Photo by Harrison Kugler on Unsplash

Crypto enthusiasts, welcome! Today, we’re diving into why Bitcoin continues to thrive despite waves of FUD (fear, uncertainty, and doubt) and why it’s steadily heading higher. Plus, we’ll touch on some fresh developments around Aptos, Shelby, and the broader crypto ecosystem. Strap in, because the crypto world never sleeps, and neither should your attention!

Bitcoin’s Resilience Amid Market Fluctuations

Bitcoin’s recent price action is a textbook example of how quickly things can change. Just yesterday, Bitcoin dipped down to $98,000, which sparked fear among many traders and investors. People were ready to give up, thinking the rally was over. But then, boom — a V-shaped recovery pushed Bitcoin back up to $106,000 almost overnight.

This rapid rebound came on the back of ceasefire news, which was a positive catalyst for crypto and global markets alike. However, there’s always a twist: fresh FUD surfaced claiming that US strikes didn’t completely dismantle Iran’s nuclear program, suggesting they could resume activities within months. While this is mostly speculation, it did inject some uncertainty into the market.

Despite these jitters, crypto futures are still green, and the general sentiment is optimistic that the conflict won’t drag on like the Ukraine-Russia war. Most expect the war to end sooner rather than later, which is a bullish backdrop for Bitcoin and crypto.

The History of FUD: Distractions and Shakeouts

FUD is nothing new to the crypto space. Looking back, we’ve weathered significant storms:

- Silvergate’s collapse in 2023

- FTX’s downfall

- Japan’s carrier trade disruptions

- Trump’s tariffs impacting markets

- The 2022 war tensions

Every time, the market found its bottom and bounced back stronger. Sometimes the recovery took months, but the resilience was undeniable. This pattern highlights why staying in the game is crucial — Bitcoin’s strength isn’t random; it’s driven by belief. People keep stacking sats and holding tight, fueling the next leg up.

Chartists will notice similarities between the current cycle and the 2017 run-up to Bitcoin’s massive spike. Although this cycle is different, led largely by institutional players, the fundamentals of Bitcoin’s upward momentum remain intact.

