It’s an exhilarating moment in the world of cryptocurrency and bitcoin. The landscape is shifting dramatically, and if you’re not paying attention now, you might miss out on one of the last opportunities to enter the market at these price levels. The buzz isn’t just hype—it’s a strategic insight into what’s happening behind the scenes, driven by Wall Street institutions and nation states. The retail crowd hasn’t even fully arrived yet.

Table of Contents

- The Last Chance Zone: Why Now Matters More Than Ever

- Federal Reserve and Rate Cuts: The Bullish Catalyst for Altcoins

- Spotlight on DeLorean Labs: A Major Player in the Sui Ecosystem

- Jerome Powell’s New Stance on Crypto: Depoliticizing Bank Exams

- Big Players Embrace Crypto: Visa and Robinhood Weigh In

- The Evolution of Finance Powered by Crypto Technology

- Stay Engaged, Stay Informed, and Position Yourself for Success

- Final Thoughts

The Last Chance Zone: Why Now Matters More Than Ever

We’ve said it before at price points like $40K, $50K, $60K, and $70K—these levels don’t come around again easily. The same applies now. Whether it’s today, next week, or a couple of months from now, we are in what I call the “last chance” period for these prices. It’s crucial to pick your spots because the next surge could be monumental.

Most people underestimate what could unfold over the next six months to two years. The indicators are overwhelmingly bullish: Bitcoin is showing incredible strength, and U.S. markets are following suit. This combination sets the stage for a crypto market ready to explode.

Federal Reserve and Rate Cuts: The Bullish Catalyst for Altcoins

The Federal Reserve, led by Jerome Powell, is under significant pressure. While similar economic metrics previously led to rate cuts at the end of 2024, Powell has stated multiple times that the only thing holding the Fed back now is the uncertainty caused by tariffs and their inflationary impacts.

One thing is clear: rate cuts are coming, and likely multiple times this year. This is fantastic news for altcoins, which tend to thrive in lower interest rate environments. Ethereum and Solana are obvious picks, but there’s more to consider. Personally, I’m betting on exchange tokens next. If you have altcoins you’re excited about, now is the time to share and explore them.

