Starting small in the world of cryptocurrency and bitcoin trading can feel overwhelming. Eight years ago, I was just a college student experimenting with random trading strategies, starting with a modest $2,500 and scaling it up to nearly $15,000 before making costly mistakes that wiped out the account. Fast forward to today, I regularly have $10,000 to $20,000 profit weeks and manage over seven figures in capital. If I were to start again in 2025, I’d follow six essential secrets that helped me grow consistently without blowing up accounts. These steps will help you focus on what truly matters and build your trading account fast and smart.

Step 1: Stick to High Probability Setups Only

When you begin trading cryptocurrency or bitcoin, it’s tempting to think that taking more trades means making more money. I fell for this trap early on, trying to take 10 to 15 trades per session by hunting for every possible pattern and idea. The result? Confusion, forced trades, and poor quality setups.

Quality beats quantity every time. There are only so many legitimate setups in a day that align perfectly with your trading model. Instead of chasing every idea, focus on refining your strategy to filter out bad trades and bad market conditions. This approach not only protects your capital but also makes trading less stressful because you wait patiently for your setups to come to you.

Here’s a key mindset shift: every time you analyze a trade, ask yourself every possible reason not to take it. This flips the usual confirmation bias on its head. When you feel like you absolutely must take a trade because it’s perfect, those are often your best setups. This discipline will help you cut through the noise and focus on high-probability trades that really matter.

Step 2: Focus on Risk, Reward, and Process—not Money

Although the goal of trading cryptocurrency and bitcoin is to make money, obsessing over dollar amounts early on can sabotage your progress. Instead, think of trading as a game where every trade has a risk factor (denoted as “R”). For example, risking 1R to make 4R means you’re focusing on the risk/reward ratio rather than the money itself.

Why? Humans are wired to react emotionally to money. When I started, I’d protect my profits defensively or revenge trade after losses, both of which disrupted my process and led to bigger mistakes. By focusing on risk and reward, you keep your emotions in check and stick to a consistent process.

