If you’ve ever wanted to master day trading cryptocurrency and bitcoin, build a consistent income stream, and gain financial freedom, you’re in the right place. After trading for over seven years and being completely self-taught, I’ve distilled everything into a simple, no-nonsense process that I wish I’d started with. This guide will walk you through the mindset, tools, and strategies you need to succeed, even if you’re brand new to trading.

Step 1: Develop the Right Trader Mindset

Trading is often misunderstood because there are millions of voices sharing conflicting advice. The first step is to rewire your thinking to match how professional traders operate. Imagine trading like flipping a coin where heads means you win $300 and tails means you lose $100. If you flip that coin ten times, the average result will tend to five heads and five tails, resulting in a net profit.

The key is to avoid getting emotionally attached to each flip (or trade). Instead, focus on the overall conditions that create a positive expectancy. This means sticking to your strategy and tracking your results over many trades rather than obsessing over individual wins or losses.

"The pro trader mindset focuses all effort on keeping the same conditions for the coin flip and tracking on average how much they make after ten coin flips."

In trading, your "coin flip" is your strategy and execution. Understanding this winning probability concept puts you ahead of 80% of new traders.

Step 2: Master Charting and Software Essentials

Next, you need the right tools to analyze markets effectively. I recommend starting with three foundational software platforms:

- TradingView: For charting and technical analysis.

- Excel or Google Sheets: For tracking trades and journaling.

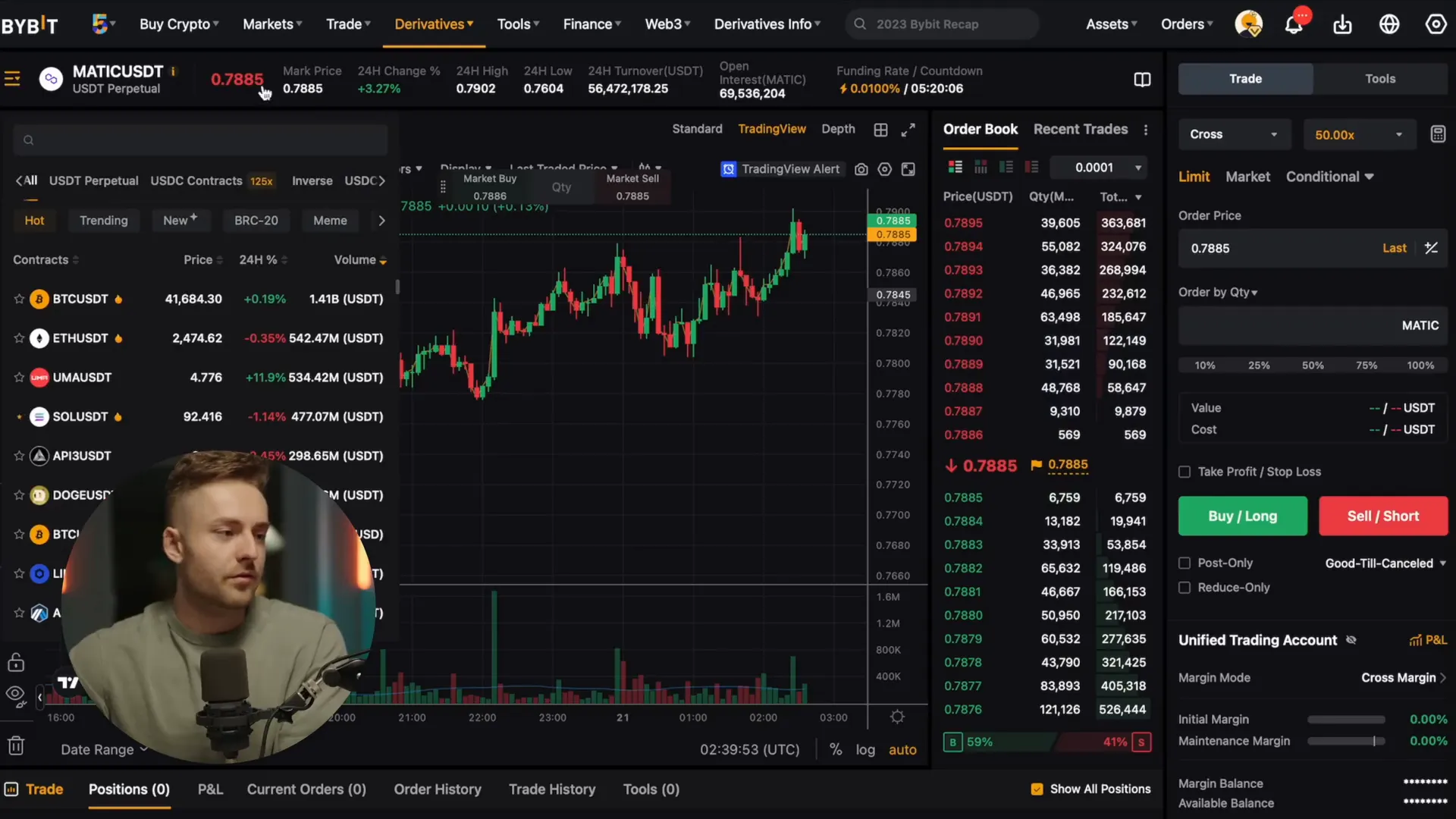

- A Trading Exchange: To execute your trades (I personally trade cryptocurrency on Bybit or Phemex).

