Welcome to an in-depth look at the latest developments in the world of Bitcoin, crypto, and blockchain investing. As the markets fluctuate, it’s crucial to understand the underlying signals, price patterns, and news driving these movements. Today, we’ll explore the recent surge in Bitcoin inflows, technical price patterns unfolding across major cryptocurrencies like Bitcoin, Ethereum, Solana, XRP, and Chainlink, and what this could mean for investors and traders alike.

This comprehensive guide distills recent market insights and technical analyses to help you navigate the dynamic crypto landscape with confidence.

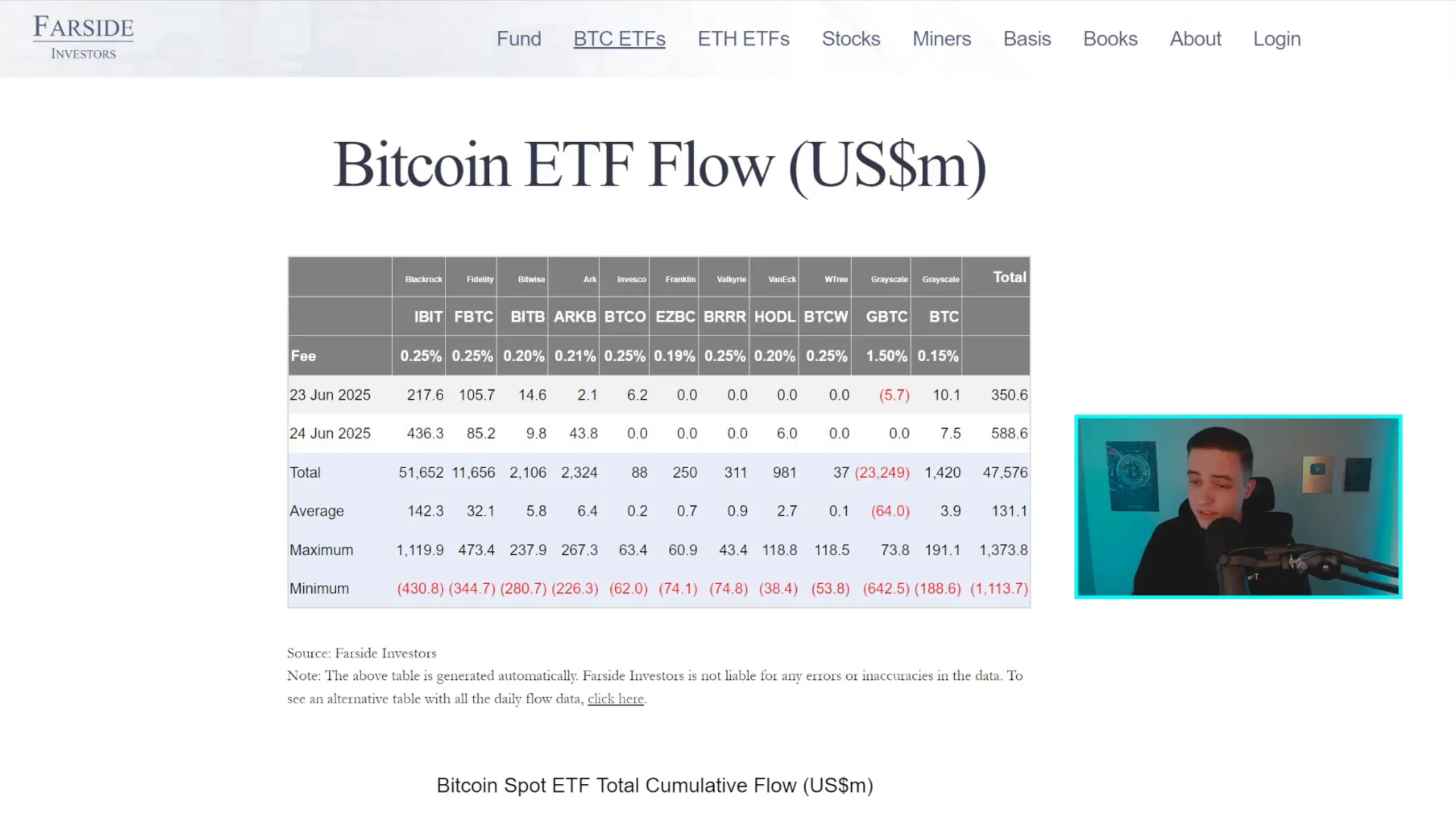

Massive Bitcoin ETF Inflows Spark Optimism

One of the most significant catalysts for Bitcoin’s recent price action has been the massive net inflows into spot Bitcoin ETFs. Over just two days, nearly a billion US dollars flowed into these funds, with Tuesday alone seeing an impressive inflow of approximately $588 million. Monday’s inflow of around $350 million contributed to a combined total of about $939 million in just 48 hours.

For those new to the concept, spot Bitcoin ETFs are exchange-traded funds backed by actual Bitcoin. When investors purchase shares, such as the BlackRock Bitcoin ETF shares (IBIT), the fund managers must acquire equivalent amounts of Bitcoin on the spot market to back those shares. Conversely, when investors redeem shares, the fund must sell Bitcoin to meet those outflows.

