In a recent dramatic turn of events, the US military launched precision strikes on Iran’s key nuclear facilities, targeting Fordeaux, Natanz, and Esfahan. This unexpected escalation sent shockwaves through the global markets and triggered a significant dip in cryptocurrency values, especially Bitcoin. As markets reel from uncertainty, it’s crucial to understand what this means for cryptocurrency, bitcoin, and the broader financial landscape.

Table of Contents

- Market Reaction to US Strikes on Iran

- Is This a Buying Opportunity?

- The Middle East’s Growing Embrace of Cryptocurrency

- Global Trends: Russia’s Strategic Bitcoin Reserves

- Decoupling of Bitcoin and Tech Stocks

- Investment Strategy in the Current Environment

- The Future of Bitcoin Adoption and Regulation

- Conclusion: Stay Informed and Invest Wisely

Market Reaction to US Strikes on Iran

The immediate aftermath of the US bombing of Iran caused turmoil in global markets. Over $1 billion was liquidated from crypto markets within 24 hours, breaking Bitcoin’s impressive 44-day streak above $100,000. Bitcoin dipped to $99,000, reflecting the nervousness of investors facing the possibility of new conflict in the Middle East.

Despite the sharp drop, it’s important to recognize that nothing fundamentally has changed with Bitcoin or cryptocurrency as assets. The dip is driven primarily by fear and uncertainty stemming from geopolitical tensions, not by any intrinsic weakness in crypto markets.

Is This a Buying Opportunity?

For those with capital on the sidelines, this dip presents a significant buying opportunity. Historically, stock markets often rise during wartime due to increased government spending and money printing to fund conflicts. Bitcoin and crypto, which are increasingly seen as quality assets, could similarly benefit from this inflationary environment.

While the prospect of a boots-on-the-ground conflict seems unlikely—given the US’s preference to avoid such engagements—the possibility of Iranian retaliation is higher now. However, the US’s superior power and alternative means of defense suggest that prolonged conflict may be avoided.

Expect volatility and uncertainty over the coming weeks, but any signs of de-escalation could trigger a strong rebound in markets, with Bitcoin and crypto potentially soaring alongside the stock market.

How Low Could Bitcoin Go?

Analyzing the charts, Bitcoin could realistically dip to the low $90,000s this month or even the high $80,000s without breaking its market structure. Even a few weeks in the $80,000 range would likely be followed by a robust recovery rally. This perspective reinforces why this is a prime time to accumulate Bitcoin and crypto assets.

The Middle East’s Growing Embrace of Cryptocurrency

Beyond the immediate conflict, there is a fascinating trend unfolding in the Middle East. Sovereign wealth funds and governments across Saudi Arabia, Abu Dhabi, Dubai, Bahrain, and Qatar are actively investing in Bitcoin and blockchain technology. Their focus extends beyond using Bitcoin as a reserve asset—they are building government infrastructures on blockchain, incorporating everything from driving licenses to property deeds.

This regional mandate on AI and blockchain signals a major shift in how governments view and utilize cryptocurrency technology, driving a broader institutional adoption that will expand market size and complexity.

Global Trends: Russia’s Strategic Bitcoin Reserves

It’s not just the Middle East embracing crypto. Russia reportedly holds over $25 billion in Bitcoin and other cryptocurrencies, fueled by mining and institutional buying. This suggests that Russia may be quietly building a strategic Bitcoin reserve.

