If you’re as passionate about Bitcoin, crypto, BTC, blockchain, and the evolving landscape of digital assets as I am, then buckle up. Today, we’re diving deep into some hot XRP and XRPL news that’s been making waves, plus an eyebrow-raising move by Barclays Bank that’s frustrating many crypto enthusiasts. Alongside, we’ll unpack the current state of the Genius Act, market dynamics, and some exciting developments in the XRP ecosystem you need to know about.

This post is packed with insights, market updates, and a little bit of fun—because let’s face it, crypto news can get heavy, and a little humor goes a long way in keeping us sane. So, whether you’re a hardcore investor, a blockchain developer, or simply curious about what’s shaking in crypto, this article is for you.

What’s Up with Barclays Bank and Crypto Transactions?

Here’s a frustrating nugget to start off with: Barclays Bank has banned customers from using their credit cards for any cryptocurrency transactions. Yes, you read that right. They’re allowing customers to withdraw crypto, but not to participate in crypto transactions using their credit or debit cards.

Barclays communicated this new policy directly to their clients, claiming it’s “to help you keep your money safe.” Ironically, if you want to use your Barclays credit card for less-than-wise spending—say, at a strip club or buying gifts for someone who might never see you again—they’re totally fine with that. But crypto? Nope, that’s a no-go.

On social media, Barclays announced:

“We’ve made the decision to stop payments made by credit or debit card to Binance until further notice.”

While they’re not blocking the ability to withdraw funds from crypto accounts, they’re shutting down any crypto transactions using Barclays cards. Customers are being directed to the FCA website for more information, but the message is clear: Barclays doesn’t want you spending your card on crypto.

From June 27th, 2025, Barclays will block all crypto transactions made with their cards. This raises a critical question: Is it really the bank's job to dictate how you spend your money?

Think about it — there are plenty of risky things you could do with your debit or credit cards, from gambling cash withdrawals to investing in speculative collectibles like rare Pokémon cards. Yet, banks don’t police those. So why single out crypto?

Should banks like Barclays, Wells Fargo, Chase, or JP Morgan have the authority to restrict your spending choices? Or should their primary role be to safeguard your funds and let you decide how to use them?

The Genius Act: Where Does It Stand?

Now, let’s talk about the Genius Act—a key piece of legislation that’s been on the lips of many in the crypto community. The bipartisan vote passed the Senate on June 17th, but guess what? It took a whole week for the House to officially receive the bill. That’s right, moving a bill from one chamber to another in Washington D.C. can be slower than you’d expect—almost as if they sent it by messenger pigeon.

According to a reliable source, Eleanor, the House Financial Services Committee has expressed concerns about passing the bill cleanly. This means they might modify it before passing it on. If they do, the bill will bounce back to the Senate for another vote, and possibly back to the House again, before it can make its way to the President’s desk.

If the House can debate the bill without modifications, it would then go straight to the President. But as of now, it’s not even on the schedule yet.

Senator Loomis recently told CNBC’s Squawk Box that she hopes both the market structure bill and the Genius Act can pass this year. She clarified that while she’s not suggesting combining the two, both pieces of legislation need to be finalized within 2024.

This is a shift from the original goal of having them done by August. So, if you’re holding your breath for quick regulatory clarity, you might want to exhale slowly and prepare for some delays.

What Does This Mean for the Crypto Market?

The passing of the Genius Act and the market structure bill are vital because they set the framework for crypto regulation and the future of stablecoins. But with competing bills possibly emerging from both the House and Senate, the process could get even more drawn out.

Until then, we watch, wait, and keep stacking.

Big Moves in the XRP Ecosystem

Now, onto some truly exciting news for XRP fans: Ripple has just released a major update for the XRP Ledger (XRPL), and the developer community is buzzing about it. This update is being called the strongest single lineup of amendments in the XRPL’s history.

Why is this important? Because upgrades are essential to encourage more developers to build on the XRPL, which in turn drives more adoption and usage. The new features include fixes for long-standing edge cases and demonstrate the tremendous collaborative effort from multiple teams.

Here’s a quick breakdown of some standout features:

- Token Escrow: This allows escrow using IOUs and multipurpose tokens, opening up new possibilities for how assets can be managed and secured on the XRPL.

- Batch Transactions: This feature lets users group and execute multiple transactions in a single step, simplifying complex operations.

