If you’re intrigued by cryptocurrency, bitcoin, and the evolving financial landscape, this article is for you. Drawing insights from Darius Dale, founder of Forty Two Macro and a top Wall Street macro strategist, we explore why the traditional ways of investing are failing most retail investors and how a revolutionary approach could change everything.

From soaring stock rallies to the rise of gold and bitcoin, Dale’s analysis reveals a looming shift in market dynamics that few are prepared for. Here’s a thoughtful guide to understanding the coming financial storm—and how you can position yourself to thrive.

Table of Contents

- Why Traditional Investing Strategies Are Failing Retail Investors

- The KISS Model: A New Way to Navigate Financial Markets

- Understanding the Market Environment: Goldilocks and Beyond

- The Risks of Being Too Cautious in an Accelerating Growth Environment

- The Paradigm C Thesis: The Rulebook Is Changing

- Embrace Volatility and Institutional Strategies to Protect Your Wealth

- Final Thoughts

Why Traditional Investing Strategies Are Failing Retail Investors

For decades, retail investors have relied on legacy products and strategies—like the classic 60/40 portfolio allocation between stocks and bonds—that promised steady growth and safety. But the reality is stark: these approaches aren’t delivering the results people need for comfortable retirements. Retirement statistics and market surveys paint a grim picture.

Coming from the upper echelons of Wall Street, Darius Dale sees this as a societal problem that demands new solutions. He points to a growing geopolitical and political imbalance in the Treasury market, where external forces are reducing demand and internal political pressures are increasing supply. This imbalance fuels a secular bond bear market, accelerating price decay and pushing yields higher.

