Circle’s IPO was nothing short of spectacular. When Circle Internet Financial, the company behind the USD Coin (USDC) stablecoin, went public, its shares debuted at $31 and then surged over 300% in a single day, briefly soaring past $100 per share. This extraordinary rally left investors and market watchers asking a critical question: does Circle’s astronomical valuation make sense, or is it just another crypto frenzy destined to fizzle out?

In this article, we’ll dive deep into Circle’s journey, its business fundamentals, growth catalysts, and the challenges it faces. We’ll also explore whether Circle stock is a buy or if caution is warranted. Along the way, we’ll look at key financial figures, strategic moves, and what the future might hold for this crypto giant.

Table of Contents

- Circle’s Journey to the IPO: From Bitcoin to Stablecoins

- Breaking Down Circle’s Financial Fundamentals

- Circle’s Ambitious Growth Catalysts

- The Challenges Ahead: Competition, Regulation, and Market Cycles

- Is Circle Stock a Smart Investment Now?

Circle’s Journey to the IPO: From Bitcoin to Stablecoins

Founded in 2013 by Jeremy Allaire and Sean Neville, Circle began with the vision of harnessing Bitcoin to build a new digital payment system. Unlike Bitcoin’s decentralized ethos, Circle focused on a centralized model. Early on, Circle joined forces with Coinbase and Digital Currency Group to advocate for increasing Bitcoin’s block size through the 2017 New York Agreement—an effort that ultimately failed.

After this setback, Circle pivoted towards Ethereum and launched USD Coin (USDC) in 2018. Developed jointly with Coinbase through the Centre Consortium, USDC quickly became one of the leading stablecoins, backed by regulatory and operational standards designed to ensure trust and transparency. For years, Circle and Coinbase shared governance and profits from USDC’s massive reserve income.

Circle’s IPO ambitions first surfaced in 2021 with plans to go public via a SPAC, riding the crypto bull run and Coinbase’s successful listing. However, regulatory roadblocks from the SEC and the fallout from the FTX collapse in late 2022 derailed those plans.

Fast forward to 2025, Circle officially announced its IPO on the New York Stock Exchange under the ticker CRCL. Institutional giants like BlackRock and Cathie Wood’s Ark Invest threw their weight behind the offering, which raised $1.1 billion at $31 per share — a price that would soon be dwarfed by the stock’s meteoric rise.

Breaking Down Circle’s Financial Fundamentals

Circle operates a unique revenue model driven by the “float” — essentially, it earns nearly all its revenue from interest on the billions of dollars held in reserves backing USDC, primarily invested in short-term U.S. government bonds. In 2024, Circle generated $1.68 billion in revenue, a 16% increase over 2023’s $1.45 billion. Early 2025 figures suggest Circle is on track for a $2.3 billion annualized revenue run rate, with Q1 revenue growing 58% year-over-year.

However, high revenue growth doesn’t necessarily mean high profits. Circle’s operating income in 2024 was just $167 million — a slim 10% margin. Adjusted EBITDA, a core profitability measure, was $284 million, underscoring tight margins after operational expenses.

A major profitability drag is Circle’s revenue-sharing deal with Coinbase. Since Coinbase exited the Centre Consortium in 2022, Circle pays Coinbase about half of the revenue generated from stablecoin reserves — $908 million in 2024 alone. This deal means that despite rising revenues, Circle’s profits have shrunk.

Another red flag: Circle reported a net loss of $769 million during the 2022 crypto bear market, highlighting its sensitivity to crypto cycles. Interest rate fluctuations also heavily impact Circle’s profits; analysts estimate that a 0.25% drop in interest rates could slash annual EBITDA by $100 million unless USDC adoption grows by at least 10% — a challenging prospect in volatile markets.

Circle’s IPO initially valued the company at $6.9 billion, but the stock’s post-IPO surge has pushed its market cap to around $36 billion, trading at over 100 times earnings — a massive premium compared to the fintech median of 31 times earnings. This valuation is clearly driven by speculation rather than fundamentals.

Circle’s Ambitious Growth Catalysts

So, what’s fueling investor optimism despite these challenges? Circle has laid out bold growth plans centered around expanding USDC’s blockchain footprint and deepening its integration with traditional finance.

