Investing as a teenager might seem like a daunting challenge, especially when the landscape is flooded with terms like Bitcoin, Crypto, BTC, Blockchain, and CryptoNews. But what if I told you that starting early is the smartest move you can make? Whether you're a Gen Z teen looking to get your financial footing or a parent seeking guidance for your child, this comprehensive guide breaks down the best investing advice tailored just for you. Think of it as leveling up your life character in the ultimate game of adulting and investing.

My name is Andrei Jikh, and I like to think of life as a video game—except, unlike a game, we don’t get to pick our characters or stats at the start; those are assigned randomly. What we do control, however, is how we play, how we level up, and how we invest our time and money. This article will walk you through the key levels of your financial journey from early teens to adulthood, focusing on building solid foundations in Bitcoin, Crypto, BTC, Blockchain, and general investing principles.

Level 13: The Beginning of Your Investment Journey

At level 13, you might be thinking, “I have $100 to invest—where do I put it?” This is a common question, and the straightforward answer is: invest where you get the greatest returns. But here’s the catch—whether you invest $100 or $1,000 in the stock market or crypto right now, the best you can expect is to make a few hundred dollars extra over several months. On the flip side, you risk losing the entire amount. The risk-to-reward ratio doesn't justify investing at this level yet.

Instead, the best investment you can make at this stage is in yourself. Think of your personal development like boosting your character stats. You can invest either your money or your time—and if you don’t have money to spare, time is your most valuable currency.

Start by absorbing as much knowledge as possible. Watch tutorials, listen to mentors, and pay close attention to those who have “beaten the game” a few times—your teachers, parents, and even grandparents who have navigated the economy’s toughest challenges. This is your age to learn and listen.

Level 14: Unlock the Power of Reading

Reading is a powerful tool to level up your financial IQ. I get it—when I was young, I hated being told what to read. That’s why I started small with picture books, and that’s perfectly fine. Progress is progress.

When you’re ready to dive deeper, here are three essential books that will transform how you view money and investing:

- The Simple Path to Wealth by J.L. Collins – This book breaks down the basics of wealth-building in a simple, accessible way. It’s a must-read for understanding investing fundamentals.

- I Will Teach You to Be Rich by Ramit Sethi – Despite its catchy title, this book offers practical advice on managing money and investing wisely.

- Harry Potter and the Goblet of Fire by J.K. Rowling – Okay, this one is more for fun, but it’s my personal favorite and reminds us that passion and imagination are important in life too.

For those ready to challenge themselves, The Intelligent Investor by Benjamin Graham is the gold standard for advanced investing strategies. But don’t rush to this “hard mode” just yet.

Levels 15 to 17: Experiment, Work, and Find Your Passion

These levels are all about evolution—both physically and mentally. You’ll notice changes, and that’s normal. At level 15, I recommend getting your first job. It was a game-changer for me because it taught me not just how to make money, but the real value of money.

For example, when I saw a Mercedes SLK priced at $60,000 in a magazine, I thought it was more affordable than I imagined. After working part-time for $9 an hour, I unlocked the reality skill tree: affording that car was far out of reach. That realization made me stop asking my parents for money and start valuing every dollar I earned.

Between levels 14 and 17, embark on as many “side quests” as possible. Try YouTube, TikTok, cooking, tennis, magic, Photoshop, photography—anything that piques your interest. This exploration will help you discover your “master skill” or passion, which many miss out on.

Finding a skill that society values can be your cheat code to financial success. I found my special ability early and invested heavily in it, which opened doors to incredible opportunities, like consulting on Now You See Me and working with Daniel Radcliffe from Harry Potter. While those experiences were amazing, the world didn’t always place a high dollar value on my skills. Your goal should be to find a passion that also has financial viability.

Level 18: The Most Crucial Stage of Your Financial Game

Welcome to level 18—the point that sets the tone for your entire financial life. This is your main storyline, not a side quest, so don’t wander off the path. Here’s what you need to do as soon as you hit this level:

1. Open Your Own Bank Account

Get a bank account in your name with the best interest rate possible. This is where you’ll park your money and let compound interest work its magic. Some of my favorites include Ally Bank and CIT Bank, both offering around 1% interest, which fluctuates with the economy and Federal Reserve decisions.