The KISS Model: A New Way to Navigate Financial Markets

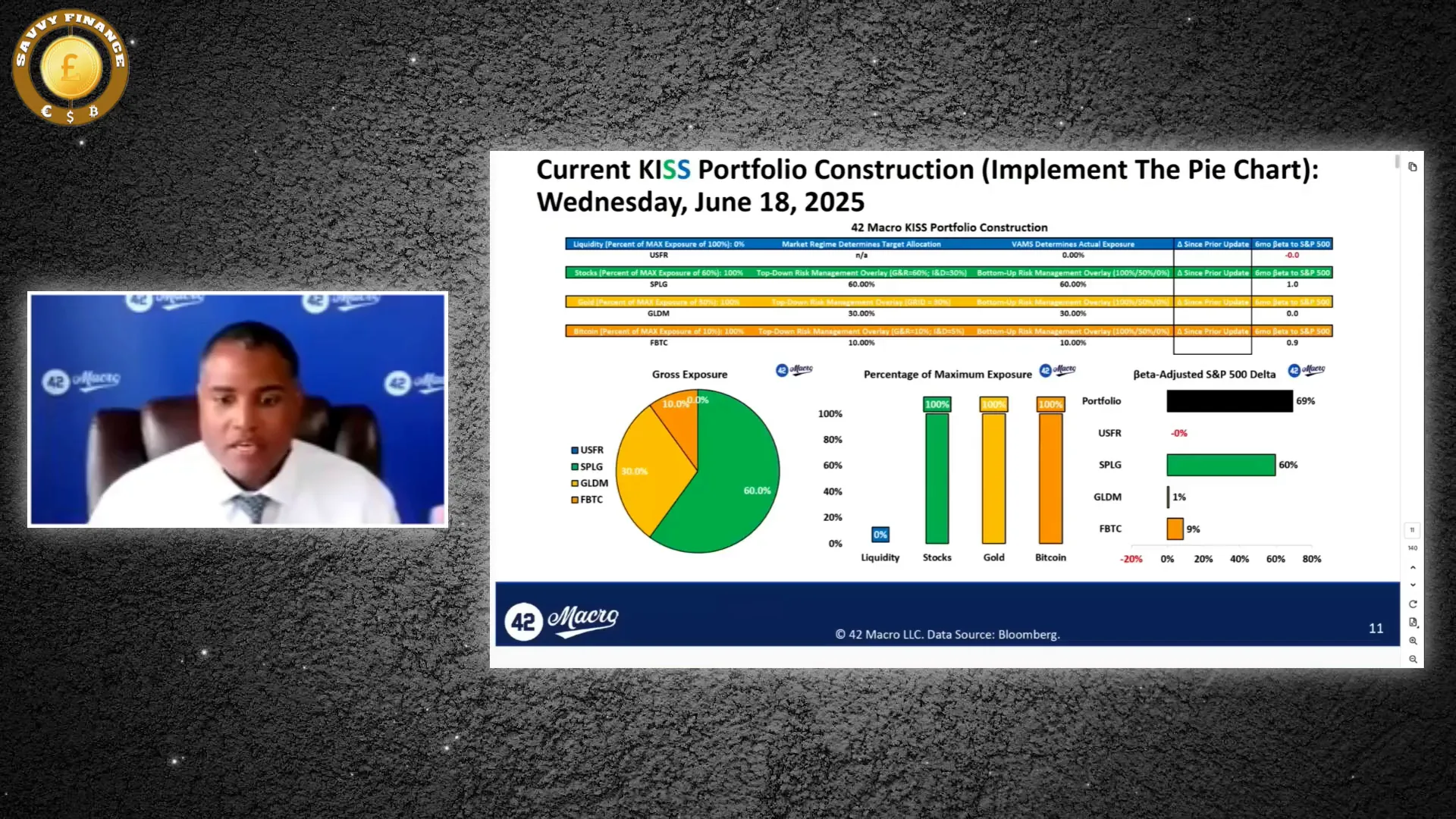

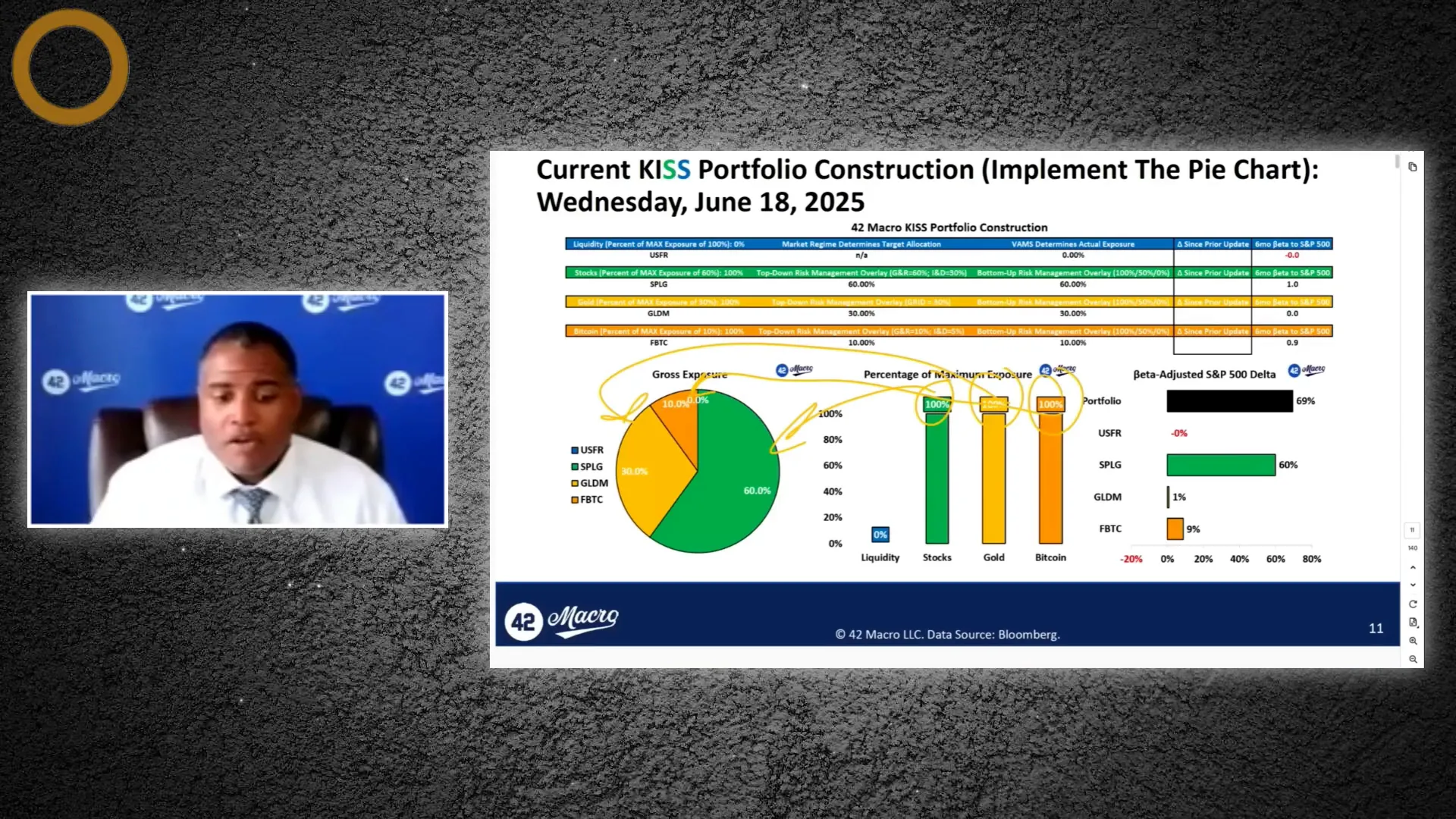

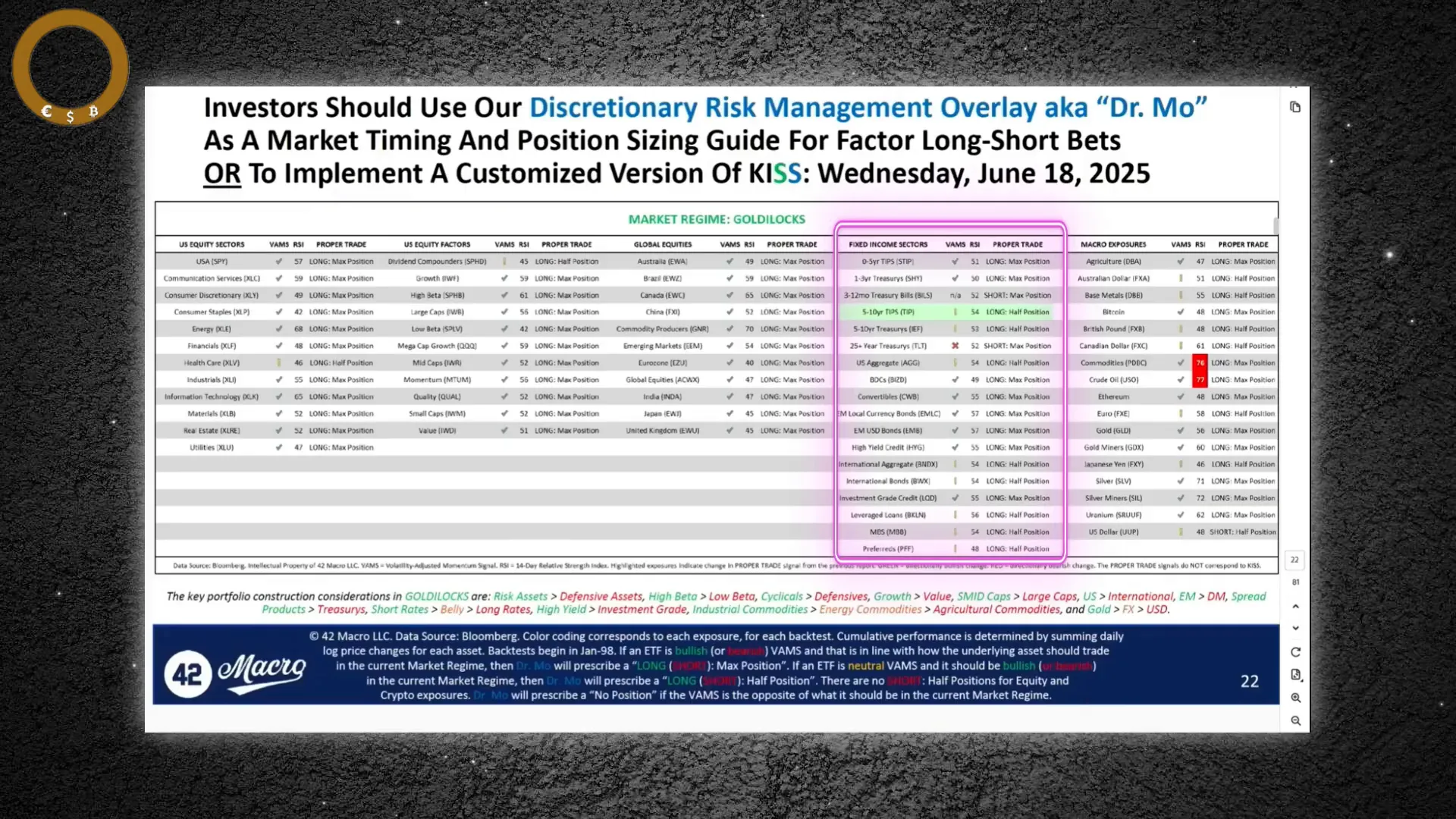

Dale’s groundbreaking model, called KISS (Keep It Simple and Systematic), offers a systematic, risk-managed approach tailored for retail investors. KISS focuses on three core asset classes: stocks, gold, and bitcoin. These are the assets Dale believes will best navigate the complexities of a forward-turning polycrisis—a period marked by overlapping fiscal, monetary, geopolitical, and economic challenges.

