If you're interested in growing a cryptocurrency or bitcoin trading account but feel held back by limited capital, you're not alone. The saying goes, "It takes money to make money," but in the world of crypto trading, that's not entirely true. Using smart strategies and proper risk management, you can start with as little as $100 and build it into a substantial income stream. Drawing from my seven years as a full-time day trader, I’ll walk you through exactly how I'd grow a $100 crypto account into $10,000 in 2025.

Whether you're new to crypto trading or looking to refine your approach, this step-by-step guide will show you how to use leverage wisely, manage risk, and apply a proven trading system to maximize your returns safely.

Step 1: Accessing Capital with Leverage

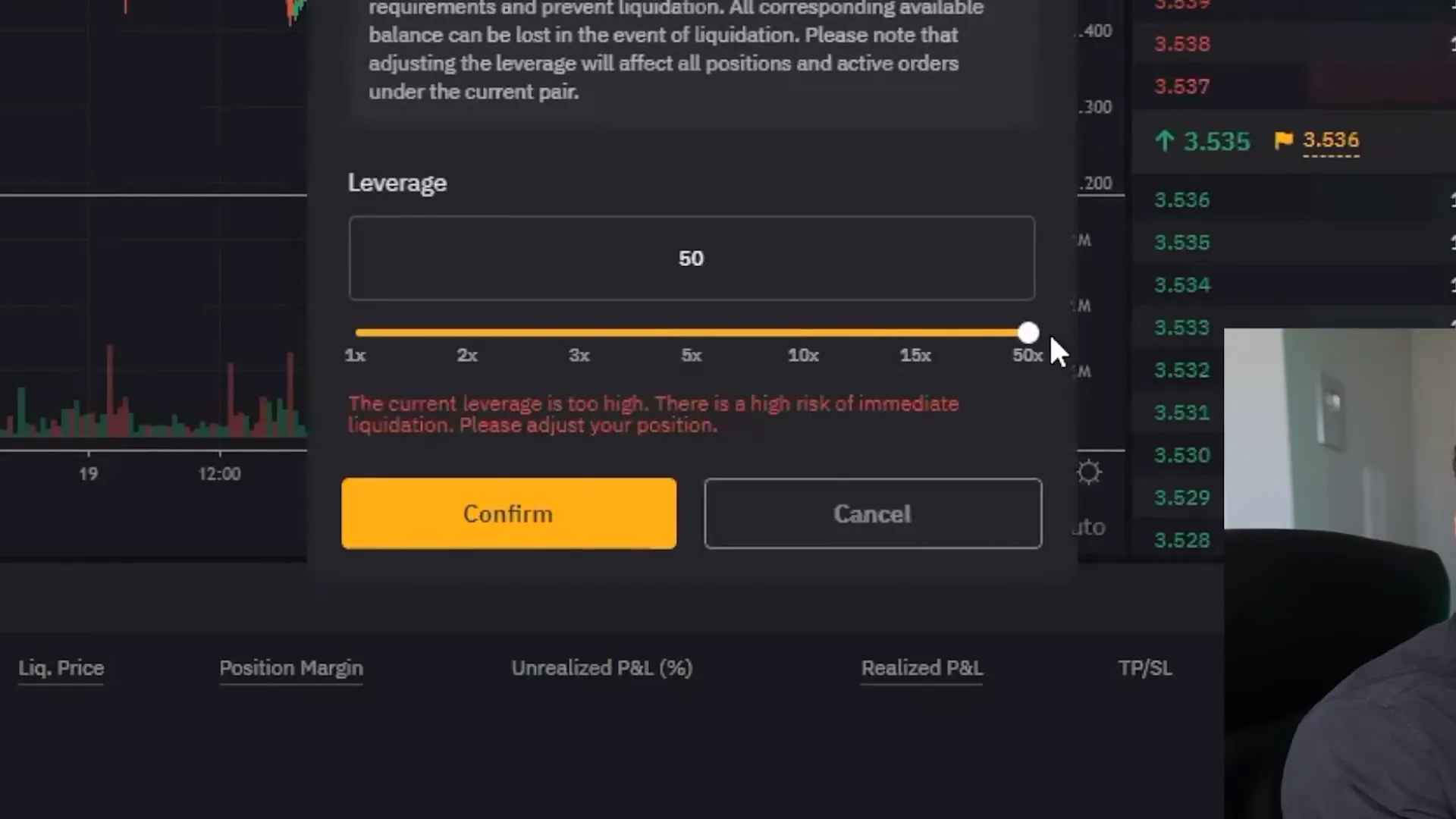

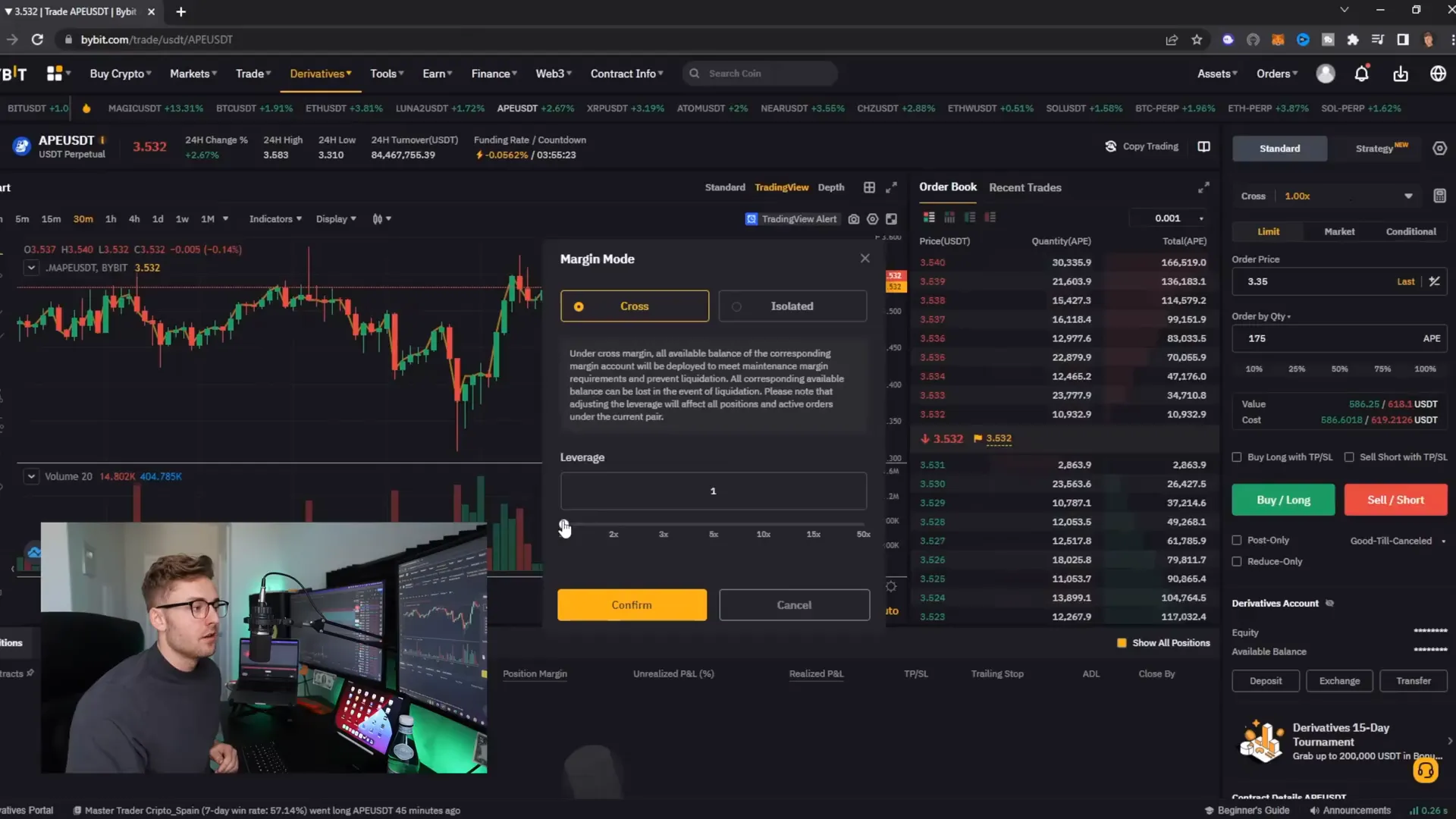

The biggest hurdle for many aspiring traders is the amount of capital they start with. Fortunately, with cryptocurrency exchanges like Bybit, you can access significant capital through leverage. Bybit offers up to 125x leverage on some pairs, though certain pairs have lower limits, often around 50x.

