In a world where geopolitical tensions can shake markets overnight, staying informed and prepared is vital for any investor, especially in cryptocurrency and bitcoin. Recent developments involving the United States, Iran, and Israel have not only captured global headlines but also sent ripples through the financial and crypto markets. Let’s break down what happened, why markets reacted the way they did, and how you can position your crypto portfolio for what lies ahead.

Table of Contents

- The Twelve-Day War: A Recap of Recent Events

- Market Reactions: Why Are Stocks and Crypto Rallying?

- Crypto Spotlight: Why Bitcoin and Altcoins Are Gaining

- Stock Market Valuation Warning and the Bigger Picture

- Reasons to Stay Bullish on Cryptocurrency and Bitcoin

- Additional Crypto Developments to Watch

- Conclusion: Stay Informed and Prepared

The Twelve-Day War: A Recap of Recent Events

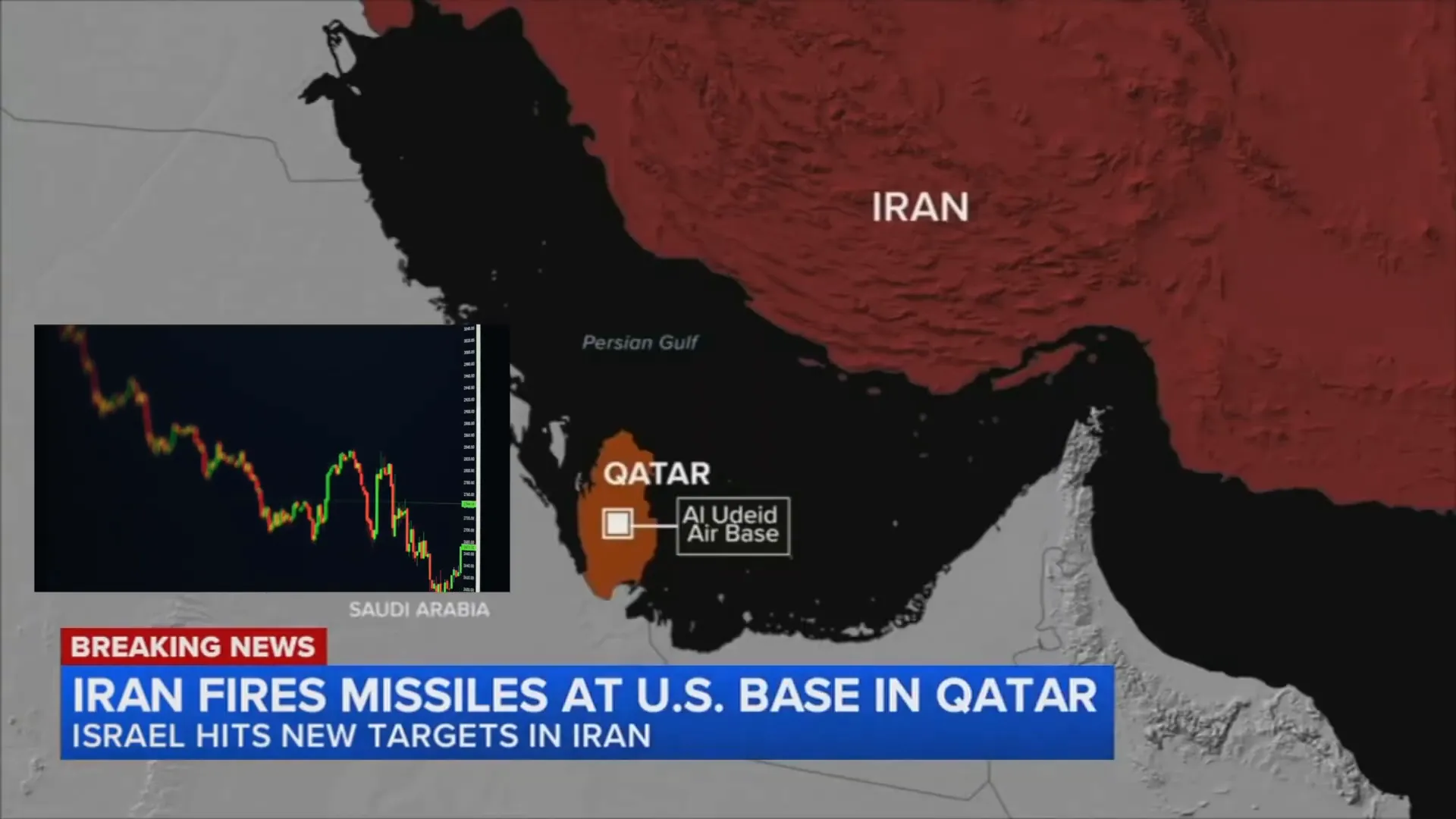

Over a tense weekend, the United States launched a military strike against Iran, which prompted an immediate retaliatory missile attack by Iran targeting the Al Udeid Airbase in Qatar—the largest US airbase in the Middle East housing around 10,000 American troops. The situation escalated rapidly, stirring uncertainty across markets globally.

