If you’re ready to dive into the world of cryptocurrency and bitcoin day trading, you’ve come to the right place. Trading can become a powerful income-generating machine when done right. But without the proper foundation, it’s easy to waste years and money chasing strategies that don’t work. I’ve been trading for over eight years, completely self-taught, and I’m here to share the simple, step-by-step process I wish I had started with. This guide will set you up with the right mindset, tools, and techniques so you can start your trading journey confidently today.

Step 1: Master Your Trading Mindset

Trading isn’t just about charts and numbers; it’s about how you think and react. The most important foundation you can build is your mindset. If you don’t rewire your brain to think like a successful trader, you’re likely to lose money and get stuck in confusion.

Here’s the truth: trading is NOT gambling. You don’t need nerves of steel if you understand your expected outcome over time. The key is to follow a strict set of rules, stay organized, and practice your execution relentlessly.

Forget the myth that you need to be a genius to trade successfully. In fact, some of the smartest people I’ve met struggle because they’re stubborn and resistant to changing their mindset. What really matters is discipline, hard work, and sticking to your rules.

Luck? It’s a factor, but you don’t rely on it—you cultivate it. Focus on being optimistic but realistic, and put yourself in the position to get lucky by following a proven process.

"You cannot improve what you don't measure." —Andrew Hansen

Organization is critical. Track every trade, measure your results, and use that data to improve. And while you do need to be able to execute under pressure, like a clutch athlete, it all comes back to training and repetition. The more you practice, the more second nature it becomes.

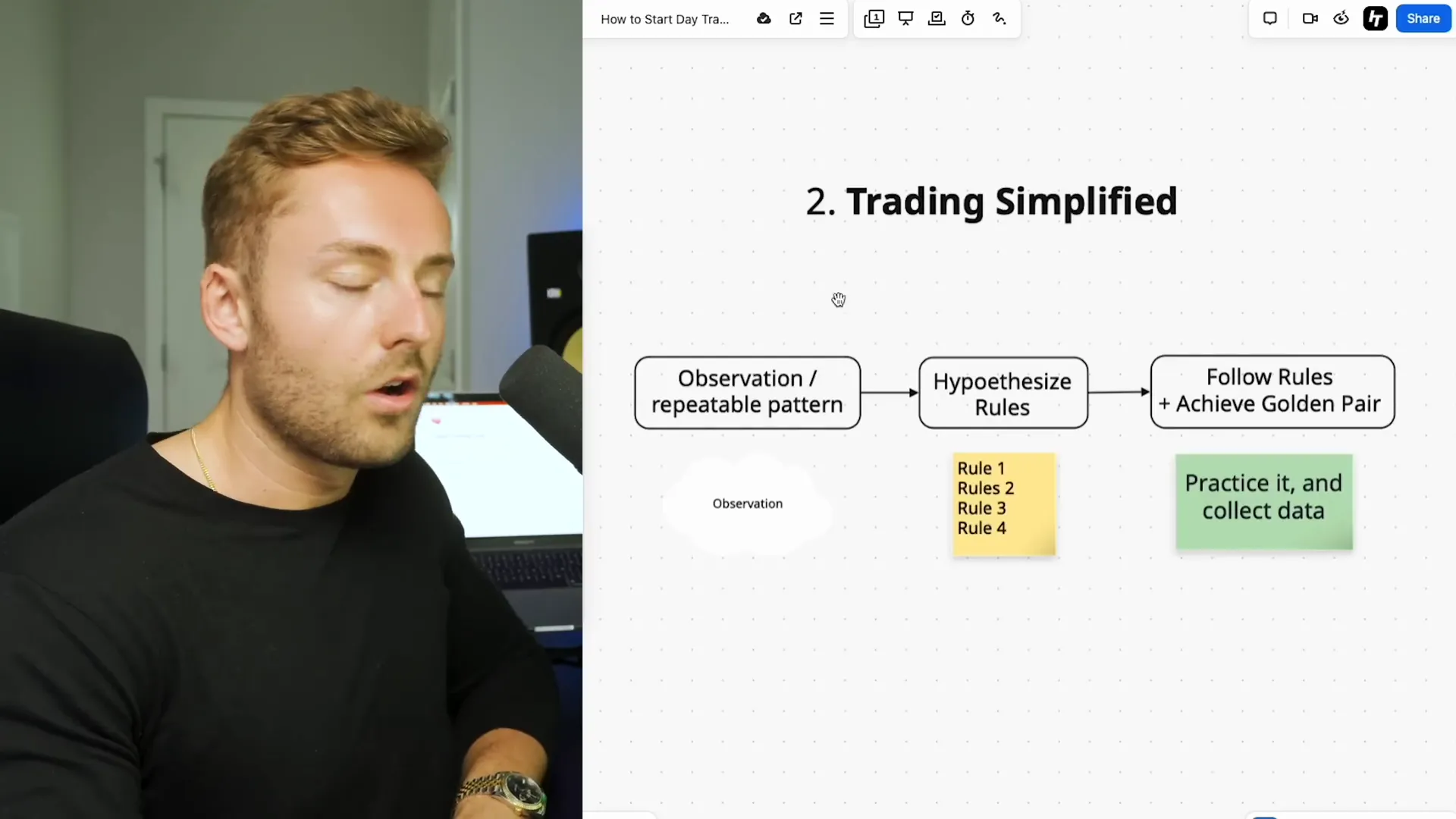

Step 2: Trading Simplified — The 3-Part Framework

Trading can look complicated, but I’ve distilled it into a simple three-step process that anyone can follow:

- Observe a repeatable pattern: Find something in the market that happens consistently, like a price pattern or a reaction during a specific time.

