The crypto market often sends mixed signals, with Bitcoin surging while many altcoins lag behind. But behind the scenes, a recent report reveals a powerful wave of adoption and optimism sweeping through Wall Street and businesses of all sizes. This shift signals that cryptocurrency and bitcoin are becoming central to business strategies and financial operations across the board.

Let’s dive into the key insights from this eye-opening report, highlighting how top companies, small businesses, and institutional investors are embracing crypto and blockchain technologies in 2025.

Table of Contents

- America’s Top Companies Are Deepening Their On-Chain Commitments

- Small and Medium Businesses Are Rapidly Adopting Crypto Solutions

- The Rise of Tokenized Assets and Stablecoins

- Institutional Investors Are Increasing Their Digital Asset Exposure

- Looking Ahead: The Future of Crypto Adoption

America’s Top Companies Are Deepening Their On-Chain Commitments

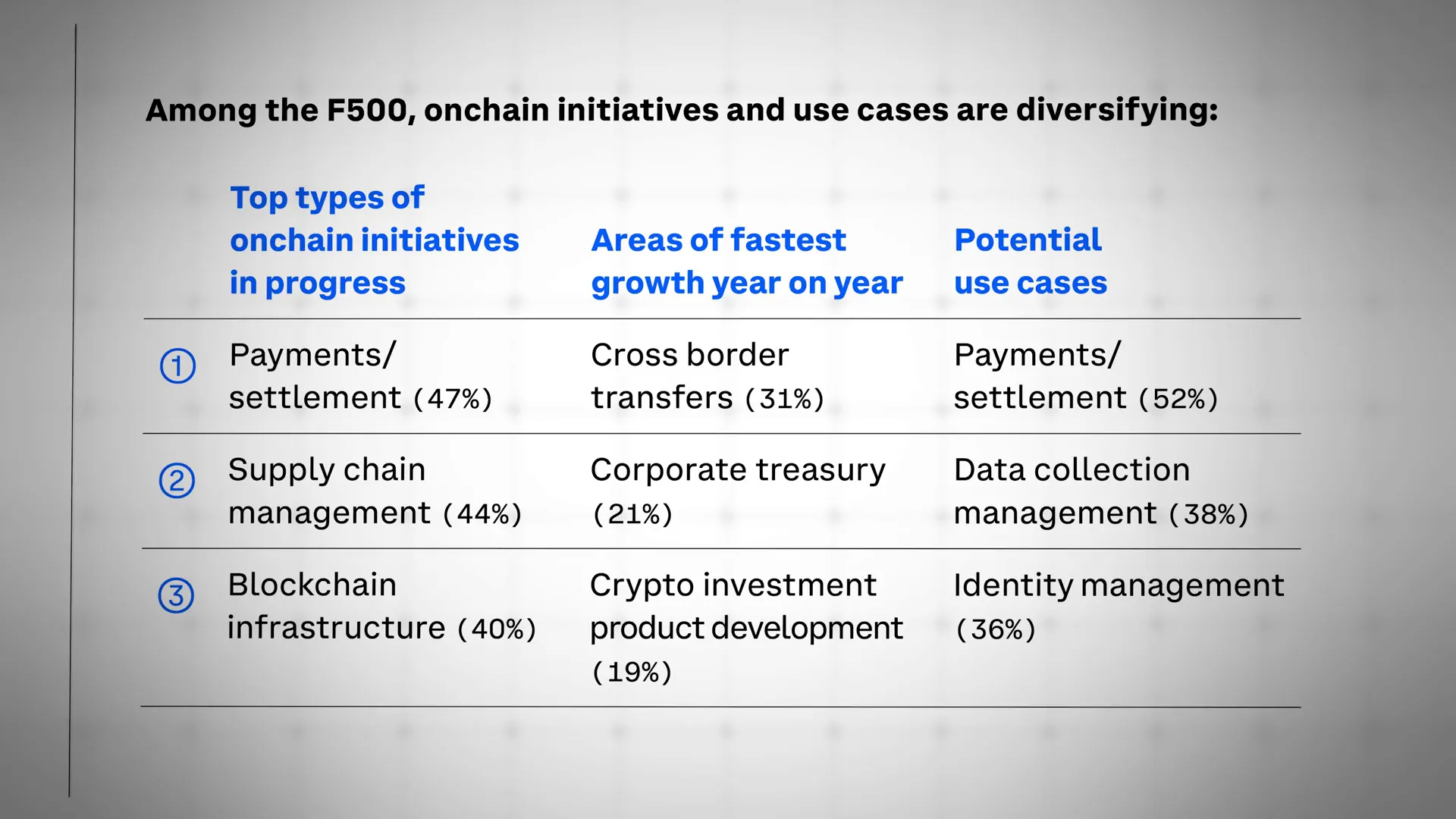

One of the most striking trends is the rapid increase in on-chain projects per company. The average number of blockchain projects per firm has jumped from six to ten, marking a 77% rise. This signals a growing commitment to blockchain initiatives across the corporate world.

Payments and settlements emerge as the most popular on-chain use case, representing 47% of initiatives. These innovations streamline financial operations and reduce friction in business transactions.

The report highlights that in the first quarter of this year, 17 unique on-chain projects were identified among Fortune 100 companies, all part of the broader Fortune 500 list. This marks a significant step as these major players integrate blockchain into their core business models.

Specifically, 18% of executives now consider on-chain initiatives a key part of their overall business strategy—a 47% increase compared to 2020. This shift reflects blockchain’s growing role as a backbone of the U.S. economy.

Small and Medium Businesses Are Rapidly Adopting Crypto Solutions

It’s not just large corporations making moves. Small and medium-sized businesses (SMBs) are quickly integrating crypto to address their top financial pain points.

Currently, 30% of SMBs report using cryptocurrency in their operations. Even more telling, 29% have accepted payments in crypto, almost doubling from 16% last year. This growing acceptance shows a broadening comfort with digital assets as a viable business tool.

Furthermore, nearly 94% of SMBs express interest in using crypto in the future, underlining the potential for continued growth in adoption. The crypto market’s expansion since 2020 has been remarkable, with transaction volumes starting a strong upward trend in September 2020 and doubling since then.

