If you’re following the cryptocurrency, bitcoin markets, you’ve likely encountered the meme “when banana?”—a humorous yet frustrating question about when the next altcoin season will arrive. After years of watching the market cycles, it’s clear that this isn’t just a random phrase; it’s a question rooted in deeper macroeconomic signals that savvy investors can decode. Today, we’ll explore a compelling macro framework developed by Raoul Pal, a former Goldman Sachs executive, that reveals why the next major surge in bitcoin and altcoins is not just possible but highly probable.

Understanding these signals can help you position yourself ahead of the curve and avoid the common pitfalls of fear and noise that cloud so many investors’ judgment.

Table of Contents

- The “Banana Zone”: What It Means for Crypto

- Why Are Investors Still Asking “When Banana?”

- Global Liquidity and Bitcoin’s Correlation

- Financial Conditions Leading the Business Cycle

- What This Means for Bitcoin and Altcoins

- Don’t Fight the Liquidity—Trust the Macro Signals

- Getting Ready for the Next Wave

The “Banana Zone”: What It Means for Crypto

Raoul Pal’s concept of the “banana zone” describes a phase of exponential growth in digital assets, driven by rising liquidity and an expanding risk appetite among investors. This phase doesn’t start with hype or flashy headlines. Instead, it begins quietly when macroeconomic conditions flip and capital starts moving further out on the risk curve. This shift is crucial because it signals that investors have more earnings and confidence, pushing them to seek higher returns beyond safer assets like Bitcoin alone.

