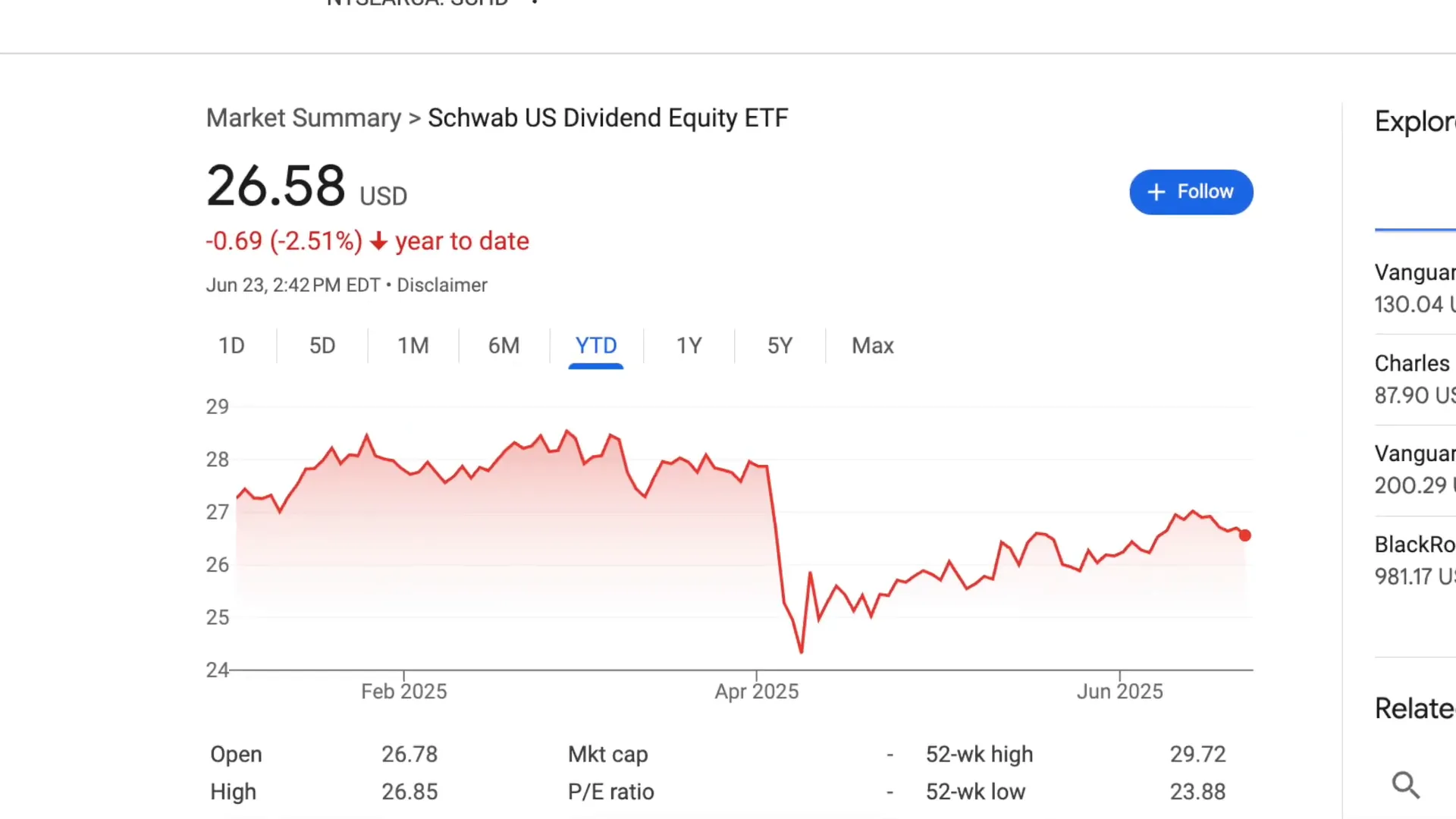

If you’re invested in dividend-focused ETFs like SCHD or considering it for your portfolio, this article is a must-read for you. I hold about one-third of my portfolio in SCHD myself, so I completely understand the concerns many investors have right now. Over the past two years, SCHD has experienced a sluggish stretch, and so far this year, it’s actually underperforming compared to major indexes like the S&P 500 and Nasdaq 100.