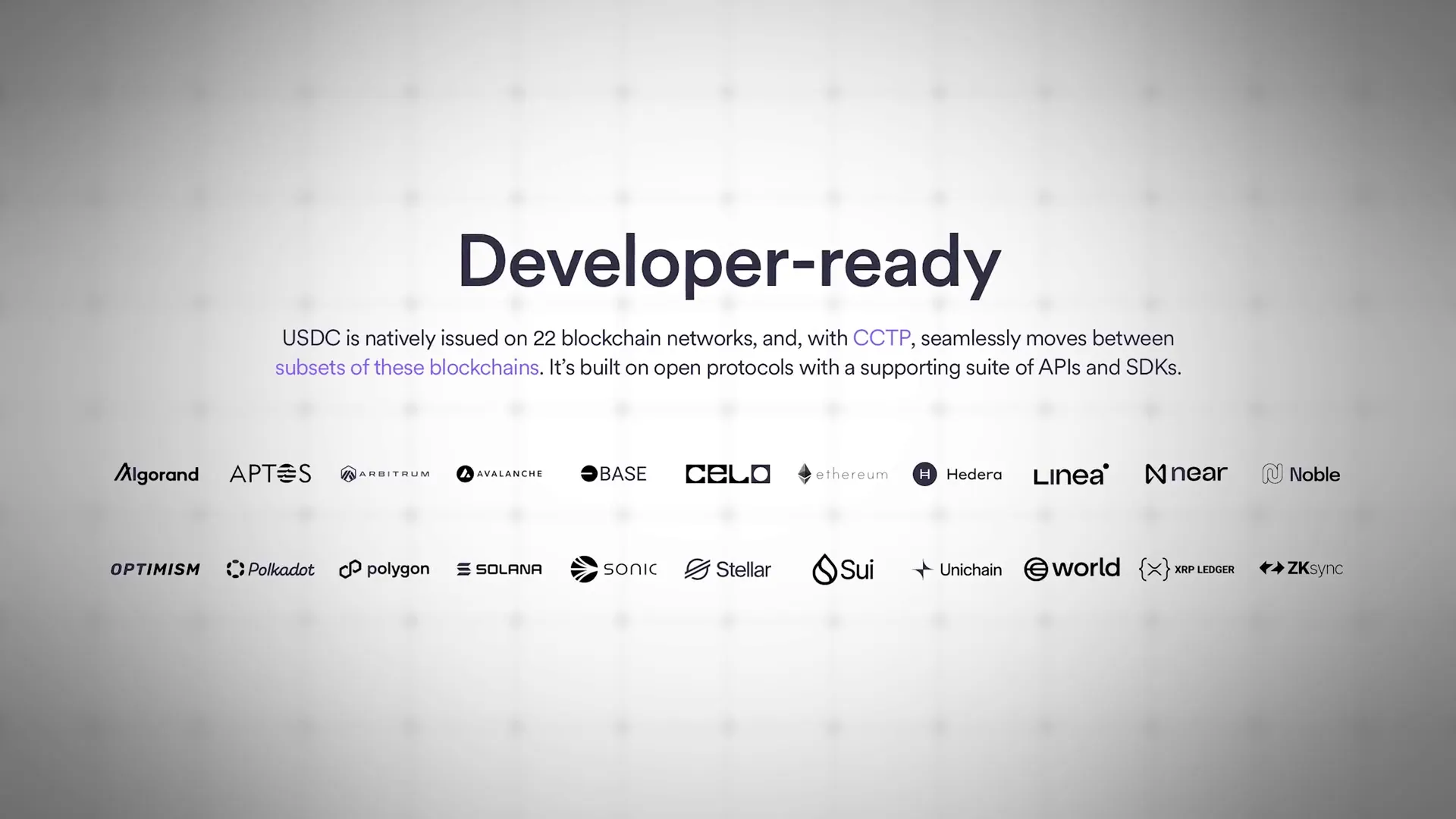

Currently, USDC operates on 22 blockchains and is expanding rapidly. Notably, USDC recently launched natively on the XRP Ledger and World Coin’s World Chain, thanks to Circle’s Cross Chain Transfer Protocol (CCTP). This technology enables near-instant transfers of USDC across blockchains, boosting liquidity and usability — key factors in driving adoption.

Circle also forged a partnership with Brazil’s fintech Matera, allowing Brazilian banks to integrate USDC directly into their payment systems, embedding Circle within the country’s traditional financial infrastructure. On the payment front, Circle is poised to capitalize on regulatory clarity around stablecoins, backed by support from Wall Street heavyweights like JP Morgan and Citibank.