- Hypothesize your rules: Create a clear set of rules based on your observation. These rules should define when to enter, exit, and how to manage risk.

- Test the golden pair: Before risking real money, collect data by practicing and backtesting your rules to prove your concept works.

This process allows you to build a trading system based on data, not guesswork. Unlike many businesses where consumer behavior can be unpredictable, trading gives you the unique ability to test and confirm your strategy’s profitability before committing real capital.

Step 3: Get Comfortable with Charting and Tools

Now that you understand the mindset and framework, it’s time to get hands-on with charting and tools. Most traders use TradingView for chart analysis because it’s powerful and offers a free version to start with.

Here’s how to begin:

- Create a free TradingView account.

- Open the charting tool and select your market (crypto, bitcoin, stocks, futures, etc.).

- Start with simple charts. Candlesticks are your best friend — they show open, close, high, and low prices in a visual “box and whisker” style.

Keep your charts clean and simple. Avoid overcrowding with too many indicators. The core of trading is understanding supply and demand imbalances—areas where buying and selling pressure tip the price up or down.

Draw trend lines to visualize these supply and demand zones. For example, if you see the price bouncing off a certain level multiple times, draw a line connecting those points. This helps predict where the price might continue or reverse.

Along with charting software, you’ll need:

- A position size calculator to manage risk precisely.

- An exchange or trading platform to execute trades (for crypto, I use Bybit; for futures, there are options like Topstep or Apex).

- A trade tracker to log your trades, measure performance, and improve.