KISS uses a market regime nowcasting process, volatility targeting, and dynamic position sizing—techniques used by top hedge funds—to manage portfolio exposure. The model dynamically adjusts risk, aiming to capture most of the upside while limiting downside exposure.

Currently, KISS is fully invested, with 60% exposure to stocks, 30% to gold, and 10% to bitcoin, leaving no cash on the sidelines. Liquidity is managed through floating rate treasuries or equivalent instruments, but the focus remains on the right balance among these three assets.

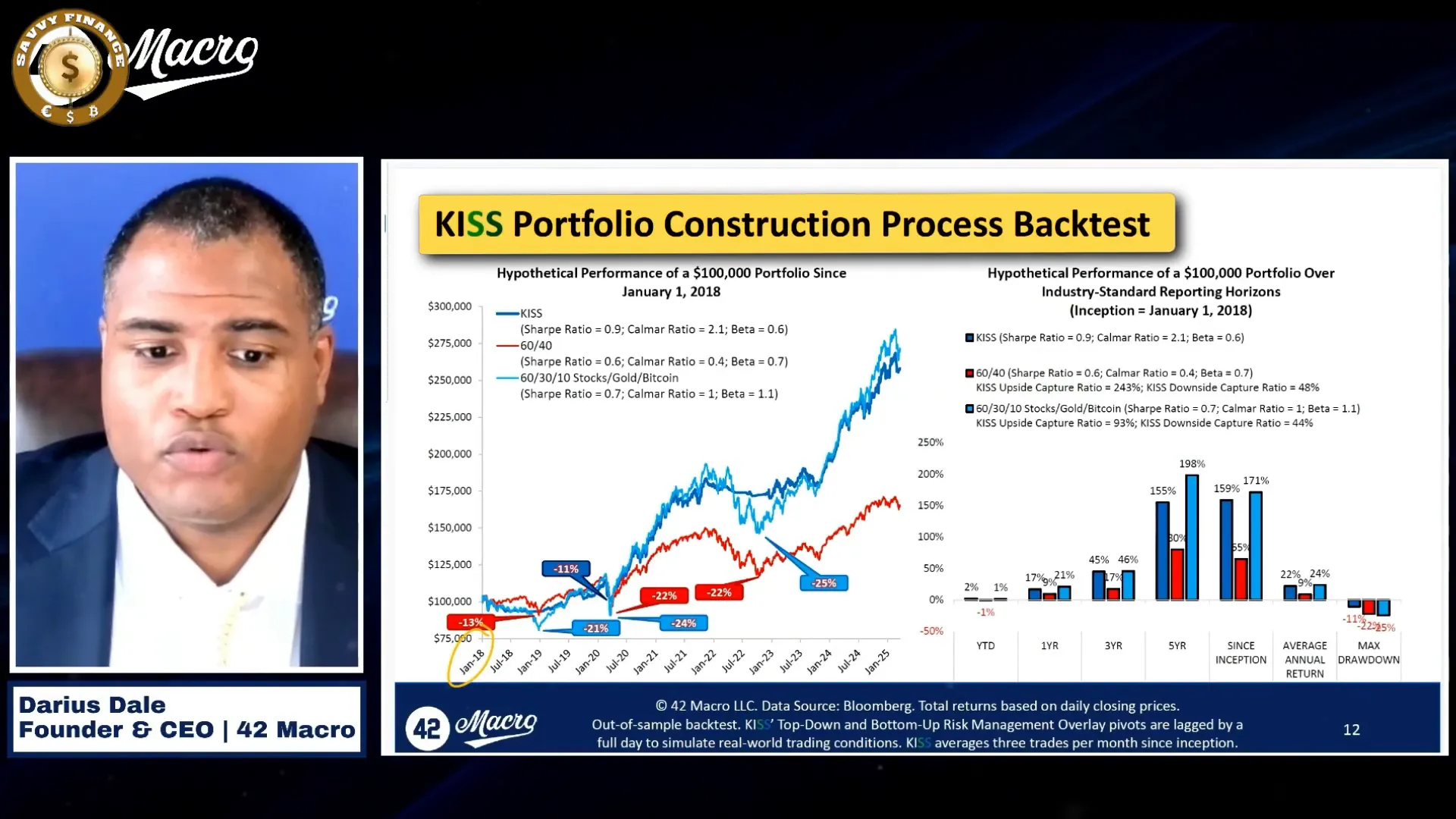

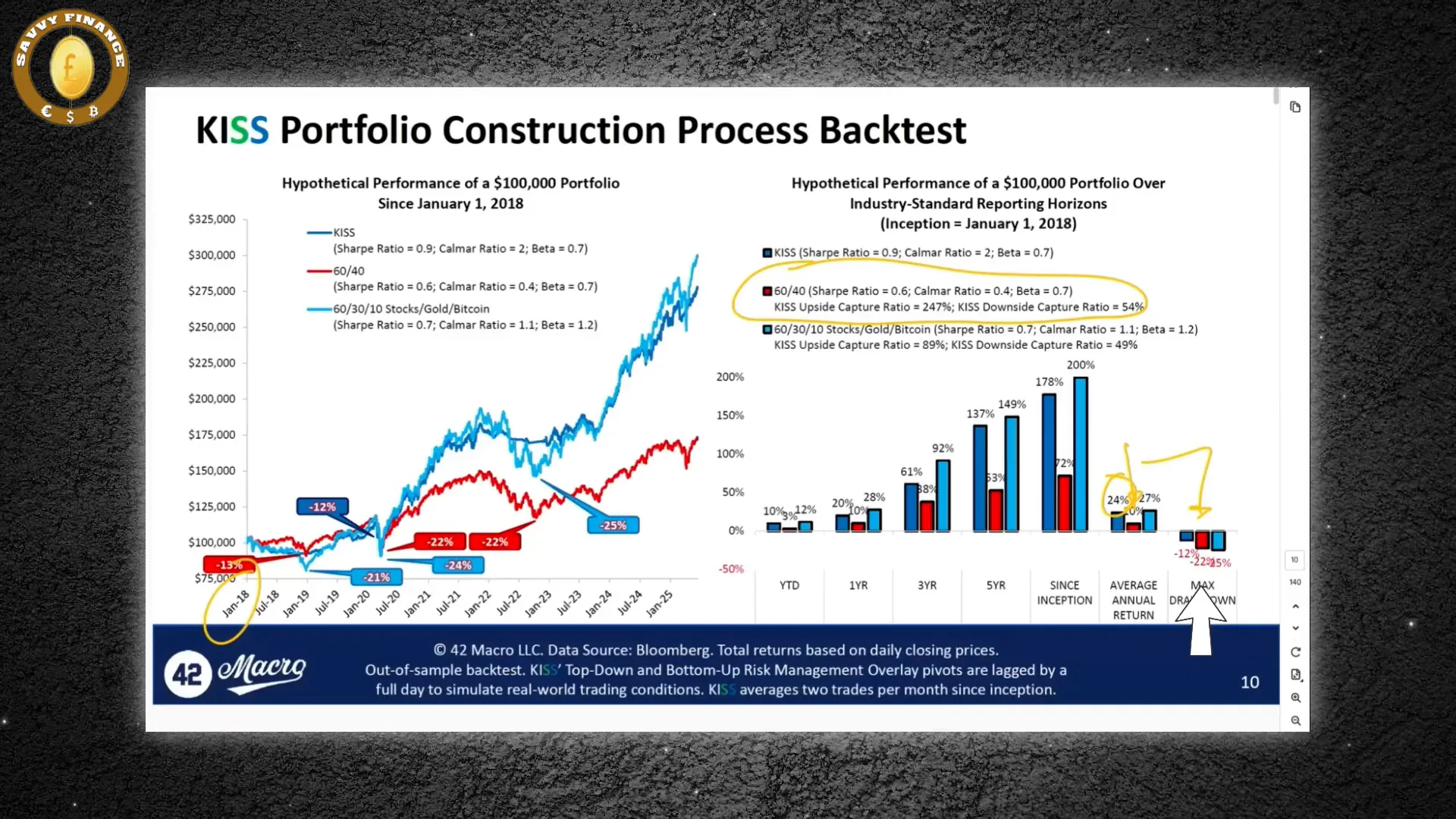

Why KISS Outperforms the 60/40 Portfolio

Dale’s backtesting from 2018 onwards shows KISS delivering an average annual return of around 24%, compared to only 10% for the traditional 60/40 portfolio. Moreover, the maximum drawdown for KISS was about -12%, nearly half of the 60/40 portfolio’s -22%. This means KISS offers roughly 2.5 times the return with only about half the risk.

