If you’re serious about trading cryptocurrency, bitcoin, and other assets, embracing AI isn’t just an option—it’s essential. The trading world is evolving fast, and those who stick to old methods risk falling behind while others gain an edge. This guide walks you through a practical blueprint to harness AI in your trading, from chart analysis to building custom indicators and backtesting strategies. Whether you’re a beginner or a seasoned trader, you’ll discover how AI can simplify your decisions, speed up your analysis, and help you trade smarter.

Table of Contents

- Why AI is a Game-Changer in Trading

- Chart Analysis Made Easy with AI

- Mastering Multi-Timeframe Analysis with AI

- Creating Custom Trading Indicators with AI

- Using AI for Stock and Crypto Fundamental Analysis

- Reviewing and Improving Your Trading Strategy with AI

- Enhancing Stock and Crypto Scanning with AI

- Converting Indicators into Backtestable Strategies

- Building an AI-Powered Trading Journal

- Final Thoughts: Don’t Get Left Behind in the AI Trading Revolution

Why AI is a Game-Changer in Trading

AI is revolutionizing how traders approach markets. Instead of relying on guesswork or spending hours on chart analysis, AI offers speed and clarity. It identifies key levels, trend structures, and zones where real money moves—helping you know exactly where to trade and where to avoid noise. This is especially crucial in volatile markets like cryptocurrency and bitcoin, where timing and precision matter.

Chart Analysis Made Easy with AI

Start simple: take a screenshot of a raw price chart and upload it to your AI tool. Use prompts like “Show me key levels, trend structure, and trade opportunities.” The AI will quickly identify major demand and supply zones. For example, it might spot a strong downtrend marked by lower highs and lower lows, highlight a critical demand zone where big money stepped in, or flag a supply zone where sellers consistently appear.

AI also marks “no trade zones” where price action is choppy and directionless. These are areas where many traders lose money by fighting market noise. Instead, AI advises waiting for price to reach real battle zones where large players compete.

Importantly, AI tracks trend shifts. After a sharp spike, it may detect that the downtrend has paused and the market is now ranging—signaling you to adapt your trading bias accordingly. This dynamic understanding helps beginners and pros alike avoid blind selling or buying in uncertain conditions.

Mastering Multi-Timeframe Analysis with AI

One of the biggest challenges traders face is conflicting signals across timeframes. The hourly chart might show a strong uptrend, while the five-minute chart displays sideways chop. AI solves this by analyzing multiple charts—daily, four-hour, thirty-minute, five-minute—and combining insights into a single, cohesive recommendation.

For example, AI might detect a strong bullish momentum on the four-hour chart, steady stair-stepping upward on the thirty-minute chart, and confirm the trend on the five-minute chart, while cautioning about potential short-term pullbacks. Based on this, AI suggests waiting for small dips to buy rather than chasing highs, providing a clear, actionable plan.