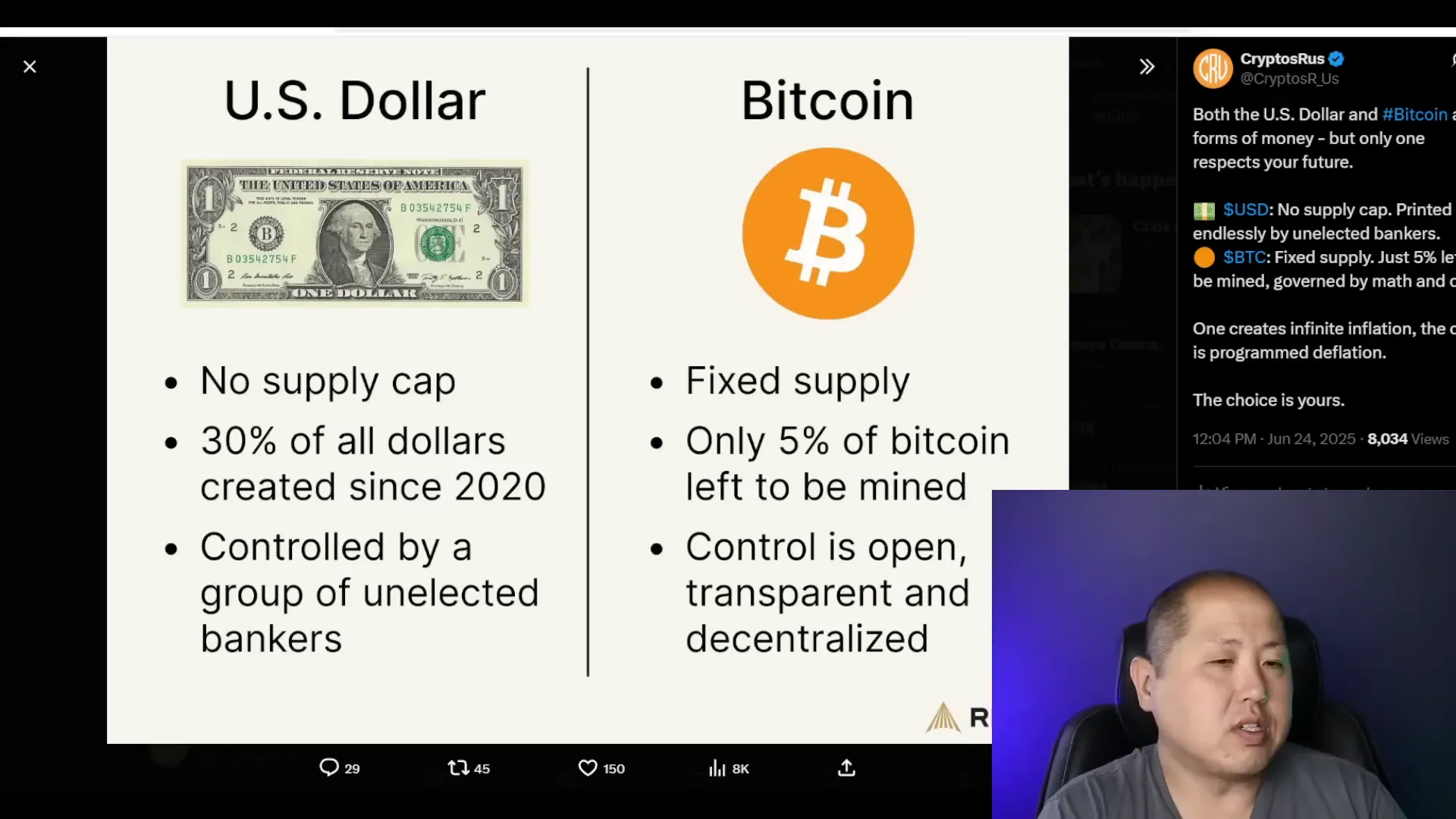

Bitcoin vs. The Dollar: Why Bitcoin Wins in the Long Run

Many of you hold Bitcoin because you understand the downside of fiat currency. The US dollar, despite being around for over 100 years, has seen over 30% of its total supply printed since COVID started. That’s an insane amount of inflation compressed into just a few years.

Unlike the dollar, Bitcoin’s supply is capped and decentralized. About 95% of all Bitcoin has already been mined, meaning everyone is competing for a fixed amount. No central bank or government controls it, and monetary policy like easing, tightening, or overprinting simply doesn’t apply.

Here’s the kicker: if you held all your money in cash since 2020, your purchasing power dropped by 19%. Even if you put your cash in money markets, you’d still be down 6.7%. But if you allocated just 3% of your portfolio to Bitcoin, you’d be up 20%. That’s nearly a 40% difference in performance just by having a small Bitcoin position. It’s a no-brainer for portfolio diversification and long-term wealth preservation.

Regulatory Clarity and the Rise of Stablecoins

Beyond Bitcoin, other crypto sectors are evolving rapidly. Pal has recently emphasized the need for more regulatory clarity, which is exactly what’s starting to happen. The SEC is shifting its stance, and the Genius Bill’s passage in the Senate is a major milestone.

The administration is also reconsidering banking rules that have been overly restrictive for crypto firms, especially decentralized projects and DeFi platforms with no clear ownership. These changes will make it easier to launch and grow crypto companies in the US.

Stablecoins are a hot topic right now, especially with Circle’s IPO seeing a significant down day — a signal of market volatility but also opportunity. Mastercard and Visa stocks have dropped around 5% recently, largely due to the growing influence of stablecoins and the Genius Bill’s momentum.

These payment giants are not sitting idle. They’re partnering with Paxos, PayPal, and other stablecoin projects to integrate crypto payments. Merchants and consumers will soon be able to accept stablecoins more seamlessly, and Chainlink’s collaboration with Mastercard will allow 3 million cardholders to buy crypto directly. This is a pivotal moment for crypto adoption.

Aptos and Shelby: Innovation in the Crypto Space

Aptos, a blockchain created by former Facebook engineers, is making waves today. Although it narrowly missed out on Wyoming’s stablecoin selection, Aptos is thriving with a stablecoin market cap reaching $1.22 billion — an all-time high.

One of the coolest developments is Shelby, a high-performance hot storage network built on Aptos in partnership with Junk Crypto. Shelby aims to support cutting-edge use cases like streaming media, on-chain data, AI data marketplaces, and social platforms across multiple chains including Ethereum and Solana. Essentially, it’s a decentralized storage solution for all the hottest internet content.

Moreover, the popular DeFi project A is expanding to Aptos, marking its first non-EVM integration. This move will bring more DeFi functionalities like lending and staking to the Aptos ecosystem, signaling strong growth and adoption ahead.

Wrapping Up: Stay Strong, Ignore the FUD, and Stack Your Sats

As of now, Bitcoin sits comfortably at $106,400, with Ethereum, Solana, XRP, and other tokens showing solid recovery. Hot movers like SE, KAYA, and Aptos are catching attention as well.

The takeaway is clear: don’t give in to the noise and fear. Bitcoin and the broader crypto market continue to prove their resilience time and again. Stay strong, stay informed, and keep stacking those sats. The future looks bright for crypto, and those who hold on tight are poised to benefit the most.

Catch you next time. Remember: ignore the FUD, stay strong, and keep stacking.

Bitcoin Thrives on FUD - Here’s Why Its Heading Higher in Crypto Markets. There are any Bitcoin Thrives on FUD - Here’s Why Its Heading Higher in Crypto Markets in here.