In this comprehensive breakdown, I’ll walk you through exactly why SCHD is down right now, what the numbers really say beyond just price returns, and whether it still deserves a place in your long-term portfolio. I’ll also share some alternative investment options to consider for 2025, helping you build a portfolio that suits your unique goals and risk tolerance.

Let’s dive deep into the current state of SCHD, backed by data and clear explanations, while weaving in insights on Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing trends that influence today’s markets.

Why is SCHD Down? Three Key Reasons Explained

SCHD’s recent underperformance can be attributed to three main factors that every investor needs to understand before making any decisions:

1. The Annual Reconstitution Was Poorly Timed

Each year, SCHD undergoes a rebalancing process, known as annual reconstitution, where the fund sells some stocks and adds others to maintain its investment strategy. This year, the rebalancing occurred on March 21, 2025, during a turbulent period marked by tariff uncertainties and heightened market volatility. This timing was unfortunate.

During this period, SCHD had to sell out of some defensive names and add new holdings that didn’t immediately hold their value. As a result, in the first quarter alone, SCHD fell by 1.16%, while the S&P 500 managed a modest gain of 0.36%. The weakness primarily stemmed from utilities and consumer staples sectors, which are major components of SCHD's defensive tilt.

This defensive tilt, usually a strength in volatile markets, backfired temporarily because the new additions failed to provide the expected stability right away.

2. Increased Exposure to the Volatile Energy Sector

The March rebalancing nearly doubled SCHD’s energy sector exposure from roughly 12% to 21%. While energy stocks can boost returns during commodity price rallies, they also introduce significant volatility because they are cyclical and sensitive to commodity price swings, especially oil.

Earlier this year, energy stocks outperformed, but recent sharp fluctuations, including oil price dips, have weighed heavily on SCHD’s overall performance. This shift away from purely defensive names to more commodity-sensitive stocks has increased the fund's risk profile.

3. Rising Treasury Bill and Bond Yields Shift Investor Preference

This is perhaps the most important factor to understand: the relationship between SCHD and risk-free yields like short-term Treasury bills and bonds.

As yields on short-term treasury bills, money market instruments, and high-yield savings accounts have risen to around 4-5%, investors have started favoring these safer alternatives over dividend ETFs like SCHD. Why? Because these instruments offer comparable or even higher yields with virtually no market risk.

If your primary goal is safety and stable cash flow, it makes sense to choose bonds or T-bills that aren’t subject to stock market fluctuations. This dynamic has diverted investor money away from SCHD, which inherently carries more risk due to its equity exposure.

Many wealthy clients and large institutions prioritize wealth preservation over maximizing growth at this stage. They prefer the “safe 4-5%” yield from cash-like instruments rather than the uncertain dividends and price fluctuations of stock ETFs.

However, when the Fed eventually lowers interest rates, those yields will drop, making SCHD and similar dividend ETFs more attractive again, as their roughly 4% dividend yield becomes a better risk-reward tradeoff compared to low bond yields.

Is SCHD Still a Smart Long-Term Investment?

Understanding the current challenges is vital, but the bigger question is whether SCHD remains a worthwhile holding for the long haul. Let’s break down what SCHD actually is and what it offers investors.

SCHD’s Defensive, Value-Oriented Nature

SCHD is built around defensive, “boring” stocks that tend to be more stable than high-growth tech or cyclical stocks. It’s a value fund with a lower beta than the S&P 500, meaning it generally experiences less volatility during market swings.

This defensive profile makes SCHD a popular choice for investors seeking steady dividend income and a buffer against market downturns.

Dividend Yield and Tax Advantages

SCHD typically pays out a dividend yield between 3.5% and 4%. These dividends are qualified, which means they are taxed at the more favorable long-term capital gains tax rate rather than as ordinary income. This tax efficiency is an attractive feature for taxable accounts.