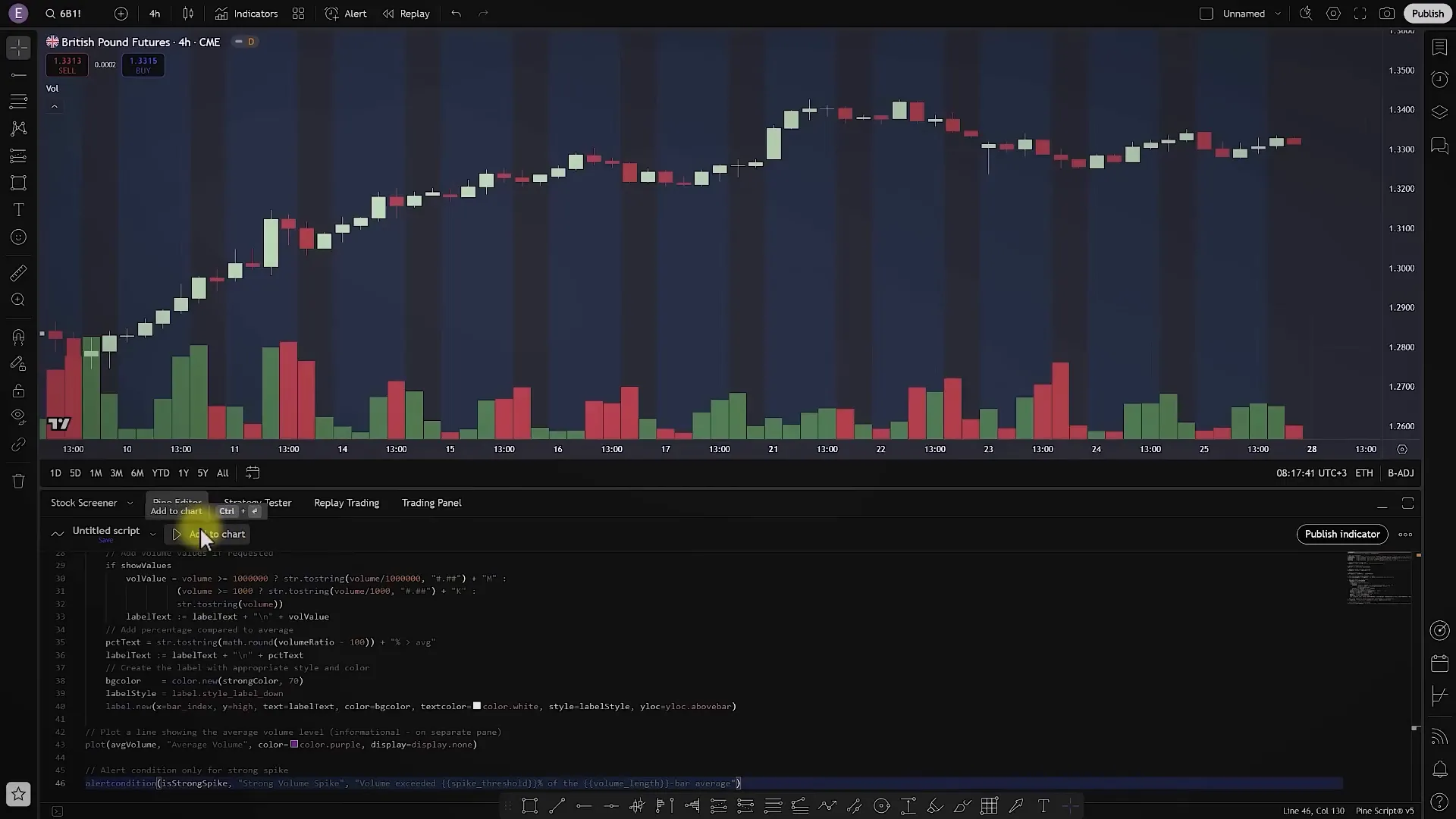

Creating Custom Trading Indicators with AI

Have a brilliant indicator idea but no coding skills? AI can help you write custom scripts. For instance, if you want an indicator that spots volume spikes—signaling when big money players enter the market—describe your concept to AI. It can generate Pine Script code for TradingView, which you can easily paste into the Pine Editor and add to your charts.

Volume spikes often precede major price moves because they reveal supply and demand imbalances that most traditional indicators miss. This AI-generated indicator acts like a professional floor trader’s tool, helping you spot where the big players are active.

Don’t worry about errors—coding can be tricky, but AI can also help debug your scripts. Just share any error messages with AI, and it will suggest fixes until your indicator works perfectly.

