 on a single trade recently, and why a piece of legislation called the Genius Act might just be the catalyst Ethereum needs to push back to its all-time highs — and maybe beyond.

Whether you’re a seasoned crypto trader or just curious about what’s next for Ethereum and the broader altcoin market, this detailed analysis will arm you with insights and strategies to navigate this exciting phase in crypto investing.

Understanding Ethereum’s Current Price Action: Price Discovery and Key Ranges

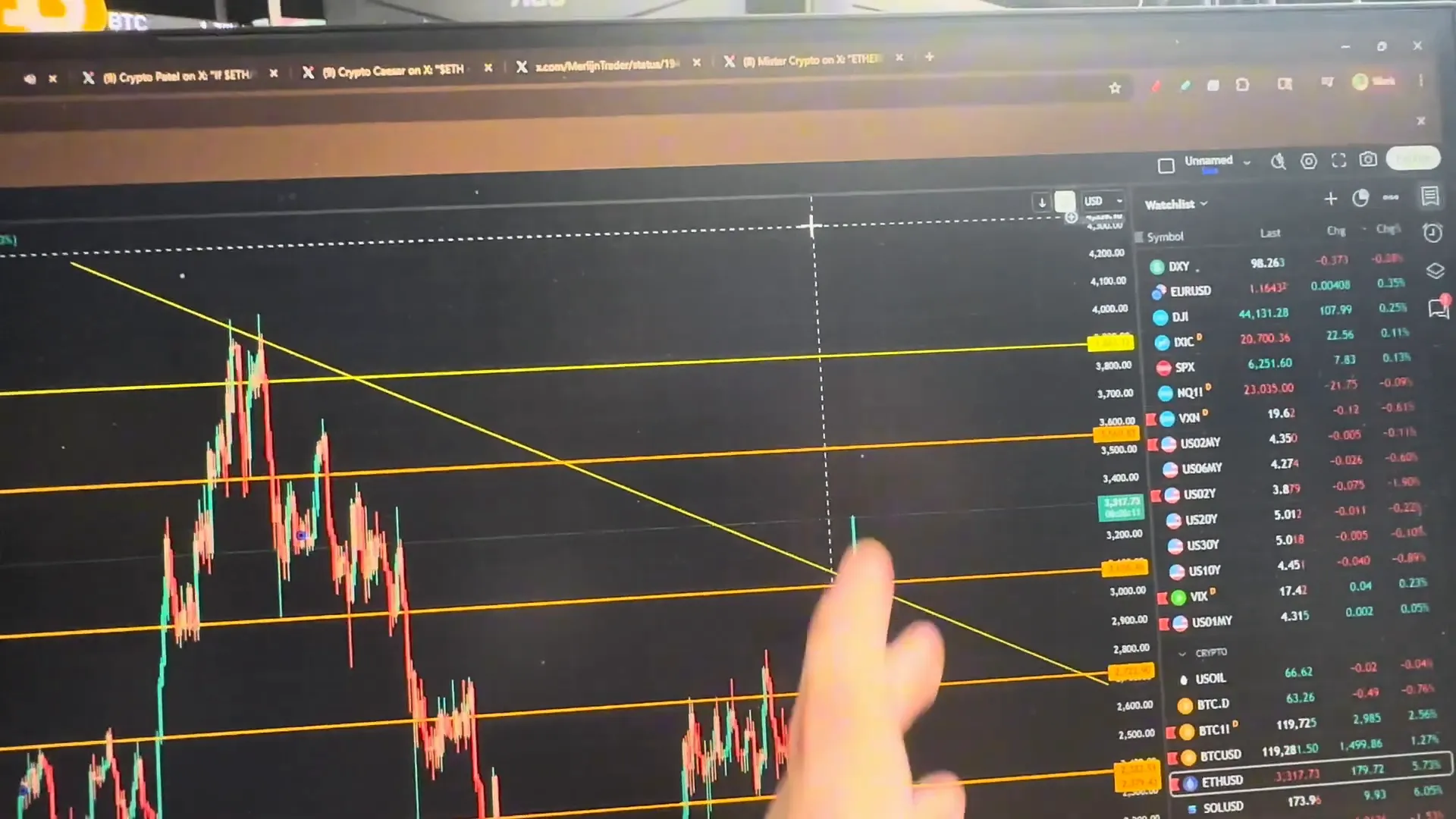

Right now, Ethereum is in what traders call “price discovery” on a local timeframe. What does that mean? Simply put, it’s breaking through previous resistance levels and exploring new price territory. Using tools like FOMO.io, it’s clear that Ethereum just bulldozed through a major resistance zone, which explains why some trades are going absolutely berserk.