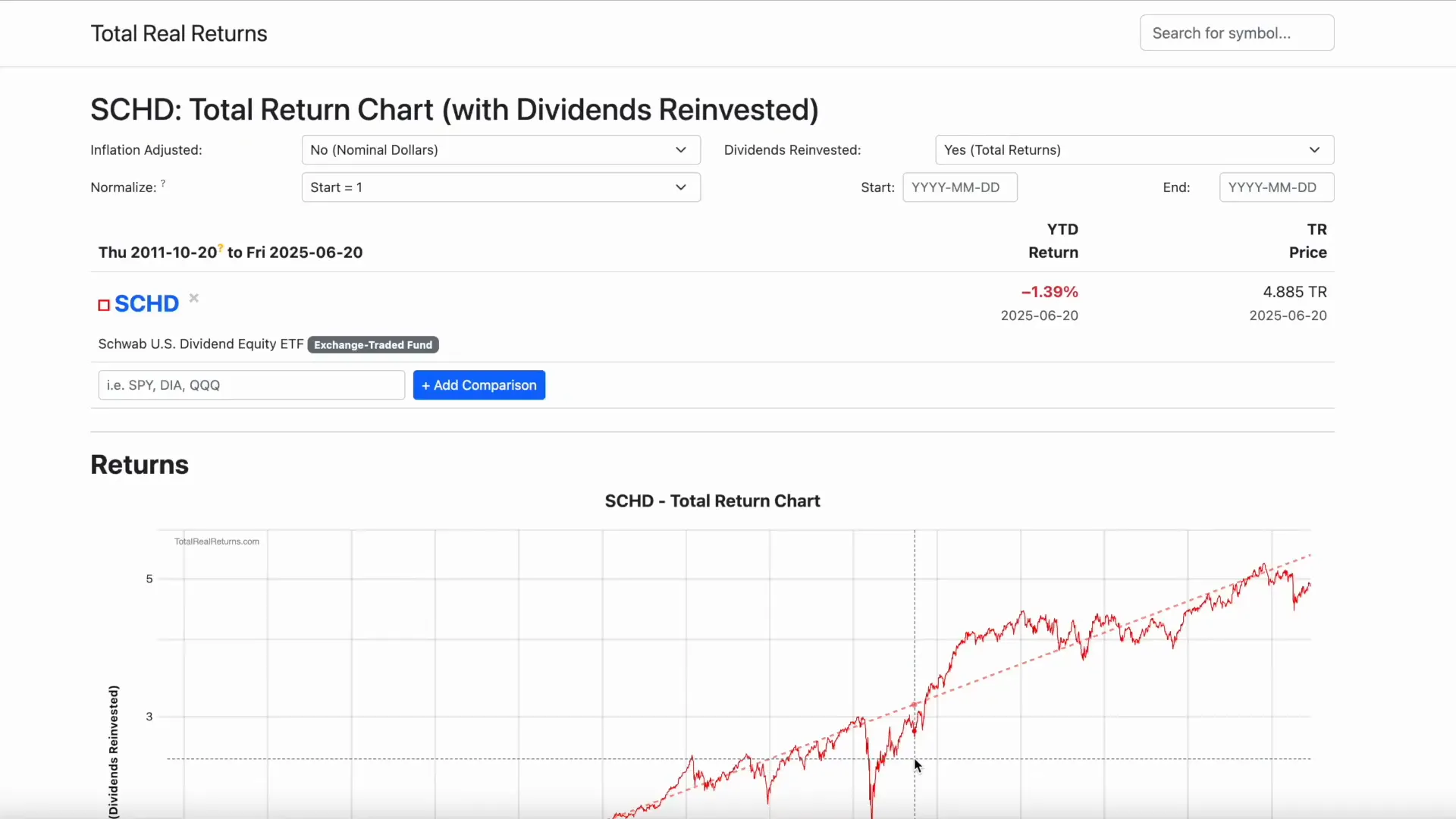

Dividend Growth and Total Returns

Besides the yield, SCHD has a solid dividend growth rate. While it’s not designed to be a high-growth ETF, it offers respectable long-term total returns that combine dividend income with moderate capital appreciation.

Many investors misunderstand total return. Price appreciation alone tells only half the story. For example, if SCHD’s price rises 5% in a year and it pays a 4% dividend yield, your total return is actually 9%. Most investors reinvest dividends, compounding their gains over time.