When you open your TradingView chart, start with a simple setup—just candlesticks and no extra indicators. Many beginners overload their charts with confusing indicators, which leads to “paralysis by over analysis.” Keep it simple and understand what moves the markets before adding complexity.

For example, a candlestick shows the open, close, high, and low prices for a set time period. The movement of these candles is driven by buyers and sellers interacting on the order book, which reflects supply and demand dynamics.

Understanding that charts are a visual representation of mass human psychology is crucial. Prices move based on the balance between supply and demand. When demand outpaces supply, prices rise; when supply exceeds demand, prices fall.

Using Trend Lines to Predict Market Moves

One of the most effective ways to anticipate price movements is by drawing trend lines. An uptrend is confirmed by a series of higher lows and higher highs, while a downtrend shows lower highs and lower lows. Trend lines help identify where supply and demand imbalances might cause price reversals.

For instance, if a price bounces off a trend line multiple times, it indicates strong demand at that level. But once the price breaks through the trend line, it may signal a new trend forming.

Step 3: Understand Trading Math and Risk Management

Successful trading is not about being right all the time but about managing risk and reward effectively. Always enter trades with a clear plan: know your entry point, take profit level, and stop loss to limit losses.

Position sizing is critical. For example, risking $50 on a trade means you must calculate the exact number of units to buy or sell to ensure you don’t lose more than that amount if the trade goes against you. Never randomly choose your trade size.

Beware of emotional trading, like increasing your position size because you feel more confident about a trade. This is a fast track to losses. Instead, follow your strategy systematically and treat every trade equally.

Trading success boils down to two factors:

- Win rate: How often your trades hit the take profit.

- Risk-reward ratio: How much you make compared to how much you risk.

Even with a win rate as low as 30%, a 1:3 risk-reward ratio (risking $50 to make $150) can be profitable over time.

"Get this whole notion out of your head that trading is about being right or predicting what's going to happen."

Step 4: Accessing Capital and Using Leverage

One of the biggest barriers beginners face is needing a lot of capital to take meaningful trades. This is where leverage comes in. Leverage lets you control a larger position with less capital. For example, a 10x leverage on a $1500 position only requires about $150 of your own money.

Using leverage does increase fees and requires careful management, but when used properly, it does not necessarily increase your risk if your position sizing is calculated correctly.

Here’s an example with MATIC cryptocurrency:

- Without leverage: Risking $25 on a trade requires holding about $1,529 worth of MATIC tokens.

- With 10x leverage: The required capital drops to around $152.

Leverage allows you to start trading with smaller capital while maintaining proper risk management.

Step 5: Practice and Journal Your Trades Religiously

Before risking real money, practice your trading strategy thoroughly and keep a detailed journal. Record each trade’s entry, exit, profit or loss, and notes about the setup. This builds your proof of concept — evidence that your strategy works over time.

I’ve created a custom spreadsheet that helps track all these details and automatically calculates your overall performance. This is a critical step because without it, you’re just gambling.

Once you see consistent profitability in your practice trades, you can start trading with real money. But don’t stay in simulation mode too long, or you’ll become complacent. Trading with real money is a different experience, and you need to transition once you’re ready.

A great way to accelerate practice is using TradingView’s bar replay feature to simulate trades on historical data. This lets you test your strategy in real-time scenarios without waiting for live market conditions.

Building Your Trading Future

Mastering these fundamentals can turn trading cryptocurrency and bitcoin into a powerful income generating machine. With the right mindset, tools, math, capital access, and disciplined practice, you can achieve time, location, and income freedom. Imagine traveling the world, living wherever you want, and scaling your income to your goals.

Trading isn’t easy, but it’s fascinating and deeply rewarding when done right. Stick to the process, keep emotions out of your decisions, and focus on consistent execution. Your trading journey starts now.

If you found this helpful, dive into your charts, start journaling your trades, and build your path to success one step at a time.

This article was created from the video How to START Day Trading For Beginners 2024 (FULL COURSE) with the help of AI.

How to Start Day Trading Cryptocurrency and Bitcoin for Beginners in 2024. There are any How to Start Day Trading Cryptocurrency and Bitcoin for Beginners in 2024 in here.