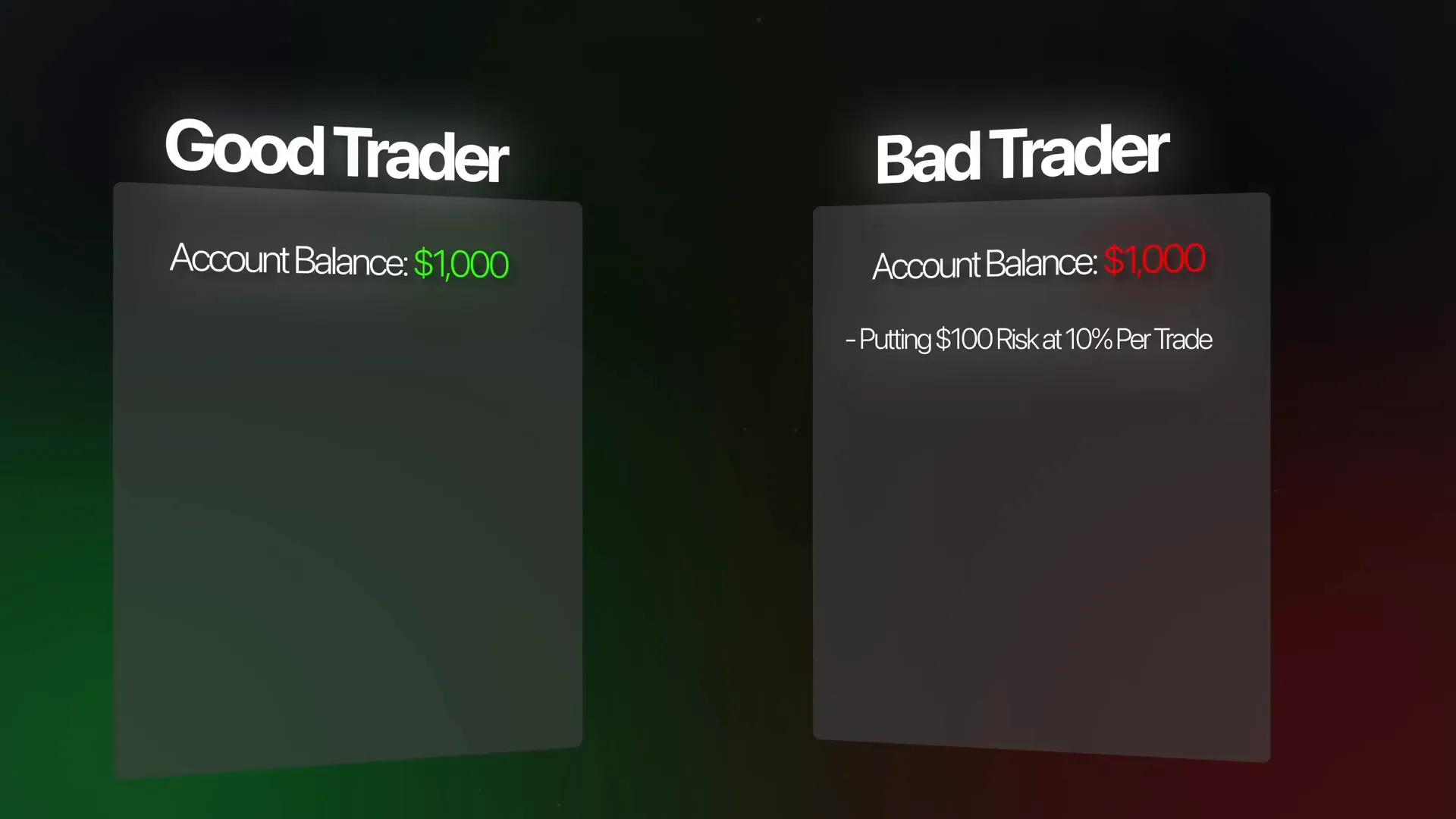

Consider two traders, each starting with $1,000:

- The bad trader risks $100 (10%) per trade.

- The good trader risks $25 (2.5%) per trade.

After losing three trades in a row (a common scenario), the bad trader’s account drops to $600, forcing a 66% return just to break even. The good trader only loses $75, keeping a clear head and sticking to the process. This small risk approach helps preserve capital, making it easier to recover and grow your account steadily.

Step 3: Let Your Trades Run and Avoid Taking Profit Too Soon

This is the hardest lesson I’ve learned: letting trades breathe. It’s tempting to lock in profits early when a trade moves in your favor and then pulls back, but taking profits too soon minimizes your upside and disrupts your growth.

Many beginners hear phrases like “you’ll never go broke taking profits,” but this advice can backfire. The key to success in trading cryptocurrency and bitcoin is keeping your losses small and letting your winners run big. Your biggest gains often come from trades you don’t obsessively watch or emotionally manage.