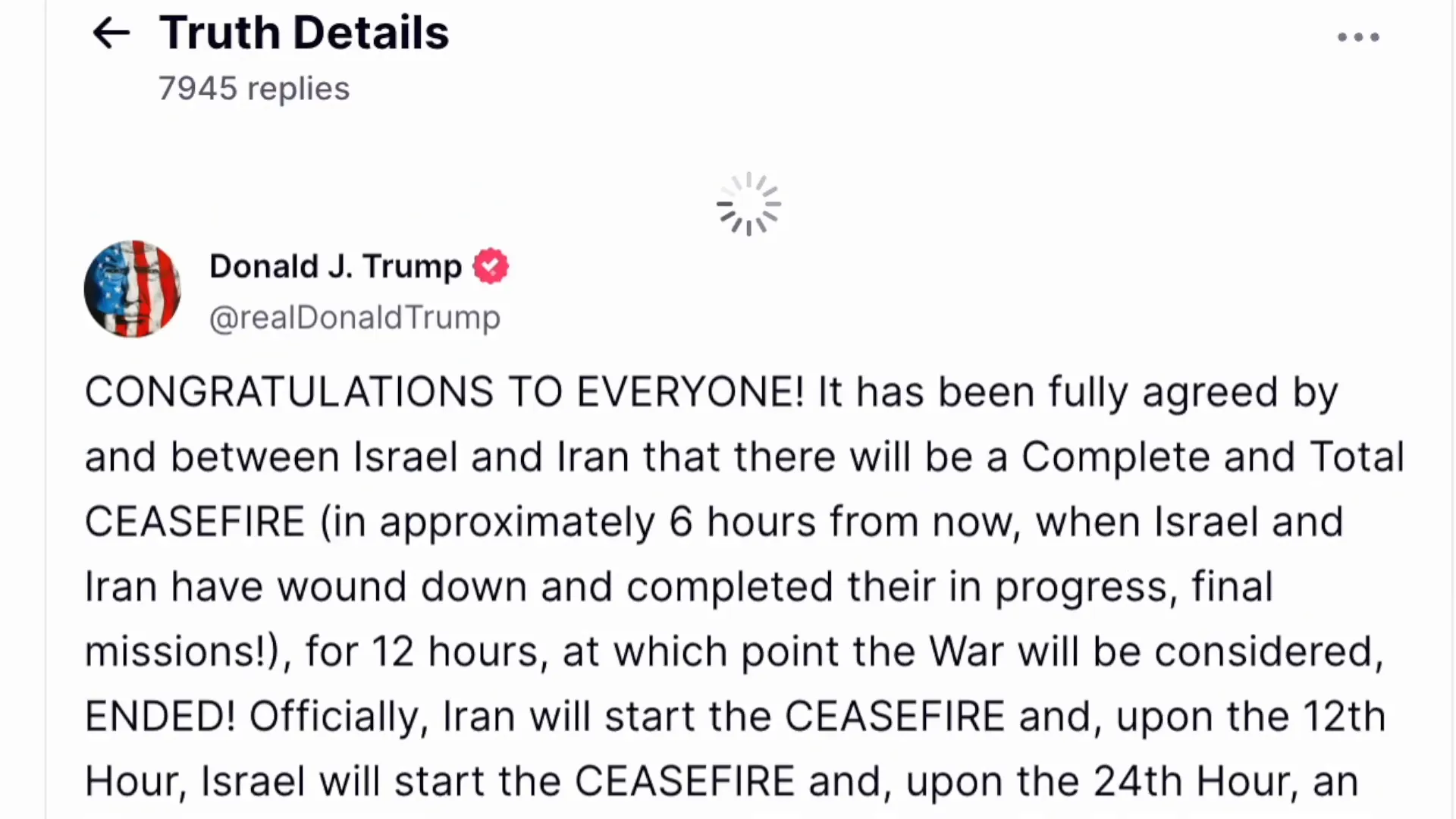

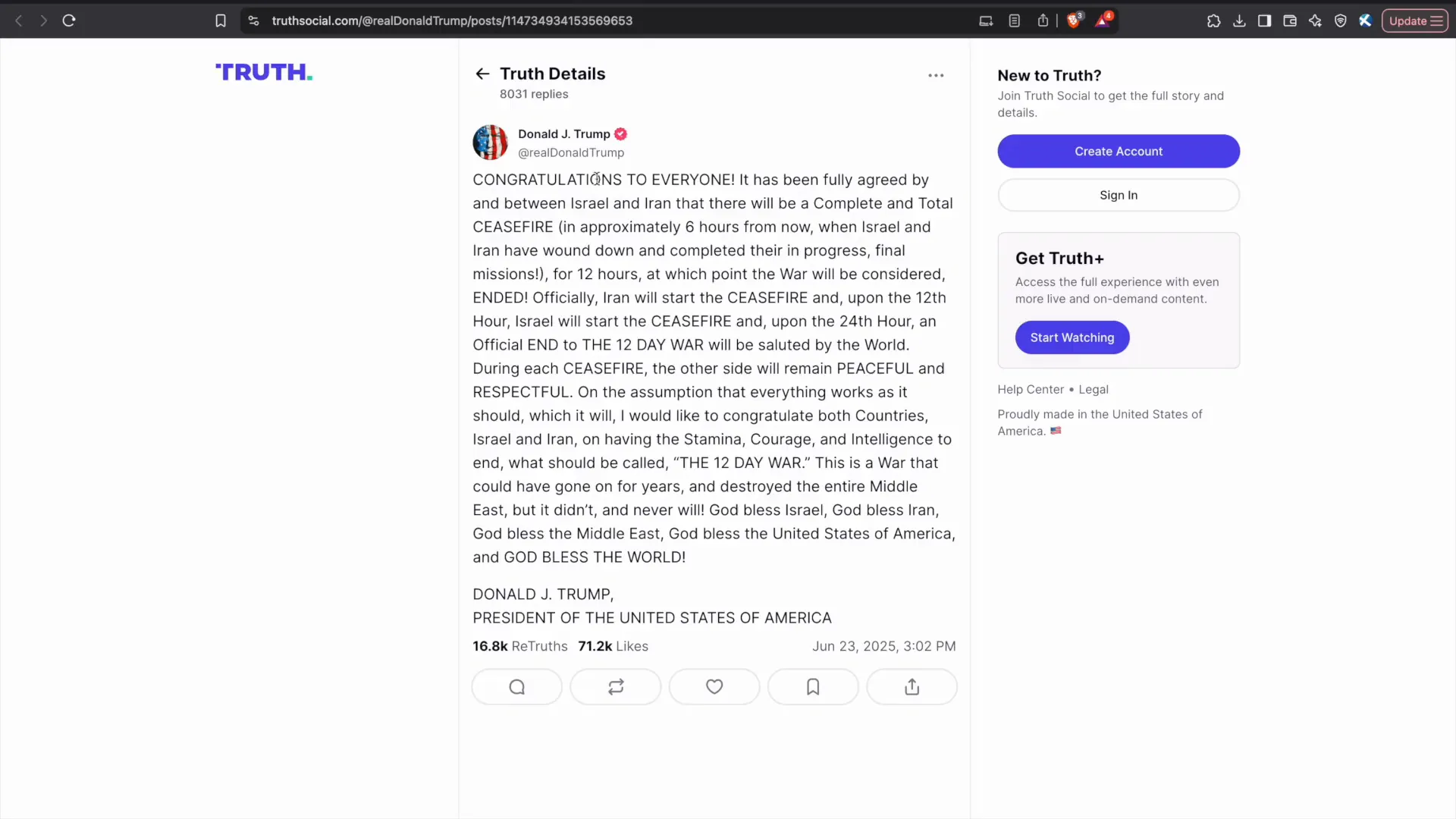

However, in a surprising turn of events, former President Donald Trump announced a ceasefire agreement between Israel and Iran, effectively ending what is now being called the twelve-day war. This announcement has brought a wave of relief and optimism, particularly impacting cryptocurrency markets.

Market Reactions: Why Are Stocks and Crypto Rallying?

