If you've ever struggled to explain cryptocurrency to your friends or family, you're not alone. When I first dove into this world, it was a revelation to realize that crypto is much more than just Bitcoin. There are thousands of coins, tokens, and decentralized applications, each with unique use cases. This guide breaks down those complex ideas into clear, straightforward explanations anyone can grasp.

Table of Contents

- What Is Cryptocurrency? The Basics Made Simple

- Coins vs Tokens: Understanding the Difference

- Are Cryptocurrencies Safe? Addressing Security and Criminal Concerns

- Why Are Cryptocurrencies So Volatile and What Gives Them Value?

- Which Cryptocurrencies Should You Consider Buying?

What Is Cryptocurrency? The Basics Made Simple

At its core, cryptocurrencies are digital currencies. Unlike physical money, which you can hold in your hand, cryptocurrencies exist purely as collections of numbers and letters—think of them as serial numbers on bills, but without the paper.

Consider how physical money works: each bill has a unique serial number that tracks where and when it was printed. Banks keep records of these bills, your account numbers, and your personal details. When you deposit a bill, your bank updates its records to reflect that transfer.

Cryptocurrencies work similarly, except instead of a central authority like a bank, the transaction records are stored across a vast network of computers worldwide, known as the blockchain. Each cryptocurrency coin is like the serial number on a bill, but without a physical counterpart. You hold your crypto in a wallet, which is like a bank account number—but without your personal identity attached.

This means you have full control over your crypto. No bank can freeze your wallet or block your transactions. However, if you lose access to your wallet or forget your recovery phrase, your crypto is lost forever.

Coins vs Tokens: Understanding the Difference

When people hear about Bitcoin or Dogecoin, they often think all cryptocurrencies are the same. In reality, there are two main types: coins and tokens.

- Coins are cryptocurrencies that operate on their own independent networks, built from scratch. Bitcoin (BTC) is the prime example, rewarded to computers that process transactions on its network.

- Tokens are built on top of existing networks and can be created quickly and easily. NFTs (non-fungible tokens), for example, are digital certificates of ownership for art or collectibles.