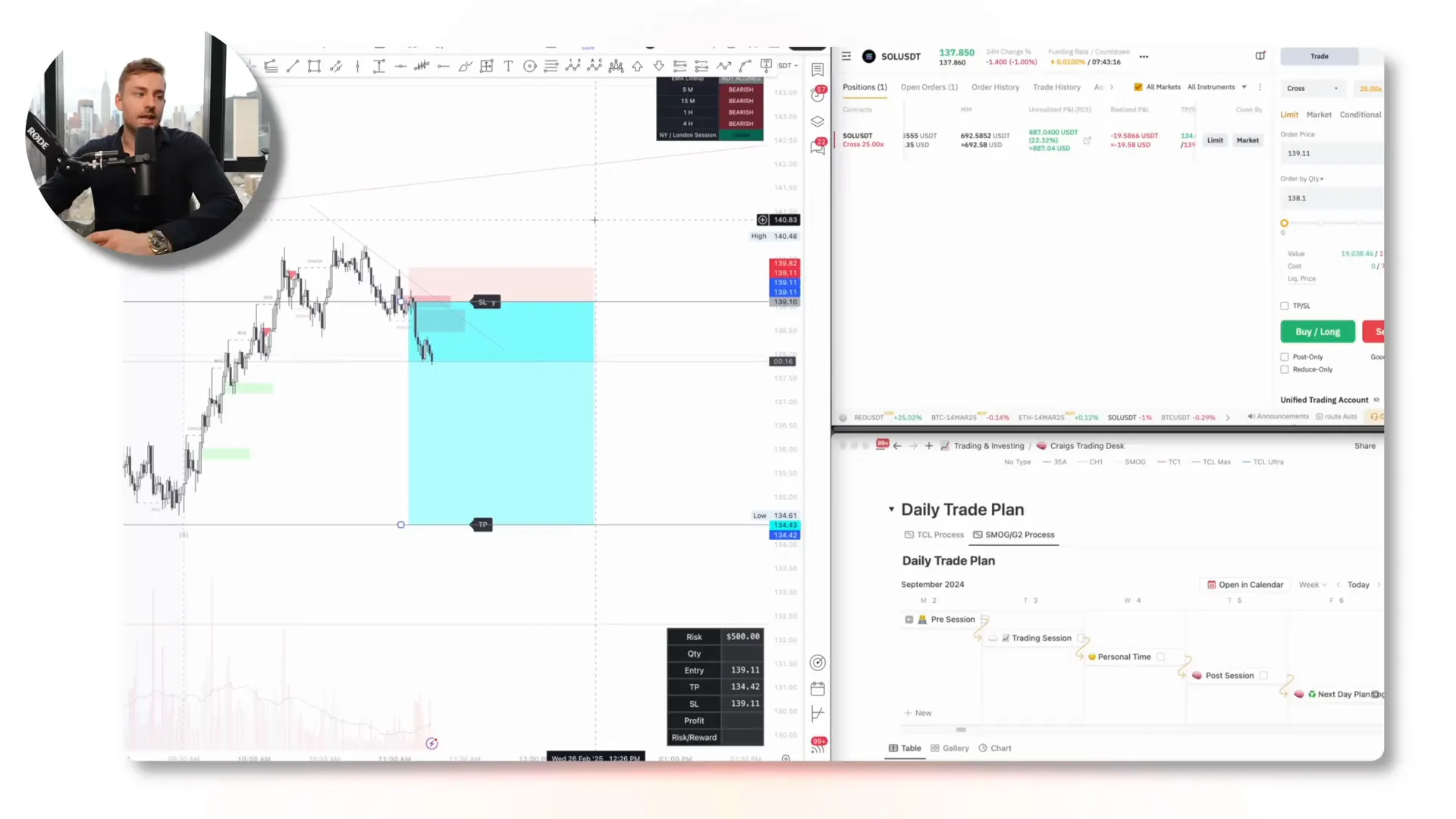

For example, I recently had a trade where I risked $500 and let the position run to nearly $4,000 profit by sticking to my plan—even when the price briefly moved against me. This discipline to hold through volatility is what separates professional traders from the rest.

Step 4: Use One Strategy at a Time

Trying to juggle multiple trading strategies at once is a recipe for confusion and inconsistency. Early in my career, I jumped from one pattern to another, chasing the “next big thing” and never mastering any single approach.

Focus is everything. When you start, pick one strategy and stick with it long enough to gather meaningful data and understand its long-term performance. Real traders talk about metrics like average risk/reward, win rate, and expectancy — not just random “ideas” or occasional wins.

For example, a strategy with a 70% win rate might seem ideal, but if your losses are five times larger than your wins, you’ll still lose money overall. Conversely, a strategy with a 25% win rate but a 5:1 risk/reward ratio can be highly profitable. Understanding these nuances requires sticking to one strategy long enough to gather real insights.

Step 5: Preserve Your Capital at All Costs

Even if you master the other secrets, failing to protect your capital during rough patches can erase all your progress. Market conditions can sometimes be irrational or unfavorable for your strategy, leading to consecutive losses.

To combat this, set a daily loss limit—mine is negative 3R. Once I hit this threshold, I stop trading for the day to avoid emotional decision-making and further losses. Preserving capital allows you to trade another day and keeps your growth sustainable.

I learned this the hard way when I lost my entire $15,000 account in one trade due to a mistake. That painful lesson taught me that protecting what you have is more important than chasing big wins.