Intuitively, war and uncertainty tend to spook financial markets. Yet, following the initial dips, both the S&P 500 and cryptocurrency markets showed gains. Bitcoin, for example, dipped over the weekend when the strike occurred—unsurprising since it’s the only major asset class trading 24/7, even on weekends. But this dip was mild, about 5%, and Bitcoin has since rallied, showing resilience and continued volatility that investors expect.

Why did the stock market rise despite the conflict? Part of the answer lies in market psychology and historical patterns. As Art Cashin famously said, “sell the build-up, buy the invasion.” Markets often price in fears ahead of time, and once a conflict begins, uncertainty diminishes, prompting investors to buy. Additionally, the market was already nervous, with elevated volatility indexes (VIX) and some derisking beforehand.

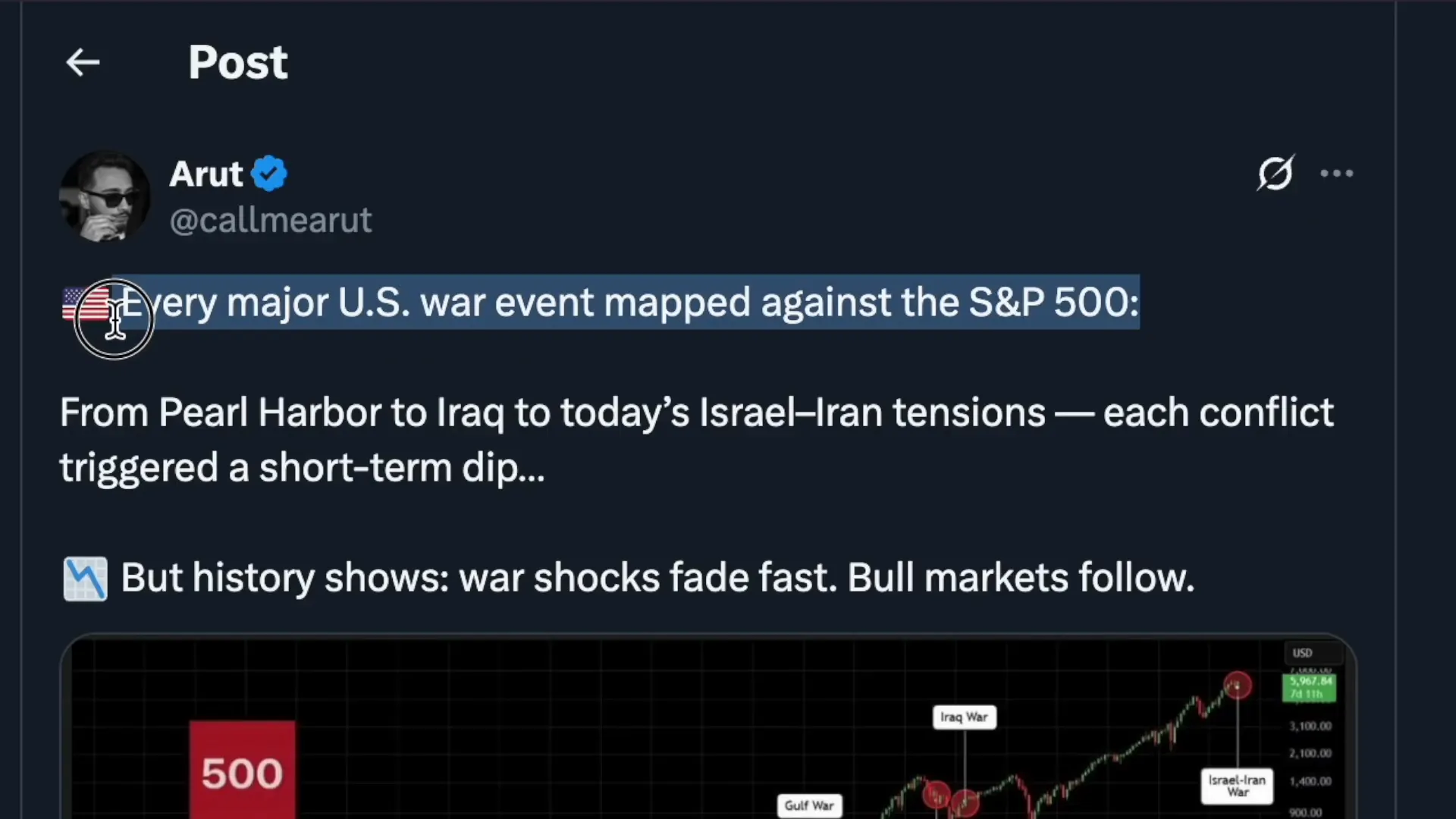

Historical data supports this behavior. Every major U.S. war event, from Pearl Harbor to Iraq and recent Israel-Iran tensions, caused short-term dips in the S&P 500. But these shocks fade quickly, and bull markets typically follow. Recovery times vary: World War II took hundreds to thousands of days, but events like 9/11 saw markets bounce back in about 30 days.