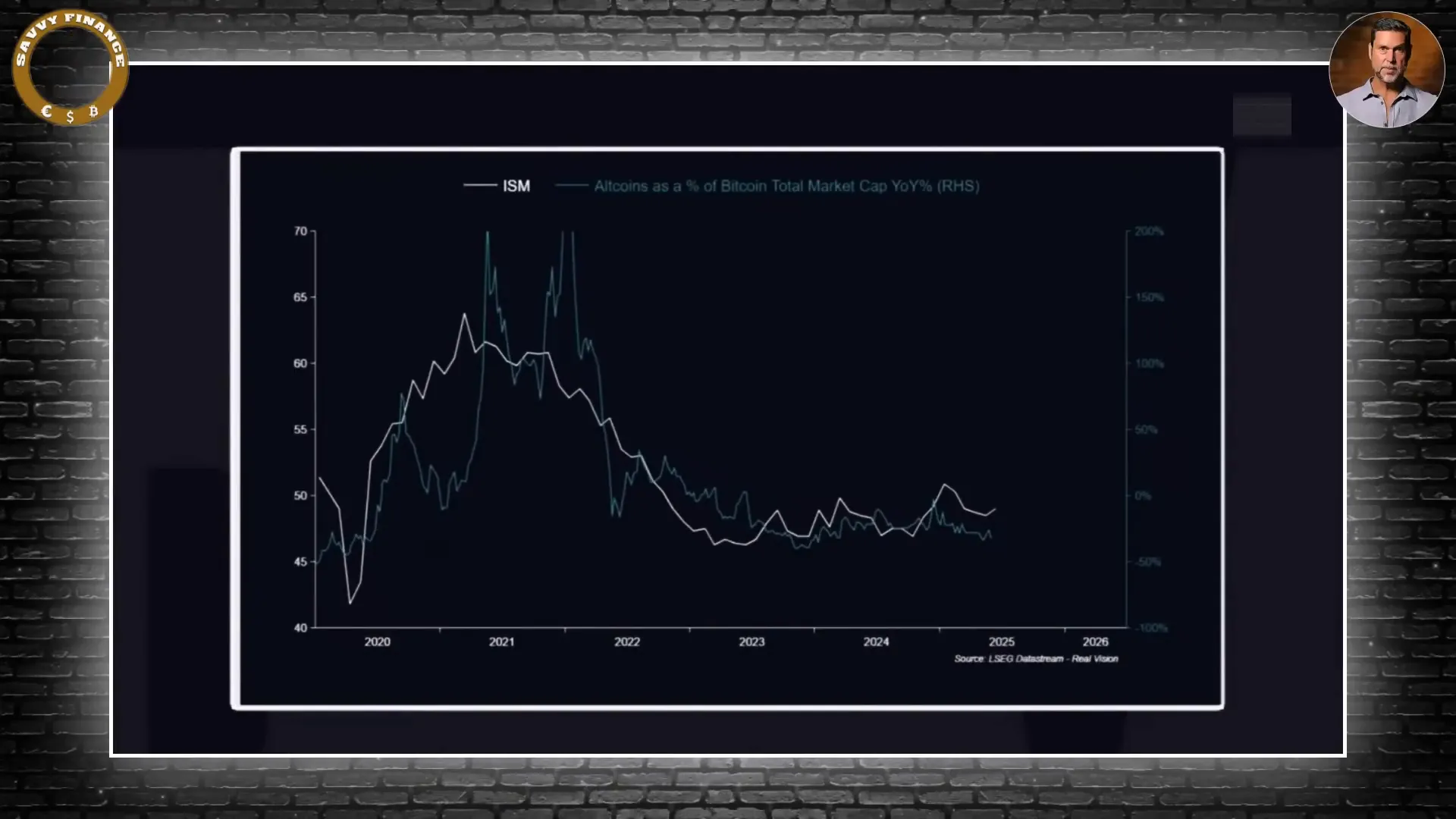

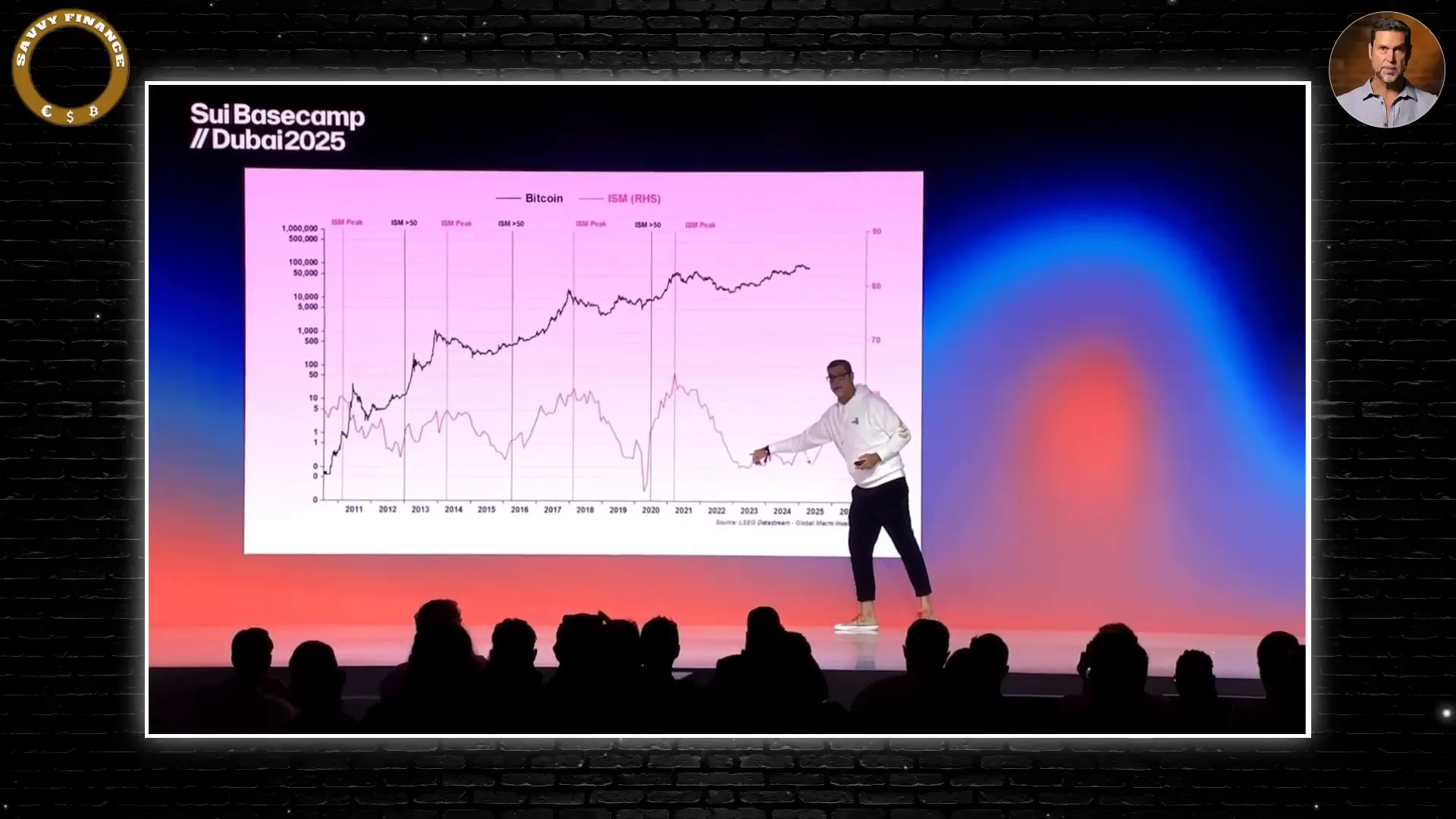

Here’s the key: altcoins tend to outperform Bitcoin when the US Manufacturing Index (ISM) rises. The ISM is a vital indicator of business conditions and economic growth. When it trends upward, it means earnings are improving and investors feel comfortable taking more risk. This dynamic traditionally triggers altcoin seasons where total crypto market capitalization rises, Bitcoin dominance falls, and altcoins shine.