Ethereum’s price history over the last two years shows some very distinct key ranges where it tends to get stuck. For example, between roughly $2,380 and $2,720, Ethereum has repeatedly bounced around, showing a lot of price action, interest, and significant order flow. Similar activity is visible between $3,000 and $3,586.

What’s exciting about the current market is that Ethereum has, for the first time in this downward trend, broken above that $3,000–$3,586 range. This breakout signals a potential move towards $4,000, which many traders interpret as a sign Ethereum could be gearing up for a return to its all-time highs.

Technical indicators like ABC formations, Fibonacci extensions, money flow, and order book data all point to an uptrend, at least to $4,000. This is a crucial level because it represents a psychological and technical barrier on the path toward higher prices.

Why Identifying These Ranges Matters

Understanding these ranges is not just academic — it’s practical. If you know where Ethereum has historically found support and resistance, you can better plan entry and exit points for trades. It also helps in managing risk by avoiding buying at tops or selling at bottoms.

Ethereum’s Bullish Potential: Realistic vs. Hopium Scenarios

Now, let’s talk about price targets. While I’m cautiously optimistic, I don’t believe Ethereum will surpass $5,000 to $6,500 this cycle. That’s my realistic case. However, I want to be clear about the bullish "hopium" scenario because a lot of traders are eyeing much higher prices — some even believe Ethereum could go parabolic toward $7,500, $10,000, or beyond.

This bullish case is often based on the idea of historical symmetry, where Ethereum might mimic Bitcoin’s past price patterns. Bitcoin has seen explosive growth phases, and if Ethereum follows a similar trajectory, those lofty price targets could become possible.

But what needs to happen for Ethereum to break past my conservative expectations? Let me break down the two biggest factors.