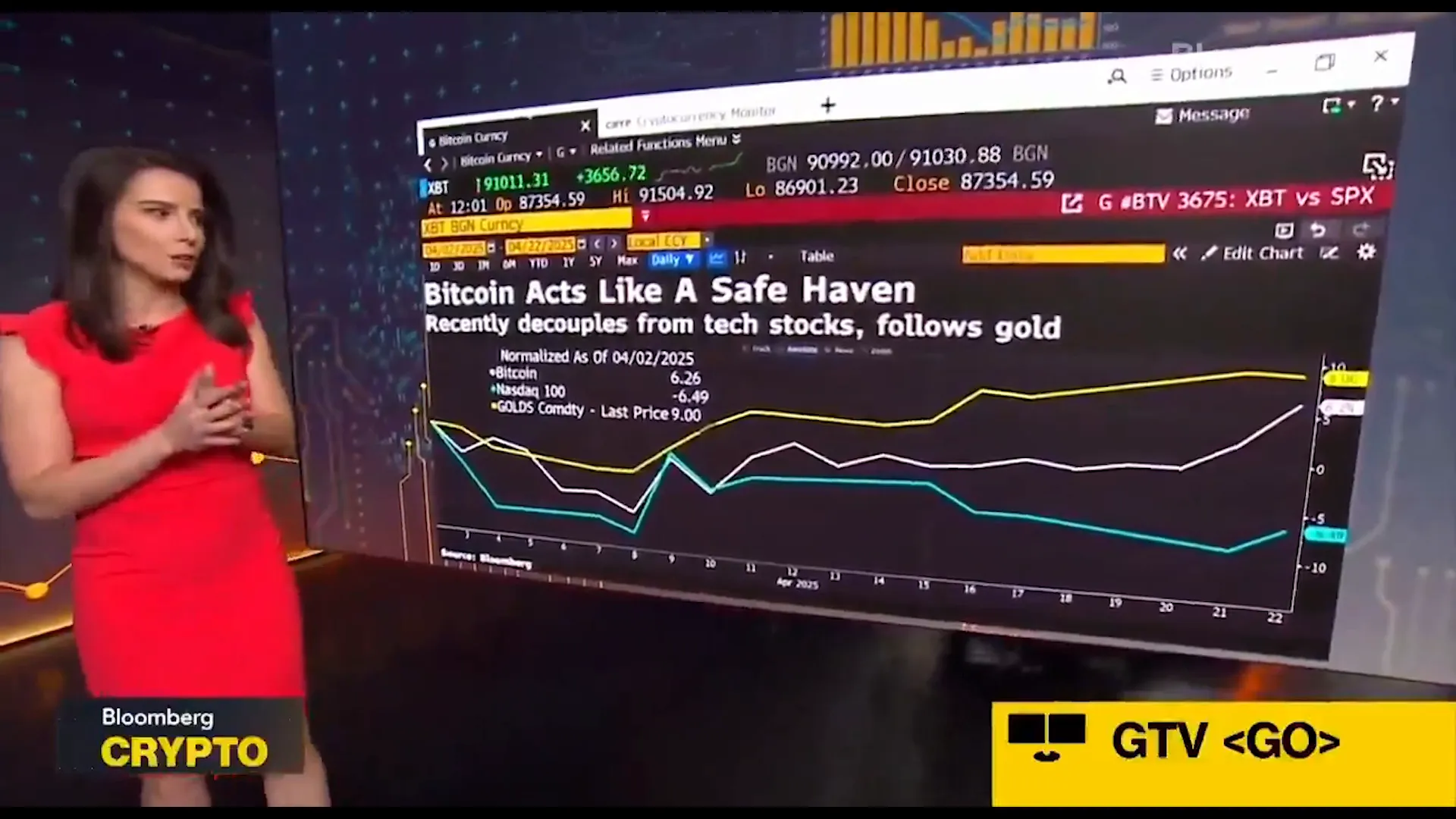

Bloomberg has even started referring to Bitcoin as “physical gold,” highlighting Bitcoin’s growing role as a safe-haven asset. In April alone, gold rose about 9%, dragging Bitcoin higher by approximately 6%, even as tech stocks like the Nasdaq 100 fell by over 6%.

Decoupling of Bitcoin and Tech Stocks

Bitcoin’s recent behavior indicates a decoupling from traditional tech equities, with investors increasingly viewing Bitcoin as a safe haven. This shift is underscored by billionaires and major institutional players reconsidering their portfolios and contemplating deploying more capital into Bitcoin at current price levels.

The third richest man in Mexico, for example, is reportedly thinking about buying more Bitcoin, reflecting a broader confidence among wealthy investors despite economic uncertainty.

Investment Strategy in the Current Environment

Given the volatility and valuation concerns in traditional stock markets, a cautious approach is warranted. Many investors are trimming exposure to stocks, focusing instead on Bitcoin miners, gold miners, and direct Bitcoin holdings. A portfolio allocation of roughly 80% Bitcoin and 20% gold through miners is becoming a popular strategy for navigating these turbulent times.

Governments’ ongoing money printing policies underpin the case for quality assets like Bitcoin to continue trending upward over time. This “new normal” of inflationary monetary policy supports the long-term thesis for Bitcoin accumulation.

The Future of Bitcoin Adoption and Regulation

On the regulatory front, the US is moving toward formal recognition and integration of Bitcoin. Executive orders and state-level initiatives, such as Texas becoming the third state to implement a strategic Bitcoin reserve, show growing institutional acceptance. Other states like Arizona and New Hampshire are following suit.

Legislative developments including the upcoming Bitcoin bill, stablecoin bill, and market structure bill will further clarify and support Bitcoin’s role in the financial system. The US’s leadership in this space will likely prompt other G20 countries to adopt similar measures, accelerating global crypto adoption.

Conclusion: Stay Informed and Invest Wisely

In times of geopolitical tension and market volatility, staying informed is critical. The cryptocurrency market is evolving rapidly, with significant institutional and governmental involvement shaping its trajectory.

For investors, the key takeaway is clear: this dip in Bitcoin and crypto is a strategic buying opportunity. Accumulating Bitcoin, maintaining a disciplined portfolio, and monitoring market developments can position investors for substantial gains in the coming months and years.

Time in the market remains the surest path to wealth accumulation in crypto. Whether you’re a seasoned investor or just getting started, staying engaged and educated on the latest trends will help you navigate this exciting yet challenging landscape.

US Bombs Iran and Crashes Bitcoin: What Happens Now in Cryptocurrency and Bitcoin Markets?. There are any US Bombs Iran and Crashes Bitcoin: What Happens Now in Cryptocurrency and Bitcoin Markets? in here.