Why Are Investors Still Asking “When Banana?”

Despite this clear macro picture, many investors remain skeptical or anxious, frustrated by sideways price action in the market. Bitcoin has recently been stuck below its all-time highs, Ethereum has lagged, and altcoins have shown mixed results. This consolidation phase confuses many, leading to the meme “when banana?” as a way to mock delays in alt season.

Raoul Pal’s frustration is palpable. He’s been sharing this data for two years, showing how the macro indicators like the ISM and global liquidity trends predict these cycles. Yet, many ignore or misinterpret these signals, distracted by politics, opinions, and fears. The truth is, the groundwork for the next banana zone phase is already laid, and when it hits, it won’t wait for you to catch up.

Global Liquidity and Bitcoin’s Correlation

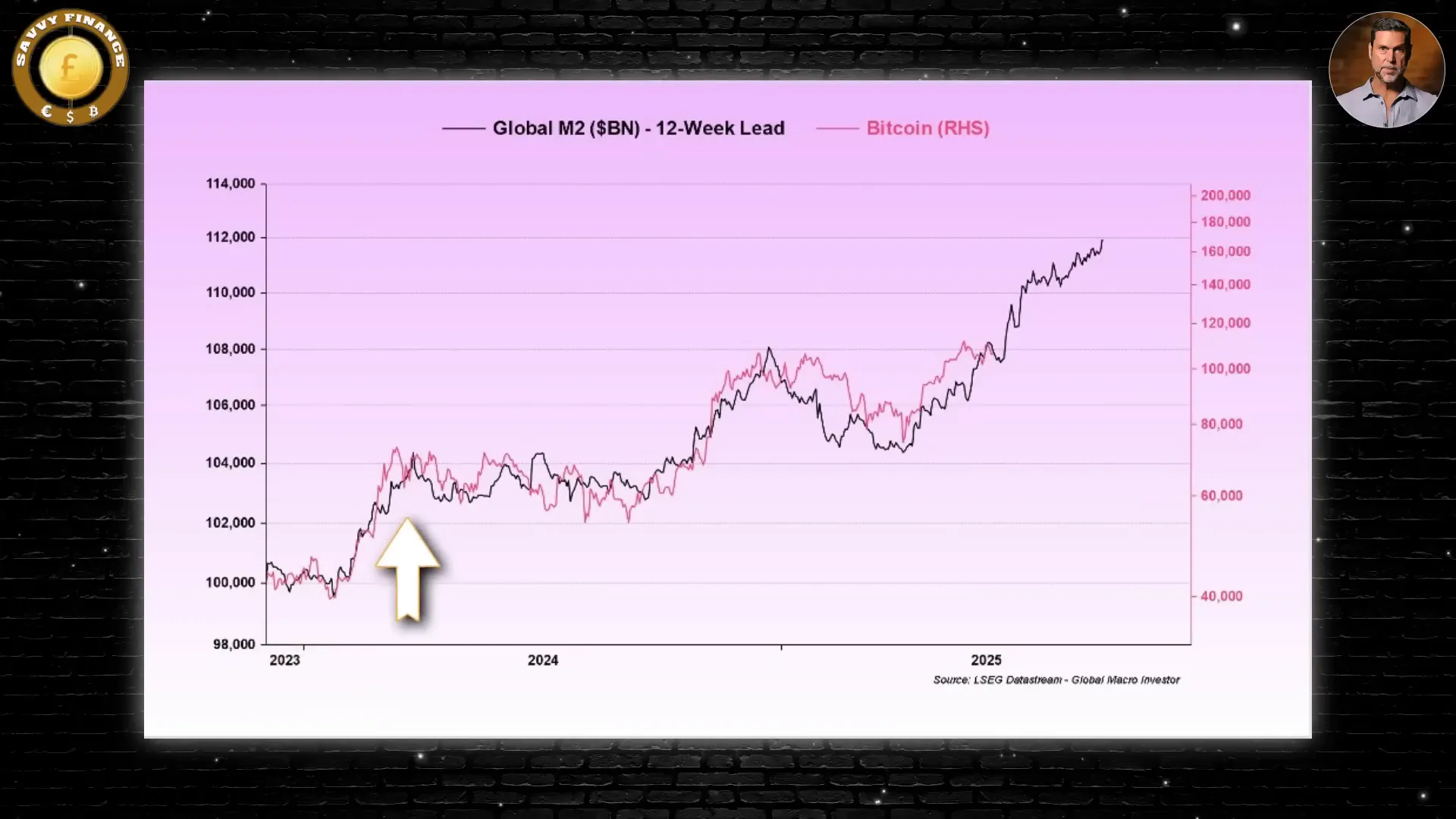

One of the most reliable indicators Pal highlights is the global M2 money supply—a broad measure of worldwide money available in the economy. Historically, this liquidity gauge leads Bitcoin’s price by several months, and currently, global M2 is rising at the fastest pace since the post-COVID reflation boom.

This surge in liquidity is backed by central bank actions, with over $2.3 trillion injected into the global economy since October 2023, led by Japan, China, and parts of Europe. Meanwhile, US financial conditions are easing despite the Federal Reserve’s pause, as seen in the falling two-year Treasury yield and weakening US dollar (DXY), which Pal predicts could fall to the 90-92 range.

All these factors create a perfect storm for rising ISM, expanding earnings, and renewed appetite for speculative assets—including altcoins.

Financial Conditions Leading the Business Cycle

Financial conditions, a blend of interest rates, the dollar’s strength, and commodity prices, play a pivotal role in this cycle. Easing financial conditions tend to lead the ISM index by about nine months. As the dollar weakens and rates come down, we can expect ISM to rise sharply, signaling improved business conditions and economic activity.

This improvement is critical because the business cycle historically drives market returns. When the cycle turns up, markets tend to follow. Pal points out that this pattern has been consistent for over a century, with market returns closely tied to the business cycle’s direction.

What This Means for Bitcoin and Altcoins

According to Pal, the crypto market entered the initial phase of the banana zone in late 2023. Bitcoin’s price has tracked the global M2 model with nearly 90% correlation, yet many investors missed this move because they weren’t paying attention to macro signals.