Leverage allows you to control a larger position than your actual account balance. For example, if you have $100 and use 100x leverage, you effectively gain $10,000 in buying power. This means you can take trades worth thousands of dollars while only putting up a fraction of the capital yourself.

Important: Leverage doesn’t change your risk tolerance; it only changes how much capital you need upfront. This is critical to understand to avoid blowing your account.

Let me illustrate how this works in practice. Suppose I want to risk $10 per trade on a $100 account (that's 10% risk per trade). If I want to buy ApeCoin and set my stop loss at a certain price, I first find the difference between my entry price and stop loss price. Let's say this difference is 0.057.

To calculate how many coins to buy while risking only $10, divide the $10 risk by the price difference:

Number of tokens = Risk per trade / (Entry price - Stop loss price)

This calculation ensures that if the trade hits your stop loss, you won't lose more than $10.

Next, calculate the capital required for this position by multiplying the number of tokens by the entry price. For example, 175 coins at $3.35 each equals $587. This is more than five times your actual $100 account balance, which would be impossible without leverage.

By applying 100x leverage, you only need to put up about $12 of your own money to control the $587 position. This way, you maintain your risk level while accessing a larger position size.

Always remember: leverage is a tool to amplify your trading capital, but your actual risk per trade should stay consistent and manageable.