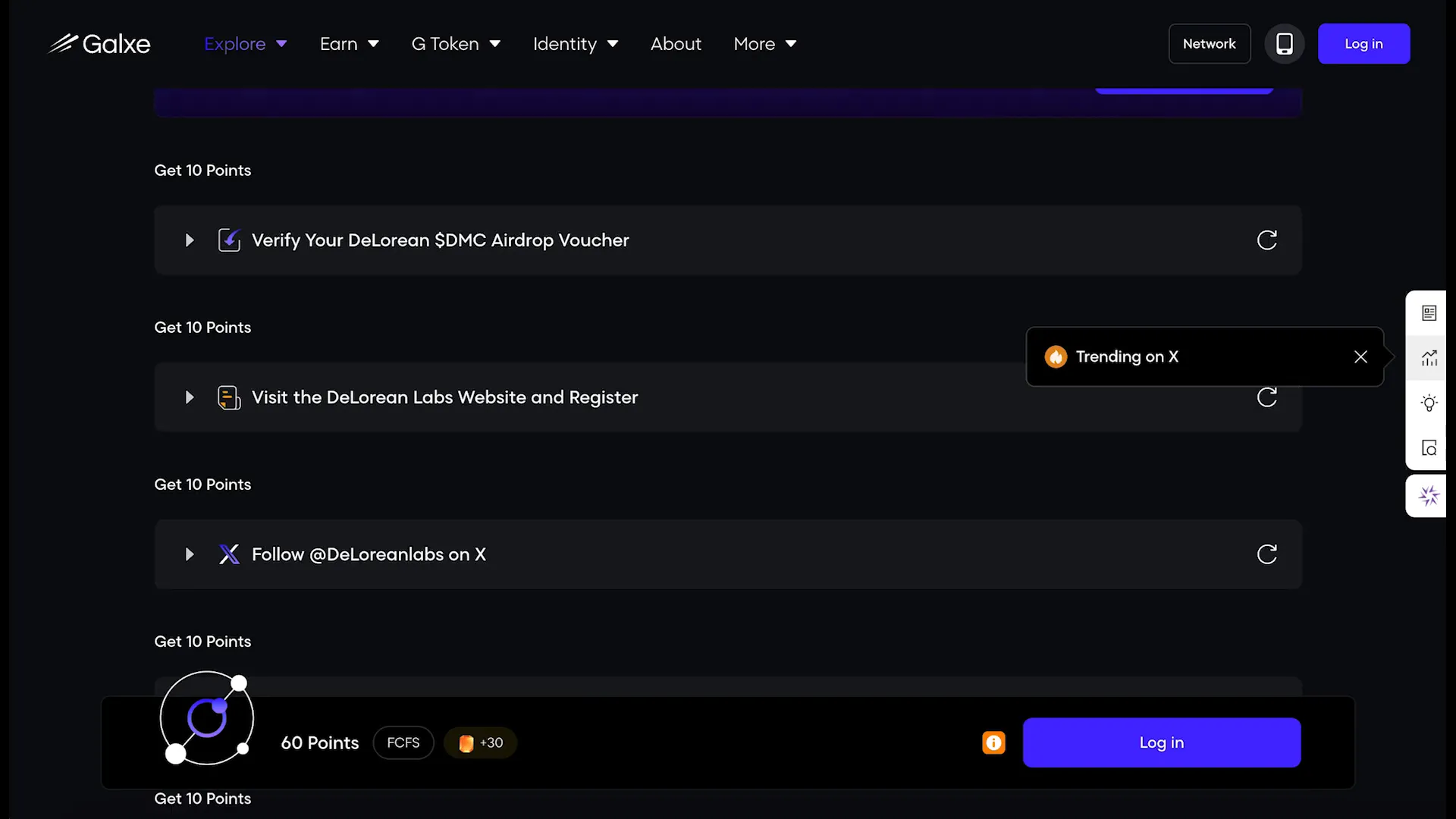

Spotlight on DeLorean Labs: A Major Player in the Sui Ecosystem

Before diving deeper, let’s take a moment to recognize a standout project: DeLorean and DeLorean Labs. Their token, DMC, just had a successful Token Generation Event (TGE) and is now available on nearly every major exchange.

What makes DeLorean unique is their status as the first major car brand to launch a native token—marking a significant milestone bridging traditional industries and Web3. They’ve even sold out limited edition electric DeLorean cars slated for release in a few years. Beyond token trading, DeLorean Labs is running a large airdrop, allowing you to get involved in multiple ways. Definitely worth a follow and further investigation.

Jerome Powell’s New Stance on Crypto: Depoliticizing Bank Exams

For the first time, the Fed Chair Jerome Powell is openly engaging with questions about Bitcoin and crypto, signaling a shift in attitude. Recently, the Fed announced that “reputational risk” will no longer be a factor in bank exams—a measure often used as a catchall for political bias.

“I think it’s positive to depoliticize bank exams and instead focus on core and measurable risks.”

This shift is significant because it addresses the debanking concerns many crypto companies have faced. Powell admitted that the Fed only recently realized this was a serious problem and is taking steps to fix it. This move, along with similar actions from other agencies, clears the way for banks to engage with the crypto space more freely.

Powell emphasized that banks get to decide who their customers are, including crypto companies, as long as they operate safely and soundly. This evolving tone reflects the growing acceptance of digital assets within traditional financial systems.