Looking at individual assets:

- Bitcoin is forming classic bullish patterns like the cup and handle on both weekly and daily charts, suggesting consolidation before a breakout.

- Ethereum has shown multiple top tests and is poised for a breakout that could signal the true start of alt season.

- Solana exhibits a beautiful cup and handle pattern, historically a precursor to new all-time highs.

- SUI, with a smaller float and earlier adoption stage, is consolidating in a wedge pattern likely to break higher, potentially outperforming Solana.

- Dogecoin is quietly setting up for its role in the upcoming altcoin season, defying skepticism.

Don’t Fight the Liquidity—Trust the Macro Signals

Every cycle brings its share of skepticism. People claim “it’s different this time,” or that macro conditions are broken and altcoin season won’t happen. Raoul Pal’s advice is simple: look at the data. Don’t fight liquidity. Don’t ignore the 97% correlation between global M2 and Nasdaq returns. Don’t bet against the business cycle.

This market isn’t driven by opinions but by real, measurable conditions. The signals are already here:

- Financial conditions are easing rapidly.

- The ISM is poised to rise above 50, the key threshold for market expansion.

- Bitcoin and major altcoins are showing classic bullish technical patterns.

These factors confirm we are still early in the banana zone. The biggest leg—where altcoins fly, Bitcoin dominance drops, and patient investors are rewarded—has yet to begin. When it does, it won’t send warnings; it will simply take off.

Getting Ready for the Next Wave

So, are you stacking Bitcoin, rotating into altcoins, or still waiting for “when banana?” The data shows we are already in the zone, and the next explosive phase is just getting started.

To position yourself wisely:

- Keep an eye on macroeconomic indicators like ISM, global M2, and financial conditions.

- Consider diversifying into strong layer one altcoins like Ethereum, Solana, and SUI.

- Watch technical patterns for breakout confirmations.

- Ignore the noise, politics, and fear that often cloud judgment.

Understanding and trusting these macro signals can be one of the easiest and most profitable trades of your lifetime.

If this insight helped you see the bigger picture, stay informed, stay patient, and get ready for the next major phase in cryptocurrency and bitcoin markets.

100% Certainty! This PERFECT Macro Signal Predicts Bitcoin’s Next All Time High. There are any 100% Certainty! This PERFECT Macro Signal Predicts Bitcoin’s Next All Time High in here.