The geopolitical landscape is shifting rapidly in 2025, with the United States formally entering the conflict between Israel and Iran through precision military strikes aimed at halting Iran’s nuclear ambitions. This significant escalation not only raises urgent questions about regional stability and global security but also sends ripples through financial markets, including the volatile world of Bitcoin, crypto, and blockchain investing.

As the dust settles from this dramatic turn, it’s crucial for investors and crypto enthusiasts alike to understand the broader implications of these events. This article dives deep into the unfolding conflict, explores potential Iranian responses, examines the U.S. military posture in the Middle East, and highlights the remarkable resilience of Bitcoin amidst turmoil. We’ll also unpack expert technical analysis on Bitcoin’s price trajectory, shedding light on what the future may hold for BTC and the broader crypto market.

If you’re serious about market security, crypto investing, or simply want to make sense of an increasingly uncertain world, this comprehensive breakdown is for you.

U.S. Military Strikes Against Iran: A New Chapter in Middle East Tensions

In a bold and unprecedented move, the United States military executed massive precision air strikes targeting three critical nuclear facilities in Iran. President Trump announced this operation as a "spectacular military success," emphasizing the close collaboration with Israel to effectively “decapitate” Iran’s nuclear program.

While the strikes were strategically calculated to avoid further immediate conflict, the world now watches anxiously: How will Iran respond?

Iranian state television has already broadcast warnings of retaliation, signaling a potential escalation. However, these statements must be interpreted cautiously, as direct official leadership communications will provide clearer insight into Iran’s next moves.

The stakes are high. Iran retains several avenues for counteraction, though the success of these maneuvers remains uncertain. Even if none achieve decisive results, they could still exacerbate regional instability, dragging neighboring countries into an expanded conflict.

The U.S. has bolstered its military presence in the Middle East, maintaining over a dozen bases and deploying three carrier strike groups, with more than 40,000 personnel in the region. This substantial buildup serves both as a deterrent and as a potential target for Iranian retaliation.

President Trump’s recent statement on social media was unequivocal: any Iranian retaliation against the U.S. will be met with overwhelming force, surpassing the recent strikes. However, this does not yet amount to a formal declaration of war, a decision that ultimately rests with Congress.

There remains hope that this military action could pressure Iran towards the negotiating table, avoiding further bloodshed. But the uncertainty fuels global apprehension.

