Cryptocurrency is no longer a fringe topic. The global financial landscape is shifting, and the G20 nations are signaling a major evolution in how digital assets like Bitcoin and XRP fit into the future economy. If you’re a crypto enthusiast or investor, understanding this emerging game theory and the strategic moves by countries such as the UK, Brazil, and the US is crucial to staying ahead.

In this article, we’ll break down the latest developments confirmed by G20 decision-makers, the growing acceptance of Bitcoin, the explosive potential of stablecoins, and Cardano’s upcoming Leos upgrade that could change the altcoin game. Let’s dive in.

Table of Contents

- The Game Theory Behind G20 Nations Embracing Bitcoin

- Brazil and the US: Speeding Up the Cryptocurrency Rush

- Cardano’s Leos Upgrade: The Next Big Leap for Altcoins

- Why This Matters for Cryptocurrency Investors

- Final Thoughts

The Game Theory Behind G20 Nations Embracing Bitcoin

Here’s the core idea: once one G20 nation publicly starts buying Bitcoin, it triggers a strategic domino effect. Other nations feel compelled to follow suit due to the intertwined nature of global finance and competitive positioning. This phenomenon is the essence of game theory in international economics.

Unfortunately, many governments have been too cautious—“timorous,” as some describe it—about embracing Bitcoin. The Bank of England, for example, has historically been hesitant to fully engage with the cryptocurrency space. But that’s starting to change.

Andrew Griffith, a British Conservative Party politician, recently expressed his enthusiasm for Bitcoin, calling it a “big opportunity for the UK.” He pointed out that while credit cards were invented in the US, the UK’s rapid adoption helped it become a fintech hub. Griffith sees Bitcoin as a similar chance for the UK to lead in innovation rather than lag behind.

He also emphasized a crucial mindset: if disruption is inevitable, governments should disrupt themselves rather than be disrupted by others. This approach can unlock new use cases for Bitcoin and distributed ledger technology that don’t necessarily threaten central banks but can act as a check on excessive state power.

This shift in attitude is prompting US firms like Coinbase and 16Zed, which had once moved to the UK, to reconsider their positions as the US government adopts a more innovation-friendly stance. The message is clear—Bitcoin’s fundamentals and network growth have made its value undeniable, forcing even skeptics in the “friend group” to acknowledge its legitimacy.

Brazil and the US: Speeding Up the Cryptocurrency Rush

Brazil, another G20 member, is also stepping up. Former officials from the Central Bank of Brazil have publicly recognized Bitcoin’s importance, showing that this isn’t random but part of a coordinated global movement.

Meanwhile, the United States Treasury Secretary recently predicted that stablecoins—a type of cryptocurrency pegged to stable assets like the US dollar—could grow 15 times their current size by the end of this decade. This prediction is supported by the passage of the Genius Act, a stablecoin regulatory framework designed to foster innovation while ensuring security.

Stablecoins are particularly interesting because they create new demand for US Treasuries. The private sector’s appetite for stablecoins means more backing by government debt instruments, which could lower borrowing costs and help manage national debt. This creates a win-win scenario: governments benefit from reduced costs, and millions of new users worldwide gain access to dollar-based digital assets.

Cryptocurrency holders who favor Ethereum, Solana, Tron, and XRP should pay attention here—these protocols currently dominate the stablecoin market share, making them key players in the ecosystem’s growth.