Step 6: Don’t Chase Daily Profit Goals

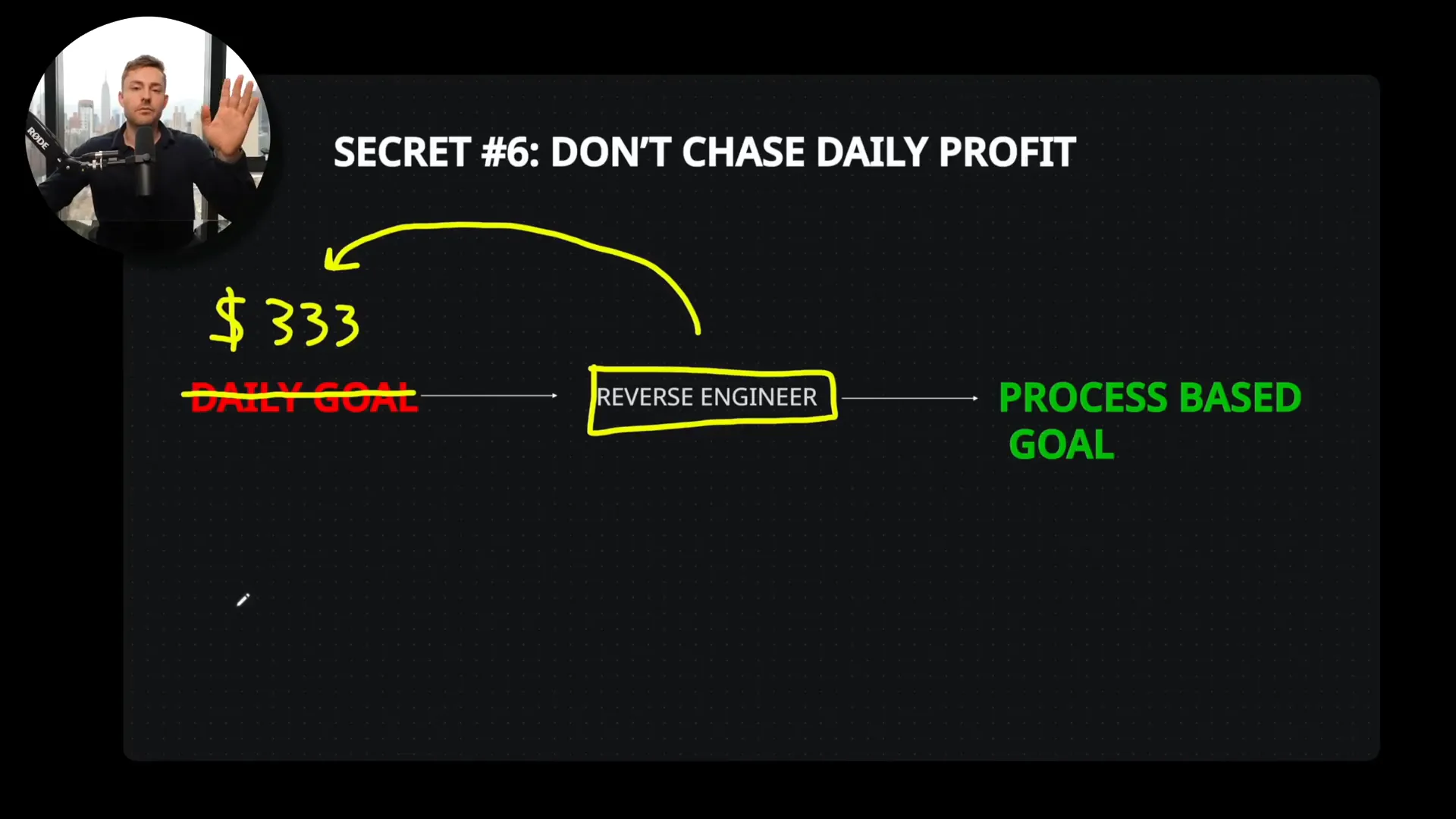

Setting daily income goals can backfire by pressuring you to “make up” losses, leading to reckless trades. Instead, reverse engineer your goals by focusing on your trading process and the expected risk factors your strategy generates over time.

For example, if your strategy yields 10R over a month, and your monthly goal is $10,000, you can calculate how much to risk per trade to hit that goal without obsessing over daily profits. This approach helps you focus on consistency and process rather than emotional reactions to daily results.

Remember: “You’re not going to rise to the occasion. You’re going to fall to the levels of your systems.” Building a sustainable system is the key to long-term success in cryptocurrency and bitcoin trading.

Bringing It All Together

After eight years of learning and refining my approach, I’ve distilled my experience into this process that prioritizes education, process, data-driven strategies, focused practice, capital preservation, and realistic goal setting.

Many traders who have joined our private team have transformed their results by following these principles. From new traders making $18,000 on a single trade to others hitting nearly $100,000 annually, the key is consistency and focus.

If you’re serious about growing your small trading account in 2025, start by mastering these six secrets. Use the free educational content available, focus on process over profits, preserve your capital, and let your winning trades run. The next step is up to you.

This article was created from the video How to Grow Your SMALL Trading Account FAST in 2025 [Step by Step] with the help of AI.

How to Grow Your SMALL Trading Account FAST in 2025 with Cryptocurrency and Bitcoin. There are any How to Grow Your SMALL Trading Account FAST in 2025 with Cryptocurrency and Bitcoin in here.