The Genius Act: A Game-Changer for Ethereum and Stablecoins

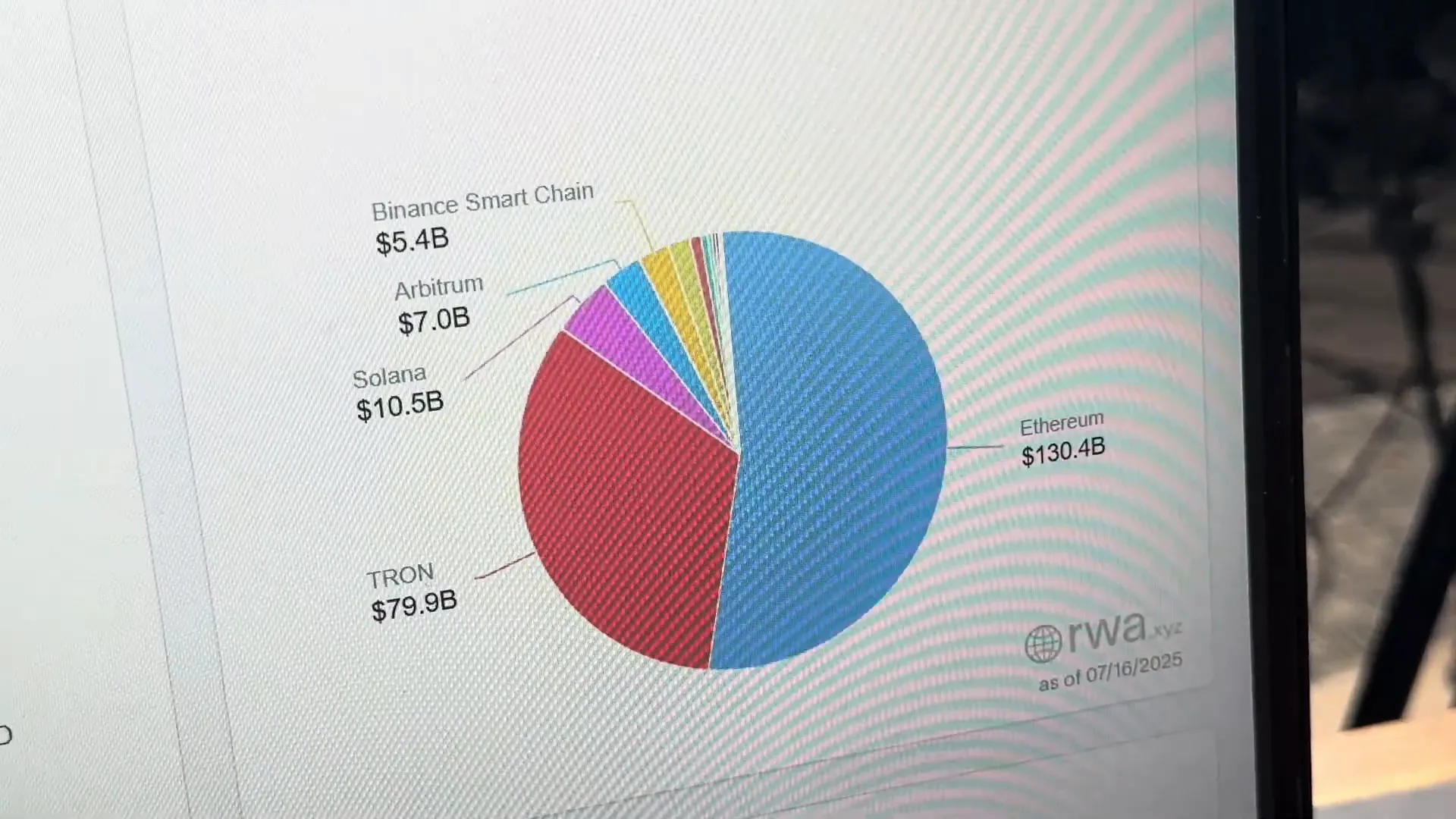

The first and perhaps most critical factor is the passage of the Genius Act. This bill is poised to bring an estimated $2 trillion into the stablecoin market, which currently sits at around $242 billion. Why does that matter for Ethereum? Because most stablecoins are built on the Ethereum blockchain.

Institutions spanning global bonds, private credit, commodities, and institutional funds are increasingly relying on Ethereum as the backbone for their financial products and tokenization efforts. The Genius Act would provide much-needed legal clarity and deregulation, effectively unleashing a tidal wave of capital into Ethereum’s ecosystem.

Additionally, Ethereum enjoys backing from the largest asset management company in the world, BlackRock, via their ETF. This institutional support combined with regulatory clarity could accelerate Ethereum’s growth in ways we haven’t seen before.

Monetary Policy Shifts: Jerome Powell and Interest Rate Cuts

The second major factor revolves around U.S. monetary policy. For Ethereum to break past my expectations, I’d need to see significant changes at the Federal Reserve — specifically, Jerome Powell either resigning, being fired, or starting to cut interest rates aggressively, potentially by 300 basis points. The president has been vocal about wanting lower interest rates, but whether this happens remains to be seen.

Why does this matter? Lower interest rates typically encourage more risk-taking and investment in assets like cryptocurrencies. It also tends to increase liquidity in the markets, which can fuel price rallies.

Lessons from My Trading Experience: How I Made Over $4,000 in One Trade

Even if my predictions don’t pan out exactly as expected, I’m not worried. Why? Because I’m making money trading smartly. Let me share one of the most valuable lessons I’ve learned in crypto trading — and it’s surprisingly simple.

Ask Yourself: When X Happens, What Is Possible?

Most crypto investors get stuck worrying about being wrong or missing out. They fear selling too early or holding too long. But the key is to ask yourself a short, powerful question: When X happens, what is possible?

For example, I once sold XRP too early. I sold at 70 cents when it was still in the range of 7–10 cents when I first bought it. At the time, I thought XRP’s price would be suppressed for years due to regulatory concerns and political factors, such as certain individuals remaining in power like Gary Gensler or Kamala Harris winning the election. It turned out XRP crushed it later, but I made my decision based on probabilities and scenarios I deemed more likely.