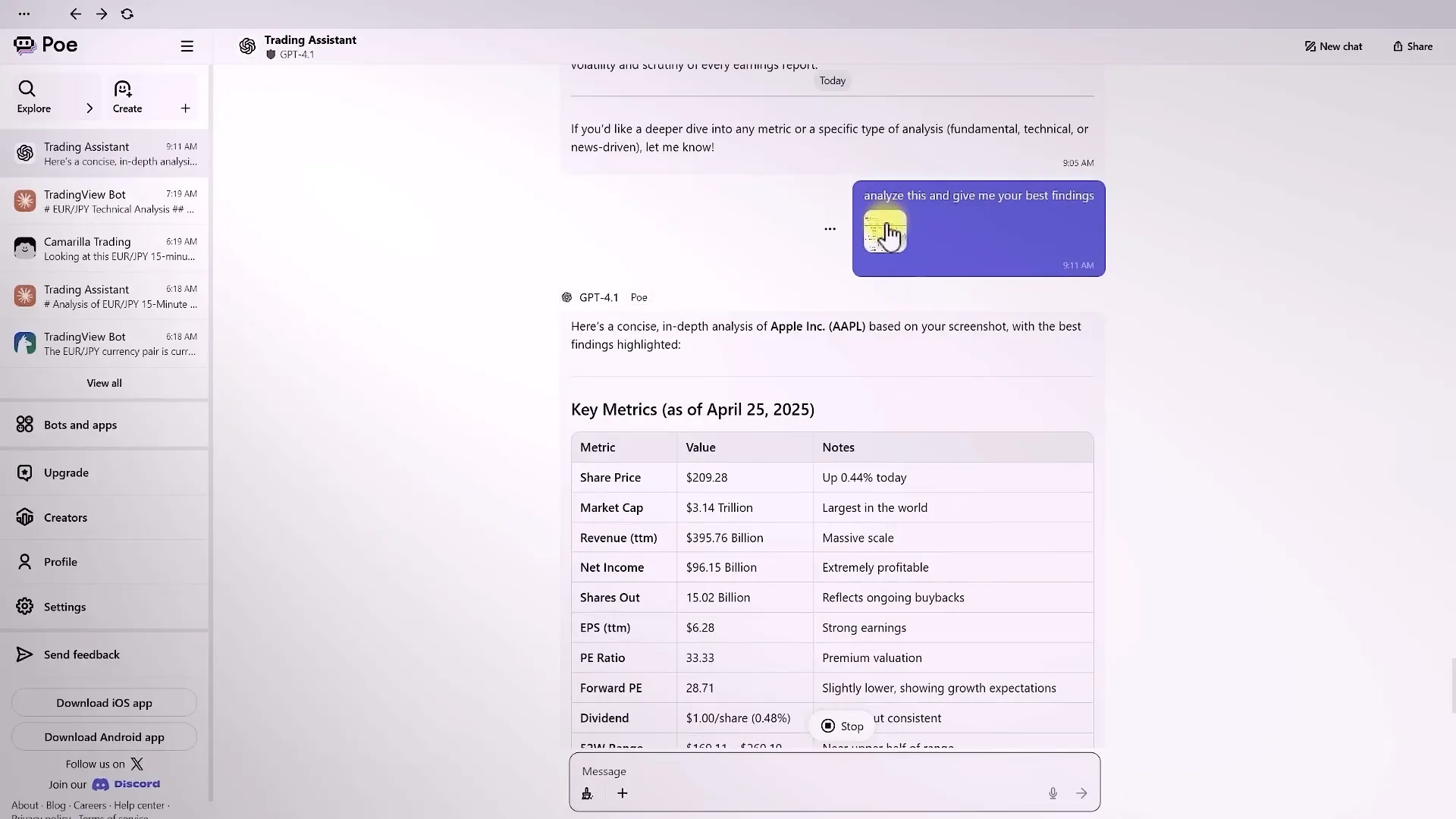

Using AI for Stock and Crypto Fundamental Analysis

Fundamental analysis can be time-consuming, especially when parsing financial reports or ratios. AI speeds this up dramatically. Simply upload screenshots or documents of a company’s fundamentals—like revenue, earnings, PE ratios, and market cap—and ask AI to summarize key insights.

For example, AI can analyze Apple’s financials in seconds, highlighting strengths such as healthy profits and reasonable valuation, while flagging potential concerns. This unbiased, data-driven approach removes emotion and confusion, making fundamental analysis accessible even for newer traders.

Reviewing and Improving Your Trading Strategy with AI

AI isn’t just for analysis—it can review your entire trading approach. Share your exact trading rules, entry and exit criteria, and risk management strategies. AI will identify blind spots, inconsistencies, and areas for improvement. For instance, it might point out that you lack a reliable way to determine if the market is trending or ranging, or that your risk management doesn’t align with your profit goals.

This honest, merit-based feedback helps you optimize your decision-making process, shifting focus from hunting perfect signals to improving how you trade overall. It’s like having a brutally honest coach who sees what you might miss.