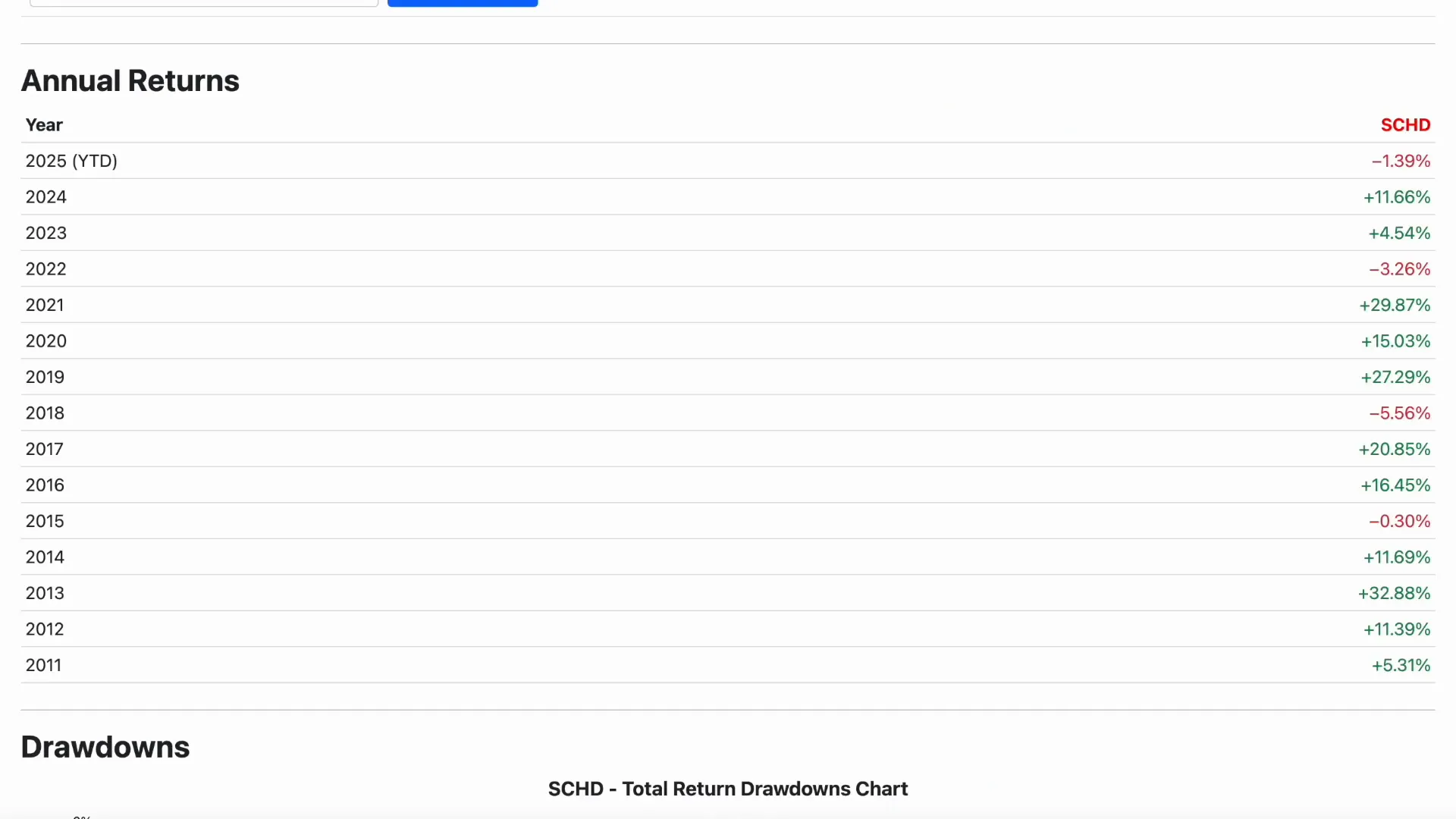

What the Numbers Say: SCHD’s Historical Performance

Looking at the data from 2011 through June 2025, SCHD has delivered impressive total returns.

- Total return since inception: approximately 388%

- Average annual return: about 12.4%

- Only four years with negative annual returns

Even during tough years, SCHD has outperformed many benchmarks. For instance, in 2022, when the S&P 500 dropped roughly 18%, SCHD declined only about 3%. This highlights its defensive qualities.

The worst annual drop SCHD has experienced was about 5.5%, which is relatively mild compared to broader market corrections.