You can apply this thinking to any crypto asset — Bitcoin, Cardano, ICP, or Ethereum. Instead of hoping for the best, prepare for possible outcomes and position yourself accordingly. This mindset helps you avoid emotional trading and the trap of “round tripping.”

What is Round Tripping and How to Avoid It

Round tripping happens when an investor buys an asset, watches it grow substantially — sometimes 10x, 20x, or even 100x — but then holds on too long out of hope. Instead of taking profits, they take screenshots of unrealized gains and convince themselves they’re rich. When the price inevitably falls, they keep holding, hoping for a rebound, only to lose much or all of their gains.

We’ve all been there. The difference is learning to manage your trades and profits with a clear plan, not just hope.

Practical Trading Strategies: How to Get the Best Entry Points in Crypto

Now, let’s talk about how I find the best entry points in the volatile crypto market. It’s easier than you might think if you use the right tools and indicators.

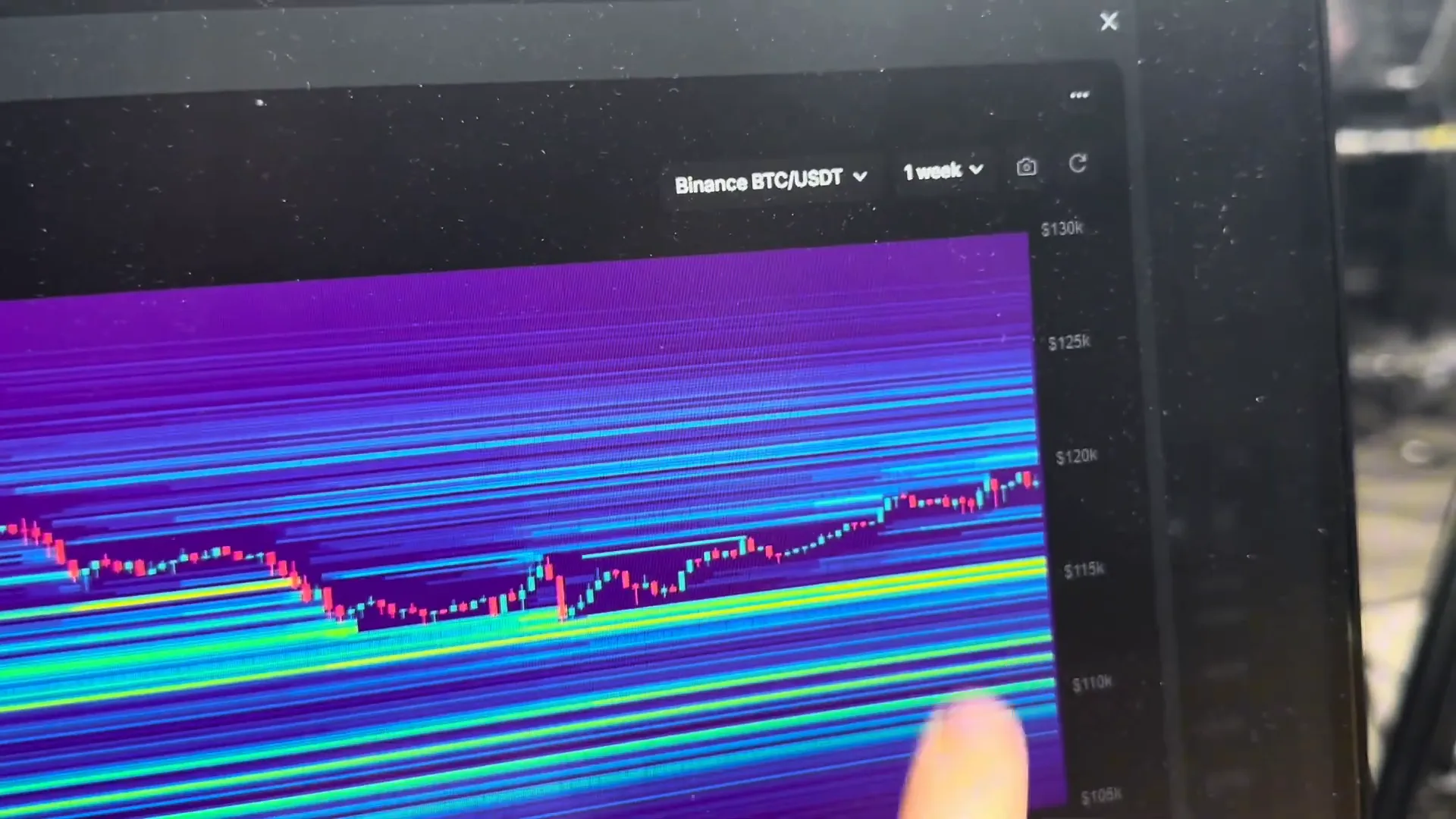

Using Technical Indicators on Weekly and Daily Timeframes

If you’re a dollar-cost averaging (DCA) investor, I recommend focusing on the weekly timeframe. Look for when the Relative Strength Index (RSI) is in the middle range, but the MACD and stochastic indicators are overextended. This combination often signals it’s a good time to buy low and sell high.

In simple terms:

- Buy near the bottom when RSI is moderate but MACD and stochastic are overextended (indicating oversold conditions).

- Avoid buying when all indicators are overextended at the top (indicating overbought conditions).

Remember, buying high and selling low is a common mistake to avoid.

Leveraging Liquidations and Key Liquidity Levels with FOMO.io

My favorite tool for day trading is FOMO.io. It highlights major liquidity levels with bright yellow lines, which represent areas where a lot of liquidations occur. When Bitcoin’s price hits one of these yellow lines on the weekly timeframe — and the technical indicators align (RSI down, MACD and stochastic overextended) — that’s my signal to DCA.

Day Trading Using 4-Hour and 12/24-Hour Timeframes

If you prefer day trading, the same principle applies but on shorter timeframes. Check the 4-hour chart for bullish RSI, MACD, and stochastic readings. Then confirm with the 12 or 24-hour chart to see if the price is bouncing off a key support or resistance level.

One important tip: Avoid trading when the price is stuck in the middle of a range. Instead, focus on entries near the top or bottom of a range, where price action is more predictable.