Unlike the 60/40 approach, which has crashed twice since 2018, KISS suffered only one moderate drawdown. This upside capture ratio of approximately 247% to 250% relative to the 60/40 portfolio makes it a compelling alternative for investors seeking both growth and risk control.

Understanding the Market Environment: Goldilocks and Beyond

According to Dale’s market regime model, we are currently in a “Goldilocks” environment—risk-on with a disinflationary bias. In this regime, investors should embrace credit and illiquidity risks and push portfolios out on the risk spectrum.

However, the market also faces the risk of transitioning to a deflationary phase, which would require a shift to more defensive positioning. This tug-of-war creates asymmetrical volatility, with wild swings reminiscent of the COVID-19 market upheaval and the extended volatility from 2022 to 2025.

Investors must understand the six key cycles driving markets: growth, inflation, monetary policy, fiscal policy, liquidity, and positioning. Positioning acts as an amplifier of inflections in these cycles, making it crucial to monitor and adapt to shifting market regimes.

The Risks of Being Too Cautious in an Accelerating Growth Environment

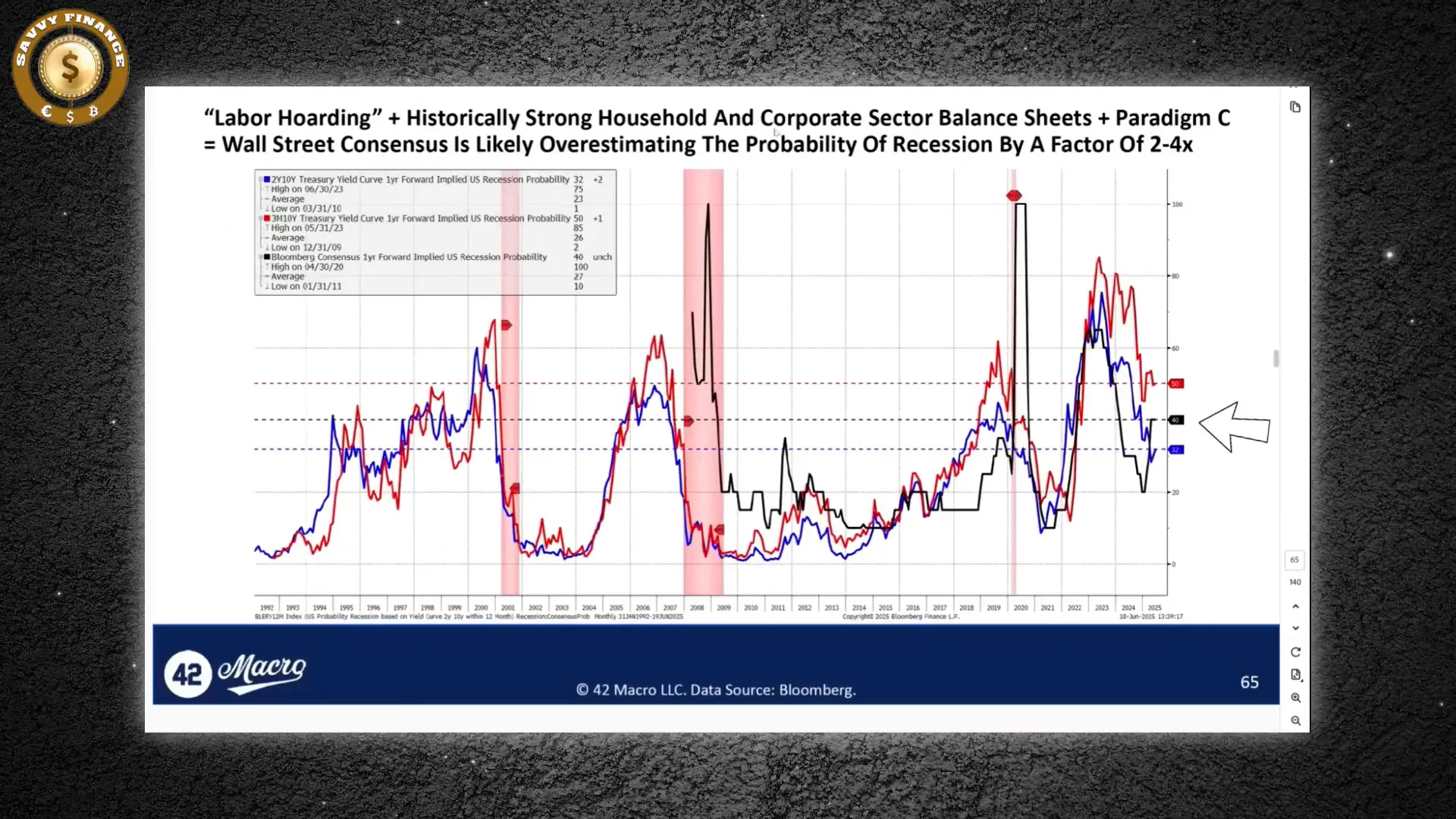

Despite fears of tariffs, geopolitical tensions, and a potential global slowdown, Dale warns that the biggest risk is being overly cautious. Investors have slashed their stock exposure from 85% to just 51% this year, and recession expectations have surged threefold to 40%. Yet, underlying data suggests a different story:

- Private balance sheets remain healthy

- Companies continue to retain workers

- Financial deregulation is set to unlock credit for the first time since 2007

- Upcoming retroactive tax cuts will boost household spending power

This combination could spark a surprise boom, catching many investors off guard while they remain stuck in defensive positions.

The Paradigm C Thesis: The Rulebook Is Changing

Dale’s Paradigm C thesis centers on a fundamental shift in Washington’s priorities—from austerity to aggressive economic growth through increased spending. This shift is poised to ignite three powerful market drivers:

- Federal Reserve Policy Shift: Jerome Powell may soon be replaced, potentially by a Trump appointee who could ease monetary policy, pushing real interest rates below zero and flooding markets with cheap money.