This track record shows that SCHD is a solid, steady performer over the long term, especially for investors who value stability and dividends.

Addressing Common Criticisms of SCHD

Some investors complain that SCHD “doesn’t move” or call it a “dog” because it hasn’t surged dramatically in recent years. However, this criticism often comes from comparing it unfairly to high-growth ETFs or expecting quick gains in short-term windows.

Remember, SCHD is not a growth fund. It’s designed to provide consistent income and less volatility, which means it won’t typically experience the same explosive rallies as tech-heavy or growth-focused funds.

Patience is key with SCHD. The long-term data clearly supports its value as a defensive holding that cushions portfolios during market turbulence.

How to Think About SCHD in Your Portfolio

Ultimately, whether SCHD is right for you depends on your personal investment goals, risk tolerance, and time horizon.

Questions to Ask Yourself

- Do you prioritize steady cash flow or rapid price appreciation?

- Is this investment for a retirement account or a brokerage account?

- How important are tax considerations to you?

- What is your risk profile—are you comfortable with some volatility, or do you prefer safety?

- Is your investment horizon long-term or short-term?

If you need your money in the short term or want quick growth, SCHD might not be the best fit. But for long-term investors who want a core defensive holding with a reliable dividend, SCHD has proven itself over time.

Alternatives to SCHD for 2025 and Beyond

If SCHD’s dividend yield or growth profile doesn’t quite match your needs, here are some alternatives to consider:

1. Covered Call ETFs for Higher Dividends

If you want bigger dividends, covered call ETFs can be an option. Some of the most trusted names include:

- SPYI

- JEPI

- QQQI

- JEPQ

These funds write covered call options to generate additional income, resulting in higher yields. However, be cautious of yield traps—some funds promise high yields but carry hidden risks. Stick to well-established ETFs with proven track records.

2. Ultra-Safe Cash Alternatives

If absolute safety is your priority, consider high-yield savings accounts, money market accounts, or short-term Treasury bills. These instruments currently offer around 4-5% yields with virtually no market risk.

This is a particularly appealing option while interest rates remain elevated. Just keep in mind yields will fall when the Fed cuts rates, at which point dividend ETFs like SCHD will become more attractive again.

3. Growth-Focused ETFs for Price Appreciation

If growth is your priority, consider market-weighted or sector-specific growth ETFs such as:

- VOO (S&P 500 ETF)

- QQQM (Nasdaq 100 ETF)

- VUG (Growth ETF)

- SCHG (Large-cap Growth ETF)

- VGT (Technology Sector ETF)

- SMH (Semiconductor ETF)

These ETFs offer higher growth potential but come with increased volatility. Be cautious about going 100% growth, as market cycles can be unpredictable. Diversify and balance growth with defensive holdings for a more resilient portfolio.

Building Your Ideal Portfolio

My personal approach—and the one I recommend to many clients—is to build a three-fund portfolio customized to your risk tolerance and time horizon. This simple yet powerful strategy balances growth, income, and safety.

By combining a core growth ETF, a dividend ETF like SCHD, and a safe bond or cash alternative, you can create a portfolio that’s designed to weather market ups and downs while steadily growing your wealth.

If you want a detailed guide on how to build this portfolio, there are many resources available that walk you through the process step-by-step. This approach keeps investing simplified and focused on your personal goals.

Final Thoughts on SCHD and Your Investing Journey

SCHD is not perfect and won’t always be the star performer, especially during certain market cycles or when safe yields elsewhere rise sharply. However, its long-term track record, dividend stability, and defensive nature make it a valuable core holding for many investors.

Whether you continue to hold SCHD, pivot to covered call ETFs, lean into safer cash alternatives, or seek growth ETFs depends on your unique financial goals, risk tolerance, and investment timeline.

Remember, investing is a personal journey, and there’s no one-size-fits-all solution. Stay informed, be patient, and build a portfolio that helps you confidently pursue financial freedom.

For more insights on investing and portfolio strategies, keep exploring trusted sources and stay connected with the latest in Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing trends.

SCHD is Killing Me.. Is It Time to Pull the Plug? | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing Insights. There are any SCHD is Killing Me.. Is It Time to Pull the Plug? | Bitcoin, Crypto, BTC, Blockchain, CryptoNews, Investing Insights in here.