Big Players Embrace Crypto: Visa and Robinhood Weigh In

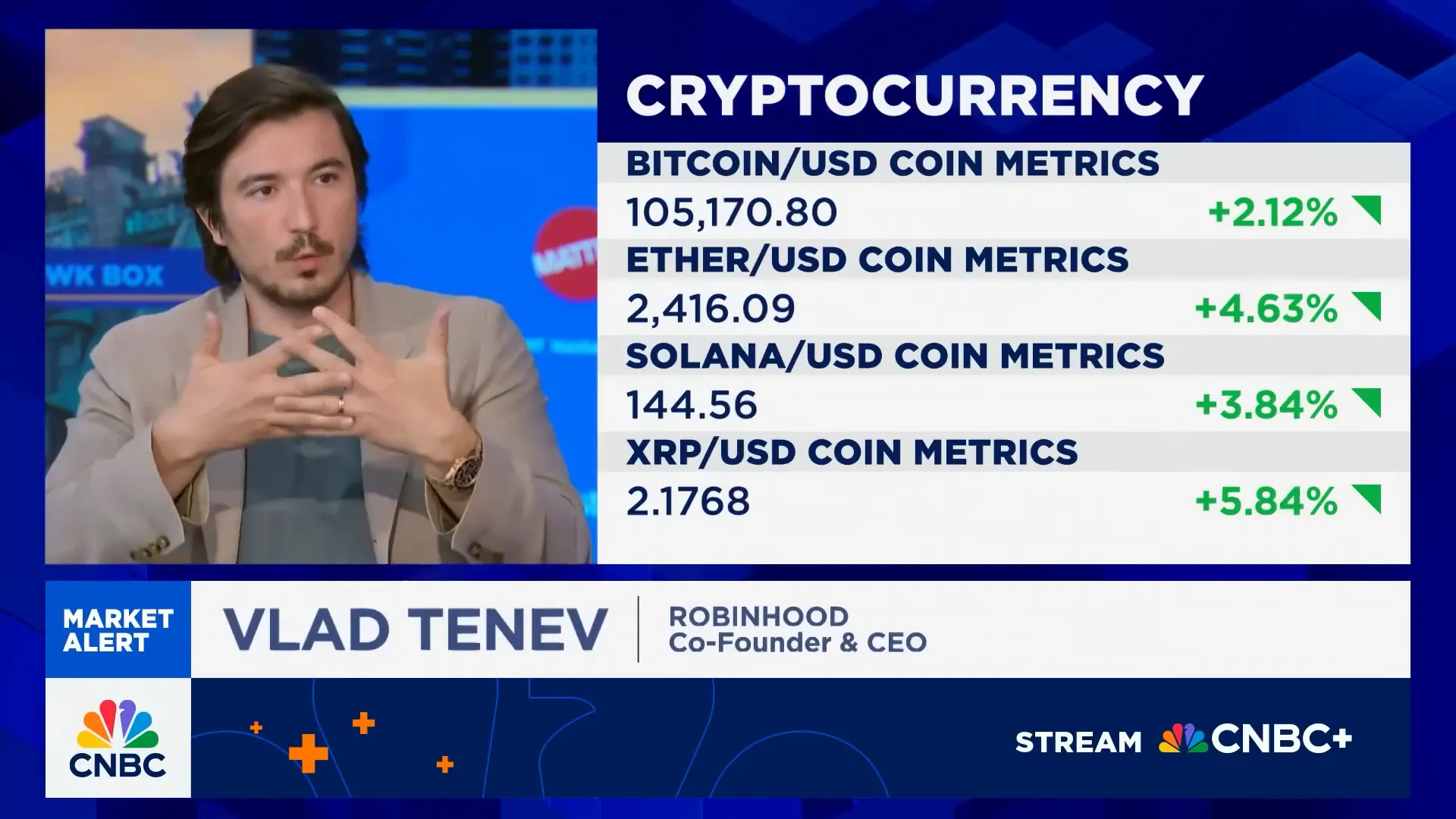

The crypto industry is no longer fighting enemies—it’s gaining allies. Visa’s CEO publicly declared bullishness on crypto and stablecoins, highlighting years of preparation to integrate these technologies. Visa is actively enabling the issuance of credentials on stablecoins and modernizing its settlement infrastructure accordingly.

The recent passage of the Genius Act in the Senate, expected to pass the House soon, will provide much-needed regulatory clarity for stablecoins. This is a huge step toward mainstream adoption and global dollarization through digital currencies.

Meanwhile, the Robinhood CEO views the upcoming Crypto Market Structure Bill (Clarity Act) as a game-changer, possibly even more impactful than the Genius Act. It could allow crypto exchanges to register with the Commodity Futures Trading Commission (CFTC), reducing the Securities and Exchange Commission (SEC)’s oversight and encouraging innovation to return to the U.S. market.

Robinhood is preparing for a future where Bitcoin and crypto replace traditional finance, acknowledging crypto’s dual nature as both a tradable asset and a fundamental underlying technology that will reshape financial services.

The Evolution of Finance Powered by Crypto Technology

Crypto is not just an asset class; it represents the next stage in the evolution of financial infrastructure. We’ve moved from paper-based systems to mainframes, then cloud computing. Now, crypto technology is transforming businesses by replacing traditional financial business logic—exchanges, lending pools, payment processors—with software-driven shared infrastructure.

This transformation means that in the future, crypto technology will power not only crypto trading but also the trading of stocks and other traditional financial assets, fully merging the two worlds.

Stay Engaged, Stay Informed, and Position Yourself for Success

With so much happening in the cryptocurrency and bitcoin space, staying subscribed to reliable sources and engaging with the market daily is critical. Time in the market is the key to building wealth, and the next bull run could be the most explosive yet.

Whether you’re here for Bitcoin accumulation or exploring promising altcoins, staying informed will help you make smarter decisions and capitalize on opportunities as they arise.

Final Thoughts

The crypto market is on the cusp of a major breakout driven by institutional involvement, regulatory clarity, and evolving technology. Rate cuts from the Federal Reserve, major projects like DeLorean Labs, and supportive voices from Visa and Robinhood CEOs all point to a bullish future.

This is your last chance to get in at these price points before the next wave of growth. Choose your investments wisely, keep your eyes on key regulatory developments, and prepare to ride the wave of innovation that’s about to reshape finance as we know it.

Remember, the game is to accumulate as much Bitcoin as possible, while using altcoins strategically to build your portfolio. The future is bright for those who stay informed and act decisively.

Last Chance to Capitalize on Cryptocurrency and Bitcoin Before They Skyrocket. There are any Last Chance to Capitalize on Cryptocurrency and Bitcoin Before They Skyrocket in here.