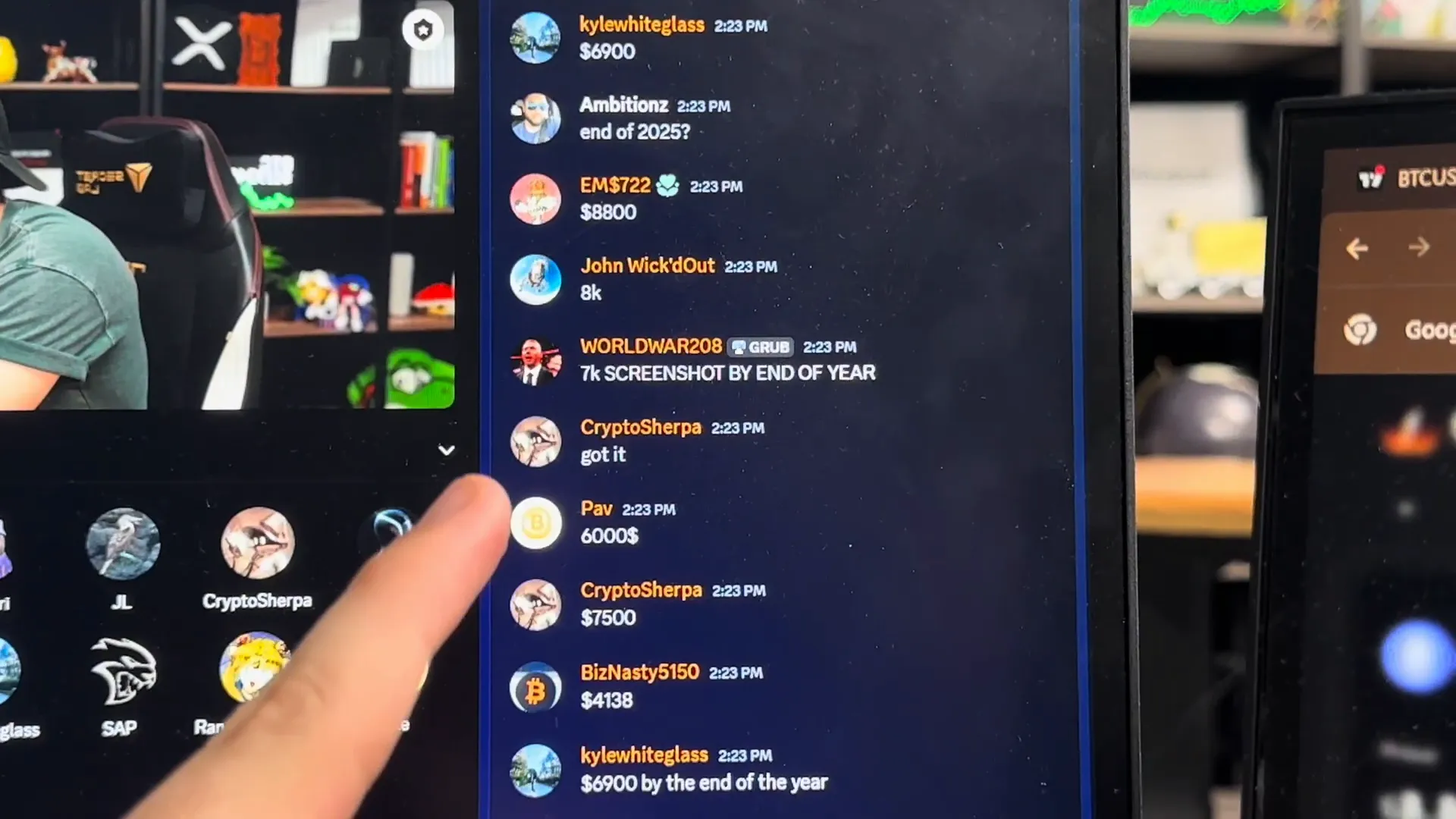

Community Insights: Ethereum Price Predictions for 2025

The crypto community is buzzing with predictions for Ethereum’s price by the end of 2025. Here are some of the numbers I’ve seen from fellow traders and enthusiasts:

- $4,100

- $6,000

- $6,500

- $6,900

- $7,500

- $8,800

- $10,000

- $88,000 (likely a typo or joke!)

- $100,000 (very speculative)

It’s an absolutely fantastic and engaged community, and I encourage you to join discussions in forums or Discord groups to share and learn from diverse viewpoints.

Why the Genius Act and Monetary Policy Could Spark the Next Altseason

To wrap up the big picture, if the Genius Act passes, expect massive inflows into the stablecoin market. Couple that with a potential lowering of interest rates and increased money printing, and you have the perfect storm for inflationary pressures and economic growth.

This environment could lead to higher wages outpacing inflation, which is a key driver for risk-on assets like Ethereum, XRP, and other altcoins finally experiencing the altseason many have been waiting for.

For traders like me and many in the Discord community, the best advice is to follow your key ranges and stay disciplined. Remember, crypto markets run 24/7/365, so there will always be another opportunity. Don’t beat yourself up for missing out on a particular pump or exit. There’s always another trade waiting.