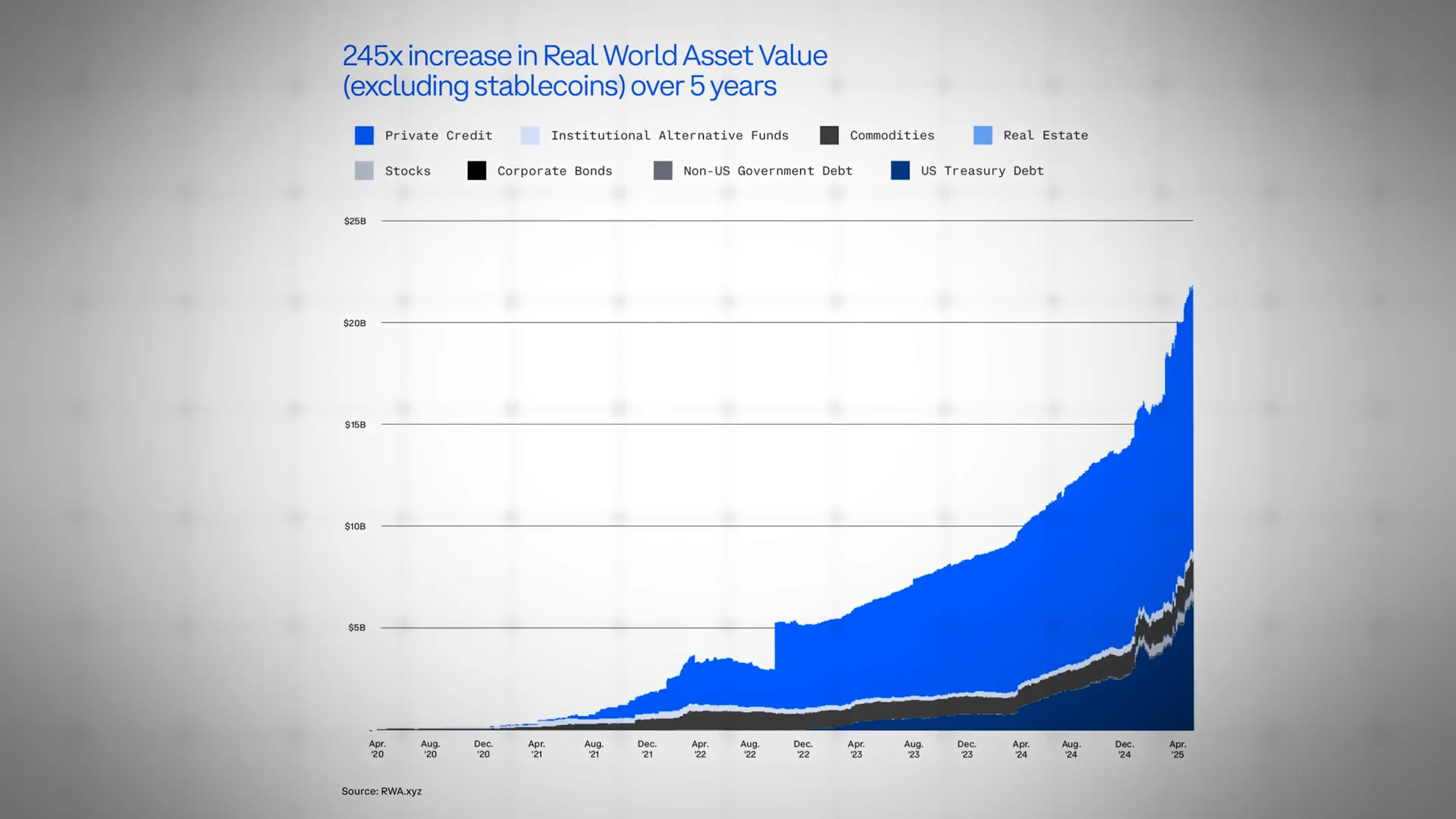

The Rise of Tokenized Assets and Stablecoins

Tokenized assets are carving out a significant niche in the evolving crypto landscape. Tokenized treasuries come in second at 13%, followed by commodities at 7%, and institutional funds at 2%. These tokenized real-world assets (RWAs) represent a growing bridge between traditional finance and blockchain.

Spot Bitcoin ETFs have also exploded in popularity, doubling cumulative inflows on the top ten all-time ETFs within the first year, reaching $50 billion. Retail investors drove 17% of this momentum, with Ethereum ETFs projecting a modest $3.5 billion influence shortly after launch.

This expansion of tokenized assets and ETFs signals a maturing market with increased participation from both retail and institutional investors, especially in Europe and the U.S.

Institutional Investors Are Increasing Their Digital Asset Exposure

The institutional investment landscape is undergoing a seismic shift. A survey conducted in January 2025 with 350 institutional decision-makers revealed that 71% currently have exposure to digital assets or plan to increase it this year.

Moreover, 14% are actively using or planning to use stablecoins, and 17.6% intend to invest in some form of tokenized assets in 2026. This growing enthusiasm from institutions is a powerful endorsement of the long-term viability of cryptocurrency and bitcoin.

As regulatory clarity improves, this momentum is expected to continue accelerating, further integrating crypto into mainstream finance.

Looking Ahead: The Future of Crypto Adoption

The data paints a clear picture: cryptocurrency and bitcoin are no longer fringe technologies but essential components of modern financial strategies. From Fortune 500 giants to SMBs and institutional investors, blockchain and crypto adoption is scaling rapidly.

As payment solutions, tokenized assets, and ETFs continue to gain traction, and as regulatory frameworks evolve, the crypto market is poised for significant growth. For investors and businesses alike, understanding these trends is crucial for navigating the future financial landscape.

Whether you’re a business leader, investor, or crypto enthusiast, this wave of adoption underscores the importance of staying informed and prepared to embrace the digital asset revolution.

They're Going ALL IN on Crypto: What Wall Street Is Buying in Cryptocurrency and Bitcoin. There are any They're Going ALL IN on Crypto: What Wall Street Is Buying in Cryptocurrency and Bitcoin in here.