The Role of Money Supply and Asset Inflation

Another key factor is the expansion of the global money supply, referred to as M2. Governments often increase spending and print money to fund wars, which inflates asset prices. This liquidity tends to filter into assets like bitcoin within 12 weeks or so, creating a lagged but meaningful impact. While this correlation holds about 80% of the time, it highlights why assets like bitcoin and stocks often rally post-conflict.

Crypto Spotlight: Why Bitcoin and Altcoins Are Gaining

Bitcoin’s unique position as “digital gold” makes it a favored store of value during uncertain times. Unlike fiat currencies, bitcoin cannot be printed or devalued by government policies, making it attractive amid geopolitical tensions and inflation concerns.

Beyond bitcoin, quality altcoins are also showing signs of recovery. For instance, the SWEET ecosystem is gaining traction, with the DeLorean Motor Company launching a crypto token (DMC) on the SUI blockchain. Supported by major exchanges like Kraken and KuCoin, this airdrop offers investors a chance to earn free tokens by participating in the race lap pools. It’s a fresh example of innovation driving interest in crypto assets beyond bitcoin.

Federal Reserve Eases Crypto Banking Restrictions

Adding to the bullish sentiment, the Federal Reserve has officially ended reputational risk oversight, easing banking restrictions for crypto firms. This policy shift removes a major barrier that previously labeled crypto-related banking activities as risky, allowing crypto companies better access to traditional financial systems. This is a significant milestone for the industry and could accelerate institutional adoption.

Stock Market Valuation Warning and the Bigger Picture

Despite the positive momentum, caution is warranted. The U.S. stock market’s price-to-earnings ratio (PE) based on the 10-year average earnings stands at 40x—double the valuation of other developed and emerging markets. This signals that stocks may be overvalued historically, meaning corrections are possible.

Prominent investors, such as the CEO of Pantera Capital, suggest that the Iran-Israel conflict will accelerate the long-term trend of separating money and state. Historically, money was backed by hard assets like gold, but governments have increasingly printed fiat currency. Now, investors are returning to hard assets for wealth preservation, with bitcoin positioned as “digital gold” due to its scarcity and resistance to inflation.

Reasons to Stay Bullish on Cryptocurrency and Bitcoin

Despite geopolitical risks and market volatility, there are several reasons to maintain a bullish outlook on cryptocurrency and bitcoin:

- Macro Visibility: Clearer tariff and regulatory outlooks into 2026 reduce uncertainty.

- Federal Reserve Stance: Growing pressure on the Fed to adopt dovish policies with potential rate cuts.

- Resilient Earnings: Corporate earnings have been stronger than expected despite economic headwinds.

- Institutional Interest: Increasing attention from high-net-worth individuals and institutions towards crypto.

With cash on the sidelines and improving fundamentals, the stage is set for potential upside in both traditional and crypto markets.

Additional Crypto Developments to Watch

Beyond bitcoin, other cryptos like VeChain are showing impressive growth, boasting 2.7 million addresses and 20 million actions. This demonstrates the enduring strength and expansion of blockchain projects.

Moreover, hedge fund veterans are planning a $100 million treasury bet on Binance’s token (BNB) through a Nasdaq-listed shell company. This move signals growing confidence and sophistication in crypto investment strategies.

Conclusion: Stay Informed and Prepared

Geopolitical events like the recent U.S.-Iran tensions and the subsequent ceasefire have profound effects on markets, especially cryptocurrency and bitcoin. History teaches us that while uncertainty can cause short-term volatility, markets and crypto assets often recover and thrive afterward.

As always, it’s essential to do your own research, understand your risk tolerance, and stay informed about global and market developments. With evolving regulations, institutional interest, and innovative projects on the rise, now is a critical time to prepare and position your crypto portfolio wisely.

Stay tuned to trusted sources for real-time updates and insights to navigate these dynamic markets successfully.

Trump Announces CEASEFIRE: How To Prepare Your Crypto Portfolio (Cryptocurrency, Bitcoin Insights). There are any Trump Announces CEASEFIRE: How To Prepare Your Crypto Portfolio (Cryptocurrency, Bitcoin Insights) in here.