Cardano’s Leos Upgrade: The Next Big Leap for Altcoins

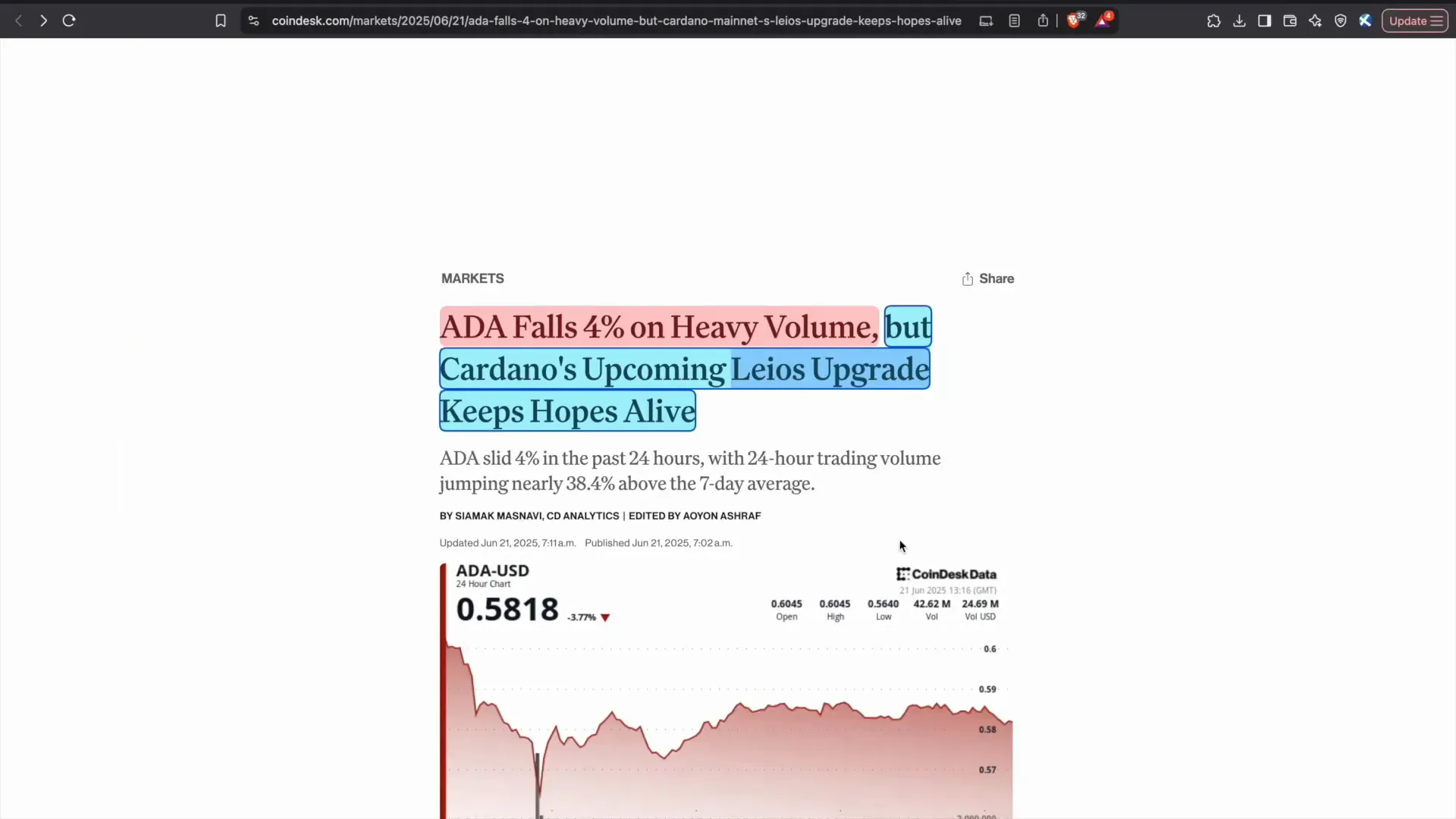

While Bitcoin and stablecoins dominate headlines, Cardano’s upcoming Leos upgrade is a game-changer for the altcoin community. Despite a recent 4% dip in ADA’s price, the trading volume surged 38% above the seven-day average, signaling strong market activity and buyer confidence ahead of the upgrade.

Leos has been six years in the making, with a goal to deliver high-performance transaction processing while maintaining decentralization—a rare combination in blockchain technology.

The upgrade is designed to optimize transaction throughput, especially during peak activity, by introducing new mechanisms like endorsements to enhance security and data availability. Cardano aims to achieve 1,000 to 2,000 transactions per second (TPS) out of the box, with simulations pushing that number to 10,000 TPS if trade-offs are accepted.

This performance leap, paired with decentralization, positions Cardano uniquely among blockchain platforms. The Leos upgrade is expected to roll out in early 2026, sparking anticipation among ADA holders and the broader crypto community.

Why This Matters for Cryptocurrency Investors

- G20’s Bitcoin Adoption: The strategic adoption by G20 nations signals a long-term commitment to integrating Bitcoin into national economies, making it a foundational asset for global finance.

- Stablecoin Growth: The expected 15x growth of stablecoins backed by US Treasuries creates a new financial ecosystem that benefits governments and users alike.

- Altcoin Innovation: Upgrades like Cardano’s Leos show that blockchain technology continues to evolve, with altcoins improving scalability and decentralization.

For anyone holding or considering investing in cryptocurrency, staying informed about these developments is essential. The landscape is evolving rapidly, and those who understand the game theory and policy shifts will be better positioned to capitalize on the opportunities ahead.

Final Thoughts

We are witnessing a pivotal moment in the history of cryptocurrency. The G20’s growing embrace of Bitcoin and crypto assets reflects a broader acceptance that these technologies are here to stay. Stablecoins are poised to reshape the financial system, and blockchain platforms like Cardano are pushing the boundaries of what’s possible.

As always, the best approach is to stay informed, understand the underlying fundamentals, and be ready to adapt as the crypto ecosystem continues to grow and mature.

If you want to stay ahead in this exciting space, keep an eye on these developments—they will shape the future of cryptocurrency investment and usage worldwide.

The G20 Just Confirmed The Plan: What Bitcoin & XRP Holders Must Know About the Future of Cryptocurrency. There are any The G20 Just Confirmed The Plan: What Bitcoin & XRP Holders Must Know About the Future of Cryptocurrency in here.