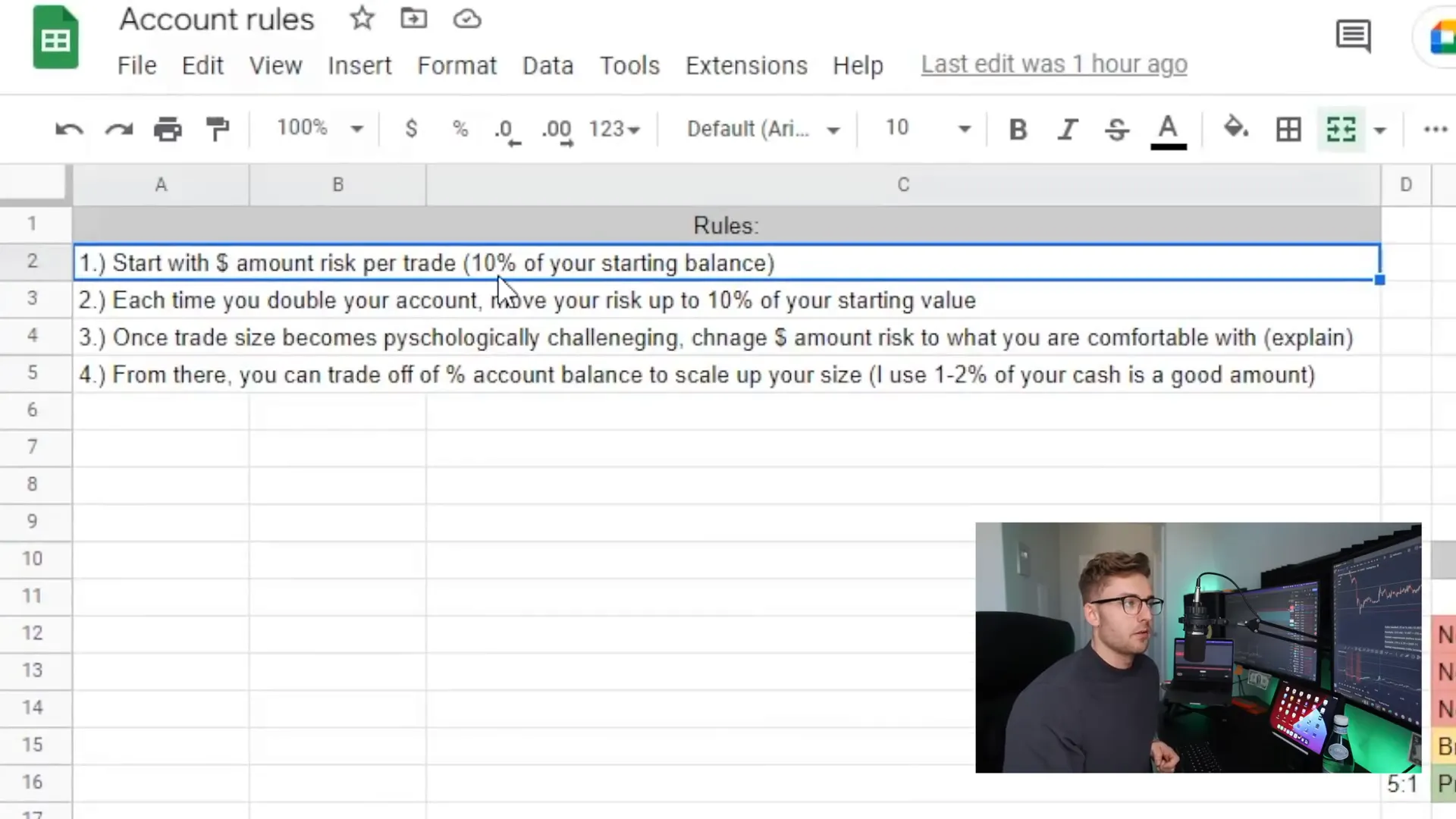

Step 2: Rules for Growing a Small Cryptocurrency Account

Growing a small account requires discipline and clear rules. Here’s the approach I recommend:

- Start with a fixed dollar risk per trade: Begin with 10% of your starting balance. For a $100 account, that's $10 risk per trade.

- Adjust your risk as your account grows: Every time you double your account, increase your dollar risk proportionally. For example, once you reach $200, risk $20 per trade (still 10%).

- Be mindful of your psychological comfort: Everyone has a different tolerance for risk. If at any point the dollar amount feels too high emotionally, reduce it. For example, if $100 risk per trade feels too much, drop it back to $50 and focus on consistent daily goals.

For me personally, I aim to make $3,000 to $5,000 per week by risking about 2.5% of my $20,000 account balance per trade. As my account grows, I’ll increase my position size accordingly to meet higher income goals.