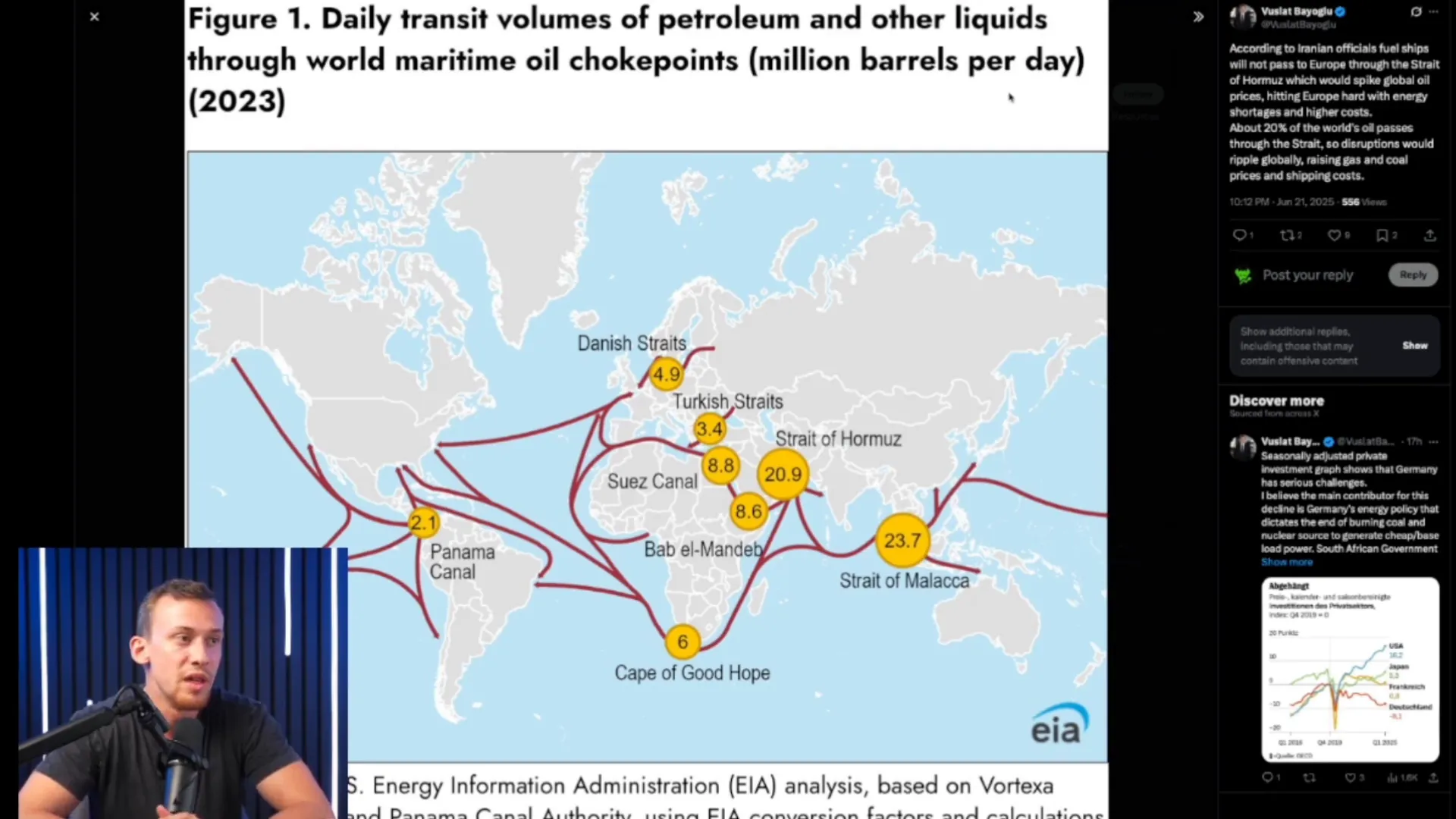

The Critical Importance of the Strait of Hormuz

One of the most pressing concerns amid this crisis is the security of the Strait of Hormuz — a vital artery for global oil commerce. Approximately 20% of all global oil trade passes through this narrow waterway bordering Iran. The significance of this route cannot be overstated:

- Daily, around 21 million barrels of oil flow through the Strait.

- It accounts for nearly 20% of the world's oil supply.

- About 90% of Saudi Arabia's and 96% of Iraq's oil exports rely on this passage.

Recent market sentiment reflects rising fears that Iran might attempt to close the Strait in retaliation, with the probability spiking from 38% to 55% in just days according to Poly Market predictions. Such a closure would send shockwaves through the global economy, disrupting energy supplies and triggering price volatility across industries worldwide.

While Iran could use this as a powerful bargaining chip, doing so risks provoking swift military responses from the United States and allied nations, including other Middle Eastern countries eager to maintain open trade routes.

It’s worth noting that the Strait of Hormuz is the second-largest oil chokepoint globally after the Strait of Malacca, which handles 24 million barrels per day. Any disruption here would not only destabilize the Middle Eastern economies but also impact major global consumers such as China.

China, a key ally of Iran and Russia, receives a substantial portion of its oil via the Strait of Hormuz and Malacca. While alternative land routes exist, they are less efficient and more vulnerable to geopolitical tensions. Therefore, Beijing’s strategic interests could push China to intervene diplomatically or militarily to safeguard these trade routes, adding another layer of complexity to the conflict.

Bitcoin and Crypto: A Beacon of Stability Amidst Geopolitical Chaos

Despite the escalating conflict and uncertainty roiling traditional markets, Bitcoin has held remarkably steady, hovering around $102,000 with only minor intraday fluctuations. This resilience is striking given Bitcoin’s historical volatility during periods of global unrest.

Bitcoin’s ability to maintain stability amid such geopolitical shocks highlights its maturation as an asset class and its growing role as a potential safe haven.