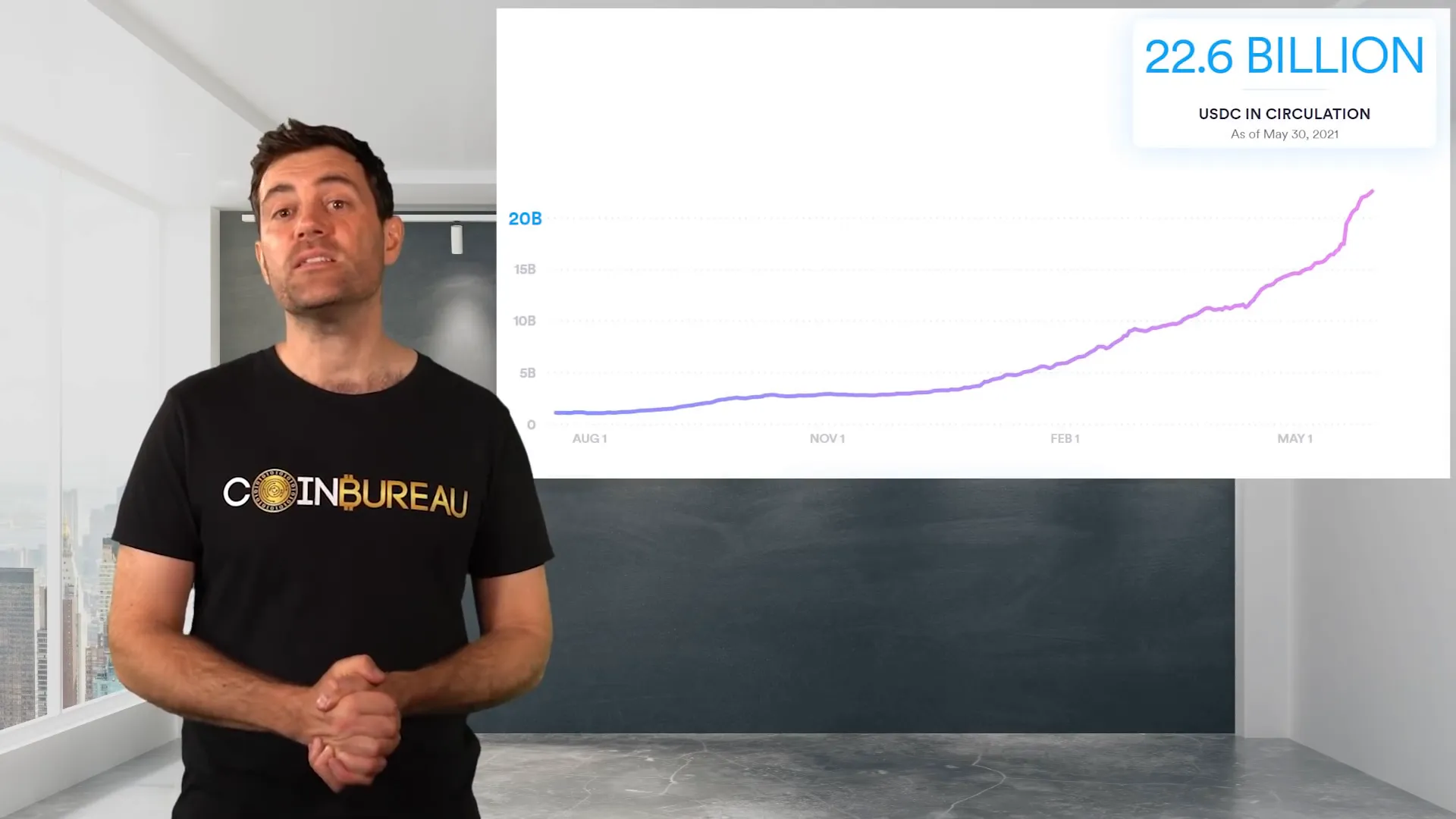

Some tokens are backed by real assets. For example, USDC is a token fully backed by U.S. dollars held in reserve, redeemable one-for-one. Similarly, PAXG tokens represent physical gold held in a vault. Both are regulated and audited for security.

But beware—because tokens are so easy to create, many are scams designed to lure in unsuspecting investors with flashy websites and social media hype.

Are Cryptocurrencies Safe? Addressing Security and Criminal Concerns

Safety is a big concern for many newcomers. The truth is, not all cryptocurrencies are created equal. Some prioritize speed over security, which can lead to problems quickly. However, many established cryptocurrencies like Bitcoin have been battle-tested over years, with millions of computers worldwide validating transactions. To corrupt such a network, a hacker would need to control more than half of these computers simultaneously—an almost impossible feat.

Most hacks happen not to the cryptocurrencies themselves but to centralized services like exchanges. That's why it's safest to keep your crypto in a personal wallet, ideally a hardware wallet, when you're not actively trading or cashing out.

Regarding criminal use, while hackers sometimes demand ransoms in Bitcoin, they usually convert it immediately to privacy-focused coins like Monero, which are much harder to trace. Bitcoin’s transactions are public and traceable, making it a poor choice for criminals to hold long term.

Why Are Cryptocurrencies So Volatile and What Gives Them Value?

Cryptocurrency prices can swing wildly—up or down by 50% in a single day. So why do they have value at all?

Think about regular money. Once, currencies were backed by gold, but today their value depends largely on trust in governments. Unfortunately, this trust has been eroding due to inflation, currency manipulation, and other economic factors.

Cryptocurrencies derive value from what they do:

- Bitcoin is often compared to digital gold. It has a capped supply and a diminishing rate of new coins created, making it scarce. As demand grows, its price tends to rise.

- Ethereum powers decentralized applications and tokens. Its coin, ether, is needed to pay for transaction fees (“gas”) on the network, creating demand that grows with adoption.

These revolutionary technologies enable lending, borrowing, and business without middlemen or traditional banks. They empower communities to govern funds collectively, potentially challenging traditional governments and corporations.

Which Cryptocurrencies Should You Consider Buying?

When people ask which cryptocurrencies to buy, the answer depends on your timeline and risk tolerance. Remember, this is not financial advice—always do your own research.

The crypto market often follows a roughly four-year cycle, with bull markets where prices rise. We're currently in such a phase, which might end soon or last into early 2022. While many coins have seen significant gains, there's still potential for 2-3x returns in this cycle or even more if you hold for the next bull market.

Risk varies widely within the crypto space. Market capitalization (market cap) is a key metric to understand here—it’s the coin’s price multiplied by its circulating supply. A token with a smaller market cap can grow faster because it takes less capital to move its price.

For example, Dogecoin has a huge market cap due to its massive supply, making it harder to grow significantly. On the other hand, some smaller tokens can see rapid price increases, but they come with higher risk.

Generally, cryptocurrencies in the top 10 by market cap, like Bitcoin, Ethereum, and Cardano, are considered lower risk and likely to be around for years to come. Investing in coins outside the top 200 is often more akin to gambling.

To learn more about specific coins and how to research them, consider checking out resources like the Coin Bureau's detailed guides and tutorials.

Understanding these basics will help you confidently explain cryptocurrency and bitcoin to anyone curious, making the complex world of crypto more accessible and less intimidating.

Explain Cryptocurrency and Bitcoin to Complete Beginners: A Simple Guide. There are any Explain Cryptocurrency and Bitcoin to Complete Beginners: A Simple Guide in here.