In January 2025, Circle acquired Hashnote, issuer of US Yield Coin (USYC), aiming to position USYC as a preferred yield-bearing collateral in crypto exchanges and institutional markets. Circle also introduced Circle Mint, a service allowing institutions to mint large USDC volumes without transaction fees, making USDC more attractive for high-volume digital dollar transfers.

Internationally, Circle launched EURC, a euro-backed stablecoin compliant with Europe’s MICA regulations. Though currently small in volume, EURC is among the first regulated stablecoins in the eurozone, positioning Circle for future European expansion.

On the regulatory front, stablecoin legislation like the Genius Act and Stable Act in the U.S. could provide the clarity needed to unlock institutional investment and broader usage of USDC.

The Challenges Ahead: Competition, Regulation, and Market Cycles

Despite these promising developments, Circle faces significant hurdles. Competition is intensifying as traditional financial giants prepare to launch their own stablecoins once regulations are clear. JPMorgan, Bank of America, Fidelity, and PayPal — all with massive trust and resources — are gearing up to challenge Circle’s market share.

Tether’s USDT remains the dominant stablecoin globally, with over $150 billion in circulation compared to USDC’s $60 billion. While USDT is mostly used for leveraged trading on centralized exchanges, USDC’s growth is more linked to DeFi activity, which remains volatile.

Circle’s compliance with Europe’s MICA regulations, while positioning it as a regulated player, also introduces risks. EURC must be backed primarily by European government debt, which is less liquid and stable than U.S. Treasuries. Rising inflation or interest rates in Europe could cause bond prices to fall, making it difficult for Circle to quickly liquidate assets during large redemptions without losses — risking a potential EURC depeg.

Circle’s relationship with Coinbase is another uncertainty. Since Coinbase’s 2022 exit from the Centre Consortium, Circle pays half of its stablecoin reserve revenue to Coinbase. However, Coinbase might launch its own stablecoin, threatening USDC’s demand on its platform. While a Coinbase exit could improve Circle’s profitability, it would also expose Circle to greater financial risk in a bear market.

Finally, the cyclical nature of crypto markets means stablecoin demand — and thus Circle’s revenue — tends to decline in bear markets. If traditional financial institutions launch their stablecoins during crypto downturns, Circle risks losing market share when it can least afford it. These competitors, backed by mega banks, might be perceived as “too big to fail,” a status Circle cannot claim even with BlackRock’s backing.

Is Circle Stock a Smart Investment Now?

Circle’s stock has undeniable momentum, fueled by impressive revenue growth and its position as one of the most regulated stablecoin issuers. But the company’s long-term strategy remains somewhat ambiguous.

One intriguing possibility is Circle’s ambition to position USDC as a “synthetic CBDC” (central bank digital currency). CEO Jeremy Allaire has discussed a future where USDC reserves could be held directly at the Federal Reserve, effectively making USDC a digital dollar indistinguishable from an official CBDC. This would shift reserves from U.S. Treasuries to central bank liabilities, potentially offering yield without price risk.

This scenario, while promising from a business standpoint, marks a significant departure from crypto’s decentralized ideals and raises concerns about programmability and control, such as the ability to freeze funds.

In Europe, where CBDC discussions are more advanced, Circle’s EURC might serve as a synthetic CBDC, explaining its compliance with MICA regulations despite the risks involved.

Given Circle’s current valuation—trading at over 100 times earnings—the stock appears significantly overvalued. History shows Circle suffered heavy losses during the last crypto bear market, and a similar downturn could send CRCL stock plummeting alongside broader crypto assets. This makes it a risky hold, especially in the next bear cycle.

That said, Circle seems to be building financial resilience to weather future downturns. With many crypto companies queued for IPOs, Circle’s stock might still rise with the bull market, but the spectacular returns seen so far are unlikely to repeat.

For investors considering exposure to crypto stocks, it might be worth watching upcoming IPOs or waiting for a market correction before jumping in. If Circle can overcome its challenges and survive the next bear market, CRCL could become a compelling buy during a downturn.

Here’s hoping this crypto bull run has more room to grow—for our altcoin bags and sanity alike.

Is Circle the Next Nvidia? Exploring the Mind-Blowing Rally and What’s Next for This Cryptocurrency Powerhouse. There are any Is Circle the Next Nvidia? Exploring the Mind-Blowing Rally and What’s Next for This Cryptocurrency Powerhouse in here.