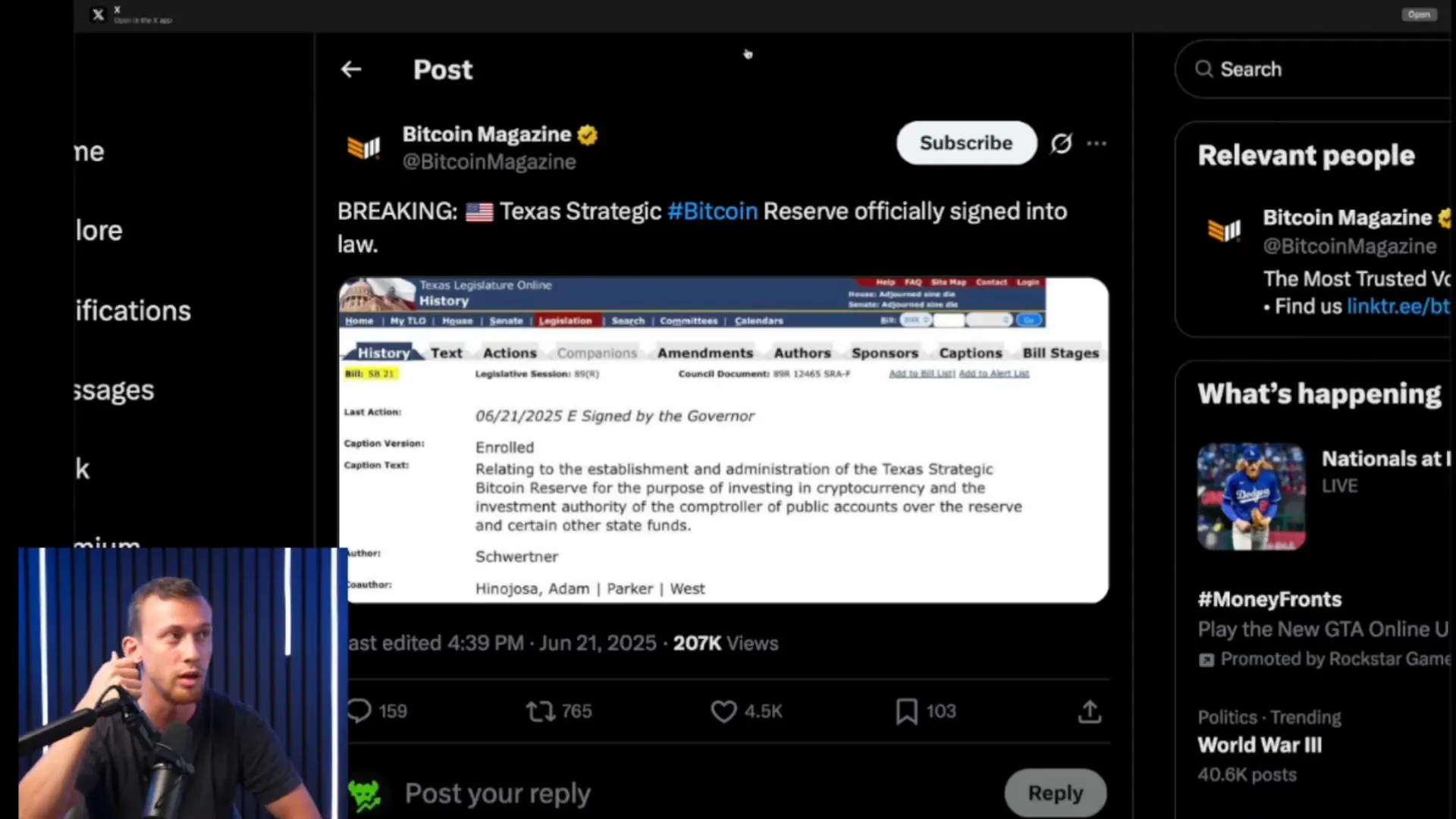

Amidst the noise of war headlines, there was a significant yet overshadowed development in the crypto space: Texas signed into law the establishment of a strategic Bitcoin reserve, becoming the third U.S. state to do so, alongside Arizona and New Hampshire.

Texas is a powerhouse with the eighth largest economy globally, boasting a GDP of approximately $2.1 trillion. While the Bitcoin reserve law is not directly tied to the size of the economy, it signals a broader institutional acceptance of Bitcoin within the United States.

This move could catalyze a rapid shift in Bitcoin adoption, encouraging other states and perhaps the federal government to recognize Bitcoin’s value not just as a speculative asset but as a strategic reserve currency.

Global Ripple Effects of Bitcoin Adoption

Texas’ legislation follows El Salvador’s pioneering adoption of Bitcoin as legal tender, which has demonstrated how crypto can transform economies by:

- Creating jobs and stimulating economic growth.

- Banking the unbanked through accessible digital wallets.

- Fostering financial inclusion with innovative programs, such as distributing free smartphones for Bitcoin use.

Similarly, Bitcoin adoption is gaining momentum in Africa and other emerging markets, where traditional banking infrastructure is limited. As more first-world economies embrace Bitcoin, countries unwilling or slow to adopt risk being left behind in the global financial evolution.

Technical Analysis: What’s Next for Bitcoin Price?

To understand Bitcoin’s near-term outlook, we turn to Paul Sampson, a respected technical analyst specializing in crypto markets. His recent analysis sheds light on probable price movements amid current global tensions.

Paul explains that Bitcoin has been trading sideways for some time, forming a “bearish shark” harmonic pattern—a Fibonacci sequence-based technical setup signaling potential price corrections.

He highlights a key target zone between $88,000 and $93,000, which he views as a likely support range in the short term. This would represent roughly a 10% dip from current levels, often seen as a healthy retracement in volatile markets.

While a short squeeze—a rapid price increase fueled by short sellers covering their positions—could temporarily push Bitcoin prices higher, Paul anticipates that negative news catalysts, such as geopolitical instability, may drive prices down into his target zone before any significant upward breakout.