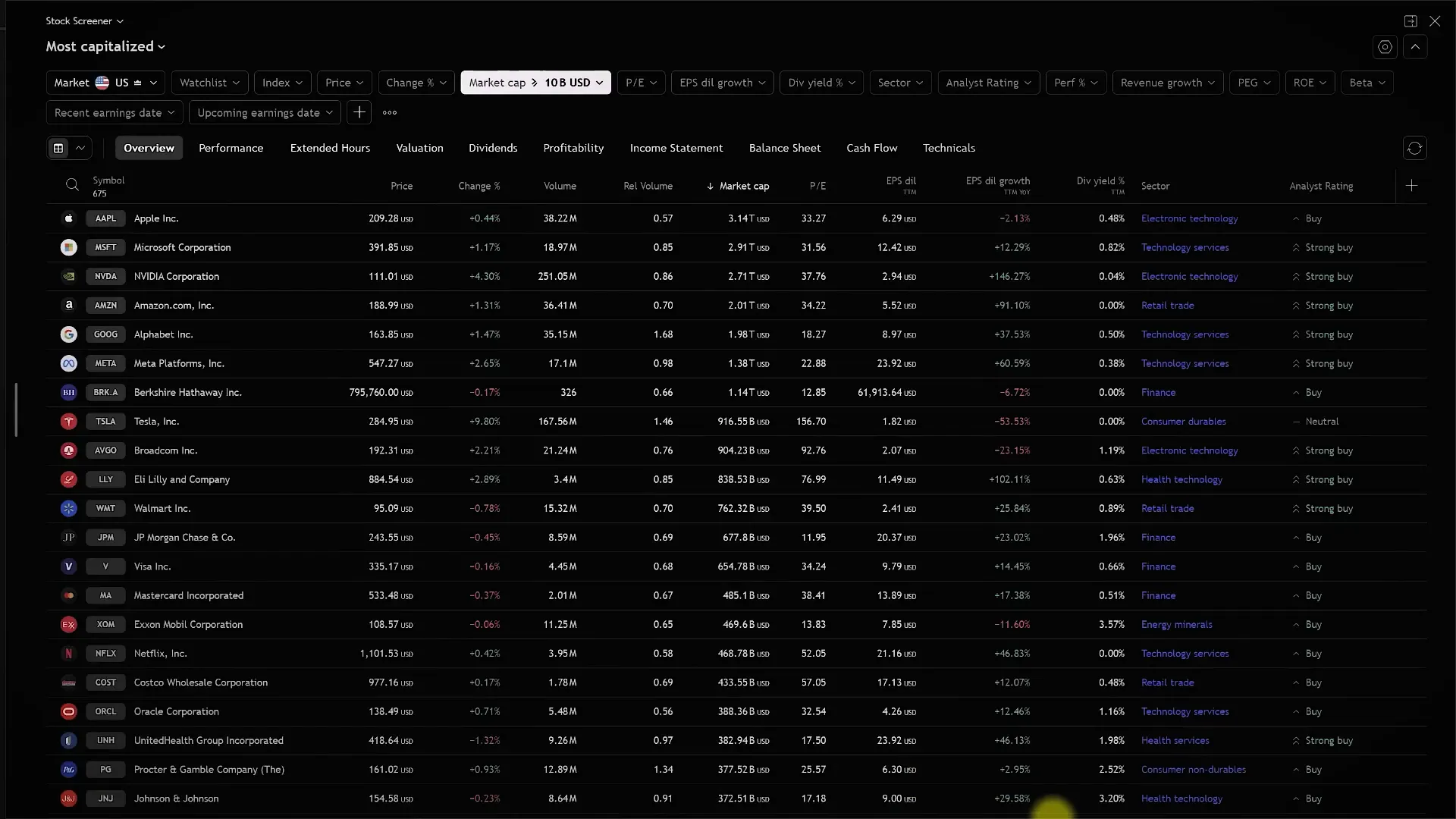

Enhancing Stock and Crypto Scanning with AI

Scanning thousands of stocks or cryptocurrencies manually is overwhelming. AI acts as a smart assistant, analyzing your TradingView screener screenshots to spot trends, sector rotations, unusual metrics, and standout opportunities.

You can ask AI to optimize your screener filters, suggest additional columns based on your trading style, and even create custom screener templates tailored to bullish, bearish, or volatile market conditions. During earnings season, AI narrows your focus to the most promising candidates, saving you valuable time.

Converting Indicators into Backtestable Strategies

If you have an indicator that gives decent signals but want to test it systematically, AI can convert it into a full trading strategy script. For example, the chandelier exit indicator—which uses average true range for trailing stops—can be transformed into a strategy that always stays in the market, switching between long and short positions based on signals.

After AI writes the strategy code, you can backtest it on platforms like TradingView. Metrics like equity curve, drawdown, number of trades, and profit factor reveal if your system has a real edge. This process takes minutes but can save you months of manual coding and testing.