In practical terms, BlackRock and similar ETF issuers have been buying substantial amounts of Bitcoin recently, directly contributing to increased buying pressure in the market. This influx of capital is a key driver behind the short-term bullish momentum in Bitcoin's price.

Additionally, geopolitical developments, such as the potential resolution of conflicts in the Middle East, have been influencing market sentiment positively, adding fuel to the bullish narrative.

Zooming Out: Is Bitcoin Still in a Bull Market?

Despite some recent pullbacks and periods of sideways consolidation, Bitcoin remains technically within a larger bull market when viewed through a broader lens. The weekly timeframe’s super trend indicator confirms this overarching trend, reminding us not to be swayed by short-term volatility.

That said, the weekly Bitcoin MACD (Moving Average Convergence Divergence) shows signs of weakness, although recent data indicates that the bearish momentum is slowing. Specifically, the histogram’s slowdown has halted, signaling that Bitcoin is no longer moving toward a bearish crossover like the one observed earlier this year between January and February.

This stagnation in bearish momentum is a positive sign, suggesting Bitcoin may be regaining bullish energy. However, a bearish divergence remains on the weekly timeframe, as Bitcoin’s price continues to form higher highs while the RSI (Relative Strength Index) forms lower highs. This divergence implies caution, as it could foreshadow a future correction unless the RSI breaks above its previous highs.

Investors should monitor the RSI level closely over the coming weeks or months for confirmation or invalidation of this bearish divergence.

Shorter-Term Outlook: Three-Day Bitcoin MACD

On the three-day timeframe, Bitcoin is approaching a potential bullish crossover in the MACD indicator. This is notable because a bearish crossover was recently confirmed, coinciding with a short-term price pullback and sideways consolidation over the past month.

Interestingly, while Bitcoin lost bullish momentum during this period, bearish momentum did not significantly increase, indicating a phase of temporary weakness rather than a full-blown bear market. The RSI has also reset during this time, providing room for upward movement if the bullish crossover confirms.

If this crossover occurs in the next few days, it could signal the start of renewed bullish momentum, which would be an encouraging development for traders looking for upward price movement.

Daily Bitcoin Price Action: Bounce and New Price Patterns

Bitcoin has recently bounced off a critical support zone between approximately $97,000 and $98,000, with the bounce occurring just above $98,000. This level remains a strong support area, and the recent breakout back above $103,000 to $104,000 further consolidates this support, which had previously acted as resistance.

Currently, Bitcoin is playing out an oversold signal on the six-hour RSI chart, a setup reminiscent of a similar oversold condition observed previously. While oversold signals do not guarantee a bullish reversal, the current price action is mirroring past outcomes, suggesting a potential bullish relief.

However, it’s crucial to remain cautious as oversold conditions can sometimes lead to only a brief rally before resuming downward trends.

Short Squeeze and Liquidity Targets

Another technical factor influencing Bitcoin’s recent price movement is the onset of a short squeeze. This occurs when short sellers rush to cover their positions due to rising prices, adding buying pressure and accelerating upward movement.

Liquidity has been building in the $106,600 to $107,000 range, a zone that Bitcoin has now successfully wiped out, fulfilling a predicted move. The next significant liquidity zone to watch is between $109,000 and $110,000, where many stop orders and buy orders cluster.

Bitcoin’s price is likely to move toward this next liquidity target, with expected resistance zones around $108,500 to $109,000, followed by major resistance near $110,000 to $110,500. The all-time high near $112,000 remains the ultimate resistance point if Bitcoin continues its bullish trajectory.

Falling Wedge Pattern: A Bullish Signal?

Bitcoin’s daily price chart is currently forming a falling wedge pattern — a technical formation characterized by descending highs and lows converging into a narrower range. Falling wedges tend to be bullish patterns, breaking upward approximately two-thirds of the time.

The current support line lies just above $100,000, while the resistance line sits just above $109,000. Confirmation of a breakout requires a daily candle close above $109,000, followed by holding that level as support.

Upon confirmation, the first price target is Bitcoin’s all-time high near $112,000. A measured move from the breakout point could push Bitcoin to around $119,000, representing a roughly 9% gain from the breakout level.

For those considering trading this breakout, a prudent strategy involves waiting for confirmation, entering a long position on breakout confirmation, and setting a stop loss just below the breakout point to minimize risk.

As the trade progresses, moving the stop loss into profitable territory helps lock in gains and protect against reversals. However, if the breakout fails and price closes back below the breakout point, the trade and pattern become invalidated, signaling a need to reassess.

Ethereum’s Recent Breakout and Price Structure

Ethereum has recently broken back above a key price level around $2,400, confirming daily candle closes above this zone and signaling a potential return to previous sideways trading ranges.

Support is now expected near $2,380 to $2,390, with stronger support around $2,100, the recent bounce zone. Resistance levels to watch include $2,500 and a more significant barrier between $2,700 and $2,800.