Step 3: The Trading Strategy I Use

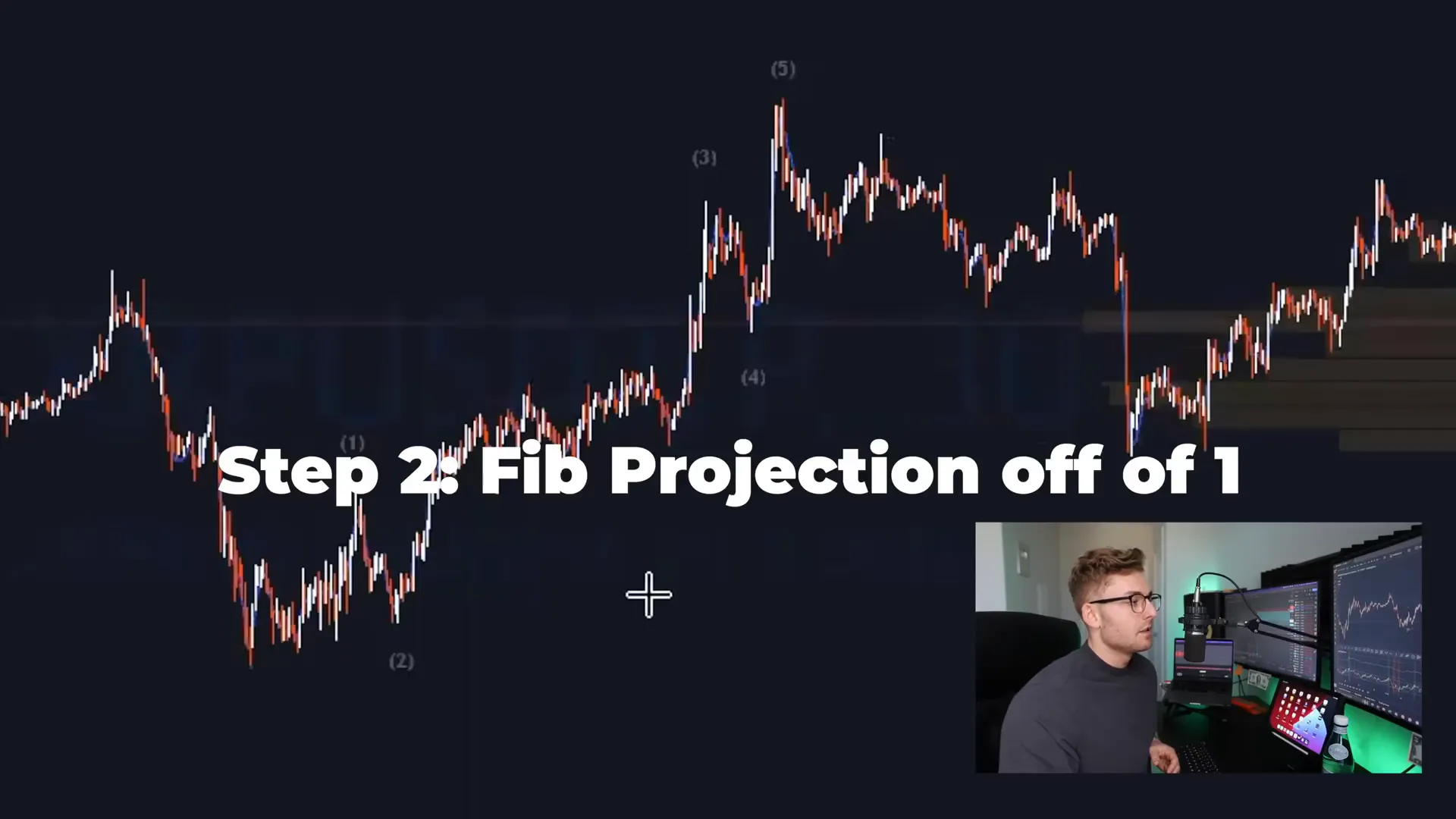

Now, let's get into the actual trading system that I've been using successfully for the past few months. This strategy is based on wave counts and Fibonacci analysis, which helps identify strong entry and exit points.

Here’s the process:

- Identify the trend and wave count: Look for a newly established uptrend. Count the waves: Wave 1 is the initial move up, Wave 2 is the first pullback, Wave 3 is the largest wave, Wave 4 is the second pullback, and Wave 5 is the final push higher.

- Use Fibonacci projections: Project the top of Wave 5 using Fibonacci extensions off Wave 1. This helps pinpoint resistance levels and potential reversal points.

- Draw trend channels: Connect the high of Wave 3 to the low of the pullback (point A) to create a channel. Clone this channel to the top of Wave 5 to anticipate price action boundaries.

- Set your entry and stop loss: For short trades, enter near the 61.8% Fibonacci retracement level of the last wave. Place your stop loss just above the Wave 5 high.

- Calculate position size: Use your fixed dollar risk and the difference between entry and stop loss to determine how many tokens to buy or short.

- Set profit target: Use Fibonacci extensions off the recent trend to identify where price is likely to move down to, giving you a clear exit point.

This system works on both long and short sides of the market, allowing you to profit whether prices go up or down.

As an example, I took a short position on XRP when it reached the 61.8% retracement level, risking $10 with 10x leverage. The trade hit my profit target overnight, yielding $41 in profit — over 4x my risk on just one trade.

Remember, you don’t need to be right all the time to be profitable. With a 1:4 risk-reward ratio, you only need to be right 20% of the time to break even. Being right 30-50% of the time makes you very profitable over the long term.

Step 4: Real Results and Community Success

This strategy isn’t just theory. One of our students applied these exact principles and locked in $2,600 on his very first trade after completing our training. His consistent profits prove that with the right knowledge and discipline, scaling a small crypto account is achievable.

There’s a lot of misinformation out there, but mastering these fundamentals will set you apart and help you grow your account steadily.

Ready to Take Your Crypto Trading to the Next Level?

If you're serious about growing your cryptocurrency and bitcoin trading account, now is the time to get started. Stick to the rules, use leverage wisely, and follow a proven strategy like the one I shared.

To support your journey, I invite you to join our trading community on Discord where you can connect with other traders, share ideas, and receive updates on giveaways and training opportunities.

Also, if you comment “Pellegrino” below and join our Discord, you could win full access to our entire training suite valued at around $1,000. I’m giving away two spots soon as a thank you to committed traders.

Use leverage cautiously, manage your risk carefully, and remember: consistent growth beats chasing quick wins. Your $100 account could be the start of something huge in 2025.

Let’s grow together and make this your best trading year yet!

This article was created from the video How I'd Start With $100 And Grow A Crypto Account In 2025 with the help of AI.

How I'd Start With $100 and Grow a Cryptocurrency Account in 2025. There are any How I'd Start With $100 and Grow a Cryptocurrency Account in 2025 in here.