- Permissioned Decentralized Exchange (DEX): Introducing compliant access control to DEXs, which is crucial for institutional adoption and regulatory compliance.

- Permission Delegations: This enables secure delegation of account permissions, making multi-user wallets and automated accounts more viable.

These improvements are not just technical upgrades—they’re foundational elements that pave the way for significant growth in the XRPL ecosystem.

Even Brad Garlinghouse, Ripple’s CEO, took to Twitter to commend the developers, saying:

"Huge progress. Kudos to you, Mayuka, and all the devs who contributed to this release."

When the CEO of Ripple gives a shoutout like that, you know something big is happening.

Market Overview: Bitcoin’s Dominance and Altcoins in the Friend Zone

Let’s zoom out and take a look at the broader crypto market. Bitcoin (BTC) is ramping up, currently sitting at around $107,997, just 3% shy of its all-time high. This is a powerful rally that has many wondering if an altcoin season is on the horizon.

However, the altcoins are mostly stuck in what I call the “friend zone” price-wise. For example:

- XRP is about 42% away from its all-time high.

- Ethereum (ETH) and Solana (SOL) are both roughly 50% off their peaks.

- Dogecoin and Cardano are even further behind, at 77% and 81% away, respectively.

This heavy Bitcoin dominance is frustrating for altcoin fans like me. Every time geopolitical tensions flare up or we get drama from influential figures like Elon Musk or Donald Trump, Bitcoin dips, and altcoins take an even harder hit.

Once Bitcoin recovers and starts climbing higher, altcoins tend to just hang around, recovering slowly but not making any explosive moves. This is why the altcoin season index is currently at a low 17 out of 100, signaling a market heavily dominated by Bitcoin.

Volume and Institutional Activity

Overall market volume is hovering around $105 billion, but keep an eye out for potentially low trading volumes over the weekend—a time when markets can be more volatile.

On the bright side, institutional players are showing strong interest in Bitcoin with two consecutive days of big inflows. This trend has been consistent throughout the year, signaling that the “big money” is still bullish on BTC.