- Financial Deregulation: Loosening of leverage requirements and capital limits will unleash massive lending, triggering a credit boom unseen since before the 2008 financial crisis.

- Massive Fiscal Stimulus: The “One Big Ugly” fiscal bill could inject $400 to $600 billion in stimulus by 2026, with tax cuts favoring corporations and capital, setting the stage for earnings to surge before any economic slowdown.

However, this optimism is tempered by the reality of soaring debt levels, with debt-to-liquidity ratios hitting 124%, far above Europe or Japan. This unsustainable trajectory means the system will eventually face crushing interest costs.

Embrace Volatility and Institutional Strategies to Protect Your Wealth

Dale’s advice is clear and uncompromising:

- Dump old-school portfolios: Traditional 60/40 portfolios will struggle, delivering low returns and steep drawdowns.

- Embrace volatility: Stocks, gold, and bitcoin will experience explosive rallies and sharp crashes—this volatility is the new normal.

- Follow institutional strategies: Models like KISS capture most of the upside while limiting downside risk, providing a lifeline amid market chaos.

Currently, all signals from the KISS model indicate full investment and Goldilocks market conditions. Dale’s final warning is sobering:

“If you're still holding outdated investment strategies hoping to ride this out safely, you'll be wiped out before you realize what hit you. This is not a normal rally. It's a storm disguised as a boom, and those who don't adapt will be roadkill while the rich double their wealth through risk and timing.”

Final Thoughts

The world of cryptocurrency, bitcoin, and broader financial markets is undergoing a seismic transformation. Geopolitical tensions, supply-demand imbalances in bond markets, shifting monetary and fiscal policies, and deregulation are converging to create unprecedented volatility and opportunity.

Darius Dale’s KISS model and Paradigm C thesis offer a roadmap to navigate this complex terrain. By focusing on stocks, gold, and bitcoin, embracing volatility, and adopting institutional-grade risk management, investors can better position themselves to survive—and thrive—in the coming financial storm.

Now is the time to rethink old assumptions, shed outdated strategies, and prepare for a new era where agility and systematic risk management are paramount.

This Is the Last Time You’ll See Bitcoin Under $100K, Ever Again!. There are any This Is the Last Time You’ll See Bitcoin Under $100K, Ever Again! in here.