Decentralized Finance (DeFi) is transforming the cryptocurrency landscape, offering innovative ways to trade, lend, stake, and earn yields without traditional intermediaries. With recent regulatory developments hinting at eased restrictions, the DeFi sector is poised for significant growth. If you’re interested in cryptocurrency and bitcoin opportunities, understanding the top DeFi projects to watch in 2025 could be a game changer for your portfolio.

Here, we dive into five promising DeFi cryptocurrencies that have strong potential to rally, backed by unique technology, solid teams, and growing ecosystems.

Table of Contents

- 1. Uniswap: The Pioneer Decentralized Exchange on Ethereum

- 2. Aave: Revolutionizing Lending and Borrowing

- 3. Sky / MakerDAO: Stablecoin and Collateral Management

- 4. Jito: Efficient Staking and MEV Capturing on Solana

- 5. Raydium: Solana-Based Automated Market Maker

- Why These DeFi Projects Matter for Cryptocurrency and Bitcoin Enthusiasts

1. Uniswap: The Pioneer Decentralized Exchange on Ethereum

Uniswap stands as one of the most influential decentralized exchanges (DEX) in the crypto space. Launched on the Ethereum blockchain, it introduced the Automated Market Maker (AMM) model, a revolutionary way to facilitate token swaps without relying on traditional order books.

The concept of AMM was initially proposed in 2016 by Ethereum co-founder Vitalik Buterin, laying the foundation for Uniswap’s success. This design allows users to trade assets directly from their wallets, promoting seamless liquidity and decentralization.

Uniswap’s native token, UNI, hit an all-time high in March 2021. During the 2019-2020 cycle, the platform managed a staggering $5.2 billion in volume, underscoring its dominance in DeFi trading. As of early 2024, Uniswap’s market capitalization sits around €107 billion, with each UNI token priced approximately at €1.40.

Its IBM compatibility and Ethereum-inspired architecture make Uniswap a robust and scalable DEX, continuously evolving with upgrades and community governance.

2. Aave: Revolutionizing Lending and Borrowing

While not detailed in the transcript, Aave is another cornerstone DeFi protocol worth mentioning. It enables users to lend and borrow assets in a decentralized manner with variable and stable interest rates. Aave’s flash loans and collateralized lending mechanisms have made it a standout in the DeFi lending space.

3. Sky / MakerDAO: Stablecoin and Collateral Management

Sky, often linked with MakerDAO, is a protocol focused on stablecoin issuance and collateral management. It helps maintain stability in volatile markets by enabling users to generate DAI, a decentralized stablecoin pegged to the US dollar, through collateralized debt positions.

These platforms play a crucial role in the DeFi ecosystem by providing liquidity solutions that reduce exposure to price swings, thus encouraging broader adoption of cryptocurrency and bitcoin assets.