And yes, in this current trade, I have roughly made $5,500 so far — proof that with the right approach, crypto can be very rewarding.

Final Thoughts on Navigating Bitcoin, Crypto, BTC, Blockchain, and Investing

Ethereum hitting $15,000 is absolutely possible — but it hinges on several key factors, including regulatory clarity, institutional adoption, and macroeconomic conditions. The Genius Act could be the breakthrough legislation that unlocks trillions into the stablecoin and Ethereum ecosystem, while shifts in monetary policy could provide the liquidity and risk appetite needed to push prices higher.

The path to these price levels won’t be linear or guaranteed. That’s why it’s crucial to keep asking yourself, “When X happens, what is possible?” and to develop a trading plan that incorporates realistic scenarios, risk management, and profit-taking strategies.

Whether you’re investing in Bitcoin, Crypto, BTC, Blockchain projects, or altcoins like Ethereum, staying informed, disciplined, and engaged with the community will help you make the most of this exciting market cycle.

Keep learning, stay patient, and trade smartly — your crypto journey is just getting started.

$15k Ethereum Possible? Exploring Altseason Predictions and Key Market Factors in Bitcoin, Crypto, BTC, Blockchain, and Investing. There are any $15k Ethereum Possible? Exploring Altseason Predictions and Key Market Factors in Bitcoin, Crypto, BTC, Blockchain, and Investing in here.