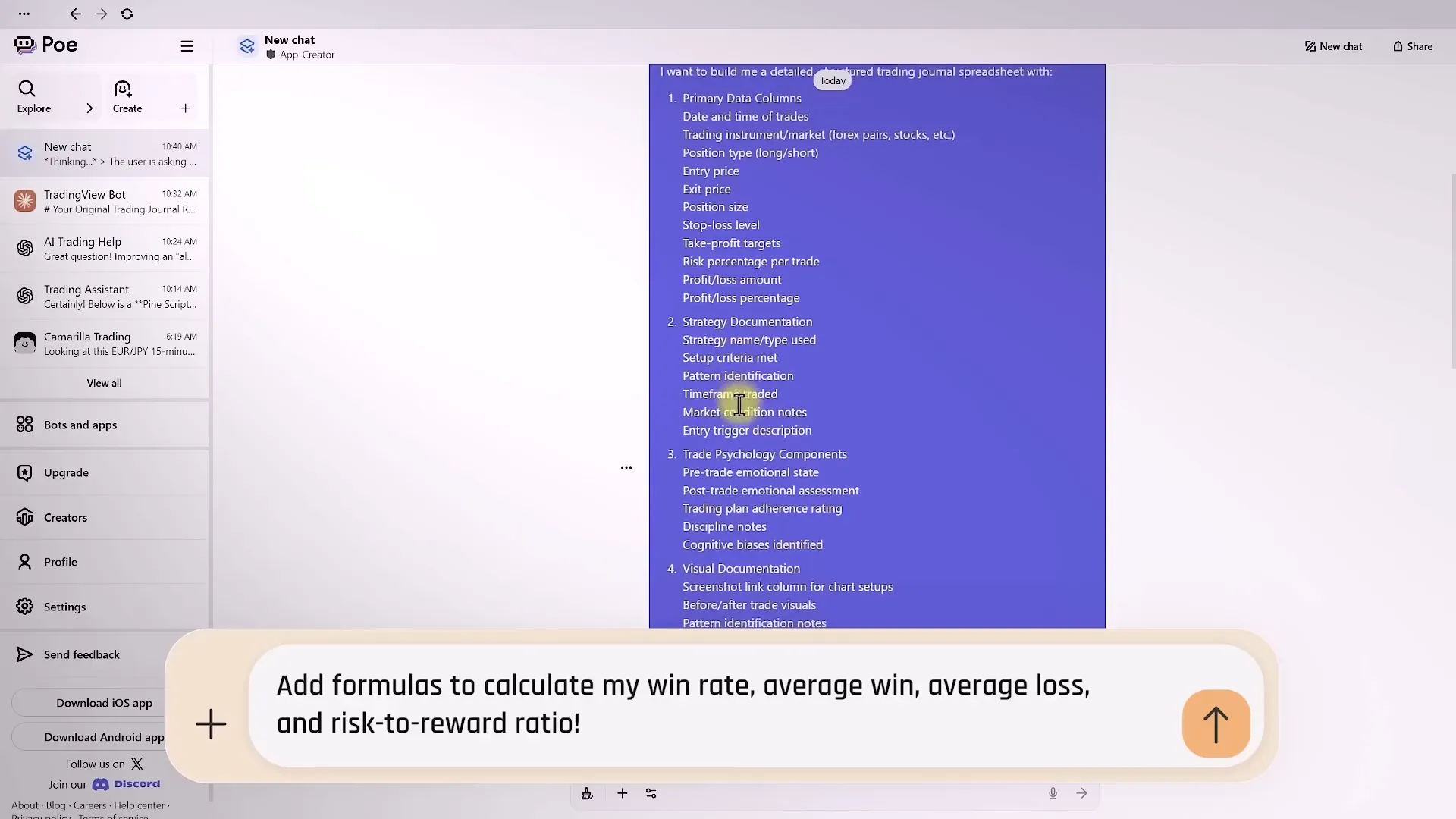

Building an AI-Powered Trading Journal

Keeping a trading journal is critical, but setting one up can be tedious. AI can create a customized spreadsheet template for you, including fields like date, market, position type, entry and exit prices, stop loss, risk percentage, profit/loss, and notes on strategy and lessons learned.

AI can also add formulas to calculate win rate, average wins/losses, and risk-to-reward ratios automatically. You can customize the journal to fit your style—adding columns for market conditions, sector performance, or links to trade setup screenshots.

Regular journaling helps you reflect on your trades, identify patterns, and improve over time. AI can even help you set reminders and create weekly review templates to spot strengths and recurring mistakes.

Final Thoughts: Don’t Get Left Behind in the AI Trading Revolution

AI is no longer a futuristic concept for traders—it’s here, and it’s reshaping how we analyze markets, develop strategies, and manage trades. Whether you’re trading cryptocurrency, bitcoin, stocks, or forex, integrating AI tools can give you a powerful edge.

From quick chart analysis and multi-timeframe insights to custom indicators, strategy backtesting, and journal automation, AI makes trading faster, clearer, and more efficient. The key is to start now—before you’re left behind using outdated methods.

Embrace AI as your trading partner, and you’ll not only keep up with the market but potentially outperform many who hesitate to adapt. This is your chance to trade smarter, not harder.

How to Use AI in Trading Before It's Too Late: A Step-by-Step Guide for Cryptocurrency, Bitcoin, and More. There are any How to Use AI in Trading Before It's Too Late: A Step-by-Step Guide for Cryptocurrency, Bitcoin, and More in here.