Despite this short-term breakout, Ethereum’s price structure remains technically bearish on the daily timeframe, characterized by lower highs and lower lows. This means the market is still in a downtrend, and a clear bullish trend reversal has yet to be confirmed.

A key sign of a potential reversal would be the formation of a higher low in the coming weeks, which would indicate growing bullish momentum and a shift in market sentiment.

Ethereum is also grappling with a bearish divergence, where price action does not align with momentum indicators like RSI, increasing the risk of continued weakness until invalidated by a strong breakout.

Solana on the Brink of a Key Breakout

Solana is attempting to break above an important resistance zone between $143 and $146, which has historically acted as both support and resistance since March 2025.

Confirmation requires a daily close above $146, after which this zone should flip to become support. If this breakout holds, Solana’s next resistance levels are expected at $154-$155, followed by $158 and major resistance near $167.

To confirm a sustainable bullish trend, Solana will need to form a higher low following the breakout, signaling a shift from the current bearish price structure to a bullish one on the daily timeframe.

XRP’s Short-Term Bounce Amid Sideways Trading

XRP is experiencing a short-term bullish relief, bouncing off support around $1.92 to $1.95 and breaking back above previous support turned resistance at approximately $2.07.

Additionally, XRP has broken above a Fibonacci resistance level near $2.19 to $2.20, which could now act as support if the price holds.

However, XRP remains within a sideways trading range, oscillating between support at $2.07 and resistance near $2.30 to $2.35. This range-bound activity suggests that XRP is consolidating and awaiting more decisive movement.

If Bitcoin continues its bullish momentum in the short term, XRP and many altcoins could follow suit, potentially testing the upper resistance levels. Nonetheless, XRP’s daily price structure remains bearish until higher highs or higher lows are confirmed, such as a breakout above $2.35.

Chainlink’s Resistance and Potential Inverse Head and Shoulders

On the 12-hour timeframe, Chainlink is encountering resistance near the 38.2% Fibonacci retracement level around $1,363 to $1,370.

A confirmed breakout above $1,370 could open the door to further gains, with resistance levels at the 50% retracement zone near $1,440-$1,450 and major resistance between $1,520 and $1,550.

Chainlink is also potentially forming an inverse head and shoulders pattern, a bullish reversal signal. The left shoulder is visible, and the right shoulder is beginning to form. For this pattern to confirm, Chainlink would likely need to pull back toward $1,280-$1,290 to establish a higher low before breaking out above $1,370.

If confirmed, this pattern could propel Chainlink toward the “golden pocket” resistance area between $1,520 and $1,550. This zone has been a significant barrier in recent months and is a critical target for bulls.

Until this breakout and pattern confirmation occur, Chainlink’s overall trend remains bearish, with lower highs and lower lows dominating the price structure.

What This Means for Crypto Investors and Traders

Across the board, Bitcoin is showing early signs of bullish momentum with key technical signals such as the falling wedge pattern and the short squeeze playing out. The massive inflows into spot Bitcoin ETFs support the case for continued buying pressure in the near term.

Ethereum, Solana, XRP, and Chainlink are all navigating critical support and resistance levels, with potential breakouts on the horizon. However, most altcoins still exhibit bearish price structures on daily timeframes, meaning caution is advised until higher lows and higher highs are confirmed.

For traders, this environment offers interesting opportunities to capitalize on potential breakout moves, especially if Bitcoin confirms a bullish trend reversal. Waiting for clear confirmation before entering trades and using prudent stop-loss strategies can help manage risk effectively.

To participate in these trading opportunities, having accounts on reliable crypto exchanges is essential. Platforms like BTNEXT and Toobit offer no-KYC access, global availability, and generous trading bonuses, making them attractive options for crypto traders.

Remember, every investment carries risk, and it’s crucial to perform your own research and consider your personal financial situation before making trading decisions.

Stay Ahead by Watching Market Movements Closely

Monitoring Bitcoin’s price action remains the best indicator of the broader crypto market’s direction. Altcoins often follow Bitcoin’s lead, so a sustained bullish move in BTC could ignite a short-term rally across many cryptocurrencies.

Key levels to watch include Bitcoin’s resistance at $109,000 to $110,000 and Ethereum’s resistance near $2,700 to $2,800. For altcoins like Solana and XRP, confirming breakouts above their respective resistance zones could signal the start of renewed bullish trends.

Technical patterns such as falling wedges, inverse head and shoulders, and liquidity zones provide valuable insights into potential price targets and entry points. Combining these with fundamental factors like ETF inflows and geopolitical developments offers a well-rounded strategy for navigating the crypto markets.

Whether you are a long-term investor or an active trader, staying informed and disciplined with your strategies will be key to capitalizing on the evolving opportunities in Bitcoin, crypto, BTC, blockchain, and the broader crypto ecosystem.

Keep your eyes on these developments, and prepare to act when the market signals align with your trading plan.

Bitcoin, Crypto, BTC, Blockchain, and CryptoNews: What’s Happening Now and What to Expect Next. There are any Bitcoin, Crypto, BTC, Blockchain, and CryptoNews: What’s Happening Now and What to Expect Next in here.