Don’t chase tiny interest rate differences, though—if you find a 0.05% better rate, that’s only about $5 more per year for every $10,000 invested. Focus on consistency instead.

2. Get a Credit Card and Build Credit

Credit cards are often misunderstood. For a long time, I thought they were just for irresponsible spending, but I was wrong. Your credit score reflects how responsibly you manage other people’s money, and a good score opens doors to better interest rates on loans and mortgages.

Even if you plan to pay cash for everything, having a credit card sets you up for financial success. I recommend starting with a secured credit card like the Discover It Secured card, which offers 2% cash back on certain categories and 1% on everything else.

If you’re a college student, go for the Discover It Cash Back Student card for better perks. Your goal is a credit score of 750 or higher, achievable in 8 months to a year by following these steps:

- Always pay your bills on time and never carry a balance. This accounts for 35% of your credit score. If you miss a payment, call the credit card company immediately—they often forgive the first missed payment.

- Keep your credit utilization rate under 30% (ideally under 10%). This means if your limit is $1,000, don’t spend more than $300, or better yet, $100.

- Length of credit history matters. This is 15% of your score, so start early. If possible, have your parents co-sign to inherit their credit history, but this depends on their credit score.

3. Open a Retirement Account

At 18, you should open a retirement account—either a traditional IRA or a Roth IRA. Think of these as special savings accounts primarily for stocks that protect you from taxes.

- Traditional IRA: You don’t pay taxes on contributions now but pay taxes when you withdraw in retirement.

- Roth IRA: You pay taxes upfront but withdraw tax-free after retirement.

You can even have both, but the total annual contribution limit is $6,000 split between them however you like. Starting early is crucial because of compound interest. For example, maxing out your Roth IRA from age 18 to 21 with an 8% growth rate can grow to $781,000 by retirement. Starting at 31 instead nets you only $287,000, almost two and a half times less, all because of time lost.

4. Buy Your First Stock

Buying your first “stonk” (stock) can be overwhelming with thousands of companies and investment styles to choose from—growth stocks, real estate, dividend investing, and more.

Don’t worry; you can learn as you go. I’ve made a video guide on picking the right investment style, which you can explore when ready. Remember, putting your stock in a retirement account maximizes tax benefits and growth potential.

5. Build Strong Financial Habits

Good habits compound just like money. Here are three key habits to develop now:

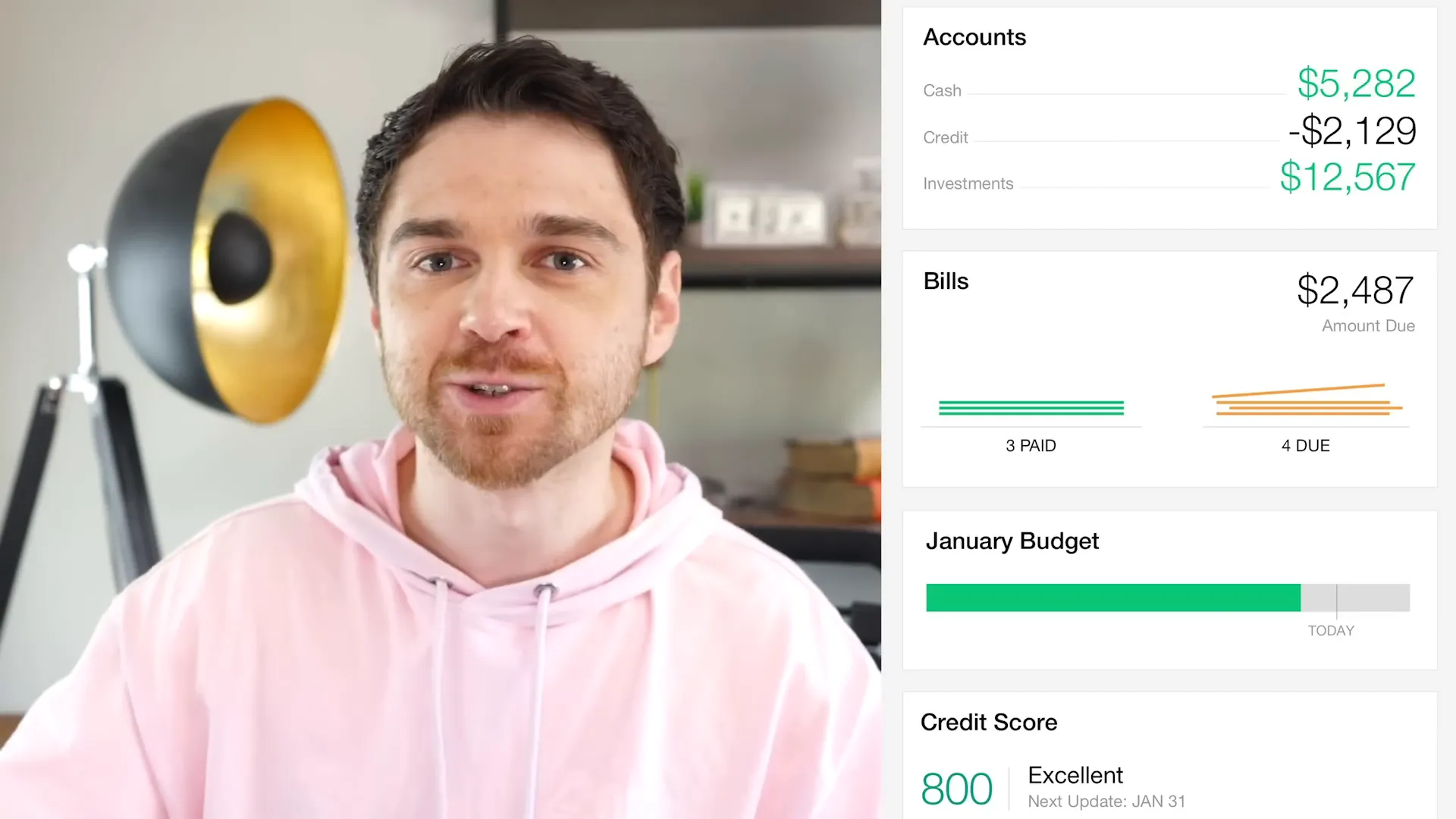

- Track your expenses. Write down every dollar you earn and spend. Use apps like Mint or Personal Capital to automate this. Knowing where your money goes helps you make better decisions.

- Take care of your health. Physical health impacts financial health. Healthcare costs skyrocket with age if neglected. Keep your body in shape to minimize future expenses.

- Be frugal, not cheap. Stretch your dollars wisely without sacrificing enjoyment. Delaying gratification is scientifically proven to build wealth faster.

Bonus Cheat Codes

If you’re lucky enough to have supportive parents, ask them to set up a custodial investment account for you. You can deposit your earnings, and when you turn 18, you inherit the account with invested funds ready to grow.

Also, join communities where you can learn and share—like my free Discord channel where we talk investing, including Bitcoin, Crypto, BTC, Blockchain, and CryptoNews. These platforms often offer free stocks when you sign up, like Webull and Robinhood, which are useful starter incentives.

Level Up and Enjoy the Game

So, whether you’re 13 or 18, the key is to start now. The earlier you invest in yourself and your financial education, the greater your returns will be. Remember, life is a game filled with RNG (random number generation)—luck plays a role, but skill and preparation trump luck over time.

Don’t quit when it gets tough. Keep practicing, learning, and leveling up.

If you’re under 18, congratulations for making it this far! You’re already ahead of most of your peers just by reading and planning. Now go out there, collect those key items, and build your character to win the wealth game.

Life moves fast. Enjoy every level, every challenge, and every reward along the way.

Good luck, and happy investing!

How To Invest For Teenagers: A Guide to Mastering Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing. There are any How To Invest For Teenagers: A Guide to Mastering Bitcoin, Crypto, BTC, Blockchain, CryptoNews, and Investing in here.