This dip could serve as a prime buying opportunity for investors who missed the recent rally, potentially setting the stage for the next leg higher in Bitcoin. However, altcoins might underperform during this correction, as they tend to be more sensitive to market fear.

Paul’s analysis stresses the importance of patience and strategic accumulation during these periods of uncertainty. The anticipated pullback could cleanse the market of weaker hands, paving the way for robust growth in the medium term.

Broader Market Implications

Bitcoin’s trajectory often correlates with traditional markets, including stocks and other financial instruments. A downturn in Bitcoin could foreshadow a similar pullback in equities and vice versa.

Given the current geopolitical tensions, investors should brace for volatility but also recognize opportunity in disciplined accumulation strategies.

Staying Focused on the Bigger Picture

It’s easy to become overwhelmed by doom-and-gloom headlines and fear-driven market reactions. However, it’s critical not to lose sight of long-term goals and the broader macro trends shaping Bitcoin and crypto adoption globally.

Institutional infrastructure for Bitcoin continues to expand rapidly. Financial giants like JPMorgan Chase are now offering Bitcoin services to retail investors, signaling growing mainstream acceptance. The recent passage of the Genius Act in the U.S. Senate will further bolster stablecoin infrastructure, fostering innovation and regulatory clarity that could positively impact the entire crypto ecosystem.

These developments underscore Bitcoin’s evolution from a speculative asset to an integral part of the global financial landscape.

Historically, Bitcoin has weathered far worse shocks than a few thousand dollars in price volatility. Those who remember the dramatic 30% declines during previous cycles understand that such fluctuations are part of the maturation process.

A Sobering Reality Check for Bitcoin Holders

A recent post circulating on social media captures the essence of Bitcoin’s current phase perfectly:

"The Wholecoiner era is almost over. We're entering the phase where the average person won't be able to own a full Bitcoin ever again. Satoshi Millionaires will be the new obtainable chase. Most people won't realize it until it's way too late. A lot of you holding a full coin right now probably don't think much of it, but mark my words, when this bull run hits, most of you will sell. You'll convince yourself it's life-changing money and walk away. And sure, it might be, but one day people are gonna look back and say, 'Wow, you had a whole Bitcoin.' Just like we laughed at the guy who spent ten thousand BTC on pizza, you, if you've got one, maybe keep it. Just one long term you really don't understand what's happening yet."

This reflection is a wake-up call for all investors, whether you hold a whole Bitcoin or a fraction thereof. The road ahead is long, and the opportunity immense.

Many of us are still accumulating, whether one-tenth or one whole Bitcoin. The key is to remain focused, disciplined, and aligned with your personal financial goals.

Preparing for an Uncertain Future

We have navigated through significant global crises before: the COVID-19 pandemic being a prime example where fear and uncertainty gave way to opportunity for those who stayed the course.

This current Middle East conflict could be another such moment. However, if the situation escalates, involving other countries or triggering actions like China’s potential moves on Taiwan, the geopolitical and economic landscape could shift dramatically.

In such scenarios, it’s vital to avoid reactive decisions driven by fear, uncertainty, and doubt (FUD). Thoughtful, informed choices about buying or selling Bitcoin and other crypto assets will serve investors better than knee-jerk reactions.

Remember, time is a critical factor in crypto investing. The Bitcoin train is moving fast, and no one is waiting. Position yourself wisely to capitalize on the tremendous benefits this revolutionary technology and asset class offer.

Your Role in the Crypto Revolution

Every investor’s journey with Bitcoin is unique. Whether your goal is to hold Bitcoin as a legacy asset, pass it on to future generations, or use it as a hedge against traditional financial risks, the path requires patience and conviction.

Keep educating yourself, stay aware of global developments like the U.S.-Iran conflict, and monitor Bitcoin’s technical trends. But above all, maintain your focus on accumulation and long-term growth.

In the grand scheme, Bitcoin and blockchain technology are reshaping finance, governance, and the global economy. By staying informed and engaged, you’re not just an investor—you’re part of a historic movement.

Weigh In: What Are Your Thoughts?

How do you see the U.S.-Iran conflict evolving, and what impact do you think it will have on global markets and Bitcoin? Do you agree with the technical outlook predicting a dip into the low $90,000 range for Bitcoin, or do you foresee a different path?

Share your thoughts and strategies below. Your insights help build a stronger, more informed crypto community.

Remember, this content is for informational purposes and not financial advice. Always do your own research and consult with professionals before making investment decisions.

U.S. Declares War...A Crucial Message to Bitcoin Holders: Navigating Conflict and Crypto in 2025. There are any U.S. Declares War...A Crucial Message to Bitcoin Holders: Navigating Conflict and Crypto in 2025 in here.