Fear and Greed Index, XRP Price Action, and Geopolitical Impact

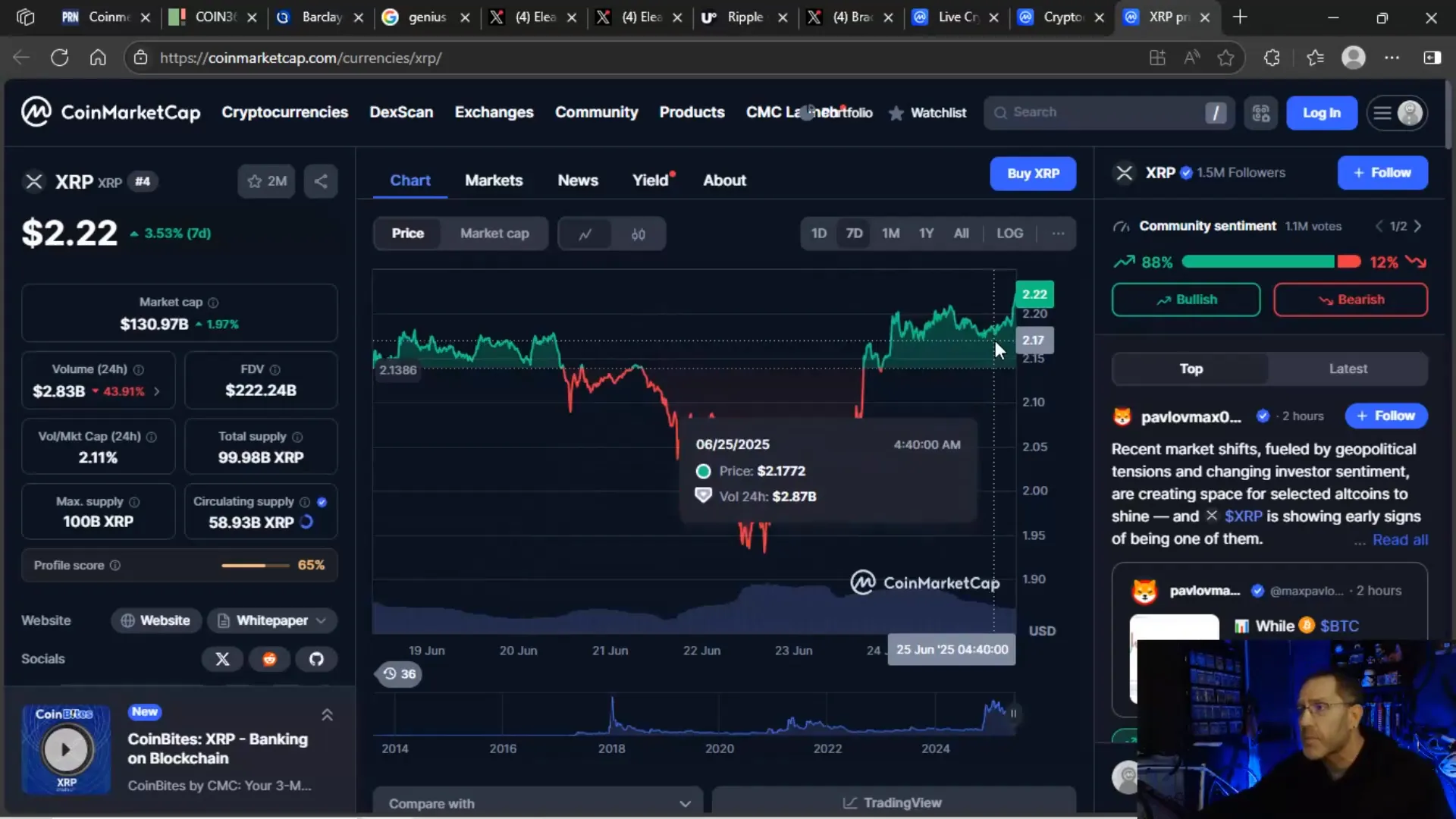

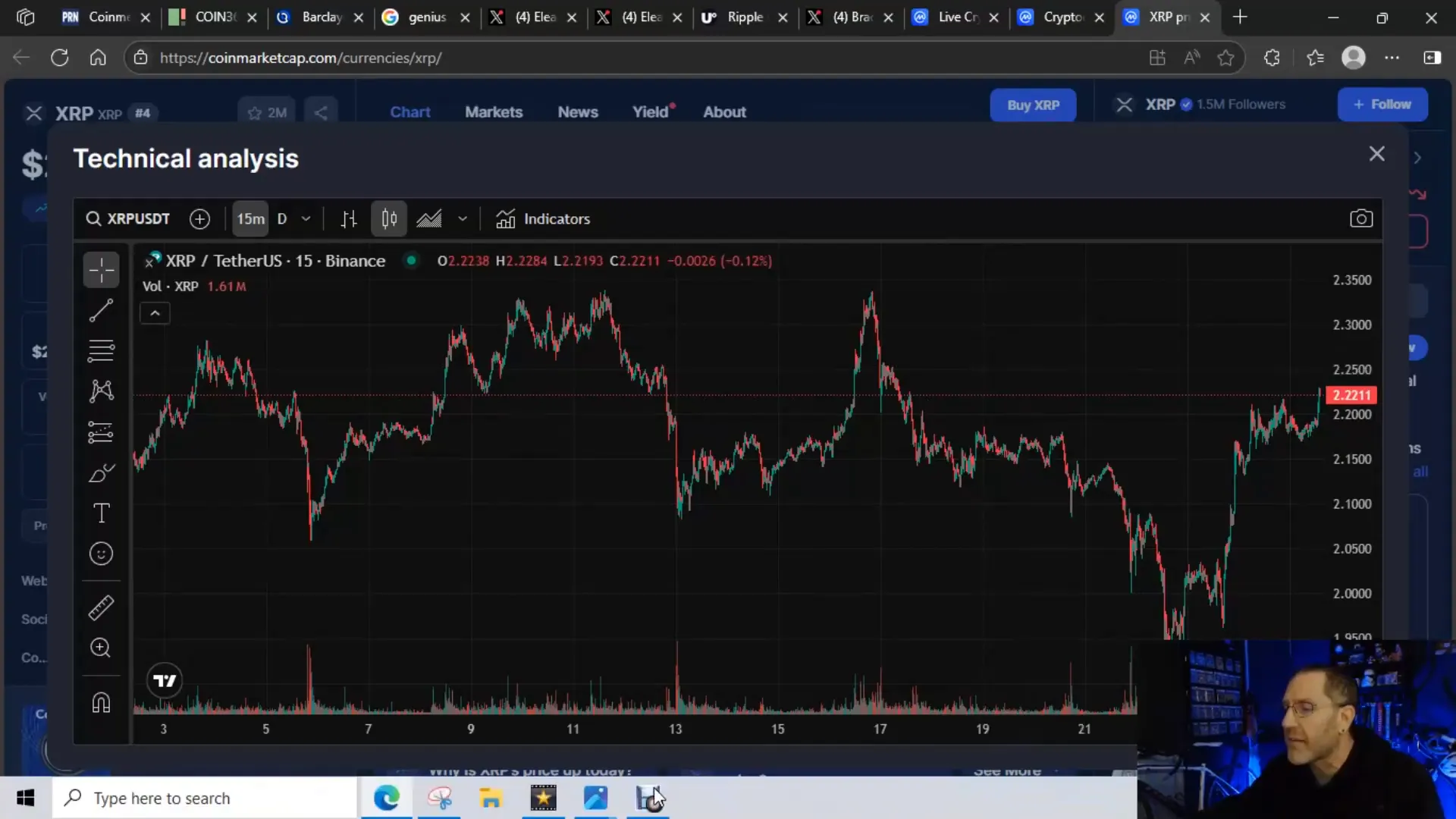

The crypto fear and greed index is sitting around neutral at 43. XRP’s trading volume is about $2.83 billion, showing decent activity but no major breakout yet.

Looking at XRP’s price action over the past week, it’s clear that geopolitical tensions, especially in the Middle East, have caused sharp dips followed by quick rebounds. For instance, XRP dipped below $2.00 to about $1.90 during a flare-up, only to bounce back nearly 30 cents once the situation eased.

These swings demonstrate the market’s sensitivity to global events, but also its resilience.

Interest in Rate Cuts Could Boost Crypto Development

There’s more good news on the horizon. Earlier this week, two Federal Reserve officials publicly expressed a desire for rate cuts as soon as July. While Chairman Jerome Powell might not be on board yet, the fact that influential Fed members are pushing for lower interest rates is significant.

Why does this matter for crypto, especially XRP and altcoins? Because lower interest rates mean cheaper money, which makes it more affordable for developers and companies to invest and build new projects on blockchain platforms like the XRPL.

Building on the XRP Ledger and other blockchain networks isn’t free—it requires capital. So, if borrowing costs drop, we can expect more innovation, more projects, and hopefully more price appreciation.

Playing the XRP Market Smartly

Currently, XRP is back to where it was about a week and a half ago, trading around $2.22. This price is what I call the “friend zone”—not low enough to be a screaming buy, but not high enough to call a breakout.