4. Jito: Efficient Staking and MEV Capturing on Solana

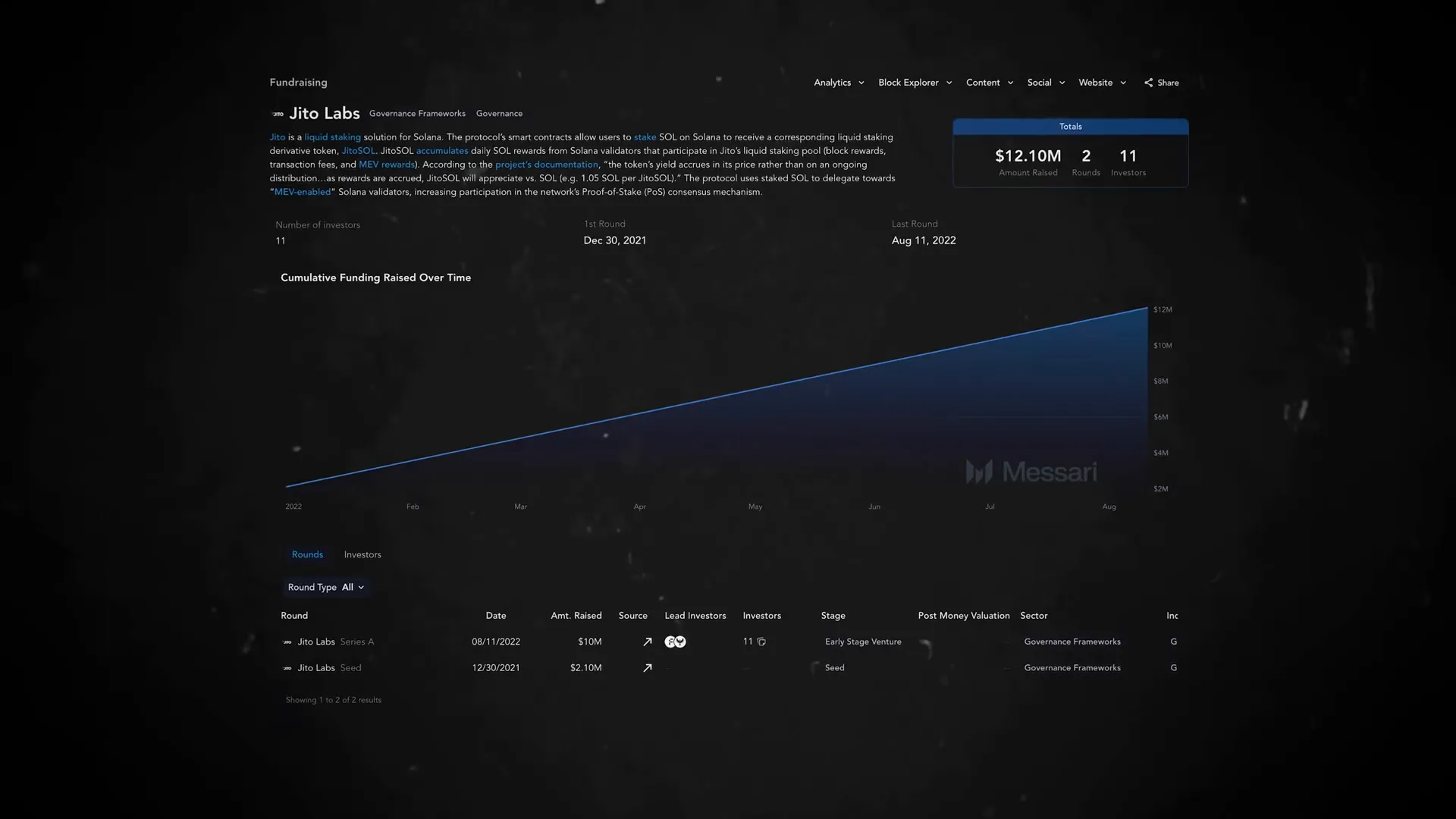

Jito is an emerging DeFi protocol on the Solana blockchain that specializes in efficient staking and MEV (Miner Extractable Value) capturing. Founded in 2022 by Lucas Breude and Dusanja Shouwani, Jito aims to optimize validator rewards and enhance network security.

The Jito platform went live in 2020 and has successfully completed two funding rounds, raising $12.1 million. Notably, in December 2023, the JTOO token launched through one of the most lucrative airdrops of the year, attracting significant attention from the community.

5. Raydium: Solana-Based Automated Market Maker

Raydium is a decentralized exchange and automated market maker built on the Solana blockchain. It leverages Solana’s high throughput and low fees to offer fast and efficient trading experiences. Raydium integrates with Serum, a decentralized order book, to provide deep liquidity and enhanced trading options.

Why These DeFi Projects Matter for Cryptocurrency and Bitcoin Enthusiasts

Each of these DeFi platforms represents a unique sector within the decentralized finance space, from decentralized exchanges and lending protocols to staking and stablecoins. Their innovations contribute to the broader adoption and usability of cryptocurrency and bitcoin, making the ecosystem more accessible and efficient.

With regulatory bodies like the SEC signaling potential easing of restrictions, the momentum behind these projects is likely to accelerate, potentially leading to significant price rallies by 2025.

For investors and enthusiasts, keeping an eye on these DeFi projects could offer valuable opportunities to participate in the next phase of cryptocurrency growth.

Top 5 DeFi Cryptocurrencies That Could Rally in 2025: Insider Picks on Cryptocurrency and Bitcoin. There are any Top 5 DeFi Cryptocurrencies That Could Rally in 2025: Insider Picks on Cryptocurrency and Bitcoin in here.