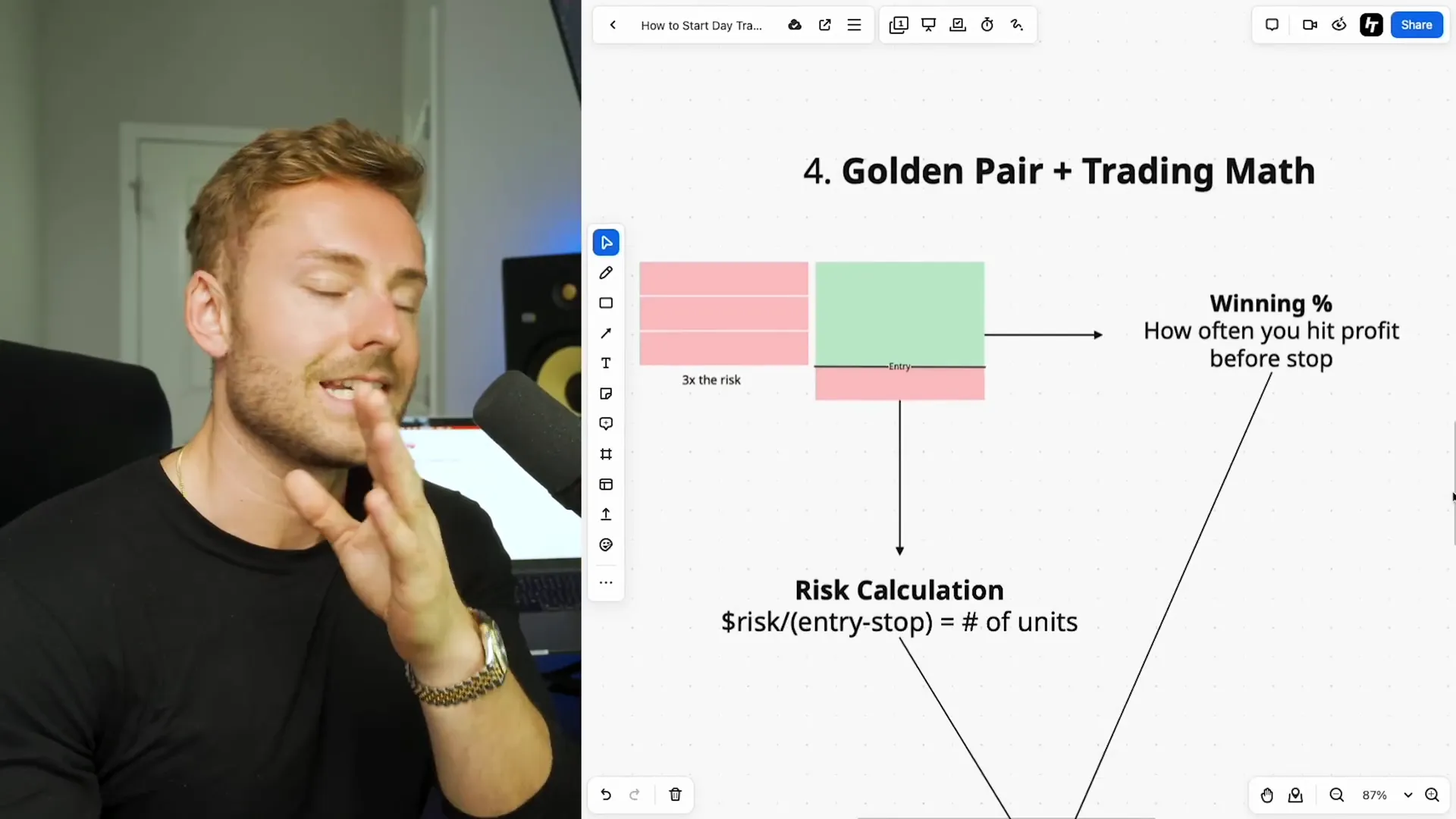

Step 4: Understand the Golden Pair — Trading Math

Once you find a repeatable pattern and have your rules set, the next step is to focus on two critical metrics:

- Average Risk-Reward Ratio: How much you stand to gain compared to how much you risk on each trade.

- Winning Percentage: How often your trades hit the profit target versus the stop loss.

For example, if your strategy risks $100 to potentially make $300 (a 3:1 risk-reward ratio), you don’t need to win every trade to be profitable. Winning just over 25% of the time can still yield profits.

Consistency is key. You must keep your risk per trade the same. Don’t risk $100 on one trade and $300 on the next because it will skew your results and make it impossible to evaluate your strategy correctly.

Here’s the simple formula I use to calculate position size:

Position Size = Risk Amount / (Entry Price - Stop Loss Price)

For example, if your entry price is $10.03, stop loss at $10.08, and you want to risk $100, the position size comes out to 1,724 units. This way, if the price hits your stop loss, you lose exactly $100.

To make this easier, I created a free position size calculator tool that you can find in my trading suite linked below. It automatically adjusts your risk, take profit, and stop loss levels on your chart.

With these metrics, you can also reference a profitability table that tells you the minimum winning percentage needed for different risk-reward ratios to break even or profit. This math is the backbone of a sustainable trading strategy.

Step 5: Access to Capital — Using Leverage and Prop Firms

Many beginners think you need a huge amount of capital to trade effectively, but that’s not necessarily true. Let’s revisit our example:

If you want to risk $100 on a trade with an entry price of $10 and a stop loss a few cents away, you might need nearly $20,000 in your account to hold the position size required. That’s a big barrier for most retail traders.

This is where leverage comes into play. For cryptocurrencies, exchanges like Bybit offer up to 100x leverage, meaning you can control a large position with a smaller amount of capital. Using 50x leverage, your required capital drops from $20,000 to about $400 while maintaining your $100 risk.

Leverage doesn’t add risk if you keep your position sizing and stop-loss rules consistent. It simply lowers the capital needed to take trades.

Another option is trading with a prop firm. These firms provide you with buying power (e.g., $50K, $100K) once you prove your profitability through a challenge. This lets you trade larger positions without risking your own capital.

Step 6: Putting It All Together — My Trading Process

Now that you’ve got the mindset, framework, tools, math, and capital access sorted, let me show you how I build and test a trading system.

Using a custom indicator I developed called the Inevitrade Pro Plus, I look for highlighted zones where the market shows strong moves up or down on a one-minute chart. My rules might be:

- Buy when a highlight appears at a dip.

- Place a stop loss just below the dip.

- Sell when a highlight appears at a peak, aiming for a 3:1 risk-reward ratio.

I then test this system by replaying the chart in real-time mode, marking each trade’s risk and reward to see how it performs over multiple trades. For instance, if I get twelve risk factors gained and only lose two, I’m left with a net positive of ten risk factors — a profitable session.

This process of backtesting and forward testing ensures my system hits the golden pair and matches the profitability table before I trade real money.

With this disciplined approach, I’m currently on a 23-win streak and consistently making thousands of dollars daily. Members of my private team have also seen impressive results by following this formulaic, data-driven process.

Trading is a business, and like any business, success comes from following a proven plan, measuring results, and executing consistently.

If you’re serious about turning cryptocurrency and bitcoin trading into an income stream, focus on these six steps. Build your foundation strong, keep it simple, and trade smart.

For free tools, trading courses, and a supportive community, check out the resources I’ve put together below. Let’s make 2024 your breakthrough year in trading.

This article was created from the video How to Start Day Trading As A Beginner [2024 Full Guide] with the help of AI.

How to Start Day Trading Cryptocurrency and Bitcoin as a Beginner: A 2024 Full Guide. There are any How to Start Day Trading Cryptocurrency and Bitcoin as a Beginner: A 2024 Full Guide in here.