If you’re patient, you can still buy XRP below $2.00 and stack your position while keeping your average cost down. On the other hand, if you’re a trader, you can play the swings as XRP moves up and down in response to market events.

Remember, XRP’s resilience is impressive. It dips below $2.00 but bounces back quickly. However, it hasn’t bounced back as strongly as Bitcoin, which is frustrating for many. The hope is that with regulatory clarity and lower rates, XRP and other altcoins will finally get their time to shine.

Final Thoughts: Navigating the Crypto Landscape

It’s a wild ride out there. Banks like Barclays are trying to control how you use your money, blocking crypto transactions while allowing other risky spending. The Genius Act and market structure bills are inching forward but may face delays. Meanwhile, Bitcoin is roaring close to its all-time highs, and altcoins like XRP are patiently waiting for their moment.

At the same time, the XRP Ledger is getting critical upgrades that will make it more attractive for developers and users alike, setting the stage for future growth. And with potential rate cuts on the horizon, the environment for crypto innovation could become much more favorable.

So, whether you’re stacking XRP sub $2.00 or watching Bitcoin inch closer to new highs, staying informed and strategic is key. Remember, the crypto market is influenced by everything from regulatory news and bank policies to geopolitical tensions and macroeconomic factors.

Happy hump day, everyone. Whether you’re a pimp, player, hustler, or just holding strong, keep your head up, stay hydrated, and keep grinding. The crypto world never sleeps, and neither should your pursuit of knowledge and opportunity.

Chew chew, choo choop is nachos!

Bitcoin, Crypto, BTC, Blockchain, and the Latest XRP & Barclays Bank Updates You Can’t Miss. There are any Bitcoin, Crypto, BTC, Blockchain, and the Latest XRP & Barclays Bank Updates You Can’t Miss in here.